What is Level 2 Market Data and Why is it Important?

In the world of trading and investing, having access to the right data can be a game-changer. Level 2 market data is a type of data that provides a deeper level of insight into market activity, allowing traders and investors to make more informed decisions. But what exactly is Level 2 market data, and how does it differ from Level 1 data?

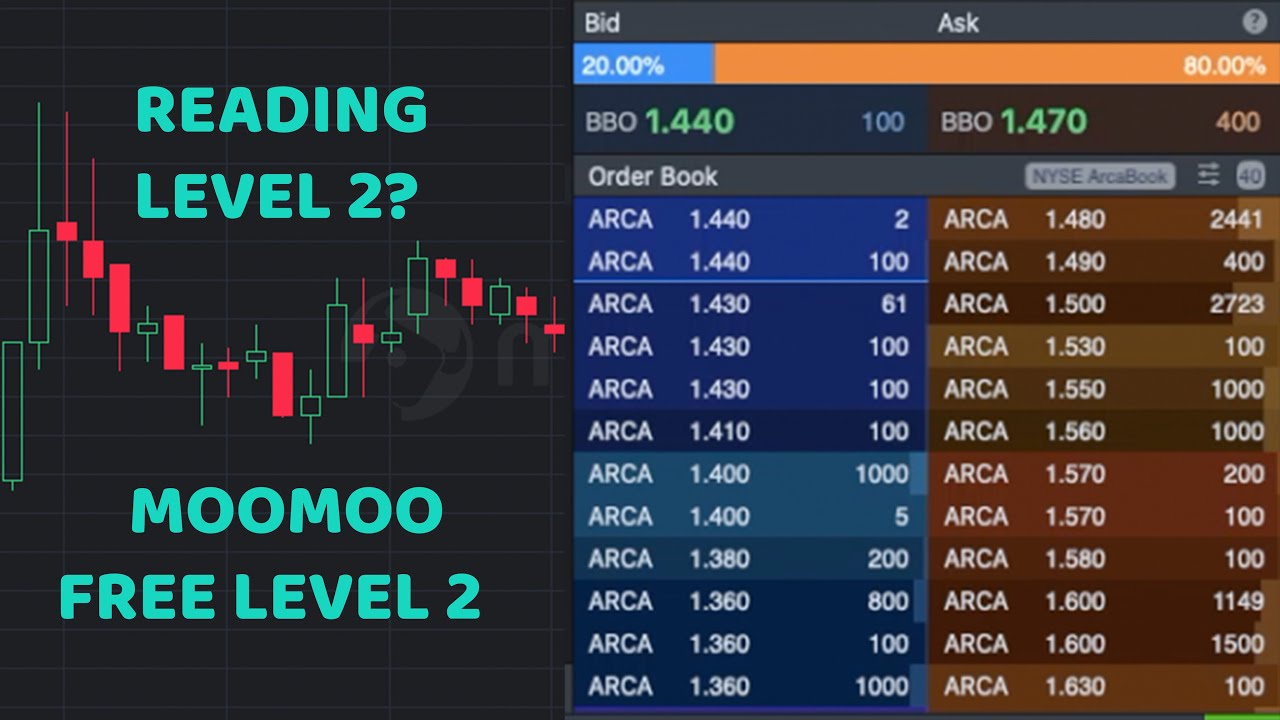

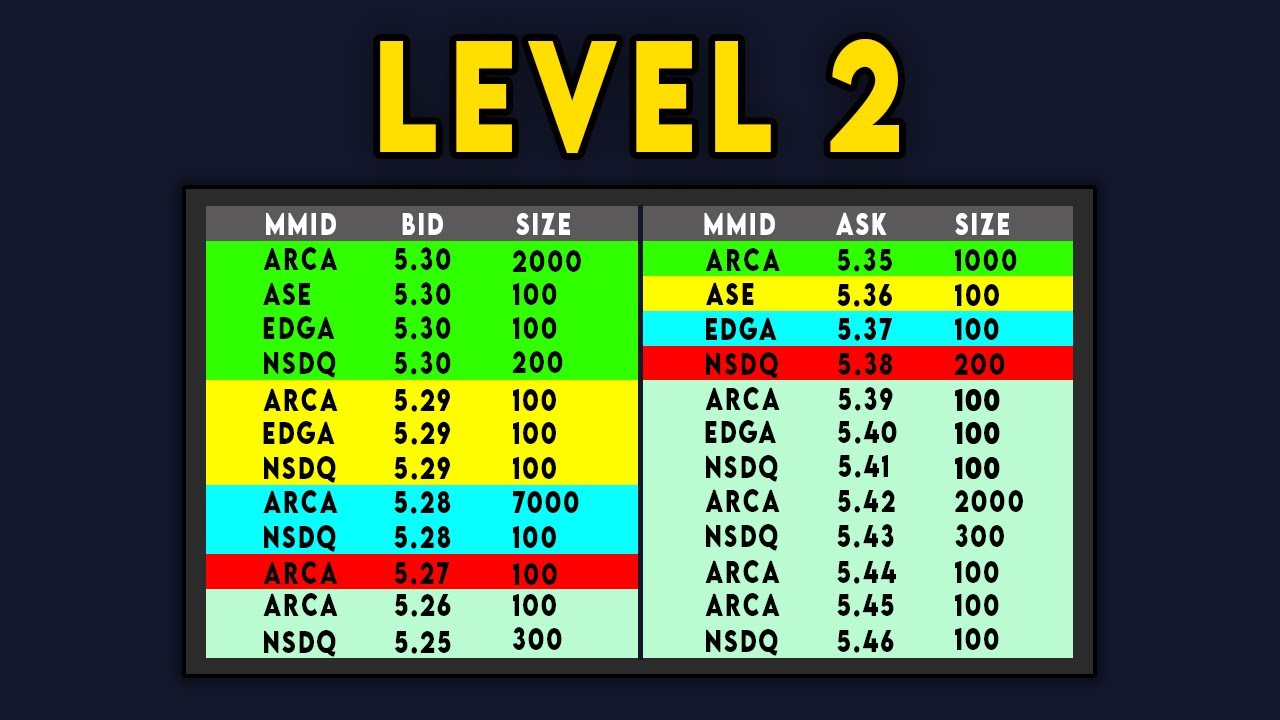

Level 1 data, also known as quote data, provides only the best bid and ask prices for a particular security. While this data is useful, it only scratches the surface of market activity. Level 2 data, on the other hand, provides a more comprehensive view of the market, including the quantity of shares available at each price level, as well as the identity of market participants. This additional information can be invaluable for traders and investors looking to gain an edge in the markets.

The benefits of having access to Level 2 data are numerous. By understanding the dynamics of the order book, traders can identify potential trading opportunities, anticipate market movements, and make more informed investment decisions. With Level 2 data, traders can also gain a better understanding of market sentiment, identify liquidity imbalances, and detect order flow imbalances. This can be particularly useful for traders looking to exploit market inefficiencies and capitalize on trading opportunities.

Learning how to understand Level 2 market data is a crucial step in taking your trading and investing to the next level. By gaining a deeper understanding of market dynamics and order flow, traders can make more informed decisions and stay ahead of the curve in fast-paced markets. In this article, we’ll explore the ins and outs of Level 2 market data, and provide a comprehensive guide on how to read and interpret this valuable data.

How to Read and Interpret Level 2 Market Data

Now that we’ve covered the basics of Level 2 market data, it’s time to dive deeper into how to read and interpret this valuable data. Reading and interpreting Level 2 data requires a combination of technical skills and market knowledge. In this section, we’ll provide a step-by-step guide on how to unlock the secrets of Level 2 market data.

