Understanding the Reward to Volatility Ratio

In the realm of investment analysis, the reward to volatility ratio is a crucial metric that helps investors and portfolio managers navigate the delicate balance between risk and potential returns. The reward to volatility ratio is given by the expected return of an investment divided by its standard deviation, providing a snapshot of the potential return per unit of risk taken. This ratio is a powerful tool for investment decisions, as it enables investors to evaluate the potential returns of different assets and portfolios, and make informed decisions about their investments. By understanding the reward to volatility ratio, investors can optimize their portfolios, minimize risk, and maximize returns. In essence, this ratio serves as a guide for investors to determine whether the potential returns of an investment justify the level of risk involved.

How to Calculate the Reward to Volatility Ratio

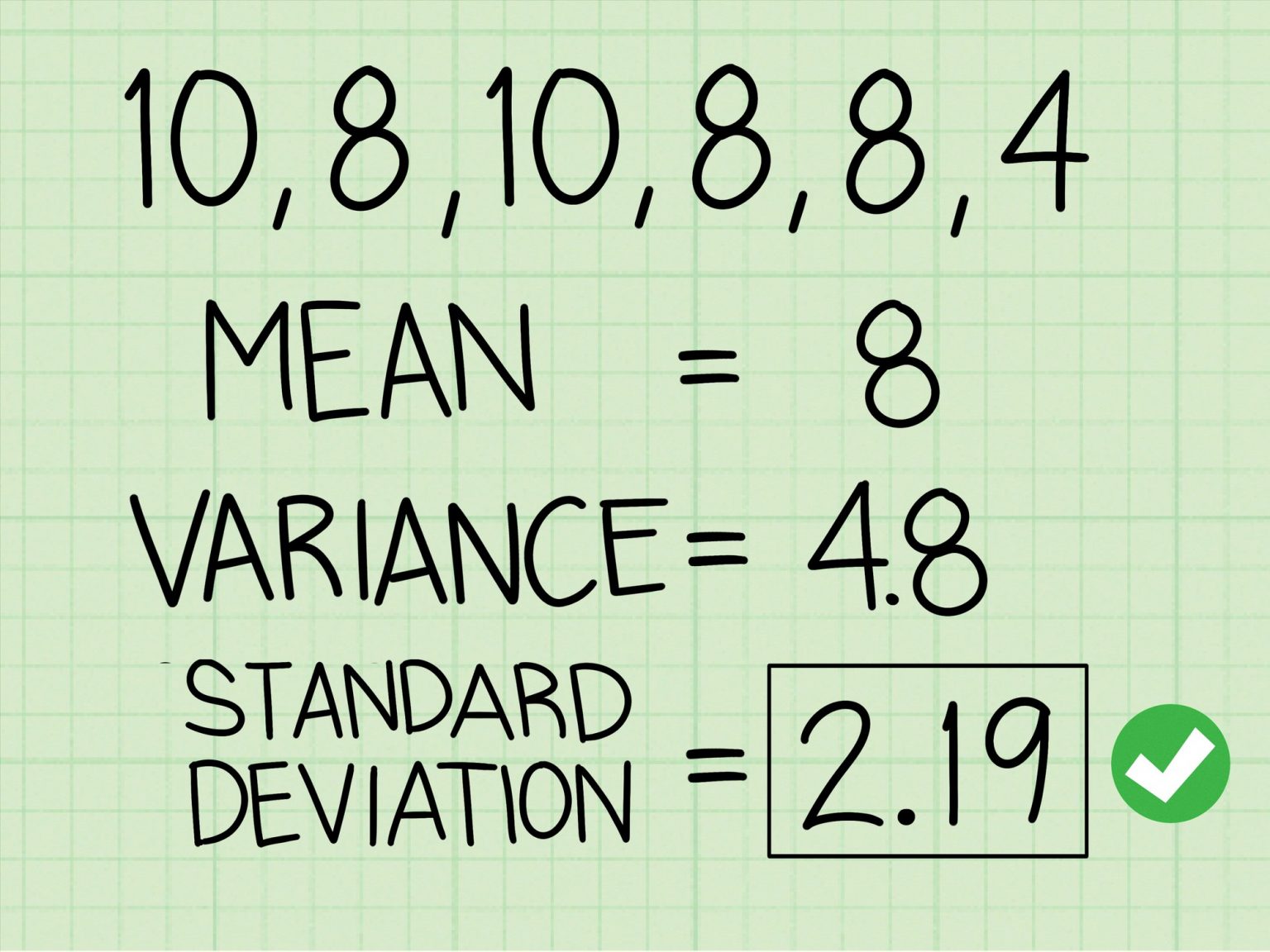

The reward to volatility ratio is a straightforward metric to calculate, and it can be done using historical data or expected returns and volatility estimates. The reward to volatility ratio is given by the expected return of an investment divided by its standard deviation. Mathematically, this can be represented as:

Reward to Volatility Ratio = Expected Return / Standard Deviation

For example, let’s say an investment has an expected return of 10% and a standard deviation of 5%. The reward to volatility ratio would be 2, indicating that for every unit of risk taken, the investment is expected to generate a return of 2%. This ratio provides a clear and concise way to evaluate the potential returns of an investment relative to its risk.

