What is SOFR and Why Does it Matter?

In the world of finance, understanding the intricacies of short-term interest rates is crucial for making informed investment decisions. One such rate that has gained significant attention in recent years is the Secured Overnight Financing Rate, or SOFR. But what is the one month SOFR rate, and why does it play a vital role in determining short-term interest rates?

SOFR is a benchmark rate that measures the cost of borrowing cash overnight, collateralized by U.S. Treasury securities. This rate is published daily by the New York Federal Reserve and serves as a reference point for various financial instruments, such as loans, derivatives, and futures contracts. The one-month SOFR rate, in particular, is a critical component of this ecosystem, as it influences the pricing of short-term credit facilities and investment products.

The significance of SOFR lies in its ability to provide a more accurate and reliable representation of the market’s expectations of future interest rates. This is particularly important in today’s low-interest-rate environment, where even small changes in short-term rates can have a significant impact on investment decisions and portfolio performance.

How to Calculate the One-Month SOFR Rate

Calculating the one-month SOFR rate is a crucial step in understanding the intricacies of short-term financing. The process involves a series of steps, which, when followed correctly, provide a accurate representation of the market’s expectations of future interest rates. So, what is the one month SOFR rate, and how is it calculated?

The one-month SOFR rate is calculated using a complex formula that takes into account the daily SOFR rates published by the New York Federal Reserve. The formula is as follows:

One-Month SOFR Rate = (Σ(Daily SOFR Rates x Day Count Factor)) / Total Day Count

Where:

Σ(Daily SOFR Rates x Day Count Factor) represents the sum of the products of daily SOFR rates and their corresponding day count factors.

Total Day Count represents the total number of days in the calculation period.

To calculate the one-month SOFR rate, you need to gather the following data inputs:

– Daily SOFR rates published by the New York Federal Reserve

– Day count factors for each day in the calculation period

– Total day count for the calculation period

Once you have gathered the necessary data, you can plug in the values into the formula and calculate the one-month SOFR rate. This rate can then be used as a reference point for various financial instruments, such as loans, derivatives, and futures contracts.

The Impact of SOFR on Financial Markets and Institutions

The Secured Overnight Financing Rate (SOFR) has a profound impact on financial markets and institutions, influencing the way they operate and make decisions. As a benchmark rate, SOFR serves as a reference point for various financial instruments, such as loans, derivatives, and futures contracts. This, in turn, affects the entire financial ecosystem, from banks and lenders to investors and borrowers.

One of the primary effects of SOFR is on lending and borrowing decisions. When the one-month SOFR rate increases, it becomes more expensive for banks to borrow money, which is then passed on to consumers in the form of higher interest rates on loans and credit cards. Conversely, a decrease in the one-month SOFR rate can lead to lower borrowing costs and increased lending activity.

Banks and other financial institutions are also heavily influenced by SOFR. They use the rate to price their products and manage their risk exposure. For instance, a bank may use the one-month SOFR rate as a reference point to determine the interest rate on a commercial loan. This, in turn, affects the bank’s profitability and risk profile.

In addition, SOFR has a significant impact on investment decisions. Investors use the rate to evaluate the attractiveness of different investment opportunities, such as bonds and other fixed-income securities. A change in the one-month SOFR rate can influence the yield on these securities, making them more or less attractive to investors.

Furthermore, SOFR plays a critical role in shaping monetary policy. Central banks, such as the Federal Reserve, use the rate to implement their monetary policy decisions, such as setting interest rates and regulating the money supply. This, in turn, affects the overall economy, influencing factors such as inflation, employment, and economic growth.

In conclusion, the impact of SOFR on financial markets and institutions is far-reaching and profound. Understanding the role of SOFR in shaping lending, borrowing, and investment decisions is crucial for navigating the complexities of short-term financing. By grasping the intricacies of SOFR, market participants can make more informed decisions and capitalize on opportunities in the ever-changing financial landscape.

