Unlocking the Potential of Treasury Yield Futures

In the world of finance, treasury yield futures play a vital role in facilitating the flow of capital between borrowers and lenders. These financial derivatives allow investors to hedge against interest rate risks and generate a stable source of income. By understanding the intricacies of treasury yield futures, investors can unlock a powerful tool for managing risk and optimizing returns in their investment portfolios. Treasury yield futures are based on the underlying treasury yields, which are influenced by a complex array of economic and market factors. As a result, grasping the concepts and mechanisms underlying treasury yield futures is essential for anyone seeking to navigate the complex landscape of modern finance.

How to Navigate the Complex World of 10-Year Treasury Yield Futures

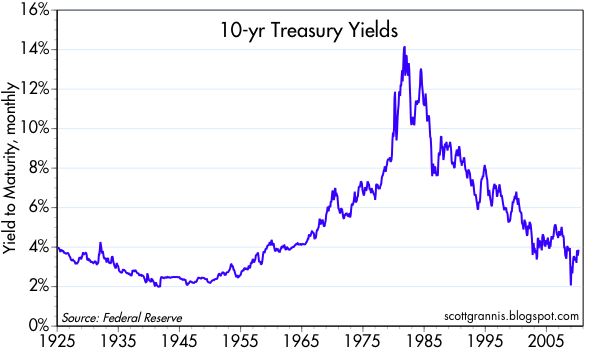

The 10-year treasury yield futures market has a rich history, dating back to the 1970s when the Chicago Board of Trade (CBOT) introduced the first treasury futures contract. Since then, the market has evolved to become a vital platform for investors, hedgers, and speculators alike. The market participants in the 10-year treasury yield futures market are diverse, ranging from institutional investors, such as pension funds and insurance companies, to individual traders and speculators. The prices of 10-year treasury yield futures are influenced by a complex array of factors, including monetary policy decisions, supply and demand imbalances, and geopolitical events. Understanding these factors is crucial for navigating the complex world of 10-year treasury yield futures and making informed investment decisions.

The Benefits of Investing in 10-Year Treasury Yield Futures

Investing in 10-year treasury yield futures offers a range of benefits that make them an attractive option for investors seeking to manage risk and generate steady returns. One of the primary advantages of 10-year treasury yield futures is their low risk profile. As a government-backed security, they are considered to be very low-risk, making them an ideal choice for risk-averse investors. Additionally, 10-year treasury yield futures are highly liquid, allowing investors to easily enter and exit positions as market conditions change. This liquidity also enables investors to take advantage of market opportunities as they arise. Furthermore, 10-year treasury yield futures have the potential to generate steady returns, making them an attractive option for investors seeking to generate income. By investing in 10-year treasury yield futures, investors can diversify their portfolios, reduce risk, and increase the potential for long-term returns.

