Unlocking the Secrets of Currency Pairs

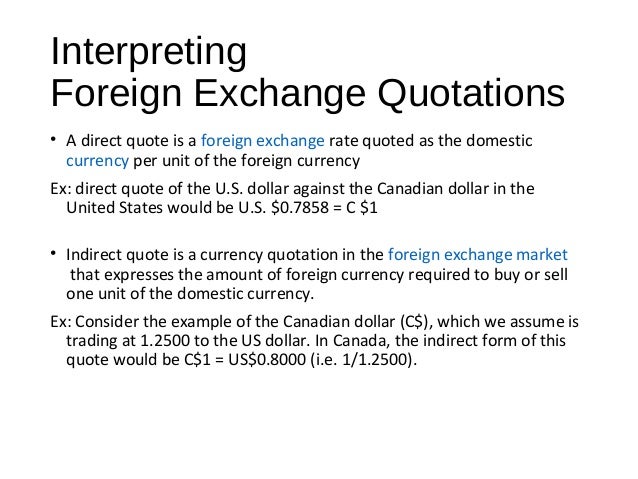

When it comes to understanding how to read currency quotes, grasping the concept of currency pairs is essential. A currency pair represents the exchange rate between two currencies, with the value of one currency quoted in terms of the other. For instance, the EUR/USD currency pair represents the exchange rate between the Euro and the US Dollar. In this pair, the Euro is the base currency, and the US Dollar is the quote currency.

Currency pairs are typically represented in a specific format, with the base currency listed first, followed by the quote currency. For example, EUR/USD, USD/JPY, and GBP/USD are all examples of currency pairs. These pairs can be further classified into major and minor pairs. Major currency pairs, such as EUR/USD and USD/JPY, are the most widely traded and liquid pairs in the market, while minor currency pairs, such as EUR/TRY or USD/MXN, are less traded and may have higher spreads.

Understanding currency pairs is crucial to learning how to read currency quotes, as it provides the foundation for analyzing exchange rates and making informed trading decisions. By grasping the concept of currency pairs, you can better navigate the complex world of foreign exchange and make more informed decisions when trading or investing in currencies. In the next section, we will delve deeper into the anatomy of a currency quote, exploring the components that make up a quote and how to interpret them.

The Anatomy of a Currency Quote

A currency quote is a complex entity that consists of several components, each providing valuable information to traders and investors. To learn how to read currency quotes effectively, it’s essential to break down these components and understand their roles. In this section, we’ll delve into the anatomy of a currency quote, exploring the base currency, quote currency, bid price, ask price, and spread.

The base currency is the first currency listed in a currency pair, while the quote currency is the second. For example, in the EUR/USD currency pair, the Euro is the base currency, and the US Dollar is the quote currency. The bid price represents the highest price that a buyer is willing to pay for a currency, while the ask price is the lowest price that a seller is willing to accept. The spread, which is the difference between the bid and ask prices, represents the profit made by the broker or market maker.

To illustrate these components, let’s consider an example. Suppose the EUR/USD currency quote is 1.1000/1.1020. In this case, the base currency is the Euro, and the quote currency is the US Dollar. The bid price is 1.1000, which means that buyers are willing to pay 1.1000 US Dollars for one Euro. The ask price is 1.1020, which means that sellers are willing to accept 1.1020 US Dollars for one Euro. The spread is 0.0020, which represents the profit made by the broker or market maker.

Understanding the components of a currency quote is crucial to learning how to read currency quotes effectively. By grasping these concepts, you can better analyze exchange rates and make more informed trading decisions. In the next section, we’ll provide a step-by-step guide on how to read a currency quote, including how to identify the base and quote currencies, and how to understand the bid and ask prices.

How to Read a Currency Quote: A Step-by-Step Guide

Learning how to read currency quotes is a crucial skill for anyone involved in foreign exchange trading or investment. In this section, we’ll provide a step-by-step guide on how to read a currency quote, including how to identify the base and quote currencies, and how to understand the bid and ask prices.

Step 1: Identify the Base and Quote Currencies

The first step in reading a currency quote is to identify the base and quote currencies. The base currency is the first currency listed in the pair, while the quote currency is the second. For example, in the EUR/USD currency pair, the Euro is the base currency, and the US Dollar is the quote currency.

Step 2: Understand the Bid Price

The bid price represents the highest price that a buyer is willing to pay for a currency. It’s the price at which a trader can sell a currency. For example, if the EUR/USD bid price is 1.1000, it means that buyers are willing to pay 1.1000 US Dollars for one Euro.

