What is Beta and Why Does it Matter?

In the realm of finance, the concept of beta plays a vital role in understanding the risk associated with investments. The beta of the market portfolio is a specific type of beta that represents the overall market’s performance. But what exactly is beta, and why is it so crucial in investment decisions?

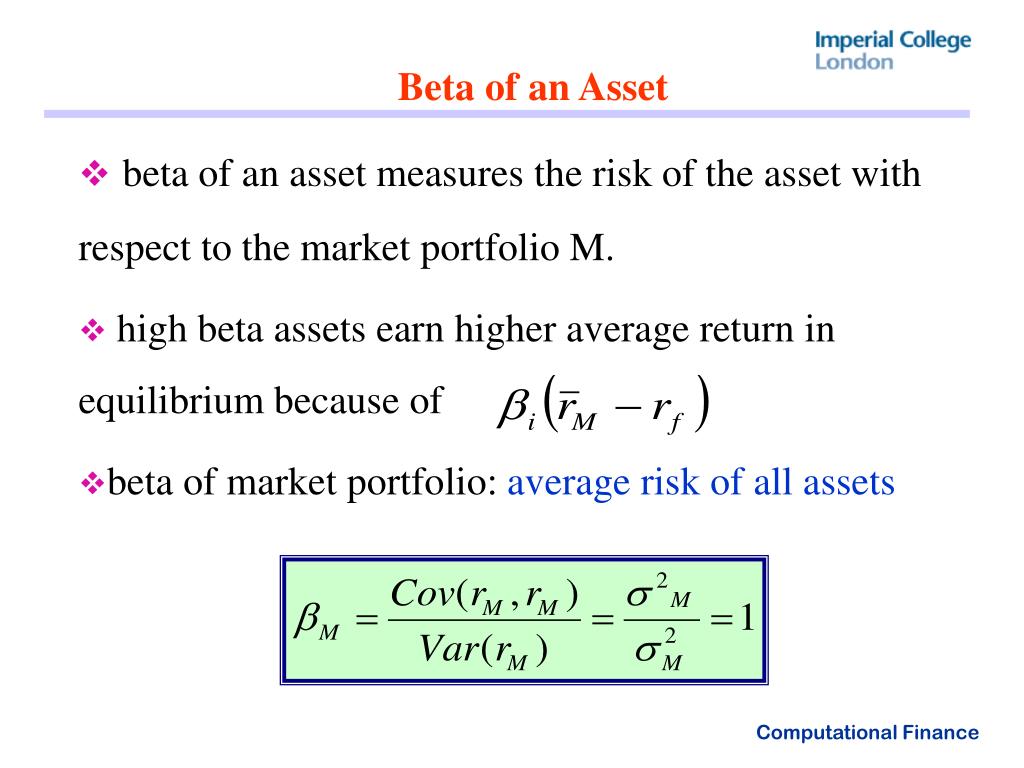

Beta is a statistical measure that quantifies the systematic risk of an investment or a portfolio. It compares the volatility of an investment to that of the overall market, providing a benchmark for investors to evaluate their investments. A beta of 1 indicates that the investment moves in line with the market, while a beta greater than 1 indicates higher volatility, and a beta less than 1 indicates lower volatility.

The significance of beta lies in its ability to help investors manage risk and maximize returns. By understanding the beta of their investments, investors can make informed decisions about their portfolios and adjust their risk levels accordingly. The beta of the market portfolio is, therefore, a critical component of this risk management process, providing a benchmark against which investors can measure the performance of their investments.

Understanding the Market Portfolio: A Benchmark for Investment Performance

The market portfolio is a crucial concept in finance, serving as a benchmark for investment performance. It represents the overall market’s performance, providing a standard against which investors can evaluate their investments. But what exactly is the market portfolio, and how is it composed?

The market portfolio is a hypothetical portfolio that consists of all investable assets in the market, weighted by their market capitalization. This means that the market portfolio includes a wide range of assets, such as stocks, bonds, and commodities, with each asset’s weight determined by its market value. The market portfolio is, therefore, a diversified portfolio that represents the overall market’s performance.