Comparing SOFR to Other Short-Term Interest Rates

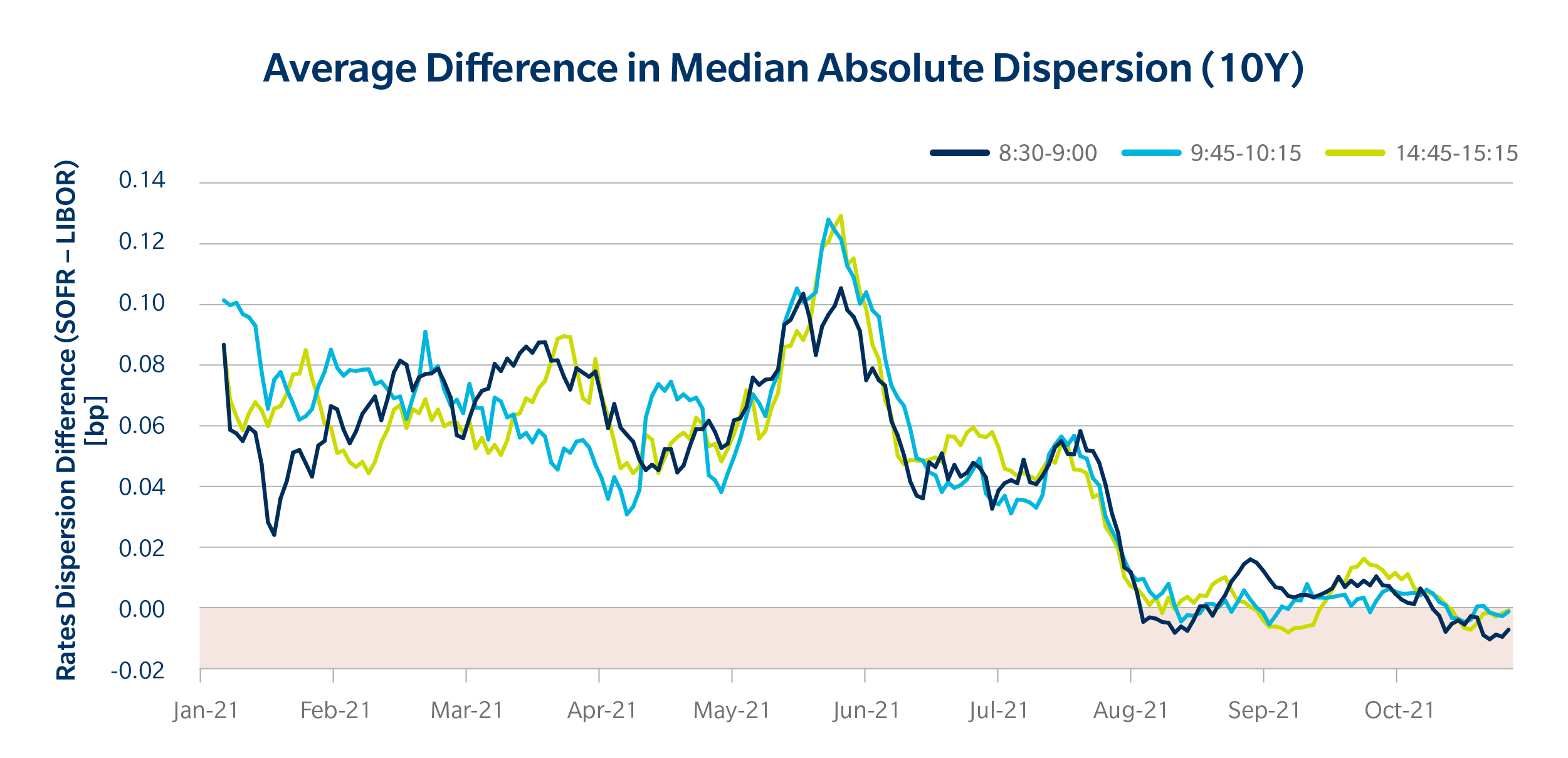

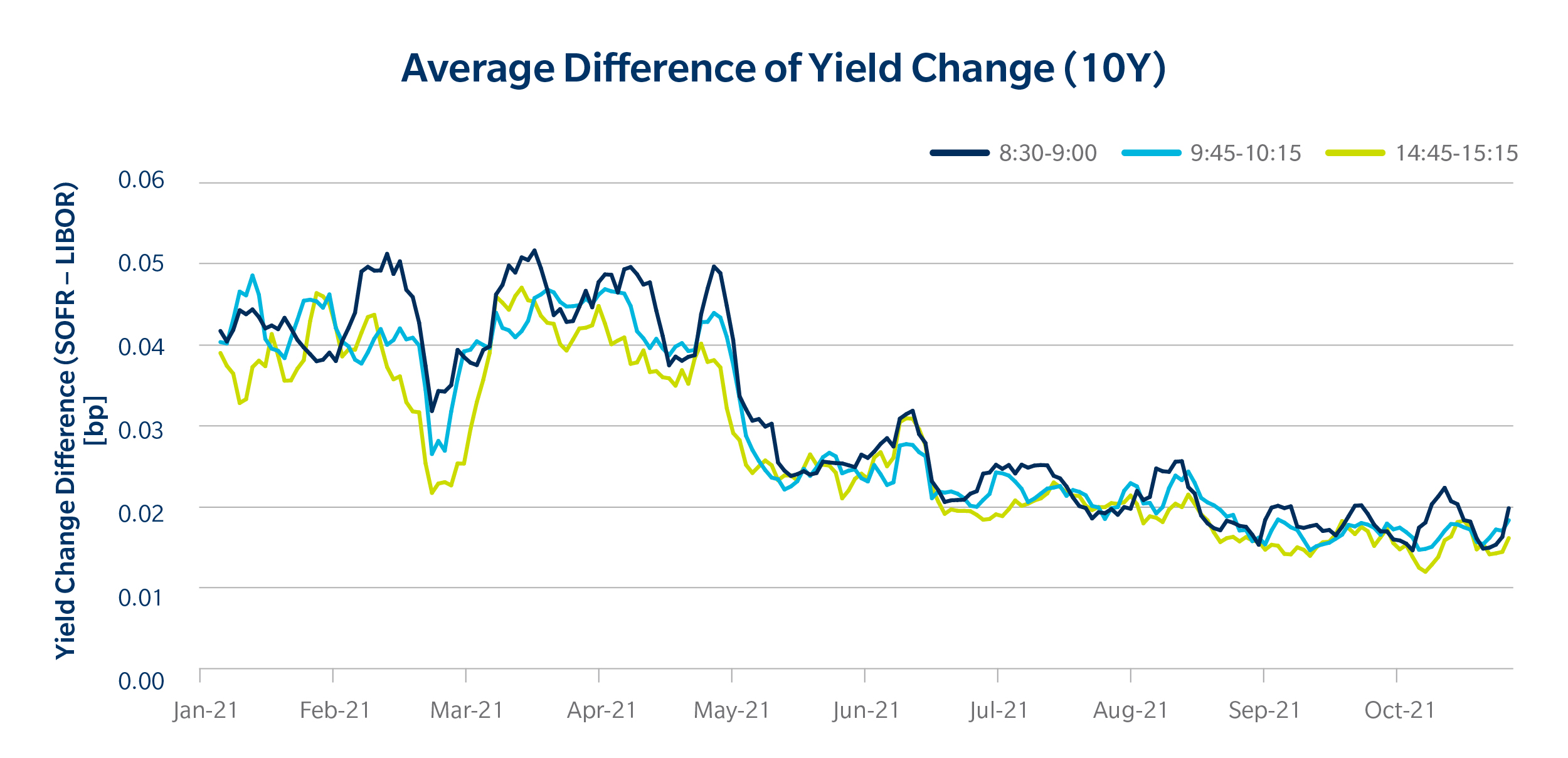

In the realm of short-term financing, several interest rates coexist, each with its unique characteristics and applications. The Secured Overnight Financing Rate (SOFR) is one such rate, but how does it compare to other prominent short-term interest rates, such as LIBOR and the Fed Funds Rate?

