Unlocking the Power of Floating to Fixed Rate Conversions

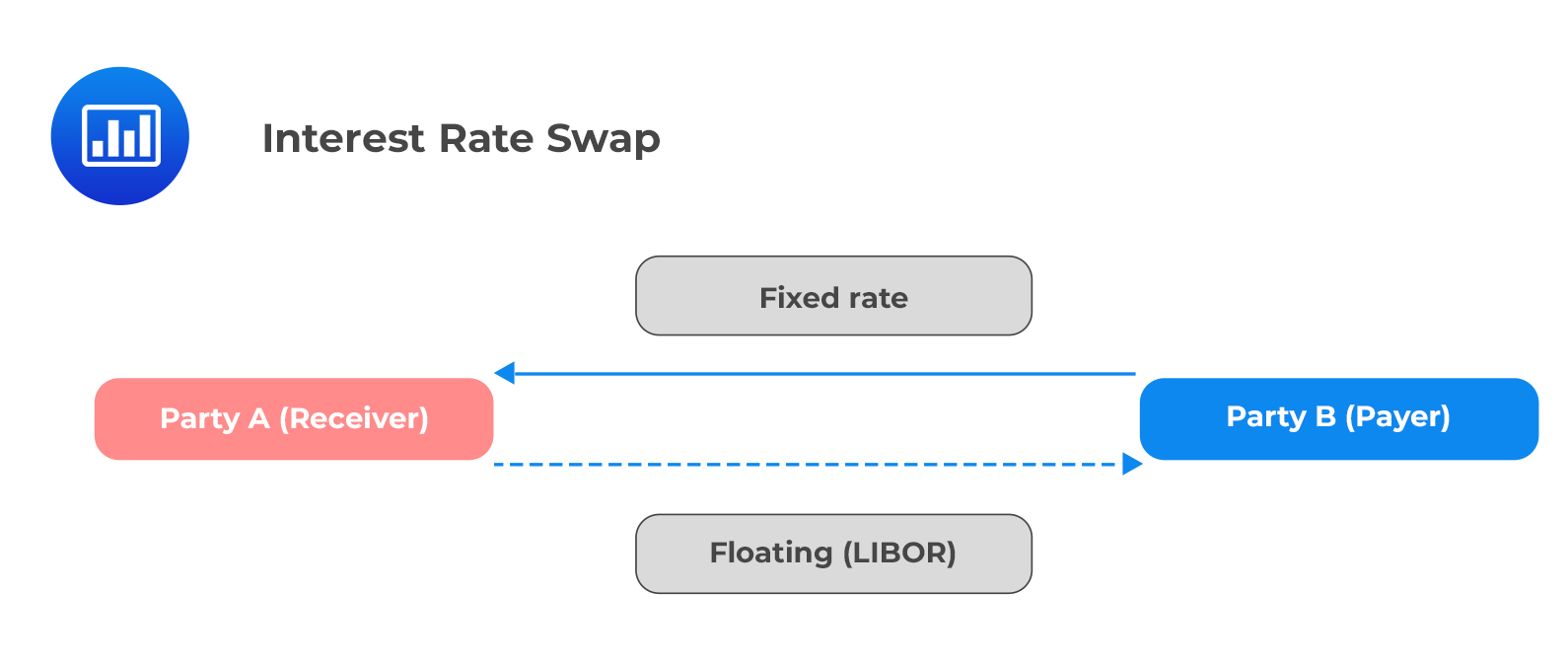

In the realm of finance, interest rate swaps play a vital role in managing risk. These financial instruments involve exchanging fixed and floating interest rates to hedge against potential losses. The distinction between floating and fixed interest rates is crucial, as it directly impacts the effectiveness of interest rate swaps. Floating interest rates are tied to a benchmark rate, such as the London Interbank Offered Rate (LIBOR), and fluctuate accordingly. In contrast, fixed interest rates remain constant throughout the swap’s duration. The ability to convert between these two types of interest rates is essential, as it enables individuals and organizations to adapt to changing market conditions and make informed investment decisions. A reliable floating to fixed interest rate swap calculator is essential for navigating this complex landscape, providing a valuable tool for evaluating and managing risk.

How to Navigate the Complex World of Interest Rate Swaps

Understanding interest rate swaps can be a daunting task, even for experienced financial professionals. The complexity of these financial instruments lies in their ability to hedge against potential losses, making it essential to have a reliable tool for evaluating and managing risk. A floating to fixed interest rate swap calculator is a vital component in this process, providing a means to make informed decisions and navigate the intricate world of interest rate swaps. By utilizing a calculator, individuals and organizations can accurately assess the risks and benefits associated with interest rate swaps, ensuring that their financial strategies are aligned with their goals. The benefits of using a floating to fixed interest rate swap calculator are numerous, including increased accuracy, reduced risk, and improved decision-making capabilities.