The significance of the market portfolio lies in its ability to provide a benchmark for investment performance. By comparing their investments to the market portfolio, investors can evaluate their performance and make informed decisions about their portfolios. The beta of the market portfolio is, therefore, a critical component of this evaluation process, providing a measure of the systematic risk of an investment or a portfolio.

As a benchmark, the market portfolio is essential for investors seeking to optimize their portfolios and achieve their desired risk-return profile. By understanding the composition and performance of the market portfolio, investors can make informed decisions about their investments and adjust their portfolios accordingly. The beta of the market portfolio is, therefore, a vital tool in this process, providing a measure of the systematic risk of an investment or a portfolio.

Calculating the Beta of the Market Portfolio: A Step-by-Step Guide

Calculating the beta of the market portfolio is a crucial step in understanding the systematic risk of an investment or a portfolio. The beta of the market portfolio is a measure of the overall market’s volatility, and it serves as a benchmark for evaluating the risk of individual investments. In this section, we will provide a step-by-step guide on how to calculate the beta of the market portfolio.

Step 1: Gather Historical Data

To calculate the beta of the market portfolio, you will need historical data on the market portfolio’s returns and the returns of a benchmark asset, such as the S&P 500 index. You can obtain this data from financial databases or websites, such as Yahoo Finance or Quandl.

Step 2: Calculate the Returns of the Market Portfolio

Calculate the returns of the market portfolio over a specific period, such as a month or a quarter. You can do this by subtracting the previous period’s closing price from the current period’s closing price and dividing the result by the previous period’s closing price.

Step 3: Calculate the Returns of the Benchmark Asset

Calculate the returns of the benchmark asset over the same period as the market portfolio. This will provide a basis for comparison between the two.

Step 4: Calculate the Beta of the Market Portfolio

Use the following formula to calculate the beta of the market portfolio:

Beta = Covariance (Market Portfolio, Benchmark Asset) / Variance (Benchmark Asset)

Where Covariance (Market Portfolio, Benchmark Asset) is the covariance between the market portfolio and the benchmark asset, and Variance (Benchmark Asset) is the variance of the benchmark asset.

For example, if the covariance between the market portfolio and the S&P 500 index is 0.05, and the variance of the S&P 500 index is 0.01, then the beta of the market portfolio would be 0.05 / 0.01 = 5.

By following these steps, you can calculate the beta of the market portfolio and gain a better understanding of the systematic risk of an investment or a portfolio. The beta of the market portfolio is a critical component of investment decisions, and it can help investors optimize their portfolios and achieve their desired risk-return profile.

Interpreting Beta Values: What Do They Mean for Investors?

Once the beta of the market portfolio is calculated, it’s essential to understand what the beta value means for investors. The beta of the market portfolio is a measure of the systematic risk of an investment or a portfolio, and it can have a significant impact on investment decisions and risk management.

A high beta value, typically above 1, indicates that the investment or portfolio is more volatile than the market portfolio. This means that the investment is riskier and may experience larger price swings than the overall market. Investors with a high-risk tolerance may be attracted to high-beta investments, as they offer the potential for higher returns. However, conservative investors may want to avoid high-beta investments to minimize their exposure to market fluctuations.

On the other hand, a low beta value, typically below 1, indicates that the investment or portfolio is less volatile than the market portfolio. This means that the investment is less risky and may experience smaller price swings than the overall market. Investors seeking stable returns may prefer low-beta investments, as they offer a more predictable performance.

A beta value of 1 indicates that the investment or portfolio has the same level of systematic risk as the market portfolio. This means that the investment is moving in line with the overall market, and its performance is closely tied to the market’s performance.

The beta of the market portfolio is a critical component of investment decisions, as it helps investors understand the level of risk they are taking on. By interpreting beta values correctly, investors can make informed decisions about their portfolios and adjust their risk levels accordingly. The beta of the market portfolio is a powerful tool for investors seeking to optimize their portfolios and achieve their desired risk-return profile.