LIBOR (London Interbank Offered Rate) is a widely used benchmark rate that measures the average interest rate at which banks lend to each other in the London interbank market. While both SOFR and LIBOR are used to determine short-term interest rates, they differ in their underlying mechanisms. SOFR is a secured rate, backed by collateral, whereas LIBOR is an unsecured rate. This distinction makes SOFR a more reliable indicator of market conditions, as it is less susceptible to manipulation.

The Fed Funds Rate, on the other hand, is the interest rate at which depository institutions lend and borrow money from each other overnight. It is set by the Federal Reserve, the central bank of the United States, and is used to implement monetary policy. While the Fed Funds Rate and SOFR are both overnight rates, they serve different purposes. The Fed Funds Rate is a policy rate, aimed at regulating the money supply and inflation, whereas SOFR is a market-driven rate, reflecting the cost of borrowing in the repo market.

Despite their differences, SOFR, LIBOR, and the Fed Funds Rate are interconnected and influence each other. For instance, changes in the Fed Funds Rate can affect the SOFR, which in turn can impact LIBOR. Understanding the relationships between these rates is essential for making informed decisions in short-term financing.

In conclusion, while SOFR, LIBOR, and the Fed Funds Rate are distinct short-term interest rates, they are intertwined and play important roles in the financial system. By recognizing their differences and similarities, market participants can better navigate the complexities of short-term financing and make more informed decisions.

What Drives Changes in the One-Month SOFR Rate?

Understanding the factors that influence changes in the one-month SOFR rate is crucial for making informed decisions in short-term financing. The SOFR rate is a sensitive indicator of market conditions, and its fluctuations can have far-reaching implications for lenders, borrowers, and investors.

Economic indicators, such as GDP growth, inflation, and unemployment rates, play a significant role in shaping the one-month SOFR rate. For instance, a strong economy with low unemployment and rising inflation may lead to higher interest rates, as the Federal Reserve seeks to curb inflationary pressures. Conversely, a slowing economy may prompt the Fed to lower interest rates, stimulating growth.

Monetary policy decisions, such as changes in the Fed Funds Rate, also have a direct impact on the one-month SOFR rate. When the Fed raises the Fed Funds Rate, it increases the cost of borrowing, which can lead to higher SOFR rates. Similarly, a decrease in the Fed Funds Rate can result in lower SOFR rates.

Market sentiment, including investor confidence and risk appetite, is another key driver of SOFR rate changes. During times of market stress or uncertainty, investors may seek safer assets, such as Treasury bills, driving up demand and pushing SOFR rates higher. Conversely, a risk-on environment can lead to lower SOFR rates as investors seek higher-yielding assets.

In addition, the supply and demand dynamics of the repo market, where banks and other financial institutions borrow and lend securities, can influence the one-month SOFR rate. Imbalances in the repo market, such as a shortage of collateral or an excess of cash, can drive SOFR rates up or down.

Lastly, regulatory changes and policy initiatives, such as the implementation of Basel III capital requirements, can also impact the one-month SOFR rate. By understanding these factors, market participants can better anticipate changes in the SOFR rate and make informed decisions in short-term financing.

For instance, a borrower seeking a commercial loan may want to consider the current economic indicators, monetary policy stance, and market sentiment before locking in a rate. By doing so, they can better navigate the complexities of SOFR rate fluctuations and make more informed decisions. Similarly, investors seeking to capitalize on SOFR rate changes can use these factors to inform their investment strategies.

Practical Applications of the One-Month SOFR Rate

The one-month SOFR rate has numerous practical applications in various aspects of short-term financing. Understanding these applications is essential for businesses, investors, and financial institutions seeking to optimize their financial strategies.