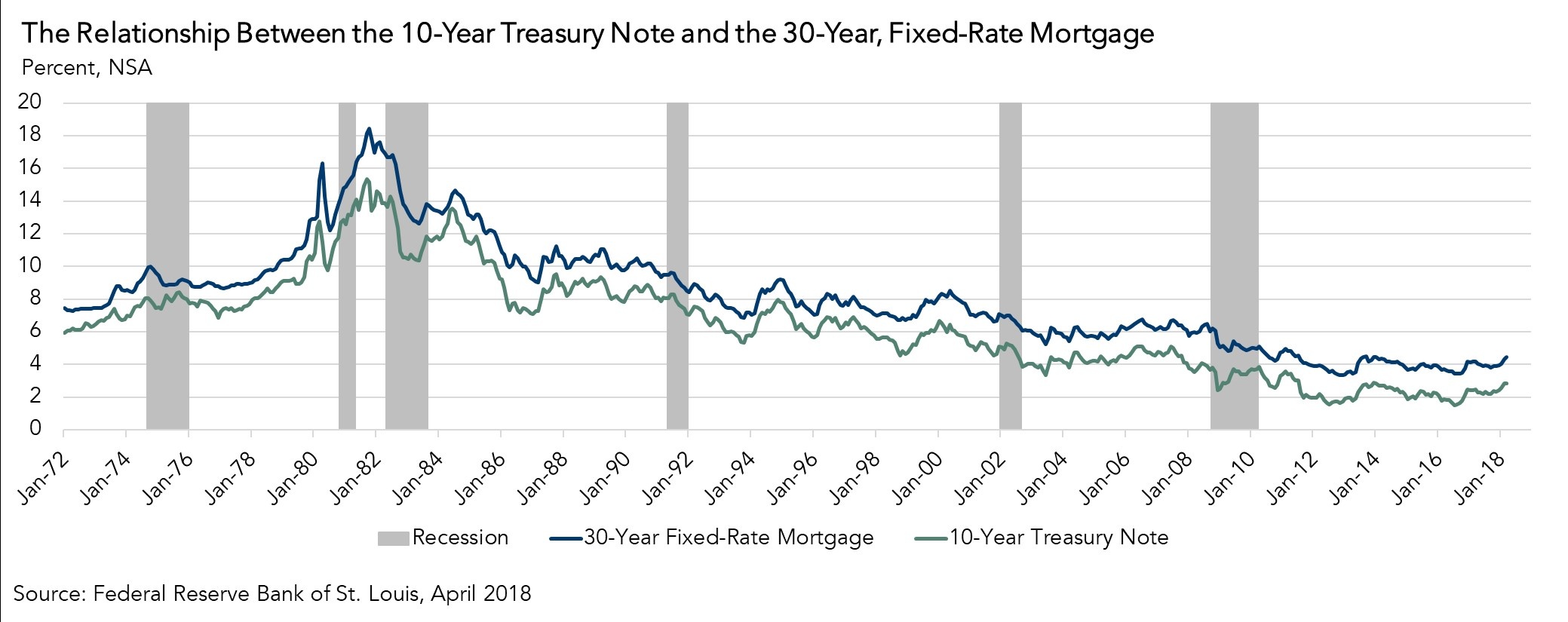

Understanding the Relationship Between Treasury Yields and the Economy

The relationship between treasury yields and the economy is complex and multifaceted. Treasury yields, including 10-year treasury yield futures, are closely tied to various economic indicators, such as GDP growth, inflation, and unemployment rates. When the economy is growing, treasury yields tend to rise as investors become more optimistic about the future and demand higher returns. Conversely, during periods of economic downturn, treasury yields tend to fall as investors seek safer havens. Inflation also plays a significant role in shaping treasury yields, as higher inflation expectations can lead to higher yields. Furthermore, monetary policy decisions, such as changes in interest rates, can also impact treasury yields. For instance, when central banks lower interest rates, treasury yields tend to fall, and vice versa. Understanding these relationships is crucial for investors seeking to navigate the 10-year treasury yield futures market and make informed investment decisions.

A Deep Dive into the Factors Affecting 10-Year Treasury Yield Futures Prices

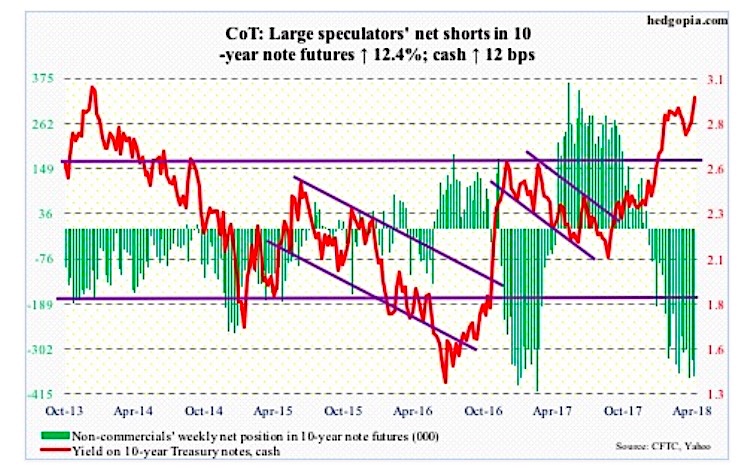

Several factors influence the prices of 10-year treasury yield futures, making it essential for investors to understand these factors to make informed investment decisions. One of the primary factors is monetary policy decisions, such as changes in interest rates, which can significantly impact 10-year treasury yield futures prices. Supply and demand imbalances also play a crucial role, as changes in the supply of treasury securities or shifts in investor demand can affect prices. Geopolitical events, such as wars, elections, or natural disasters, can also impact 10-year treasury yield futures prices, as they can influence investor sentiment and risk appetite. Additionally, economic indicators, such as GDP growth, inflation, and unemployment rates, can also affect 10-year treasury yield futures prices, as they influence investor expectations and sentiment. Furthermore, technical factors, such as market sentiment and positioning, can also impact prices. By understanding these factors, investors can better navigate the 10-year treasury yield futures market and make more informed investment decisions.

Strategies for Trading 10-Year Treasury Yield Futures Successfully

Trading 10-year treasury yield futures requires a deep understanding of the market and a well-thought-out strategy. One popular strategy is hedging, which involves taking a position in 10-year treasury yield futures to offset potential losses in other investments. Speculation is another strategy, where investors take a position based on their market expectations, with the goal of profiting from price movements. Arbitrage is also a viable strategy, involving the simultaneous purchase and sale of 10-year treasury yield futures to take advantage of price discrepancies. To minimize risks and maximize returns, investors should focus on risk management, diversification, and continuous market monitoring. Additionally, investors should stay up-to-date with market news and analysis to make informed trading decisions. By employing these strategies and staying informed, investors can successfully trade 10-year treasury yield futures and achieve their investment goals.

The Role of Technical Analysis in 10-Year Treasury Yield Futures Trading

Technical analysis plays a crucial role in 10-year treasury yield futures trading, as it enables investors to identify patterns and trends in price movements. By analyzing charts and graphs, investors can identify key levels of support and resistance, which can inform their trading decisions. Indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can also be used to predict price movements and identify potential trading opportunities. Furthermore, technical analysis can help investors identify trends and patterns in 10-year treasury yield futures prices, such as head and shoulders patterns, triangles, and wedges. By combining technical analysis with fundamental analysis, investors can gain a more comprehensive understanding of the 10-year treasury yield futures market and make more informed trading decisions. Additionally, technical analysis can help investors manage risk by identifying potential areas of support and resistance, and adjusting their trading strategies accordingly. By incorporating technical analysis into their trading strategy, investors can increase their chances of success in the 10-year treasury yield futures market.

Conclusion: Why 10-Year Treasury Yield Futures Should Be Part of Your Investment Portfolio

In conclusion, 10-year treasury yield futures offer a unique investment opportunity for those seeking to diversify their portfolios and manage interest rate risks. By understanding the benefits and risks associated with 10-year treasury yield futures, investors can make informed decisions about incorporating them into their investment strategies. The low risk profile, high liquidity, and potential for steady returns make 10-year treasury yield futures an attractive option for investors seeking to balance their portfolios. Furthermore, the correlation between treasury yields and economic indicators highlights the importance of including 10-year treasury yield futures in a diversified investment portfolio. By incorporating technical analysis and various trading strategies, investors can maximize their returns and minimize their risks. In today’s volatile market, 10-year treasury yield futures offer a stable source of income and a hedge against interest rate risks, making them an essential component of a well-diversified investment portfolio.