Understanding the Concept of Expected Return

In the world of finance, expected return is a crucial concept that plays a vital role in portfolio management. It represents the anticipated profit or gain that an investment is likely to generate over a specific period. The expected return of a portfolio formula is a powerful tool that helps investors make informed decisions about their investments. By understanding expected return, investors can set realistic goals, optimize their portfolio’s potential, and make informed decisions about asset allocation. In essence, expected return serves as a guiding light, illuminating the path to successful investment outcomes. It is a fundamental component of investment analysis, and its significance cannot be overstated.

How to Calculate Expected Return: A Step-by-Step Guide

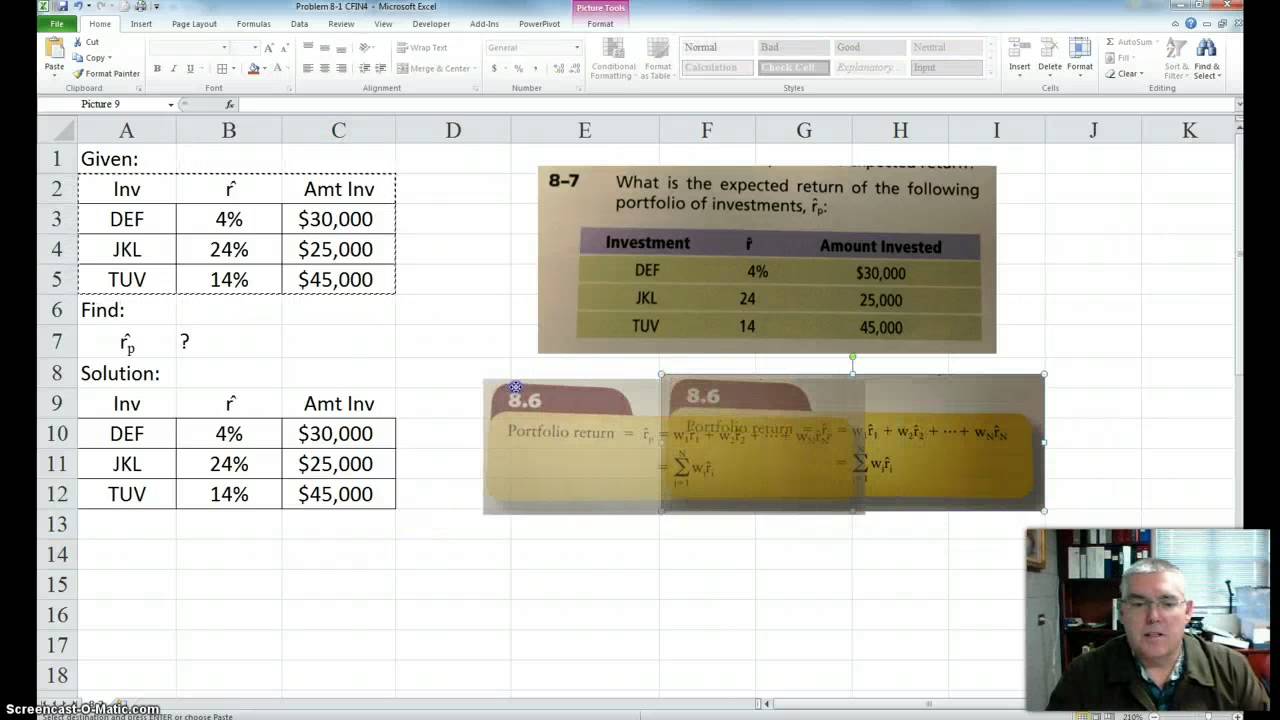

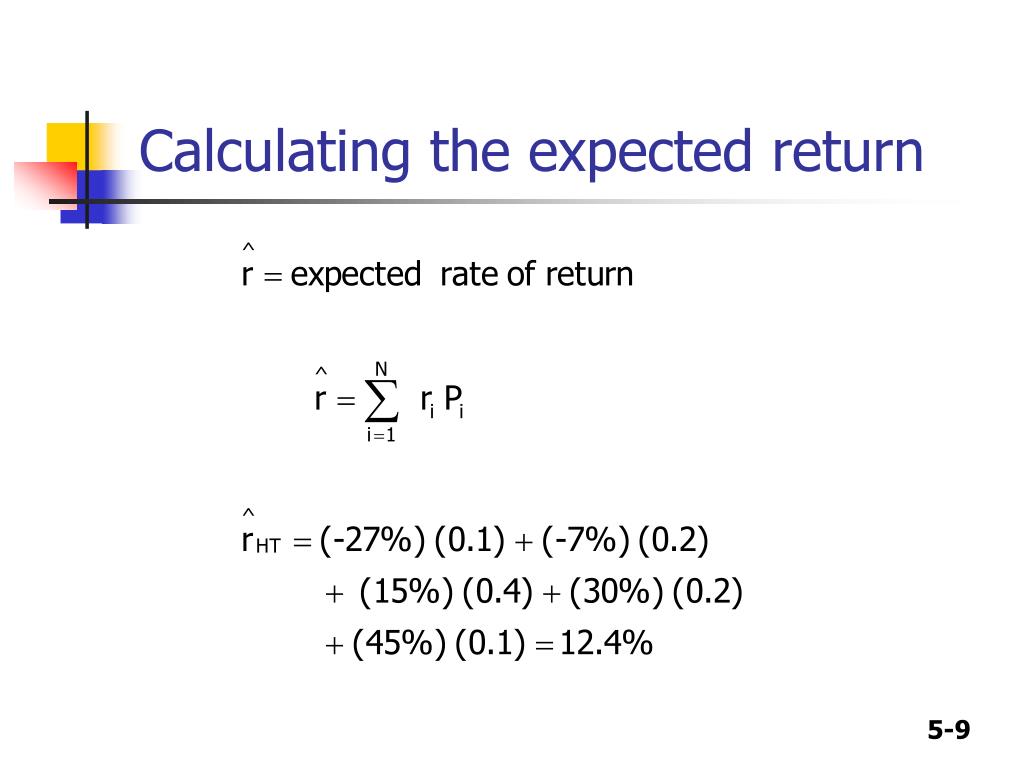

The expected return of a portfolio formula is a crucial tool for investors, providing a quantitative measure of the potential performance of an investment. The formula is as follows: Expected Return = (Sum of (Probability of each outcome x Rate of return of each outcome)). To apply this formula in real-world scenarios, investors must first identify the possible outcomes of an investment, assign a probability to each outcome, and determine the rate of return for each outcome. By multiplying the probability of each outcome by its corresponding rate of return, investors can calculate the expected return of the investment. This calculation is essential in portfolio management, as it enables investors to make informed decisions about asset allocation, risk management, and performance evaluation. By understanding how to calculate expected return, investors can unlock the full potential of their portfolios and achieve their investment goals.

The Role of Risk and Volatility in Expected Return