In commercial lending, the one-month SOFR rate serves as a benchmark for pricing loans. Banks and other lenders use the SOFR rate to determine the interest rates they charge on commercial loans, ensuring that they remain competitive while maintaining a profitable margin. Borrowers, on the other hand, can use the SOFR rate to negotiate better loan terms and optimize their financing costs.

In asset-based financing, the one-month SOFR rate is used to determine the interest rates charged on inventory financing, accounts receivable financing, and other types of asset-based loans. This helps businesses to better manage their working capital and optimize their cash flow.

Risk management strategies also rely heavily on the one-month SOFR rate. Financial institutions use the SOFR rate to hedge against interest rate risks, ensuring that they are protected against potential losses arising from changes in interest rates. Investors can also use the SOFR rate to inform their investment decisions, such as allocating assets to fixed-income securities or adjusting their portfolio composition.

Furthermore, the one-month SOFR rate is used in various financial instruments, such as floating-rate notes, commercial paper, and certificates of deposit. These instruments are often tied to the SOFR rate, which determines the interest rates paid to investors. As a result, understanding the one-month SOFR rate is crucial for investors seeking to optimize their returns.

In addition, the one-month SOFR rate has implications for treasury management and cash management strategies. Businesses can use the SOFR rate to optimize their short-term investments, such as commercial paper and treasury bills, and to manage their cash flows more effectively.

By understanding the practical applications of the one-month SOFR rate, businesses and investors can make more informed decisions in short-term financing, optimize their financial strategies, and navigate the complexities of the financial markets.

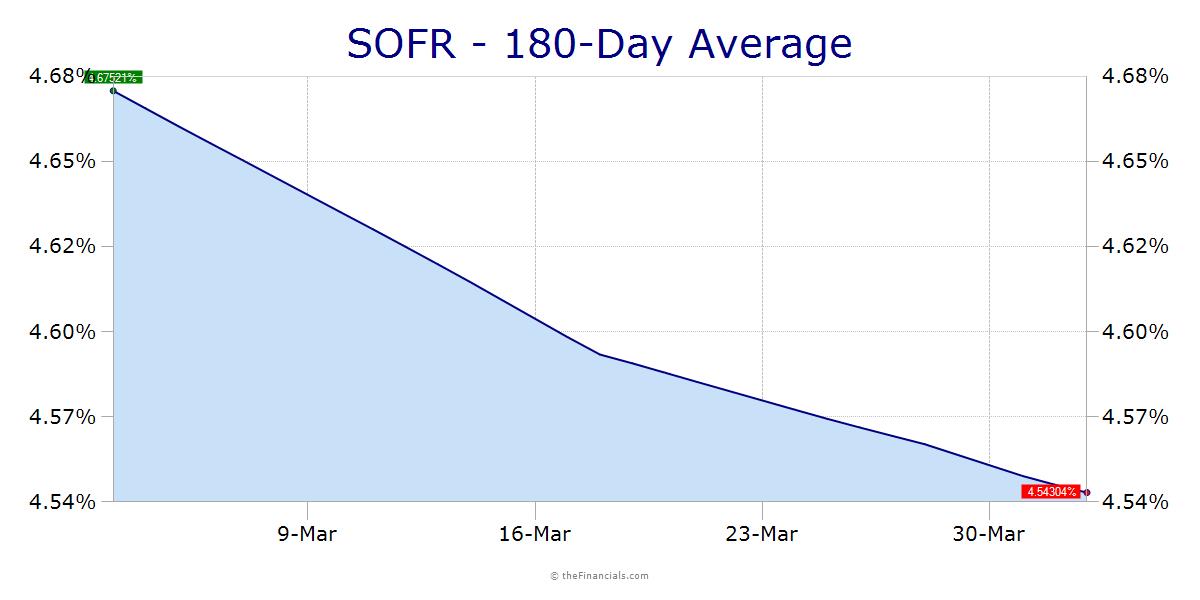

SOFR Rate Forecasting: Trends and Predictions

As the financial industry continues to adapt to the Secured Overnight Financing Rate (SOFR), forecasting trends and predicting future changes in the one-month SOFR rate have become increasingly important. Understanding these trends and predictions can help businesses, investors, and financial institutions make informed decisions in short-term financing.

