Understanding the Concept of Beta in Finance

In the world of finance, beta is a crucial metric that measures the volatility of an investment or a portfolio. It is a numerical value that indicates the degree of systematic risk associated with a particular asset or investment. Beta is used to calculate the expected return on an investment, providing investors and analysts with a valuable tool for making informed decisions. A beta of 1 indicates that the investment moves in line with the market, while a beta greater than 1 indicates higher volatility, and a beta less than 1 indicates lower volatility. Understanding beta is essential for investors seeking to optimize their portfolios and manage risk effectively. As we delve deeper into the world of finance, it is essential to understand the concept of unlevered beta, a critical component of capital budgeting decisions.

What is an Unlevered Beta and Why is it Important?

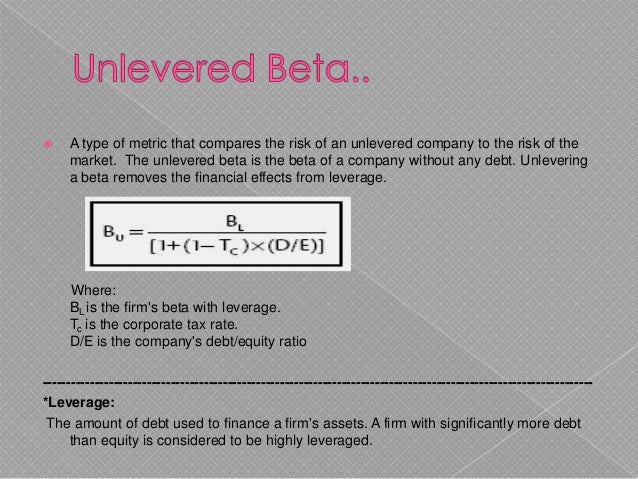

An unlevered beta, also known as an asset beta, is a financial metric that measures the volatility of a company’s assets, excluding the effects of debt. It is a critical component in evaluating the performance of a company or a project, as it helps investors and analysts understand the underlying risk of the business. Unlevered beta is essential in capital budgeting decisions, as it enables companies to assess the viability of projects and make informed investment decisions. In contrast to levered beta, which takes into account the company’s debt, unlevered beta provides a more accurate representation of the company’s underlying risk. By understanding unlevered beta, investors and analysts can better assess the potential return on investment and make more informed decisions.

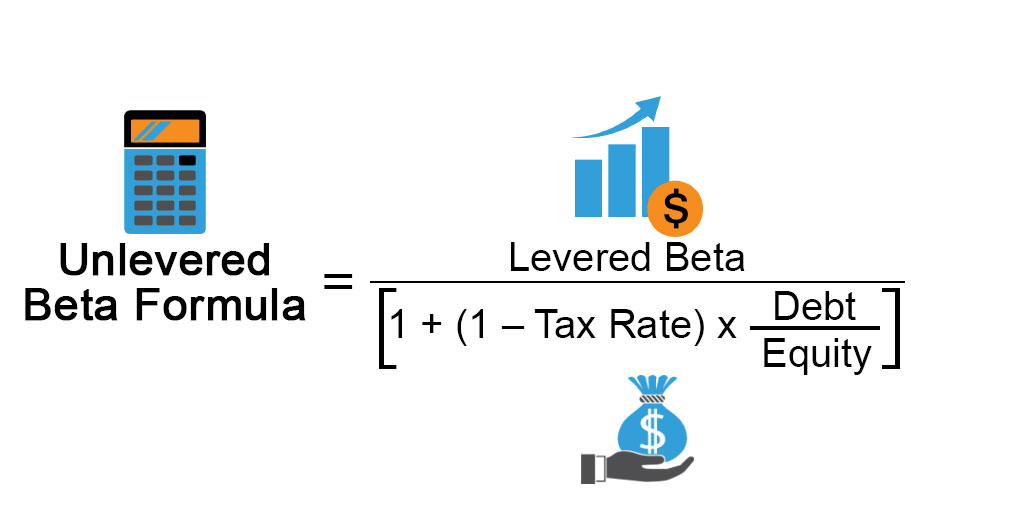

How to Calculate Unlevered Beta: A Step-by-Step Approach

Calculating unlevered beta is a crucial step in evaluating the performance of a company or a project. The unlevered beta formula is as follows: Unlevered Beta = Levered Beta / (1 + (1 – Tax Rate) \* (Debt/Equity)). This formula takes into account the company’s debt and tax rate to provide a more accurate representation of the company’s underlying risk. To calculate unlevered beta, follow these steps:

Step 1: Determine the company’s levered beta, which can be found in financial databases or calculated using historical stock prices.

