What is Geometric Average Rate of Return?

In the realm of investment analysis, understanding the concept of geometric average rate of return is crucial for making informed decisions. Geometric average rate of return is a metric used to evaluate the performance of an investment over time, taking into account the compounding effect of returns. It provides a more accurate representation of an investment’s growth by considering the impact of compounding, which is essential for investors seeking to maximize their returns. In contrast to arithmetic average rate of return, which simply averages the returns of each period, geometric average rate of return offers a more realistic picture of an investment’s performance. By utilizing a geometric average rate of return calculator, investors can gain a deeper understanding of their portfolio’s performance and make more informed decisions about their investments.

Why You Need a Geometric Average Rate of Return Calculator

In investment decision-making, accuracy and precision are crucial. A geometric average rate of return calculator plays a vital role in providing investors with a clear understanding of their portfolio’s performance over time. By using a geometric average rate of return calculator, investors can gain a more accurate representation of their returns, taking into account the compounding effect of returns over multiple periods. This is particularly important for investors seeking to maximize their returns, as it allows them to make informed decisions about their investments and adjust their strategies accordingly. A geometric average rate of return calculator is an essential tool for any investor looking to optimize their portfolio’s performance and achieve their long-term financial goals.

How to Choose the Right Geometric Average Rate of Return Calculator

When selecting a geometric average rate of return calculator, it’s essential to consider several key features to ensure accuracy and ease of use. A good geometric average rate of return calculator should be user-friendly, allowing investors to easily input their data and receive accurate results. Accuracy is also crucial, as small errors can lead to significant discrepancies in investment decisions. Additionally, a customizable geometric average rate of return calculator can be beneficial, as it allows investors to tailor the calculator to their specific needs and investment strategies. Some calculators may also offer advanced features, such as the ability to calculate returns for multiple periods or investments, making them more versatile and valuable to investors. By considering these factors, investors can choose a geometric average rate of return calculator that meets their needs and helps them make informed investment decisions.

Top Geometric Average Rate of Return Calculators for Investors

With numerous geometric average rate of return calculators available, it can be overwhelming to choose the right one. To help investors make an informed decision, we’ve reviewed and compared some of the most popular geometric average rate of return calculators. Online tools such as Investopedia’s Geometric Average Return Calculator and Calculator.net’s Geometric Mean Return Calculator offer ease of use and accuracy. Spreadsheet templates like Microsoft Excel’s Geometric Average Rate of Return Template and Google Sheets’ Geometric Mean Return Template provide customization options and flexibility. Other notable calculators include NerdWallet’s Investment Calculator and Kiplinger’s Investment Return Calculator, which offer additional features such as investment tracking and portfolio analysis. When selecting a geometric average rate of return calculator, investors should consider their specific needs and investment goals, as well as the calculator’s features, accuracy, and ease of use.

