Unlocking the Power of Repurchase Agreements

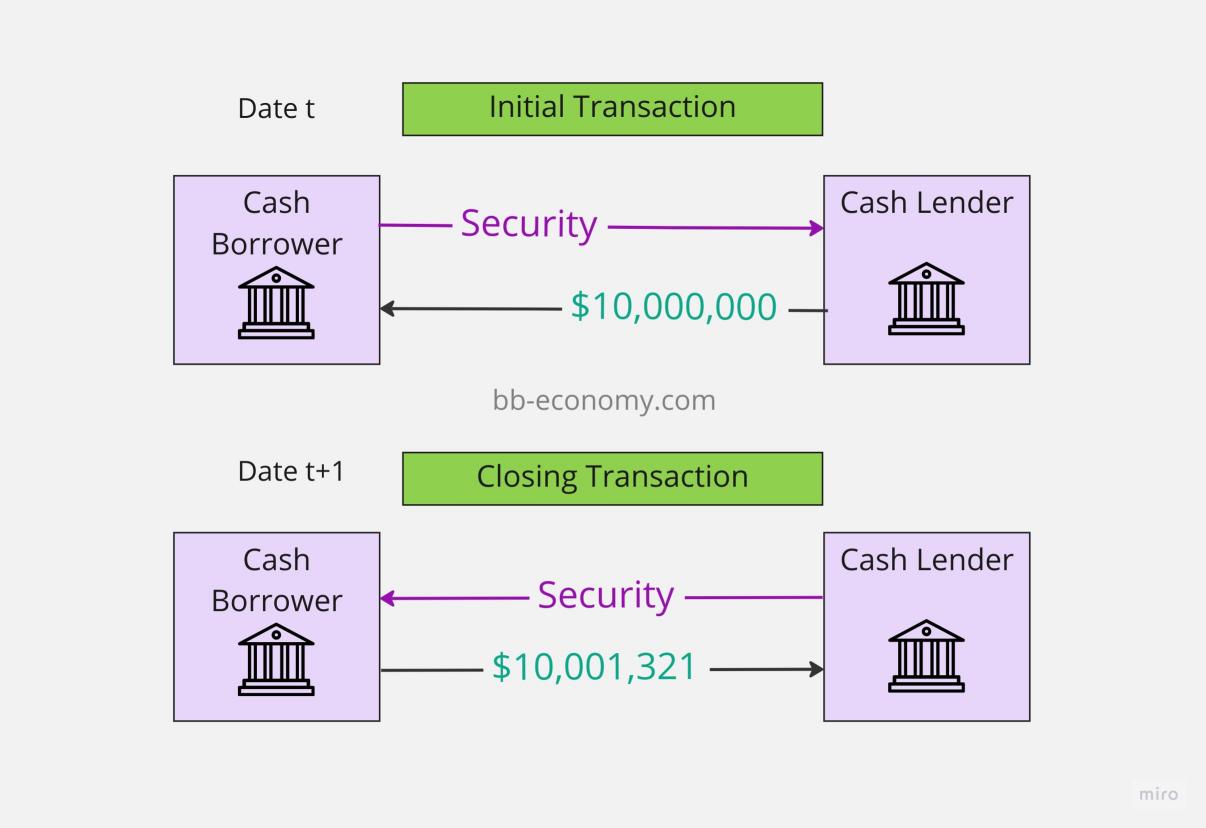

In the financial market, repurchase agreements, also known as repo agreements, play a crucial role in facilitating liquidity and managing risk. A repurchase agreement is a financial transaction in which one party sells securities to another party with an agreement to repurchase the same securities at a later date, often with a fixed price. This arrangement enables institutions to access short-term funding, while also providing a means to manage their balance sheets and mitigate risk. By leveraging repurchase agreements, financial institutions can optimize their liquidity management, reduce risk exposure, and improve their overall financial stability. In contrast to reverse repurchase agreements, traditional repurchase agreements involve the sale of securities with an agreement to repurchase, whereas reverse repurchase agreements involve the purchase of securities with an agreement to resell. Understanding the intricacies of repurchase agreements is essential for navigating the complexities of the financial market and making informed investment decisions.