Currently, market analysts and experts predict that the one-month SOFR rate will continue to fluctuate in response to changes in economic indicators, monetary policy, and market sentiment. With the Federal Reserve’s ongoing efforts to normalize interest rates, the SOFR rate is expected to rise in the short term, potentially reaching 2.5% by the end of the year.

However, some experts argue that the SOFR rate may experience downward pressure due to the ongoing COVID-19 pandemic and its impact on global economic growth. As a result, the one-month SOFR rate may remain relatively stable, hovering around 2.2% in the near future.

In the long term, the SOFR rate is expected to continue playing a critical role in shaping the short-term financing landscape. As the financial industry becomes increasingly reliant on SOFR-based instruments, the rate’s fluctuations will have far-reaching implications for lending, borrowing, and investment decisions.

To navigate these trends and predictions, businesses and investors must stay informed about changes in the one-month SOFR rate and its underlying drivers. By doing so, they can optimize their financial strategies, mitigate risks, and capitalize on opportunities in the short-term financing market.

For instance, borrowers seeking commercial loans can use SOFR rate forecasts to negotiate better loan terms and optimize their financing costs. Investors, on the other hand, can use these forecasts to inform their investment decisions, such as allocating assets to fixed-income securities or adjusting their portfolio composition.

Ultimately, understanding the trends and predictions surrounding the one-month SOFR rate is crucial for businesses and investors seeking to thrive in the short-term financing market. By staying ahead of the curve, they can make informed decisions, optimize their financial strategies, and navigate the complexities of SOFR rate fluctuations.

Navigating the Complexities of SOFR Rate Fluctuations

As the financial industry continues to adapt to the Secured Overnight Financing Rate (SOFR), navigating the complexities of SOFR rate fluctuations has become a critical challenge for businesses, investors, and financial institutions. With the one-month SOFR rate influencing a wide range of financial decisions, it is essential to develop strategies for mitigating risks and capitalizing on opportunities.

One key approach is to maintain a deep understanding of the factors driving changes in the one-month SOFR rate, including economic indicators, monetary policy, and market sentiment. By staying informed about these factors, businesses and investors can anticipate potential changes in the SOFR rate and adjust their financial strategies accordingly.

Another strategy is to diversify investment portfolios and lending activities to minimize exposure to SOFR rate fluctuations. This can involve allocating assets to a range of fixed-income securities, such as commercial paper and treasury bills, and adjusting loan terms to reflect changes in the SOFR rate.

Risk management strategies also play a critical role in navigating SOFR rate fluctuations. Businesses and investors can use hedging instruments, such as interest rate swaps and options, to mitigate the risks associated with changes in the SOFR rate. Additionally, they can employ scenario analysis and stress testing to anticipate potential outcomes and develop contingency plans.

In commercial lending, businesses can use the one-month SOFR rate to negotiate better loan terms and optimize their financing costs. By understanding the SOFR rate and its underlying drivers, they can develop more effective financing strategies and minimize their exposure to interest rate risks.

Ultimately, navigating the complexities of SOFR rate fluctuations requires a deep understanding of the one-month SOFR rate and its role in shaping the short-term financing landscape. By developing effective strategies for mitigating risks and capitalizing on opportunities, businesses and investors can thrive in a rapidly changing financial environment.

As the financial industry continues to evolve, understanding what is the one month SOFR rate and its implications will remain crucial for making informed decisions in short-term financing. By staying ahead of the curve, businesses and investors can optimize their financial strategies, navigate the complexities of SOFR rate fluctuations, and achieve their goals in a rapidly changing financial landscape.