The Beta of the Market Portfolio: Historical Trends and Insights

The beta of the market portfolio is not a static value, and it has changed over time in response to various market and economic factors. Analyzing historical trends and insights of the beta of the market portfolio can provide valuable information for investors and help them make more informed investment decisions.

Historically, the beta of the market portfolio has tended to increase during periods of high market volatility and decrease during periods of low market volatility. For example, during the 2008 financial crisis, the beta of the market portfolio surged as investors became increasingly risk-averse and sought safer investments. Conversely, during the bull market of the 2010s, the beta of the market portfolio decreased as investors became more confident and took on more risk.

Several factors can influence the value of the beta of the market portfolio, including changes in interest rates, inflation, and economic growth. For instance, a rise in interest rates can increase the beta of the market portfolio as investors become more risk-averse and seek higher returns to compensate for the increased cost of borrowing. Similarly, a decline in economic growth can decrease the beta of the market portfolio as investors become more cautious and seek safer investments.

The beta of the market portfolio is also influenced by the composition of the market portfolio itself. For example, if the market portfolio is heavily weighted towards technology stocks, the beta of the market portfolio may be higher due to the higher volatility of these stocks. Conversely, if the market portfolio is heavily weighted towards bonds, the beta of the market portfolio may be lower due to the lower volatility of these investments.

By understanding the historical trends and insights of the beta of the market portfolio, investors can gain a better appreciation of the risks and opportunities associated with different investments. The beta of the market portfolio is a critical component of investment decisions, and understanding its behavior over time can help investors make more informed decisions and achieve their desired risk-return profile.

How to Use the Beta of the Market Portfolio in Investment Decisions

The beta of the market portfolio is a powerful tool for investors seeking to optimize their portfolios and achieve their desired risk-return profile. By understanding the beta of the market portfolio, investors can make informed decisions about their investments and adjust their portfolios to manage risk effectively.

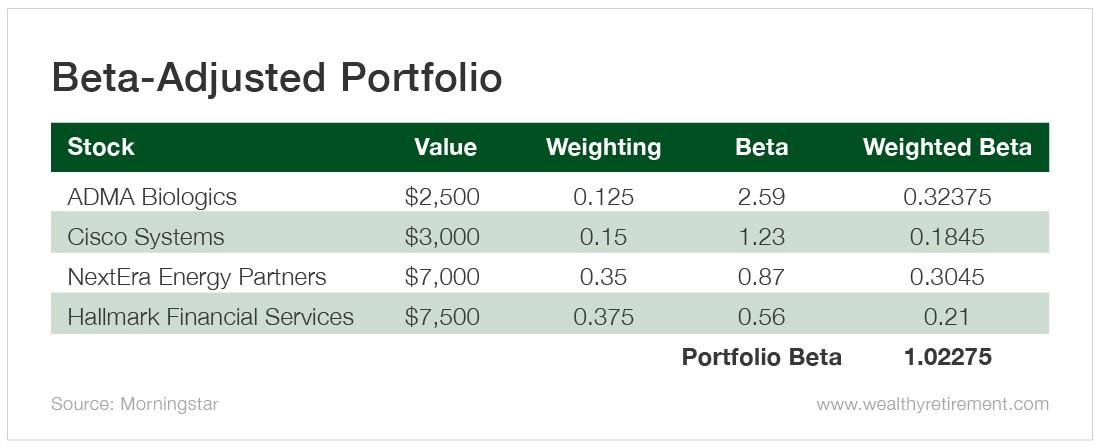

One way to use the beta of the market portfolio is to adjust the overall risk level of a portfolio. For example, if an investor has a high-risk tolerance, they may want to invest in assets with a high beta, such as stocks, to maximize returns. On the other hand, if an investor has a low-risk tolerance, they may want to invest in assets with a low beta, such as bonds, to minimize risk.

The beta of the market portfolio can also be used to diversify a portfolio. By investing in assets with different betas, investors can reduce their overall risk and increase their potential returns. For example, an investor may want to invest in a mix of high-beta stocks and low-beta bonds to achieve a balanced portfolio.