Step 2: Determine the company’s debt-to-equity ratio, which can be found in the company’s financial statements.

Step 3: Determine the company’s tax rate, which can be found in the company’s financial statements or through industry research.

Step 4: Plug in the values into the unlevered beta formula to calculate the unlevered beta.

For example, let’s say a company has a levered beta of 1.2, a debt-to-equity ratio of 0.5, and a tax rate of 25%. Using the formula, the unlevered beta would be approximately 0.96. This means that the company’s assets have a volatility of 0.96, excluding the effects of debt.

Using unlevered beta in capital budgeting decisions is essential, as it provides a more accurate representation of the company’s underlying risk. By understanding the unlevered beta, companies can make more informed investment decisions and optimize their portfolios.

The Difference Between Levered and Unlevered Beta: A Comparative Analysis

Levered beta and unlevered beta are two distinct concepts in finance, each serving a unique purpose in evaluating the performance of a company or a project. Understanding the differences between these two types of beta is crucial for investors and analysts to make informed decisions.

Levered beta, also known as equity beta, measures the volatility of a company’s stock price in relation to the overall market. It takes into account the company’s debt and equity structure, providing a comprehensive view of the company’s risk profile. Levered beta is commonly used in capital asset pricing models (CAPM) to estimate the expected return on an investment.

Unlevered beta, on the other hand, measures the volatility of a company’s assets, excluding the effects of debt. It provides a more accurate representation of the company’s underlying risk, unaffected by the company’s capital structure. Unlevered beta is essential in capital budgeting decisions, as it enables companies to evaluate the viability of projects and make informed investment decisions.

The key differences between levered and unlevered beta lie in their calculation and application. Levered beta is calculated using the company’s stock price and market data, while unlevered beta is calculated using the company’s debt and equity structure. Levered beta is used in CAPM to estimate expected returns, while unlevered beta is used in capital budgeting decisions to evaluate project viability.

In scenarios where a company has a high debt-to-equity ratio, levered beta may overstate the company’s risk profile, leading to inaccurate investment decisions. In such cases, unlevered beta provides a more accurate representation of the company’s underlying risk. Conversely, in scenarios where a company has a low debt-to-equity ratio, levered beta may be a more suitable measure of risk.

In conclusion, understanding the differences between levered and unlevered beta is essential for investors and analysts to make informed decisions. By recognizing the strengths and limitations of each type of beta, companies can optimize their investment decisions and achieve their financial goals.

Real-World Applications of Unlevered Beta: Case Studies and Examples

Unlevered beta has been widely used in various industries and companies to evaluate the performance of projects and make informed investment decisions. Here are some real-world examples and case studies that demonstrate the application of unlevered beta in capital budgeting decisions.

Case Study 1: Coca-Cola’s Acquisition of Costa Coffee

In 2019, Coca-Cola acquired Costa Coffee for $5.1 billion. To evaluate the viability of the acquisition, Coca-Cola’s financial team used unlevered beta to assess the underlying risk of Costa Coffee’s assets. By using unlevered beta, Coca-Cola was able to exclude the effects of debt and focus on the inherent risk of the assets, leading to a more accurate evaluation of the acquisition.

Case Study 2: Amazon’s Expansion into Cloud Computing

In the early 2000s, Amazon Web Services (AWS) was a relatively new player in the cloud computing market. To evaluate the viability of expanding into this market, Amazon’s financial team used unlevered beta to assess the underlying risk of the project. By using unlevered beta, Amazon was able to identify the project’s risk profile and make informed investment decisions, leading to the successful expansion of AWS.

Case Study 3: General Electric’s Divestiture of GE Capital

In 2015, General Electric (GE) divested its financial services unit, GE Capital, to focus on its core industrial businesses. To evaluate the viability of the divestiture, GE’s financial team used unlevered beta to assess the underlying risk of GE Capital’s assets. By using unlevered beta, GE was able to exclude the effects of debt and focus on the inherent risk of the assets, leading to a more accurate evaluation of the divestiture.

These case studies demonstrate the importance of unlevered beta in capital budgeting decisions. By using unlevered beta, companies can evaluate the underlying risk of projects and make informed investment decisions, leading to improved financial performance and long-term success.