In practice, investors can calculate the reward to volatility ratio using historical data, such as the average annual return and standard deviation of an asset or portfolio over a specific period. Alternatively, they can use expected returns and volatility estimates based on market forecasts or other analytical models. Regardless of the approach, the reward to volatility ratio provides a valuable tool for investors to make informed decisions about their investments.

The Role of Expected Return and Standard Deviation

The reward to volatility ratio is a powerful metric that relies on two fundamental components: expected return and standard deviation. Understanding the role of these variables is crucial to effectively using the reward to volatility ratio in investment decisions.

Expected return represents the anticipated profit or gain from an investment. It is a measure of the potential upside of an investment, and it is typically expressed as a percentage. In the context of the reward to volatility ratio, expected return serves as the numerator, providing a sense of the potential reward associated with an investment.

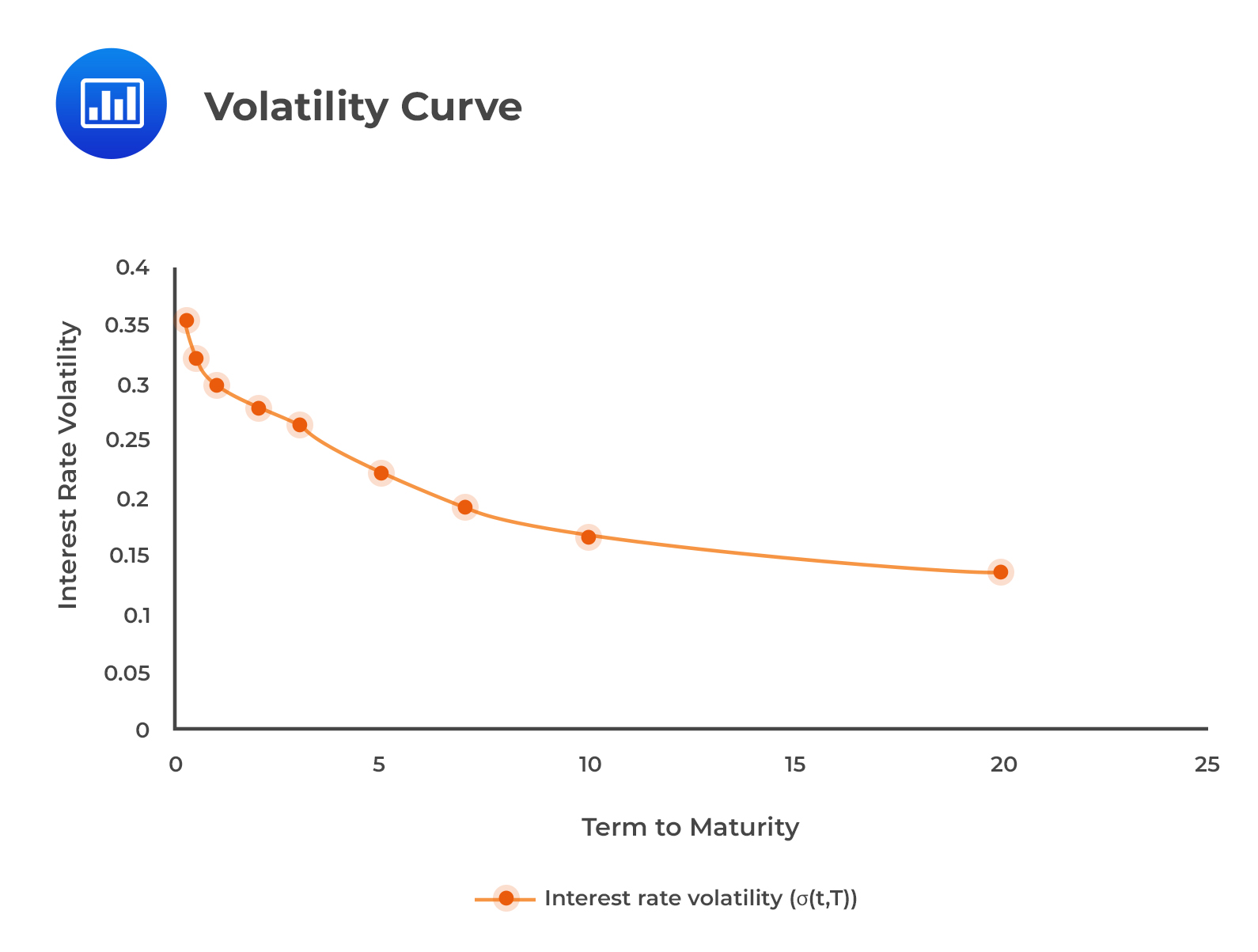

Standard deviation, on the other hand, measures the volatility or risk of an investment. It represents the degree of uncertainty or dispersion of returns around the expected return. A higher standard deviation indicates greater volatility, while a lower standard deviation suggests less volatility. In the reward to volatility ratio, standard deviation serves as the denominator, providing a sense of the risk associated with an investment.

The interplay between expected return and standard deviation is critical in the reward to volatility ratio. A high expected return accompanied by a low standard deviation is generally more desirable than a low expected return with a high standard deviation. The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk.

By understanding the role of expected return and standard deviation in the reward to volatility ratio, investors can make more informed decisions about their investments. They can identify opportunities with high potential returns and manageable risk, and avoid investments with low potential returns and excessive volatility.

Interpreting the Reward to Volatility Ratio

Once the reward to volatility ratio is calculated, it’s essential to interpret the results correctly to make informed investment decisions. The ratio provides a snapshot of the potential return of an investment relative to its risk, allowing investors to evaluate opportunities and make strategic decisions.

A high reward to volatility ratio indicates that an investment has a high potential return relative to its risk. This suggests that the investment may be a good opportunity, as it offers a high return for a given level of risk. Conversely, a low reward to volatility ratio indicates that an investment has a low potential return relative to its risk, suggesting that it may not be a desirable opportunity.