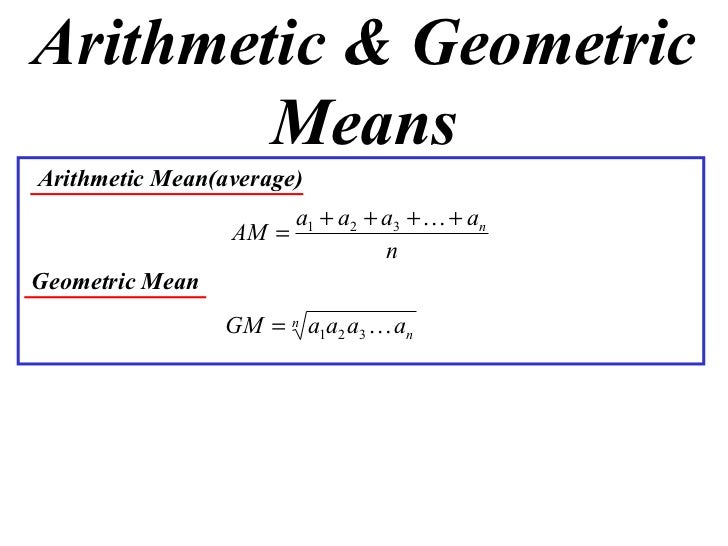

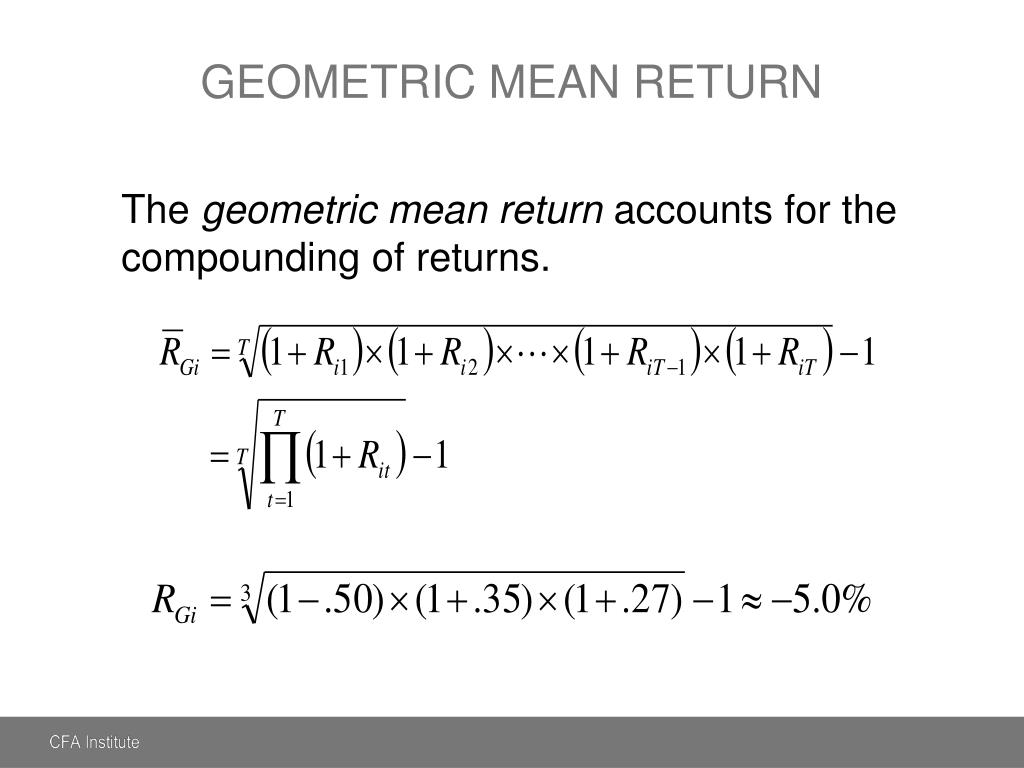

Understanding the Formula Behind Geometric Average Rate of Return

The geometric average rate of return is calculated using a mathematical formula that takes into account the compounding effect of returns over time. The formula is as follows: (1 + R1) × (1 + R2) × … × (1 + Rn)^(1/n) – 1, where R1, R2, …, Rn are the returns for each period, and n is the number of periods. This formula calculates the rate of return that, when compounded, would produce the same total return as the series of individual returns. The geometric average rate of return is a more accurate representation of returns over time because it takes into account the compounding effect, which can significantly impact investment returns. For example, if an investment returns 10% in year one and 20% in year two, the arithmetic average return would be 15%, but the geometric average return would be approximately 14.5%, reflecting the compounding effect of the returns. A geometric average rate of return calculator can simplify this calculation, providing investors with a quick and accurate way to evaluate their investment returns.

Common Mistakes to Avoid When Calculating Geometric Average Rate of Return

When calculating geometric average rate of return, investors often make mistakes that can lead to inaccurate results. One common error is ignoring the compounding effect of returns over time. This can result in an overestimation of returns, as the geometric average rate of return takes into account the compounding effect. Another mistake is using incorrect time periods, such as using monthly returns to calculate an annual geometric average rate of return. This can lead to an inaccurate representation of returns over time. Additionally, investors may fail to account for fees and expenses, which can significantly impact returns. Furthermore, using a geometric average rate of return calculator that is not accurate or reliable can also lead to mistakes. To avoid these errors, investors should carefully select a geometric average rate of return calculator and ensure that they understand the formula and inputs required. By avoiding these common mistakes, investors can ensure that they are making informed investment decisions based on accurate calculations.

Real-World Applications of Geometric Average Rate of Return

In the world of investments, geometric average rate of return plays a crucial role in portfolio management and performance evaluation. For instance, investment managers use geometric average rate of return to evaluate the performance of their portfolios over time, taking into account the compounding effect of returns. This helps them to identify areas of improvement and make informed decisions about asset allocation. Additionally, geometric average rate of return is used to compare the performance of different investment products, such as mutual funds or exchange-traded funds (ETFs). By using a geometric average rate of return calculator, investors can easily compare the returns of different investment products and make informed decisions about their investments. Furthermore, geometric average rate of return is used in risk management to assess the volatility of investments and to determine the potential returns of different investment strategies. In this way, geometric average rate of return is a powerful tool that helps investors to make informed decisions and achieve their investment goals.

Maximizing Your Investment Returns with Geometric Average Rate of Return

To maximize investment returns, investors can leverage the power of geometric average rate of return. One key strategy is diversification, which involves spreading investments across different asset classes to minimize risk. By using a geometric average rate of return calculator, investors can evaluate the performance of different asset classes and identify areas of opportunity. Additionally, long-term investing is a key principle of maximizing returns. By taking a long-term view, investors can ride out market fluctuations and benefit from the compounding effect of returns over time. Another strategy is to regularly review and rebalance a portfolio, using geometric average rate of return to evaluate performance and make informed decisions. Furthermore, investors can use geometric average rate of return to evaluate the performance of different investment managers or financial advisors, helping to identify the best options for their investment goals. By combining these strategies with the power of geometric average rate of return, investors can unlock their full investment potential and achieve long-term financial success.