Step 1: Understanding Order Book Dynamics

The order book is the heart of Level 2 market data, providing a real-time snapshot of market activity. To read and interpret Level 2 data, it’s essential to understand the dynamics of the order book, including the bid-ask spread, order flow, and market depth. By analyzing the order book, traders can identify potential trading opportunities, anticipate market movements, and make more informed investment decisions.

Step 2: Identifying Market Trends

Identifying market trends is a critical component of reading and interpreting Level 2 market data. By analyzing the order book and identifying patterns and trends, traders can anticipate market movements and make more informed investment decisions. This includes identifying areas of support and resistance, as well as recognizing changes in market sentiment.

Step 3: Recognizing Trading Opportunities

The ultimate goal of reading and interpreting Level 2 market data is to identify trading opportunities. By analyzing the order book and identifying areas of imbalance, traders can capitalize on trading opportunities and gain an edge in the markets. This includes identifying liquidity imbalances, detecting order flow imbalances, and exploiting market inefficiencies.

By following these steps and gaining a deeper understanding of Level 2 market data, traders can unlock the secrets of the market and make more informed investment decisions. Remember, how to understand Level 2 market data is a crucial step in taking your trading and investing to the next level. In the next section, we’ll delve deeper into the concept of order flow and its impact on market dynamics.

Understanding Order Flow and Market Dynamics

Order flow is a critical component of Level 2 market data, providing insights into market dynamics and sentiment. By analyzing order flow data, traders can gain a deeper understanding of market behavior, identify potential trading opportunities, and anticipate market movements. In this section, we’ll delve deeper into the concept of order flow and its impact on market dynamics.

What is Order Flow?