In general, a reward to volatility ratio greater than 1 is considered attractive, as it indicates that the potential return exceeds the risk. A ratio less than 1 suggests that the risk outweighs the potential return, and investors may want to reconsider the investment. The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk.

When interpreting the reward to volatility ratio, it’s essential to consider the investment’s overall risk profile, as well as the investor’s risk tolerance and investment goals. For example, an investor with a high risk tolerance may be willing to accept a lower reward to volatility ratio in pursuit of higher returns, while a conservative investor may prioritize a higher ratio to minimize risk.

By correctly interpreting the reward to volatility ratio, investors can make informed decisions about their investments, optimize their portfolios, and maximize their returns.

Real-World Applications of the Reward to Volatility Ratio

The reward to volatility ratio is a versatile metric that has numerous real-world applications in investment scenarios. Its ability to quantify the potential return of an investment relative to its risk makes it an essential tool for investors, portfolio managers, and financial analysts.

One of the most significant applications of the reward to volatility ratio is in portfolio optimization. By calculating the ratio for different assets or asset classes, investors can identify the most attractive opportunities and construct a portfolio that balances risk and potential return. This approach enables investors to maximize their returns while minimizing their exposure to risk.

The reward to volatility ratio is also widely used in risk management. By analyzing the ratio for different investments, investors can identify potential risks and take steps to mitigate them. For example, an investment with a low reward to volatility ratio may be deemed too risky, and investors may choose to diversify their portfolio or hedge against potential losses.

In addition, the reward to volatility ratio is used in asset allocation, where it helps investors determine the optimal mix of assets in their portfolio. By evaluating the ratio for different asset classes, such as stocks, bonds, and commodities, investors can allocate their resources effectively and achieve their investment goals.

The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk. This metric is widely used in investment decisions, as it enables investors to make informed choices about their investments and optimize their portfolios.

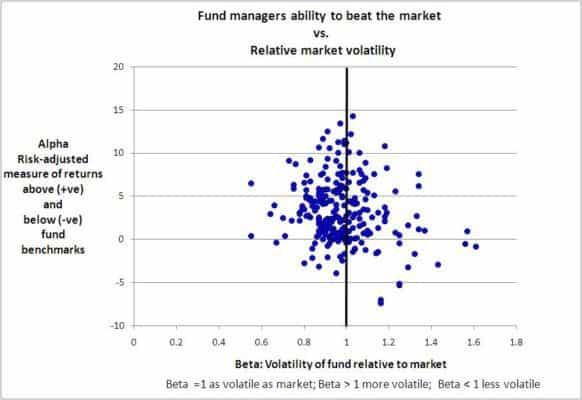

Other real-world applications of the reward to volatility ratio include performance measurement, where it is used to evaluate the performance of investment managers and funds, and risk assessment, where it is used to identify potential risks and opportunities in different investments.