Common Mistakes to Avoid When Using Unlevered Beta

While unlevered beta is a powerful tool in finance, its misuse can lead to inaccurate results and poor investment decisions. Here are some common mistakes to avoid when using unlevered beta:

Mistake 1: Incorrect Calculation of Unlevered Beta

One of the most common mistakes is incorrect calculation of unlevered beta. This can occur due to incorrect input values, incorrect formula application, or misunderstanding of the concept. To avoid this mistake, it is essential to understand the formula and apply it correctly.

Mistake 2: Misinterpretation of Results

Another common mistake is misinterpreting the results of unlevered beta calculation. Unlevered beta provides a measure of the underlying risk of a company’s assets, but it does not provide a complete picture of the company’s risk profile. Investors and analysts must consider other risk metrics, such as value-at-risk (VaR) and expected shortfall (ES), to get a comprehensive view of the company’s risk.

Mistake 3: Ignoring Industry and Market Factors

Unlevered beta is sensitive to industry and market factors, and ignoring these factors can lead to inaccurate results. For example, a company operating in a highly volatile industry may have a higher unlevered beta than a company operating in a stable industry. Investors and analysts must consider these factors when interpreting the results of unlevered beta calculation.

Mistake 4: Using Unlevered Beta as a Standalone Metric

Unlevered beta is just one of the many risk metrics available, and using it as a standalone metric can lead to incomplete analysis. Investors and analysts must consider other risk metrics, such as VaR and ES, to get a comprehensive view of the company’s risk profile.

To avoid these mistakes, investors and analysts must have a thorough understanding of the concept of unlevered beta, its calculation, and its application in capital budgeting decisions. By avoiding these common mistakes, investors and analysts can make informed investment decisions and achieve their financial goals.

The Role of Unlevered Beta in Modern Portfolio Theory

In modern portfolio theory, unlevered beta plays a crucial role in evaluating the risk of a portfolio. Unlevered beta is used to measure the systematic risk of a portfolio, which is the risk that cannot be diversified away. By using unlevered beta, investors and analysts can identify the underlying risk of a portfolio and make informed investment decisions.

Unlevered beta is closely related to other risk metrics, such as value-at-risk (VaR) and expected shortfall (ES). VaR measures the potential loss of a portfolio over a specific time horizon with a given probability, while ES measures the expected loss of a portfolio in the worst α% of cases. Unlevered beta is used to calculate these risk metrics, providing a comprehensive view of a portfolio’s risk profile.

In addition, unlevered beta is used in asset pricing models, such as the capital asset pricing model (CAPM) and the arbitrage pricing theory (APT). These models use unlevered beta to estimate the expected return on an investment, providing a framework for investors to evaluate the performance of a portfolio.

The use of unlevered beta in modern portfolio theory has several benefits. It allows investors to evaluate the risk of a portfolio in a more accurate and comprehensive manner, enabling them to make informed investment decisions. Additionally, unlevered beta provides a framework for investors to optimize their portfolios, maximizing returns while minimizing risk.

In conclusion, unlevered beta plays a vital role in modern portfolio theory, providing a framework for investors to evaluate the risk of a portfolio and make informed investment decisions. By understanding the role of unlevered beta in modern portfolio theory, investors can optimize their portfolios and achieve their financial goals.

Conclusion: Unlocking the Power of Unlevered Beta in Finance

In conclusion, unlevered beta is a powerful tool in finance that provides a comprehensive measure of a company’s or project’s underlying risk. By understanding what is an unlevered beta and its significance in capital budgeting decisions, investors and analysts can make informed investment decisions and achieve their financial goals.

Throughout this article, we have discussed the concept of beta in finance, the difference between levered and unlevered beta, and the step-by-step approach to calculating unlevered beta. We have also explored the real-world applications of unlevered beta, common mistakes to avoid, and its role in modern portfolio theory.

The importance of unlevered beta in finance cannot be overstated. It provides a framework for investors to evaluate the performance of a company or project, and make informed investment decisions. By using unlevered beta, investors can optimize their portfolios, maximize returns, and minimize risk.

In today’s fast-paced and volatile financial markets, understanding unlevered beta is crucial for investors and analysts. By unlocking the power of unlevered beta, investors can gain a competitive edge, make informed investment decisions, and achieve their financial goals.