What is a Treasury Bill and How Does it Work?

Treasury bills, a low-risk investment option, offer a fixed return in the form of a discount to face value. They are backed by the credit and taxing power of the government, making them an attractive option for investors seeking a safe haven for their capital.

In essence, treasury bills are a way for governments to borrow money from investors for a short period, typically ranging from a few weeks to a year. The investor purchases the treasury bill at a discounted price, and upon maturity, the government repays the face value, resulting in a profit for the investor. This profit is the difference between the discounted purchase price and the face value, effectively serving as the interest earned on the investment.

Treasury bills differ from other fixed-income securities, such as bonds and commercial paper, in terms of their short tenure, liquidity, and credit quality. They are often used by investors to park their funds for a short duration, earning a low but relatively risk-free return. Understanding the characteristics and benefits of treasury bills is essential for investors looking to diversify their portfolios and manage risk effectively.

Understanding the Pricing Mechanism of Treasury Bills

The pricing mechanism of treasury bills is a complex process influenced by various market and economic factors. At its core, the price of a treasury bill is determined by the interaction of supply and demand in the market. The government, as the issuer, sets the face value and auction date, while investors bid on the securities, driving the price up or down.

The auction process plays a crucial role in determining the price of treasury bills. In a typical auction, investors submit bids, and the government accepts the bids that meet its desired yield. The auction process ensures that the price of the treasury bill reflects the market’s expectations of the government’s creditworthiness and the prevailing interest rates.

Market conditions, such as inflation, economic growth, and monetary policy, also impact the price of treasury bills. For instance, during periods of high inflation, investors may demand higher yields to compensate for the erosion of purchasing power, driving up the price of treasury bills. Conversely, in times of economic downturn, investors may seek safe-haven assets, increasing demand and pushing prices down.

Understanding the pricing mechanism of treasury bills is essential for investors seeking to calculate the price of treasury bill formula accurately. By grasping the interplay of supply and demand, auction processes, and market conditions, investors can make informed investment decisions and maximize their returns.

How to Calculate the Price of a Treasury Bill Using the Formula

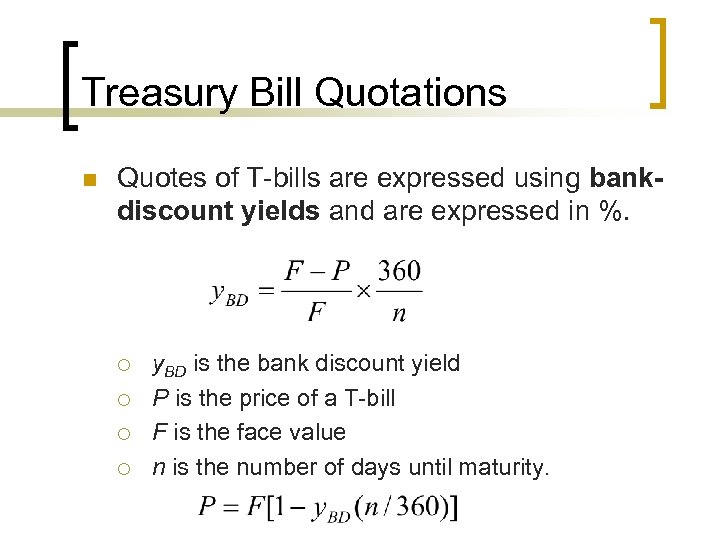

To calculate the price of a treasury bill, investors can use the following formula: Price = Face Value / (1 + (Discount Rate x Maturity Period)). This formula takes into account the face value of the treasury bill, the discount rate, and the maturity period to determine the price of the security.

Let’s break down each component of the formula:

Face Value: This is the amount that the government promises to pay back to the investor at maturity. It is the principal amount of the investment.

Discount Rate: This is the rate at which the treasury bill is discounted from its face value. It is expressed as a decimal and represents the percentage of the face value that the investor is willing to accept as a discount.

Maturity Period: This is the length of time until the treasury bill matures. It is expressed in years and affects the discount rate applied to the face value.

By plugging in the values for face value, discount rate, and maturity period, investors can calculate the price of the treasury bill formula. For example, if the face value is $1,000, the discount rate is 2%, and the maturity period is 0.5 years, the price of the treasury bill would be $980.

Understanding how to calculate the price of a treasury bill using the formula is crucial for investors seeking to make informed investment decisions. By grasping the relationship between face value, discount rate, and maturity period, investors can accurately determine the price of treasury bill formula and maximize their returns.

Breaking Down the Treasury Bill Formula: A Closer Look

The price of treasury bill formula is a complex equation that takes into account several key variables. To gain a deeper understanding of how the formula works, let’s dissect each component and examine how they interact to determine the price of the security.

The formula is: Price = Face Value / (1 + (Discount Rate x Maturity Period)). At first glance, it may seem straightforward, but each variable plays a critical role in determining the price of the treasury bill.

The face value, also known as the principal, is the amount that the government promises to pay back to the investor at maturity. It is the foundation of the formula and provides the basis for the calculation.

The discount rate, expressed as a decimal, represents the percentage of the face value that the investor is willing to accept as a discount. It is influenced by market conditions, such as inflation and interest rates, and can fluctuate over time.

The maturity period, expressed in years, affects the discount rate applied to the face value. A longer maturity period typically results in a higher discount rate, as investors demand a higher return for tying up their capital for an extended period.

When we combine these variables, we can see how they interact to determine the price of the treasury bill. For instance, if the face value is $1,000, the discount rate is 2%, and the maturity period is 0.5 years, the price of the treasury bill would be $980. This means that the investor is willing to accept a discount of $20 from the face value in exchange for the security.