Order flow refers to the flow of orders into and out of the market, including buy and sell orders, limit orders, and market orders. By analyzing order flow data, traders can identify patterns and trends in market activity, including changes in market sentiment and liquidity.

How to Analyze Order Flow Data

Analyzing order flow data requires a combination of technical skills and market knowledge. To get started, traders can use various tools and indicators, such as order flow charts and heat maps, to visualize market activity and identify patterns and trends. By analyzing order flow data, traders can identify market sentiment, detect potential trading opportunities, and anticipate market movements.

Identifying Market Sentiment with Order Flow Data

Order flow data can be used to identify market sentiment, including bullish and bearish sentiment. By analyzing order flow data, traders can identify changes in market sentiment, including shifts in buying and selling pressure. This can be particularly useful for traders looking to anticipate market movements and capitalize on trading opportunities.

Detecting Trading Opportunities with Order Flow Data

Order flow data can also be used to detect potential trading opportunities, including liquidity imbalances and order flow imbalances. By analyzing order flow data, traders can identify areas of market inefficiency and capitalize on trading opportunities. This can be particularly useful for traders looking to gain an edge in the markets.

By understanding order flow and its impact on market dynamics, traders can gain a deeper understanding of market behavior and identify potential trading opportunities. In the next section, we’ll discuss various trading strategies that can be employed using Level 2 market data, including identifying liquidity imbalances, detecting order flow imbalances, and exploiting market inefficiencies.

Identifying Trading Opportunities with Level 2 Data

Level 2 market data provides a wealth of information for traders looking to identify trading opportunities. By analyzing Level 2 data, traders can identify liquidity imbalances, detect order flow imbalances, and exploit market inefficiencies. In this section, we’ll discuss various trading strategies that can be employed using Level 2 market data.

Identifying Liquidity Imbalances

Liquidity imbalances occur when there is a mismatch between buy and sell orders in the market. By analyzing Level 2 data, traders can identify areas of liquidity imbalance and capitalize on trading opportunities. This can be particularly useful for traders looking to exploit market inefficiencies and gain an edge in the markets.

Detecting Order Flow Imbalances

Order flow imbalances occur when there is a mismatch between buy and sell orders at different price levels. By analyzing Level 2 data, traders can identify areas of order flow imbalance and anticipate market movements. This can be particularly useful for traders looking to anticipate market trends and capitalize on trading opportunities.

Exploiting Market Inefficiencies

Market inefficiencies occur when there is a mismatch between market prices and their true value. By analyzing Level 2 data, traders can identify areas of market inefficiency and exploit them for profit. This can be particularly useful for traders looking to gain an edge in the markets and capitalize on trading opportunities.

Other Trading Strategies

In addition to identifying liquidity imbalances, detecting order flow imbalances, and exploiting market inefficiencies, there are several other trading strategies that can be employed using Level 2 market data. These include identifying areas of high trading activity, detecting changes in market sentiment, and anticipating market movements.

By understanding how to identify trading opportunities with Level 2 data, traders can gain a competitive edge in the markets and capitalize on trading opportunities. In the next section, we’ll discuss common pitfalls to avoid when using Level 2 market data, including misinterpreting data, ignoring market context, and failing to adapt to changing market conditions.

Common Pitfalls to Avoid When Using Level 2 Market Data

While Level 2 market data can be a powerful tool for traders and investors, it’s not without its pitfalls. In this section, we’ll highlight common mistakes traders make when using Level 2 market data, including misinterpreting data, ignoring market context, and failing to adapt to changing market conditions.

Misinterpreting Data

One of the most common pitfalls when using Level 2 market data is misinterpreting the data. This can occur when traders fail to understand the nuances of Level 2 data or when they rely too heavily on a single metric or indicator. To avoid misinterpreting data, traders should take a holistic approach to analyzing Level 2 data, considering multiple metrics and indicators to gain a comprehensive understanding of market dynamics.

Ignoring Market Context

Another common pitfall is ignoring market context when using Level 2 market data. This can occur when traders fail to consider broader market trends, news, and events that may be impacting market dynamics. To avoid ignoring market context, traders should stay up-to-date with market news and events, and consider how these may be impacting Level 2 data.

Failing to Adapt to Changing Market Conditions

Level 2 market data is not a static entity, and market conditions can change rapidly. Failing to adapt to changing market conditions can lead to poor trading decisions and losses. To avoid this pitfall, traders should continuously monitor and refine their trading strategy, incorporating new data and insights as they become available.

Other Common Pitfalls

In addition to misinterpreting data, ignoring market context, and failing to adapt to changing market conditions, there are several other common pitfalls to avoid when using Level 2 market data. These include overreliance on a single trading strategy, failing to diversify, and ignoring risk management principles.