Understanding the Reverse Repurchase Agreement: A Closer Look

A reverse repurchase agreement, also known as a reverse repo, is a financial transaction in which one party purchases securities from another party with an agreement to resell those securities at a later date, often with a fixed price. This arrangement is the opposite of a traditional repurchase agreement, where one party sells securities with an agreement to repurchase. Reverse repurchase agreements play a crucial role in the financial system, enabling institutions to manage their liquidity, reduce risk exposure, and optimize their balance sheets. In contrast to repurchase agreements, reverse repurchase agreements involve the purchase of securities, rather than the sale, and are often used by central banks as a monetary policy tool to regulate the money supply and maintain financial stability. By understanding the intricacies of reverse repurchase agreements, financial institutions and investors can better navigate the complexities of the repo market and make informed investment decisions. The key differences between repurchase agreements and reverse repurchase agreements lie in their underlying mechanics, with repurchase agreements involving the sale of securities and reverse repurchase agreements involving the purchase of securities.

How to Navigate the Repo Market: A Step-by-Step Approach

Participating in the repo market can be a complex and daunting task, especially for those new to repurchase agreements and reverse repurchase agreements. However, by following a step-by-step approach, financial institutions and investors can effectively navigate the repo market and achieve their financial goals. The first step is to find a suitable counterparty, which can be a bank, a broker-dealer, or another financial institution. It is essential to conduct thorough due diligence on the counterparty to ensure their creditworthiness and reputation. Once a counterparty is identified, the next step is to negotiate the terms of the repurchase agreement, including the type and quantity of securities, the duration of the agreement, and the interest rate. Managing risk is also crucial, and this can be achieved by diversifying the portfolio, monitoring market trends, and maintaining adequate collateral. Additionally, it is essential to understand the differences between repurchase agreements and reverse repurchase agreements, as well as their distinct features, advantages, and disadvantages. By following these steps and staying informed about the repo market, financial institutions and investors can successfully participate in the repo market and achieve their financial objectives.

The Key Differences: Repurchase Agreement vs Reverse Repurchase Agreement

When it comes to navigating the repo market, understanding the differences between repurchase agreements and reverse repurchase agreements is crucial. While both types of agreements involve the sale and repurchase of securities, they have distinct features, advantages, and disadvantages. A repurchase agreement, also known as a repo, involves the sale of securities with an agreement to repurchase them at a later date, often with a fixed price. On the other hand, a reverse repurchase agreement, also known as a reverse repo, involves the purchase of securities with an agreement to resell them at a later date, often with a fixed price. One of the key differences between the two is the direction of the cash flow. In a repurchase agreement, the cash flows from the buyer to the seller, whereas in a reverse repurchase agreement, the cash flows from the seller to the buyer. Additionally, repurchase agreements are often used by financial institutions to manage their liquidity and reduce risk, while reverse repurchase agreements are often used by central banks as a monetary policy tool to regulate the money supply and maintain financial stability. Understanding the differences between repurchase agreements and reverse repurchase agreements, including their distinct features, advantages, and disadvantages, is essential for financial institutions and investors looking to participate in the repo market. By grasping the nuances of these agreements, market participants can make informed investment decisions and optimize their financial strategies. The reverse repurchase agreement vs repurchase agreement debate highlights the importance of understanding the intricacies of the repo market, and how each type of agreement can be used to achieve specific financial goals.