In addition, the beta of the market portfolio can be used to evaluate the performance of an investment manager. By comparing the beta of a portfolio to the beta of the market portfolio, investors can determine whether the investment manager is taking on excessive risk or not enough risk to achieve their desired returns.

Furthermore, the beta of the market portfolio can be used to construct a portfolio that tracks the overall market’s performance. By investing in a mix of assets with a beta similar to the beta of the market portfolio, investors can create a portfolio that mirrors the market’s performance and achieves broad diversification.

In conclusion, the beta of the market portfolio is a critical component of investment decisions, and understanding how to use it can help investors achieve their desired risk-return profile. By adjusting the overall risk level of a portfolio, diversifying a portfolio, evaluating the performance of an investment manager, and constructing a portfolio that tracks the overall market’s performance, investors can make informed decisions and achieve long-term investment success.

Common Misconceptions About the Beta of the Market Portfolio

Despite its importance in finance, the beta of the market portfolio is often misunderstood by investors. Several misconceptions surround its calculation, interpretation, and application, which can lead to poor investment decisions. In this section, we will address some of the most common misconceptions about the beta of the market portfolio.

Myth 1: The beta of the market portfolio is a fixed value. Reality: The beta of the market portfolio is not a fixed value and can change over time in response to various market and economic factors. For example, during periods of high market volatility, the beta of the market portfolio may increase as investors become more risk-averse.

Myth 2: A high beta is always bad. Reality: A high beta does not necessarily mean that an investment is bad. A high beta simply means that the investment is more volatile than the market portfolio, which can be beneficial for investors seeking higher returns.

Myth 3: The beta of the market portfolio is only relevant for stocks. Reality: The beta of the market portfolio is relevant for all types of investments, including bonds, commodities, and currencies. It provides a benchmark for evaluating the systematic risk of any investment.

Myth 4: The beta of the market portfolio is calculated using a simple formula. Reality: While the formula for calculating the beta of the market portfolio is straightforward, it requires a deep understanding of finance and statistics to apply it correctly. Furthermore, the beta of the market portfolio is often estimated using complex models and algorithms.

Myth 5: The beta of the market portfolio is only used by institutional investors. Reality: The beta of the market portfolio is a valuable tool for all investors, regardless of their size or sophistication. It provides a framework for evaluating and managing risk, which is essential for achieving long-term investment success.

By understanding these common misconceptions about the beta of the market portfolio, investors can avoid costly mistakes and make more informed investment decisions. The beta of the market portfolio is a powerful tool that can help investors achieve their desired risk-return profile and achieve long-term investment success.

Conclusion: Mastering the Beta of the Market Portfolio for Long-Term Success

In conclusion, the beta of the market portfolio is a crucial concept in finance that plays a vital role in investment decisions and risk management. By understanding the beta of the market portfolio, investors can gain valuable insights into the systematic risk of their investments and make informed decisions to achieve their desired risk-return profile.

The beta of the market portfolio is a powerful tool that can help investors navigate the complexities of the financial markets. By mastering the beta of the market portfolio, investors can optimize their portfolios, minimize risk, and maximize returns. Whether you are a seasoned investor or just starting out, understanding the beta of the market portfolio is essential for achieving long-term investment success.

Throughout this article, we have explored the concept of beta, the composition and role of the market portfolio, and how to calculate and interpret the beta of the market portfolio. We have also discussed common misconceptions about the beta of the market portfolio and how to use it in investment decisions.

In today’s fast-paced and ever-changing financial markets, it is more important than ever to have a deep understanding of the beta of the market portfolio. By doing so, investors can stay ahead of the curve, make informed decisions, and achieve their long-term investment goals. Remember, the beta of the market portfolio is a key component of a successful investment strategy, and mastering it is essential for achieving long-term success.

In conclusion, the beta of the market portfolio is a critical component of investment decisions and risk management. By understanding and applying the concepts discussed in this article, investors can unlock the secrets of market portfolio risk management and achieve long-term investment success.