By understanding these common pitfalls, traders can avoid common mistakes and maximize the benefits of using Level 2 market data. In the next section, we’ll discuss best practices for integrating Level 2 data into a trading strategy, including setting up a trading platform, creating a data-driven approach, and continuously monitoring and refining the strategy.

Best Practices for Integrating Level 2 Data into Your Trading Strategy

Integrating Level 2 market data into a trading strategy requires a thoughtful and structured approach. In this section, we’ll provide practical tips and best practices for incorporating Level 2 data into a trading strategy, including setting up a trading platform, creating a data-driven approach, and continuously monitoring and refining the strategy.

Setting Up a Trading Platform

The first step in integrating Level 2 data into a trading strategy is to set up a trading platform that can handle the complexity of Level 2 data. This may involve selecting a trading platform that provides real-time access to Level 2 data, as well as advanced analytics and visualization tools.

Creating a Data-Driven Approach

A data-driven approach is essential for successfully integrating Level 2 data into a trading strategy. This involves using Level 2 data to inform trading decisions, rather than relying on intuition or emotional bias. By creating a data-driven approach, traders can identify trading opportunities, manage risk, and optimize their trading strategy.

Continuously Monitoring and Refining the Strategy

Level 2 market data is constantly changing, and a trading strategy must be able to adapt to these changes. This involves continuously monitoring the performance of the trading strategy, refining the approach as needed, and incorporating new data and insights as they become available.

Other Best Practices

In addition to setting up a trading platform, creating a data-driven approach, and continuously monitoring and refining the strategy, there are several other best practices to keep in mind when integrating Level 2 data into a trading strategy. These include staying up-to-date with market news and events, managing risk, and continuously learning and refining skills.

By following these best practices, traders can successfully integrate Level 2 market data into their trading strategy, gaining a competitive edge in the markets and improving their overall trading performance. In the next section, we’ll provide real-world examples of how Level 2 market data has been used successfully in trading and investing.

Case Studies: Real-World Examples of Level 2 Market Data in Action

In this section, we’ll explore real-world examples of how Level 2 market data has been used successfully in trading and investing. These case studies demonstrate the power of Level 2 data in providing traders and investors with a competitive edge in the markets.

Case Study 1: Identifying Liquidity Imbalances

A hedge fund used Level 2 market data to identify liquidity imbalances in the options market. By analyzing order flow data, the fund was able to detect imbalances in the order book and exploit them for profit. This strategy resulted in a significant increase in returns, outperforming the broader market.

Case Study 2: Detecting Order Flow Imbalances

A proprietary trading firm used Level 2 market data to detect order flow imbalances in the equities market. By analyzing the order flow data, the firm was able to identify potential trading opportunities and capitalize on them. This strategy resulted in a significant increase in trading profits, with a high Sharpe ratio.

Case Study 3: Exploiting Market Inefficiencies

A quantitative trading firm used Level 2 market data to exploit market inefficiencies in the futures market. By analyzing the order book dynamics, the firm was able to identify mispricings in the market and capitalize on them. This strategy resulted in a significant increase in returns, with a low risk profile.

These case studies demonstrate the power of Level 2 market data in providing traders and investors with a competitive edge in the markets. By understanding how to read and interpret Level 2 data, traders can identify trading opportunities, manage risk, and optimize their trading strategy. In the next section, we’ll summarize the key takeaways from the article and emphasize the importance of understanding Level 2 market data for trading success.

Conclusion: Mastering Level 2 Market Data for Trading Success

In conclusion, understanding Level 2 market data is crucial for trading success in today’s fast-paced markets. By grasping the concepts of Level 2 data, traders and investors can gain a competitive edge, make informed decisions, and optimize their trading strategies. Throughout this article, we’ve explored the importance of Level 2 market data, how to read and interpret it, and how to integrate it into a trading strategy.

By mastering Level 2 market data, traders can identify trading opportunities, manage risk, and stay ahead of the competition. It’s essential to remember that Level 2 data is not a magic bullet, but rather a powerful tool that requires skill, knowledge, and practice to wield effectively. By following the best practices outlined in this article and continuing to learn and refine their skills, traders can unlock the full potential of Level 2 market data and achieve trading success.

As we’ve seen, how to understand Level 2 market data is a critical component of trading success. By understanding order book dynamics, identifying market trends, and recognizing trading opportunities, traders can gain a deeper insight into market behavior and make more informed decisions. Whether you’re a seasoned trader or just starting out, mastering Level 2 market data is an essential step in achieving your trading goals.

In today’s markets, having access to Level 2 market data is no longer a luxury, but a necessity. By incorporating Level 2 data into your trading strategy, you can stay ahead of the competition, adapt to changing market conditions, and achieve long-term trading success. Remember, the key to success lies in understanding how to understand Level 2 market data and using it to inform your trading decisions.