Risk and volatility are two crucial factors that play a significant role in determining the expected return of a portfolio. In essence, risk refers to the uncertainty or probability of an investment’s actual return deviating from its expected return. Volatility, on the other hand, measures the extent to which an investment’s value fluctuates over time. When calculating the expected return of a portfolio formula, it is essential to consider these factors, as they can significantly impact the potential performance of an investment. A higher-risk investment, for instance, may offer a higher expected return to compensate for the increased uncertainty. Conversely, a lower-risk investment may offer a lower expected return. By understanding the relationship between risk, volatility, and expected return, investors can construct a portfolio that balances risk and potential return, ultimately achieving their investment goals. This delicate balance is critical in portfolio management, as it enables investors to make informed decisions about asset allocation and risk management.

Weighted Average Cost of Capital (WACC): A Key Component of Expected Return

The Weighted Average Cost of Capital (WACC) is a crucial component of the expected return of a portfolio formula. It represents the average cost of capital that a company or investment must pay to its investors, including debt holders and shareholders. The WACC is calculated by multiplying the cost of each capital component (debt and equity) by its respective weight, and then summing the products. The formula for WACC is: WACC = (E/V x Re) + (D/V x Rd x (1 – T)), where E is the market value of equity, V is the total market value of the company, Re is the cost of equity, D is the market value of debt, Rd is the cost of debt, and T is the tax rate. The WACC is a key input in the expected return of a portfolio formula, as it reflects the minimum return that a company or investment must generate to satisfy its investors. By understanding the WACC and its calculation, investors can better estimate the expected return of a portfolio and make informed decisions about asset allocation and investment opportunities.