Step 3: Understand the Ask Price

The ask price represents the lowest price that a seller is willing to accept for a currency. It’s the price at which a trader can buy a currency. For example, if the EUR/USD ask price is 1.1020, it means that sellers are willing to accept 1.1020 US Dollars for one Euro.

Step 4: Calculate the Spread

The spread is the difference between the bid and ask prices. It represents the profit made by the broker or market maker. For example, if the EUR/USD bid price is 1.1000 and the ask price is 1.1020, the spread is 0.0020.

By following these steps, you can learn how to read currency quotes effectively and make more informed trading decisions. Remember, understanding how to read currency quotes is a crucial skill for anyone involved in foreign exchange trading or investment. In the next section, we’ll explore the conventions used in currency quotes, including the use of pips, points, and percentages.

Understanding Currency Quote Conventions

When learning how to read currency quotes, it’s essential to understand the conventions used in the foreign exchange market. These conventions help traders and investors navigate the complexities of currency quotes and make informed decisions. In this section, we’ll explore the conventions used in currency quotes, including the use of pips, points, and percentages.

Pips: The Smallest Unit of Currency Quotes

A pip is the smallest unit of price movement in a currency quote. It’s usually equal to 0.0001 of the quote currency. For example, if the EUR/USD currency quote moves from 1.1000 to 1.1005, it has moved 5 pips. Pips are used to measure the profit or loss of a trade, and they’re an essential concept for traders and investors.

Points: A Larger Unit of Currency Quotes

A point is a larger unit of price movement in a currency quote. It’s usually equal to 0.01 of the quote currency. For example, if the EUR/USD currency quote moves from 1.1000 to 1.1100, it has moved 10 points. Points are used to measure larger price movements and are often used in conjunction with pips.

Percentages: Measuring Currency Quote Movements

Percentages are used to measure the percentage change in a currency quote. For example, if the EUR/USD currency quote moves from 1.1000 to 1.1200, it has moved 2% (1.1200 – 1.1000 = 0.0200, which is 2% of 1.1000). Percentages are used to measure the overall performance of a currency pair and are often used in investment and trading decisions.

By understanding these conventions, you can better navigate the complexities of currency quotes and make more informed trading decisions. Remember, learning how to read currency quotes is a crucial skill for anyone involved in foreign exchange trading or investment. In the next section, we’ll discuss how to interpret changes in currency quotes, including what a rising or falling quote means, and how to identify trends and patterns.

Interpreting Currency Quote Movements

Once you’ve learned how to read currency quotes, the next step is to interpret changes in those quotes. This is crucial for making informed trading decisions and staying ahead of market trends. In this section, we’ll discuss how to interpret changes in currency quotes, including what a rising or falling quote means, and how to identify trends and patterns.

Rising and Falling Quotes: What Do They Mean?

A rising currency quote means that the value of the base currency is increasing relative to the quote currency. For example, if the EUR/USD currency quote rises from 1.1000 to 1.1100, it means that the Euro has strengthened against the US Dollar. On the other hand, a falling currency quote means that the value of the base currency is decreasing relative to the quote currency.

Identifying Trends and Patterns

Identifying trends and patterns in currency quotes is essential for making informed trading decisions. There are several ways to do this, including using technical analysis tools such as moving averages, relative strength index (RSI), and Bollinger Bands. These tools can help traders identify trends, predict price movements, and make informed decisions.

Trend Analysis: Understanding the Direction of the Market

Trend analysis involves identifying the direction of the market and making decisions based on that direction. There are three main types of trends: upward, downward, and sideways. An upward trend indicates that the market is rising, a downward trend indicates that the market is falling, and a sideways trend indicates that the market is moving horizontally.

By understanding how to interpret changes in currency quotes, you can make more informed trading decisions and stay ahead of market trends. Remember, learning how to read currency quotes is a crucial skill for anyone involved in foreign exchange trading or investment. In the next section, we’ll discuss common mistakes to avoid when reading currency quotes, including misinterpreting the bid and ask prices, or misunderstanding the spread.

Common Mistakes to Avoid When Reading Currency Quotes

When learning how to read currency quotes, it’s essential to avoid common mistakes that can lead to misinterpretation and poor trading decisions. In this section, we’ll highlight common mistakes that beginners make when reading currency quotes, including misinterpreting the bid and ask prices, or misunderstanding the spread.

