What Drives Investor Decisions: Understanding the Significance of EPS

In the world of finance, earnings per share (EPS) plays a vital role in driving investor decisions. But why is earnings per share important? The answer lies in its ability to influence stock prices and portfolio management. EPS serves as a key indicator of a company’s financial health, providing investors with valuable insights into its profitability and growth potential. By examining EPS, investors can gain a better understanding of a company’s ability to generate revenue, manage expenses, and create value for shareholders. This, in turn, enables them to make more informed investment decisions, ultimately driving the performance of their portfolios. As a result, EPS has become a crucial metric for investors seeking to maximize their returns and minimize their risks.

How to Evaluate a Company’s Financial Health Using EPS

Evaluating a company’s financial health is a crucial step in making informed investment decisions. One key metric that plays a vital role in this process is earnings per share (EPS). But why is earnings per share important in this context? The answer lies in its ability to provide valuable insights into a company’s ability to generate profits, manage expenses, and create value for shareholders. By examining EPS, investors can gain a better understanding of a company’s financial performance, including its revenue growth, expense management, and profitability. This, in turn, enables them to assess the company’s financial health and make informed decisions about their investments. A company with a strong EPS is often a sign of a healthy financial position, indicating its ability to generate consistent profits and create value for shareholders.

The Link Between EPS and Stock Valuation: What You Need to Know

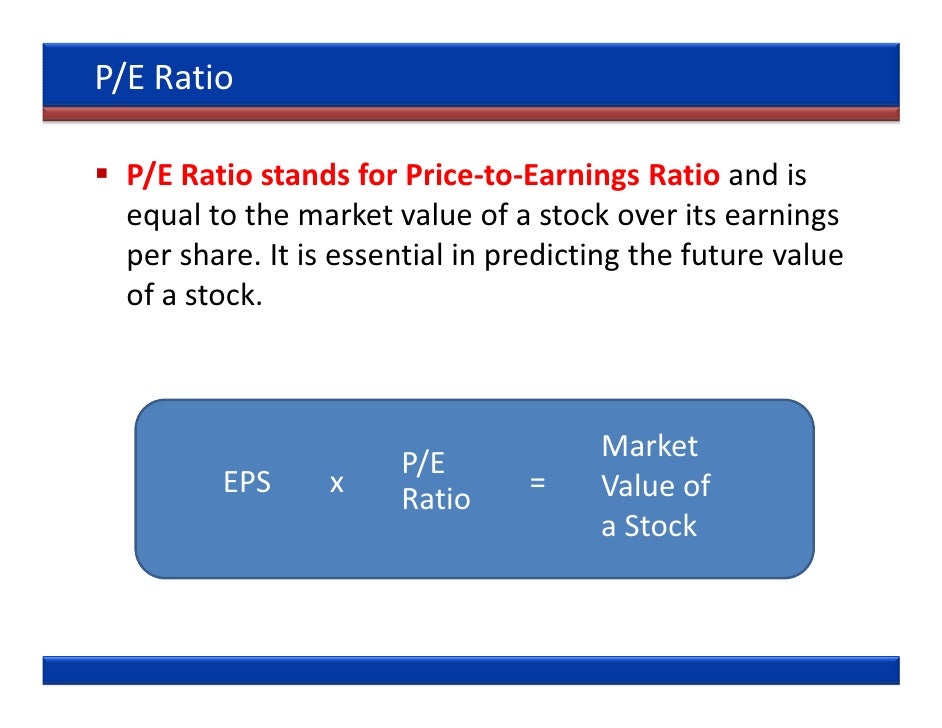

The relationship between earnings per share (EPS) and stock valuation is a crucial one in the world of finance. But why is earnings per share important in this context? The answer lies in its ability to influence stock prices and the overall market sentiment. When a company’s EPS increases, it can lead to a rise in stock prices, as investors become more confident in the company’s ability to generate profits and create value for shareholders. Conversely, a decline in EPS can result in a decrease in stock prices, as investors become more cautious about the company’s financial health. This is because EPS serves as a key indicator of a company’s financial performance, providing investors with valuable insights into its revenue growth, expense management, and profitability. By examining the link between EPS and stock valuation, investors can gain a better understanding of the market’s expectations and make more informed investment decisions.