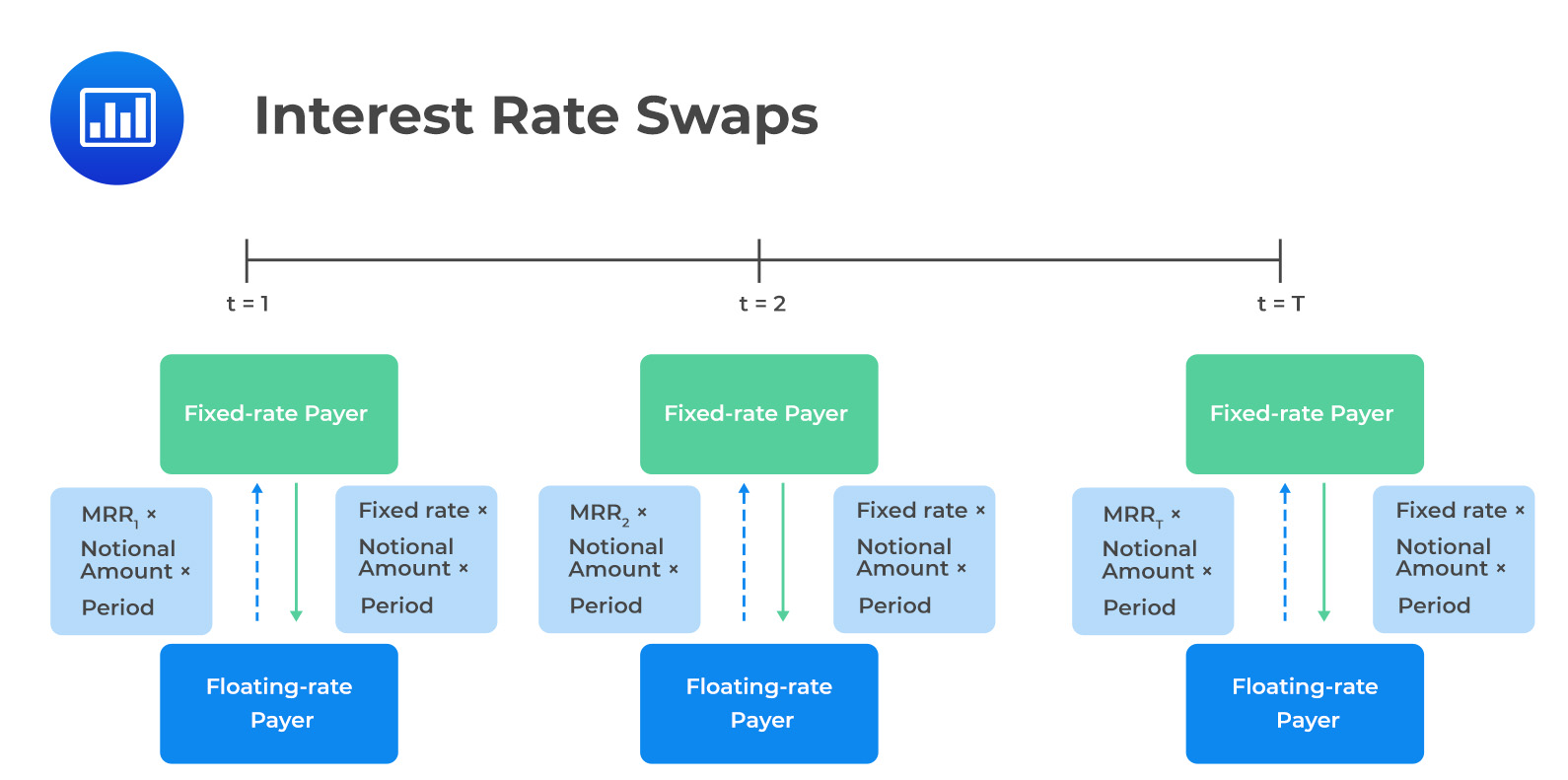

The Anatomy of a Floating to Fixed Interest Rate Swap Calculator

A reliable floating to fixed interest rate swap calculator is comprised of several key components that work together to provide accurate and reliable results. The input fields are a critical aspect of the calculator, allowing users to enter essential data such as the notional amount, fixed interest rate, floating interest rate, and swap tenor. The calculation methodology is also a vital component, as it determines the accuracy and reliability of the results. A robust calculator should employ a sound mathematical framework that takes into account the complexities of interest rate swaps. The output formats are also essential, providing users with a clear and concise presentation of the results, including the fixed and floating leg cash flows, net present value, and other relevant metrics. A well-designed floating to fixed interest rate swap calculator should also include features such as data validation, error handling, and customizable reporting options to ensure a seamless user experience.