The Role of Central Banks in Repo Agreements

Central banks play a vital role in the repo market, using repurchase agreements as a key monetary policy tool to regulate the money supply and maintain financial stability. By engaging in repurchase agreements, central banks can inject liquidity into the financial system, stabilize financial markets, and influence interest rates. In times of economic stress, central banks may use reverse repurchase agreements to absorb excess liquidity and prevent inflation. Additionally, central banks use repurchase agreements to manage their own liquidity needs, such as financing their operations and maintaining their balance sheets. The use of repurchase agreements by central banks has a ripple effect on the entire financial system, influencing the availability of credit, the level of interest rates, and the overall stability of the financial markets. Furthermore, central banks’ participation in the repo market helps to set the tone for the entire market, with their actions influencing the behavior of other market participants. The significance of central banks in the repo market cannot be overstated, and their actions have a profound impact on the overall health of the financial system. Understanding the role of central banks in repo agreements is essential for financial institutions and investors looking to navigate the complexities of the repo market. By grasping the intricacies of central banks’ involvement in the repo market, market participants can better anticipate changes in monetary policy and make informed investment decisions. The reverse repurchase agreement vs repurchase agreement debate highlights the importance of central banks’ role in the repo market, and how their actions shape the financial landscape.

Risks and Challenges in Repo Agreements: What You Need to Know

While repurchase agreements can be an effective tool for managing liquidity and reducing risk, they are not without their challenges. One of the primary risks associated with repurchase agreements is counterparty risk, which occurs when the counterparty defaults on their obligation to repurchase the securities. This risk can be mitigated by carefully selecting counterparties and implementing robust credit risk management practices. Another significant risk is liquidity risk, which arises when the market for the underlying securities becomes illiquid, making it difficult to sell or repurchase the securities. Operational risk is also a concern, as the complexity of repurchase agreements can lead to errors and inefficiencies in the settlement and collateral management processes. Furthermore, the use of reverse repurchase agreements can also pose risks, particularly if not properly understood and managed. For instance, a reverse repurchase agreement can increase the risk of a liquidity crisis if not managed carefully. It is essential for financial institutions and investors to carefully consider these risks and challenges when participating in the repo market. By understanding the potential pitfalls of repurchase agreements, market participants can take steps to mitigate these risks and ensure that their repo transactions are executed effectively. The reverse repurchase agreement vs repurchase agreement debate highlights the importance of risk management in the repo market, and how a deep understanding of these agreements can help mitigate potential risks and challenges.

Best Practices for Implementing Repo Agreements

Implementing repurchase agreements effectively requires careful planning, attention to detail, and a deep understanding of the repo market. One of the key best practices is to ensure that all documentation is thorough and accurate, including the master agreement, trade confirmations, and settlement instructions. This helps to prevent disputes and ensures that all parties are clear on their obligations. Another essential best practice is to manage collateral effectively, including selecting high-quality collateral, monitoring collateral values, and ensuring that collateral is properly pledged and released. Settlement procedures are also critical, and it is essential to have robust processes in place for settling repo transactions, including same-day settlement and next-day settlement. Furthermore, it is crucial to have a comprehensive risk management framework in place, including credit risk, market risk, and operational risk management. This helps to identify and mitigate potential risks associated with repurchase agreements. By following these best practices, financial institutions and investors can ensure that their repo transactions are executed efficiently and effectively, minimizing the risk of errors and disputes. The reverse repurchase agreement vs repurchase agreement debate highlights the importance of careful implementation, and how a deep understanding of these agreements can help to ensure successful repo transactions.

The Future of Repo Agreements: Trends and Opportunities

The repo market is constantly evolving, and repurchase agreements are no exception. One of the emerging trends in the repo market is the increasing use of technology to improve efficiency and reduce costs. This includes the adoption of blockchain technology, artificial intelligence, and machine learning to automate repo transactions, improve collateral management, and enhance risk management. Another trend is the growing importance of sustainability in the repo market, with financial institutions and investors seeking to incorporate environmental, social, and governance (ESG) considerations into their repo transactions. The rise of fintech companies is also expected to play a significant role in shaping the future of the repo market, with these companies offering innovative solutions for repo transactions, collateral management, and risk management. Furthermore, the ongoing debate around the reverse repurchase agreement vs repurchase agreement highlights the need for greater standardization and harmonization of repo agreements, which could lead to increased efficiency and reduced costs in the repo market. As the repo market continues to evolve, it is essential for financial institutions and investors to stay ahead of the curve, embracing new technologies, trends, and opportunities to maximize the benefits of repurchase agreements. By doing so, they can unlock the full potential of the repo market and achieve their liquidity management and risk reduction goals.