By understanding the individual components of the price of treasury bill formula and how they interact, investors can gain a deeper appreciation for the complexities of treasury bill pricing and make more informed investment decisions.

Real-World Examples of Treasury Bill Pricing

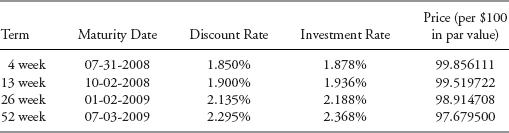

To illustrate how the price of treasury bill formula is applied in practice, let’s consider a few real-world examples.

Example 1: A 26-week treasury bill with a face value of $1,000 and a discount rate of 1.5% has a maturity period of 0.5 years. Using the formula, the price of the treasury bill would be $985. This means that the investor is willing to accept a discount of $15 from the face value in exchange for the security.

Example 2: A 52-week treasury bill with a face value of $5,000 and a discount rate of 2.2% has a maturity period of 1 year. Using the formula, the price of the treasury bill would be $4,890. This means that the investor is willing to accept a discount of $110 from the face value in exchange for the security.

Example 3: A 4-week treasury bill with a face value of $10,000 and a discount rate of 0.8% has a maturity period of 0.08 years. Using the formula, the price of the treasury bill would be $9,920. This means that the investor is willing to accept a discount of $80 from the face value in exchange for the security.

These examples demonstrate how the price of treasury bill formula is used in practice to calculate the price of treasury bills with varying face values, discount rates, and maturity periods. By applying the formula to real-world data, investors can gain a better understanding of how to calculate the price of treasury bills and make informed investment decisions.

In each of these examples, the price of treasury bill formula is used to determine the price of the security based on the face value, discount rate, and maturity period. By understanding how to apply the formula in different scenarios, investors can gain a deeper appreciation for the complexities of treasury bill pricing and make more informed investment decisions.

Tips for Investors: Maximizing Returns on Treasury Bills

When it comes to maximizing returns on treasury bills, investors need to be strategic and informed. Here are some actionable tips to help investors get the most out of their treasury bill investments:

Timing is everything: Treasury bill prices can fluctuate based on market conditions. Investors should keep an eye on interest rates and economic indicators to time their purchases strategically. Buying when interest rates are low and selling when they rise can help maximize returns.

Diversify your portfolio: Spreading investments across different types of treasury bills with varying maturity periods can help minimize risk and maximize returns. This strategy can also help investors take advantage of changing market conditions.

Understand the price of treasury bill formula: Having a deep understanding of the price of treasury bill formula is crucial for making informed investment decisions. Investors should be able to calculate the price of a treasury bill using the formula and understand how different variables affect the price.

Manage risk: Treasury bills are considered low-risk investments, but investors should still be aware of the risks involved. Investors should consider their overall risk tolerance and adjust their investment strategy accordingly.

Monitor market conditions: Market conditions can affect the price of treasury bills. Investors should stay up-to-date with market news and trends to make informed investment decisions.

Consider laddering: Laddering involves investing in multiple treasury bills with staggered maturity dates. This strategy can help investors take advantage of changing interest rates and maximize returns.

By following these tips, investors can maximize their returns on treasury bills and make the most of this low-risk investment option. Remember, understanding the price of treasury bill formula is key to making informed investment decisions.

Common Mistakes to Avoid When Calculating Treasury Bill Prices

When calculating the price of a treasury bill, investors must be precise and accurate to avoid costly mistakes. Here are some common errors to watch out for:

Misunderstanding the discount rate: The discount rate is a critical component of the price of treasury bill formula. Investors must ensure they understand how to calculate the discount rate correctly, as a small mistake can lead to significant errors in the price calculation.

Incorrectly applying the formula: The price of treasury bill formula involves a series of calculations, and investors must apply the formula correctly to get an accurate result. A single mistake in the calculation can lead to an incorrect price.

Failing to account for compounding: Treasury bills with longer maturity periods may involve compounding, which can affect the price calculation. Investors must ensure they account for compounding correctly to get an accurate result.

Ignoring market conditions: Market conditions can affect the price of treasury bills, and investors must consider these conditions when calculating the price. Failing to do so can lead to an inaccurate price calculation.

Not considering the face value: The face value of a treasury bill is a critical component of the price calculation. Investors must ensure they use the correct face value when applying the price of treasury bill formula.

By being aware of these common mistakes, investors can avoid costly errors and ensure they get an accurate calculation of the price of a treasury bill. Remember, understanding the price of treasury bill formula is key to making informed investment decisions.

Conclusion: Mastering the Art of Treasury Bill Pricing

In conclusion, understanding the price of treasury bill formula is crucial for investors looking to make informed investment decisions. By grasping the intricacies of the formula and its applications, investors can unlock the full potential of treasury bills as a low-risk investment option.

Throughout this guide, we have delved into the world of treasury bills, exploring their characteristics, benefits, and pricing mechanisms. We have also provided a step-by-step guide on how to calculate the price of a treasury bill using the formula, as well as real-world examples to illustrate its application.

Moreover, we have offered actionable advice for investors looking to maximize returns on treasury bills, including strategies for timing purchases, managing risk, and diversifying portfolios. By avoiding common mistakes and understanding the price of treasury bill formula, investors can make informed decisions that drive their investment goals forward.

In today’s fast-paced investment landscape, having a deep understanding of treasury bills and their pricing mechanisms is essential for success. By mastering the art of treasury bill pricing, investors can unlock a world of low-risk investment opportunities and achieve their financial objectives with confidence.