Common Pitfalls to Avoid When Using the Reward to Volatility Ratio

While the reward to volatility ratio is a powerful tool for investment decisions, it’s essential to avoid common pitfalls that can lead to misinterpretation or misuse. By being aware of these potential pitfalls, investors can ensure that they use the ratio effectively and make informed decisions.

One common mistake is ignoring other risk metrics. The reward to volatility ratio provides a snapshot of an investment’s potential return relative to its risk, but it’s essential to consider other risk metrics, such as beta, value at risk, and expected shortfall. By relying solely on the reward to volatility ratio, investors may overlook other critical risk factors.

Another pitfall is relying too heavily on historical data. While historical data can provide valuable insights, it’s essential to consider the limitations of using past performance to predict future results. Market conditions and investor sentiment can change rapidly, rendering historical data less relevant. Investors should consider multiple scenarios and stress-test their portfolios to ensure they’re prepared for unexpected events.

Additionally, investors should avoid using the reward to volatility ratio in isolation. This metric is most effective when used in conjunction with other analytical tools and techniques, such as fundamental analysis, technical analysis, and scenario planning. By combining these approaches, investors can gain a more comprehensive understanding of an investment’s potential and make more informed decisions.

Furthermore, investors should be cautious when using the reward to volatility ratio to compare different investments. The ratio is sensitive to the time period and data used, and small changes in these variables can significantly impact the results. Investors should ensure that they’re using consistent data and time periods when comparing different investments.

By being aware of these common pitfalls, investors can use the reward to volatility ratio effectively and make informed decisions. The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk. By avoiding these common mistakes, investors can unlock the full potential of this powerful metric and achieve their investment goals.

Advanced Techniques for Refining the Reward to Volatility Ratio

While the traditional reward to volatility ratio provides a solid foundation for investment decisions, advanced techniques can further refine this metric to provide more accurate and nuanced insights. By incorporating alternative risk metrics and machine learning algorithms, investors can unlock new levels of precision and sophistication in their risk-return analysis.

One advanced technique is to use alternative risk metrics, such as value at risk (VaR) or expected shortfall (ES), in place of standard deviation. These metrics provide a more comprehensive view of an investment’s risk profile, allowing investors to better capture tail risks and extreme events. By incorporating these metrics into the reward to volatility ratio, investors can gain a more accurate understanding of an investment’s potential returns relative to its risk.

Another advanced technique is to incorporate machine learning algorithms into the reward to volatility ratio. By analyzing large datasets and identifying complex patterns, machine learning algorithms can help investors identify hidden relationships between risk and return. This can enable investors to develop more sophisticated investment strategies that take into account a wider range of factors and scenarios.

Additionally, investors can use techniques such as Monte Carlo simulations and scenario analysis to stress-test their portfolios and evaluate their performance under different market conditions. This can help investors identify potential vulnerabilities and opportunities, and make more informed decisions about their investments.

The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk. By incorporating advanced techniques and alternative risk metrics, investors can refine this ratio and gain a more nuanced understanding of the complex relationships between risk and return.

Ultimately, the key to unlocking the full potential of the reward to volatility ratio is to remain flexible and adaptable, and to be willing to incorporate new techniques and insights as they become available. By staying at the forefront of risk-return analysis, investors can maximize their returns and achieve their investment goals.

Conclusion: Maximizing Returns with the Reward to Volatility Ratio

In conclusion, the reward to volatility ratio is a powerful tool for investors seeking to navigate the complex relationships between risk and return. By understanding the significance of this metric, investors can make more informed decisions about their investments and maximize their returns.

The reward to volatility ratio is given by the expected return divided by the standard deviation, providing a clear and concise way to evaluate the potential returns of an investment relative to its risk. By incorporating this metric into their investment decisions, investors can develop a more nuanced understanding of the trade-offs between risk and return.

Moreover, by avoiding common pitfalls and incorporating advanced techniques, investors can refine their use of the reward to volatility ratio and unlock new levels of precision and sophistication in their risk-return analysis. Whether used in portfolio optimization, risk management, or other investment scenarios, the reward to volatility ratio is an essential tool for any investor seeking to maximize their returns.

Ultimately, the key to success lies in combining a deep understanding of the reward to volatility ratio with a willingness to adapt and innovate. By staying at the forefront of risk-return analysis, investors can stay ahead of the curve and achieve their investment goals.

By mastering the reward to volatility ratio, investors can unlock the full potential of their investments and achieve long-term success. Whether you’re a seasoned investor or just starting out, this powerful metric is an essential tool for anyone seeking to navigate the complex world of risk and return.