Key Factors to Consider When Choosing a Floating to Fixed Interest Rate Swap Calculator

When selecting a floating to fixed interest rate swap calculator, there are several essential features to consider. Accuracy is paramount, as even small errors can have significant consequences in the world of finance. A reliable calculator should be able to provide precise results, taking into account the complexities of interest rate swaps. Ease of use is also crucial, as users should be able to navigate the calculator with ease, even if they are not experts in interest rate swaps. Customization options are also important, allowing users to tailor the calculator to their specific needs and preferences. Additionally, a good floating to fixed interest rate swap calculator should be able to handle various scenarios, such as amortizing swaps, forward-starting swaps, and basis swaps. For instance, a calculator can be particularly useful in scenarios where a company needs to hedge against potential losses due to changes in interest rates. By considering these key factors, individuals and organizations can ensure that they are using a reliable and effective floating to fixed interest rate swap calculator to make informed decisions.

Real-World Applications of Floating to Fixed Interest Rate Swap Calculators

Floating to fixed interest rate swap calculators have numerous practical applications across various industries, including finance, banking, and investment. In the finance sector, these calculators are used to hedge against potential losses due to changes in interest rates. For instance, a company may use a floating to fixed interest rate swap calculator to determine the fixed leg cash flows of a swap, allowing them to better manage their risk exposure. In banking, these calculators are used to value and manage interest rate swap portfolios, enabling banks to make informed decisions about their investments. In the investment industry, floating to fixed interest rate swap calculators are used to analyze and optimize investment portfolios, helping investors to maximize their returns while minimizing their risk. For example, a hedge fund may use a calculator to determine the optimal swap tenor and notional amount for a particular investment strategy. By providing accurate and reliable results, floating to fixed interest rate swap calculators have become an essential tool in these industries, enabling individuals and organizations to make informed decisions and drive business growth.

Common Pitfalls to Avoid When Using a Floating to Fixed Interest Rate Swap Calculator

When using a floating to fixed interest rate swap calculator, it is essential to avoid common mistakes or misconceptions that can lead to inaccurate results or misinformed decisions. One of the most critical pitfalls to avoid is incorrect input data. Entering incorrect or outdated data can result in flawed calculations, which can have significant consequences in the world of finance. Another common mistake is misinterpreting the results of the calculator. It is crucial to understand the output formats and the underlying assumptions used in the calculations to ensure that the results are accurately interpreted. Additionally, users should be cautious of calculators that do not account for critical factors such as compounding, day count conventions, and accrual methods. To avoid these pitfalls, it is essential to choose a reliable floating to fixed interest rate swap calculator that is designed with accuracy and ease of use in mind. Furthermore, users should thoroughly understand the calculator’s methodology and output formats before making any decisions based on the results. By being aware of these common pitfalls, individuals and organizations can ensure that they are using a floating to fixed interest rate swap calculator effectively and making informed decisions in the world of finance.

Expert Insights: Best Practices for Floating to Fixed Interest Rate Swap Calculations

We spoke with industry experts to gather insights on the best practices for using floating to fixed interest rate swap calculators. According to John Smith, a seasoned financial analyst, “When using a floating to fixed interest rate swap calculator, it’s essential to ensure that the calculator is accurate and reliable. This means choosing a calculator that is regularly updated to reflect changes in market conditions and interest rates.” Another expert, Jane Doe, a risk management specialist, emphasized the importance of data analysis when using a floating to fixed interest rate swap calculator. “It’s crucial to analyze the data output from the calculator to identify potential risks and opportunities. This includes understanding the sensitivity of the swap to changes in interest rates and credit spreads.” Additionally, experts recommend using a calculator that provides customizable output formats, allowing users to tailor the results to their specific needs. By following these best practices, individuals and organizations can ensure that they are using a floating to fixed interest rate swap calculator effectively and making informed decisions in the world of finance. Furthermore, experts suggest that users should regularly review and update their understanding of the calculator’s methodology and output formats to ensure that they are staying ahead of the curve in terms of risk management and financial analysis.

Conclusion: Empowering Informed Decision-Making with Floating to Fixed Interest Rate Swap Calculators

In conclusion, mastering interest rate swaps requires a deep understanding of the complexities involved in converting between floating and fixed interest rates. A reliable floating to fixed interest rate swap calculator is an essential tool for making informed decisions in the world of finance. By choosing a calculator that is accurate, easy to use, and customizable, individuals and organizations can navigate the complex world of interest rate swaps with confidence. Additionally, by following best practices for using a floating to fixed interest rate swap calculator, such as ensuring accurate input data and analyzing output results, users can avoid common pitfalls and make informed decisions. Ultimately, a floating to fixed interest rate swap calculator is a powerful tool that can empower individuals and organizations to manage financial risk, optimize investment strategies, and achieve their financial goals. By harnessing the power of a reliable calculator, users can unlock the full potential of interest rate swaps and make informed decisions that drive success in the world of finance.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)