Misinterpreting the Bid and Ask Prices

One of the most common mistakes beginners make is misinterpreting the bid and ask prices. The bid price is the price at which a trader can sell a currency, while the ask price is the price at which a trader can buy a currency. Misunderstanding these prices can lead to incorrect trading decisions and significant losses.

Misunderstanding the Spread

The spread is the difference between the bid and ask prices. It’s a crucial component of a currency quote, as it represents the profit made by the broker or market maker. Misunderstanding the spread can lead to incorrect calculations of profit and loss, and poor trading decisions.

Ignoring Market Conditions

Another common mistake is ignoring market conditions when reading currency quotes. Market conditions, such as economic indicators, news events, and technical analysis, can significantly impact currency prices. Ignoring these conditions can lead to poor trading decisions and significant losses.

Failing to Monitor Currency Quote Movements

Failing to monitor currency quote movements can lead to missed trading opportunities and significant losses. It’s essential to stay up-to-date with market news and analysis to make informed trading decisions.

By avoiding these common mistakes, you can improve your skills in how to read currency quotes and make more informed trading decisions. Remember, learning how to read currency quotes is a crucial skill for anyone involved in foreign exchange trading or investment. In the next section, we’ll discuss real-world applications of currency quotes, including international trade, travel, and investment.

Real-World Applications of Currency Quotes

Currency quotes play a crucial role in various real-world scenarios, including international trade, travel, and investment. Understanding how to read currency quotes is essential for making informed decisions in these areas. In this section, we’ll explore how currency quotes are used in real-world scenarios.

International Trade

In international trade, currency quotes are used to determine the price of goods and services. For example, if a company in the United States imports goods from Japan, it needs to know the exchange rate between the US Dollar and the Japanese Yen to determine the cost of the goods. Understanding how to read currency quotes helps companies to negotiate better prices and manage their foreign exchange risk.

Travel

When traveling abroad, understanding currency quotes is essential for exchanging currency and managing expenses. For example, if a traveler is going to Europe, they need to know the exchange rate between their home currency and the Euro to determine how much money they need to exchange. Knowing how to read currency quotes helps travelers to avoid unnecessary fees and get the best exchange rate.

Investment

In investment, currency quotes are used to determine the value of investments in foreign markets. For example, if an investor wants to invest in a foreign stock, they need to know the exchange rate between their home currency and the currency of the foreign market. Understanding how to read currency quotes helps investors to make informed decisions and manage their foreign exchange risk.

Other Applications

Currency quotes are also used in other areas, such as tourism, education, and remittances. Understanding how to read currency quotes is essential for making informed decisions in these areas and avoiding unnecessary fees and losses.

In conclusion, understanding how to read currency quotes is crucial for making informed decisions in various real-world scenarios. By learning how to read currency quotes, individuals and businesses can manage their foreign exchange risk, negotiate better prices, and make informed investment decisions. In the next section, we’ll discuss tips and resources for further learning and improvement.

Taking Your Currency Quote Skills to the Next Level

Mastering the art of how to read currency quotes is a continuous process that requires ongoing learning and improvement. To take your currency quote skills to the next level, it’s essential to stay up-to-date with market news and analysis, and to continually refine your understanding of currency quotes.

Stay Informed with Market News and Analysis

Staying informed with market news and analysis is crucial for understanding how to read currency quotes. Market news and analysis provide valuable insights into market trends and patterns, which can help you make informed decisions when reading currency quotes. Follow reputable sources of market news and analysis, such as Bloomberg, Reuters, and CNBC, to stay up-to-date with the latest developments.

Refine Your Understanding of Currency Quotes

Refining your understanding of currency quotes requires continuous learning and practice. Practice reading currency quotes regularly, and challenge yourself to analyze complex quotes and identify trends and patterns. You can also take online courses or attend seminars to further your knowledge of currency quotes.

Use Online Resources to Improve Your Skills

There are many online resources available that can help you improve your skills in how to read currency quotes. Websites such as XE.com and Oanda.com provide real-time currency quotes and analysis, while online forums and communities provide a platform for discussing currency quotes and sharing knowledge.

Join a Community of Currency Quote Enthusiasts

Joining a community of currency quote enthusiasts can provide valuable opportunities for learning and improvement. Online forums and communities, such as Reddit’s Forex community, provide a platform for discussing currency quotes and sharing knowledge with other enthusiasts.

By following these tips and resources, you can take your currency quote skills to the next level and become an expert in how to read currency quotes. Remember, mastering the art of currency quotes requires continuous learning and improvement, so stay informed, refine your understanding, and use online resources to improve your skills.