Expected Return vs. Historical Return: What’s the Difference?

When it comes to evaluating investment opportunities, investors often rely on historical return data to inform their decisions. However, it’s essential to understand the distinction between expected return and historical return to make informed investment choices. Historical return refers to the actual return an investment has generated in the past, whereas expected return is the anticipated return an investment is likely to generate in the future. While historical return can provide valuable insights, it has limitations. Past performance is not always a reliable indicator of future results, and investors who rely solely on historical data may be caught off guard by unexpected market shifts. In contrast, expected return takes into account various factors, including the expected return of portfolio formula, risk, volatility, and market conditions, to provide a more comprehensive view of an investment’s potential. By understanding the difference between expected return and historical return, investors can make more informed decisions and avoid common pitfalls, such as overestimating the potential of an investment based on past performance.

Real-World Applications of Expected Return in Portfolio Management

In portfolio management, expected return plays a crucial role in informing investment decisions and optimizing portfolio performance. One of the primary applications of expected return is in asset allocation, where it helps investors determine the optimal mix of assets to achieve their investment goals. By estimating the expected return of different asset classes, investors can allocate their portfolio in a way that balances risk and potential return. Expected return is also essential in risk management, as it enables investors to identify potential risks and adjust their portfolio accordingly. For instance, if an investor expects a particular stock to have a high expected return but also comes with high volatility, they may choose to diversify their portfolio to mitigate risk. Additionally, expected return is used in performance evaluation, where it serves as a benchmark to assess the performance of a portfolio or investment manager. By comparing the actual return of a portfolio to its expected return, investors can evaluate the effectiveness of their investment strategy and make adjustments as needed. Furthermore, the expected return of portfolio formula can be used to evaluate the feasibility of different investment projects and determine which ones are likely to generate the highest returns. By applying expected return analysis in these ways, investors can make more informed decisions and optimize their portfolio’s performance over the long term.

Common Pitfalls to Avoid When Calculating Expected Return

When calculating expected return, investors often make mistakes that can lead to inaccurate results and poor investment decisions. One common pitfall is ignoring risk, which can result in an overestimation of expected return. Investors must consider the risk associated with an investment and adjust their expected return accordingly. Another mistake is using incorrect or outdated data, which can lead to inaccurate calculations. It’s essential to use reliable and up-to-date data to ensure accurate expected return calculations. Additionally, investors may fail to consider the expected return of portfolio formula, which can result in an incomplete understanding of the portfolio’s potential. Furthermore, investors may rely too heavily on historical data, which can be misleading, as past performance is not always indicative of future results. To avoid these pitfalls, investors should carefully consider all relevant factors, including risk, volatility, and market conditions, when calculating expected return. By doing so, investors can make more informed decisions and avoid costly mistakes. It’s also essential to regularly review and update expected return calculations to ensure they remain accurate and relevant. By being aware of these common pitfalls, investors can optimize their portfolio’s performance and achieve their investment goals.

Maximizing Portfolio Performance with Expected Return Analysis

In conclusion, expected return analysis is a crucial component of portfolio management, enabling investors to make informed decisions and optimize their portfolio’s performance. By understanding the expected return of portfolio formula and its application in real-world scenarios, investors can better navigate the complexities of portfolio construction and management. By considering the role of risk and volatility, the importance of WACC, and the distinction between expected and historical return, investors can create a well-diversified portfolio that balances risk and potential return. Furthermore, by avoiding common pitfalls and incorporating expected return analysis into their investment strategy, investors can maximize their portfolio’s performance over the long term. Expected return analysis is not a one-time event, but rather an ongoing process that requires regular monitoring and adjustments to ensure that the portfolio remains aligned with the investor’s goals and objectives. By embracing expected return analysis, investors can unlock their portfolio’s full potential and achieve their investment goals with confidence.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)