Why EPS Matters in Comparative Analysis: A Key Metric for Investors

In the world of finance, comparative analysis is a crucial tool for investors seeking to evaluate the performance of different companies and make informed investment decisions. One key metric that plays a vital role in this process is earnings per share (EPS). But why is earnings per share important in comparative analysis? The answer lies in its ability to provide a standardized measure of a company’s profitability, enabling investors to compare the financial performance of different companies across various industries. By examining EPS, investors can gain valuable insights into a company’s revenue growth, expense management, and profitability, allowing them to make more informed decisions about their investments. Moreover, EPS enables investors to identify trends and patterns in a company’s financial performance, providing a more comprehensive understanding of its strengths and weaknesses. This, in turn, enables investors to make more informed decisions about their investments, ultimately driving better returns and minimizing risk.

The Role of EPS in Identifying Undervalued and Overvalued Stocks

One of the most significant applications of earnings per share (EPS) is in identifying undervalued and overvalued stocks. By examining a company’s EPS, investors can gain valuable insights into its intrinsic value and potential for growth. This is because EPS provides a standardized measure of a company’s profitability, enabling investors to compare its performance to that of its peers and the broader market. When a company’s EPS is higher than its peers, it may indicate that the stock is undervalued, presenting a potential buying opportunity for investors. On the other hand, a lower EPS may suggest that the stock is overvalued, indicating a potential selling opportunity. By understanding why is earnings per share important in this context, investors can make more informed decisions about their investments, ultimately driving better returns and minimizing risk. Moreover, EPS can help investors identify companies with strong growth potential, enabling them to capitalize on emerging trends and opportunities. By incorporating EPS into their investment strategy, investors can gain a competitive edge in the market, ultimately driving long-term success.

EPS as a Tool for Predicting Future Performance: What the Numbers Reveal

Earnings per share (EPS) is not only a valuable metric for evaluating a company’s current financial performance, but it also holds significant predictive power for its future growth. By examining a company’s EPS trend over time, investors can gain valuable insights into its ability to generate profits, manage expenses, and create value for shareholders. This, in turn, can help investors predict a company’s future financial performance and potential for growth. Why is earnings per share important in this context? It provides a standardized measure of a company’s profitability, enabling investors to compare its performance to that of its peers and the broader market. Moreover, EPS can help investors identify companies with strong growth potential, enabling them to capitalize on emerging trends and opportunities. By analyzing a company’s EPS, investors can identify areas of strength and weakness, providing a more comprehensive understanding of its future prospects. This, ultimately, enables investors to make more informed decisions about their investments, driving better returns and minimizing risk.

The Impact of EPS on Dividend Payments and Shareholder Returns

The relationship between earnings per share (EPS) and dividend payments is a critical one, as it has a direct impact on shareholder returns. Companies with a strong EPS are more likely to distribute dividends to their shareholders, providing a regular income stream and increasing investor confidence. Conversely, companies with a weak EPS may struggle to maintain dividend payments, leading to a decline in shareholder returns. Why is earnings per share important in this context? It provides a clear indication of a company’s ability to generate profits and sustain dividend payments, enabling investors to make informed decisions about their investments. Moreover, EPS can influence a company’s dividend payout ratio, which is the percentage of earnings paid out as dividends. A higher EPS can lead to a higher dividend payout ratio, resulting in greater returns for shareholders. By examining a company’s EPS, investors can gain valuable insights into its dividend payment potential, enabling them to optimize their investment portfolios and maximize returns.

Conclusion: Why Earnings per Share Remains a Critical Metric for Investors

In conclusion, earnings per share (EPS) is a vital metric that plays a crucial role in financial analysis. Its significance extends beyond mere profitability, influencing investor decisions, stock prices, and portfolio management. Why is earnings per share important? It provides a standardized measure of a company’s financial performance, enabling investors to evaluate its ability to generate profits, manage expenses, and create value for shareholders. By examining EPS, investors can gain valuable insights into a company’s intrinsic value, potential for growth, and ability to distribute dividends. Moreover, EPS serves as a key metric in comparative analysis, allowing investors to evaluate the performance of different companies and make informed investment decisions. As a predictive tool, EPS can indicate a company’s future financial performance and potential for growth, enabling investors to optimize their investment portfolios and maximize returns. In today’s fast-paced and competitive investment landscape, EPS remains a critical metric that investors cannot afford to ignore.