What are Treasury Bills and How Do They Work?

Treasury bills are a low-risk investment option that provides a fixed return in the form of interest. They are issued by central banks to raise capital and are backed by the credit and taxing power of the government. The characteristics of treasury bills include a fixed face value, a specific maturity period, and a discount rate that determines the interest rate. One of the key benefits of investing in treasury bills is that they provide a safe haven for investors’ funds, offering a fixed return with minimal risk. This makes them an attractive option for investors seeking to diversify their portfolios and manage risk. Treasury bills differ from other investment instruments, such as bonds and stocks, in terms of their short-term nature and low-risk profile. Understanding the characteristics and benefits of treasury bills is essential to making informed investment decisions, including how to calculate interest rate on treasury bill. With their low-risk profile and fixed returns, treasury bills are an ideal investment option for those seeking a stable source of income. By investing in treasury bills, investors can earn a steady return and achieve their investment objectives, making them a valuable addition to any investment portfolio. As investors consider investing in treasury bills, it is essential to understand how to calculate interest rate on treasury bill to make informed decisions.

Determining the Interest Rate on Your Treasury Bill Investment

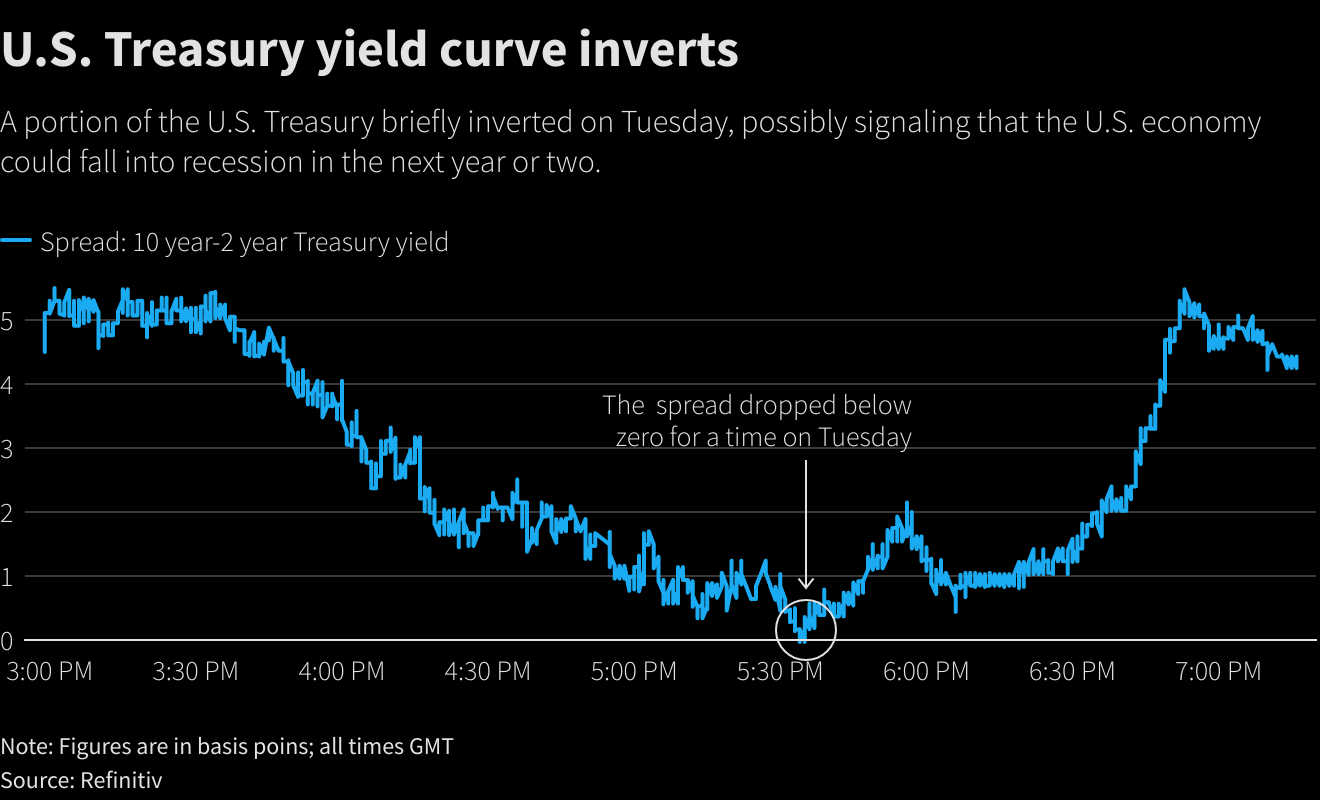

Understanding the interest rate on treasury bills is crucial for investors seeking to maximize their returns. The interest rate on a treasury bill determines the return on investment, making it essential to comprehend the factors that influence it. Market conditions, economic indicators, and monetary policy decisions all play a significant role in shaping the interest rate on treasury bills. For instance, during periods of high inflation, interest rates tend to rise to combat inflationary pressures. Conversely, during economic downturns, interest rates may decrease to stimulate economic growth. To calculate interest rate on treasury bill, investors must consider these factors and their impact on the overall interest rate. By grasping the underlying factors that influence interest rates, investors can make informed decisions and optimize their returns on treasury bill investments. A thorough understanding of interest rates is vital to navigating the treasury bill market and achieving investment objectives.

How to Calculate the Interest Rate on a Treasury Bill

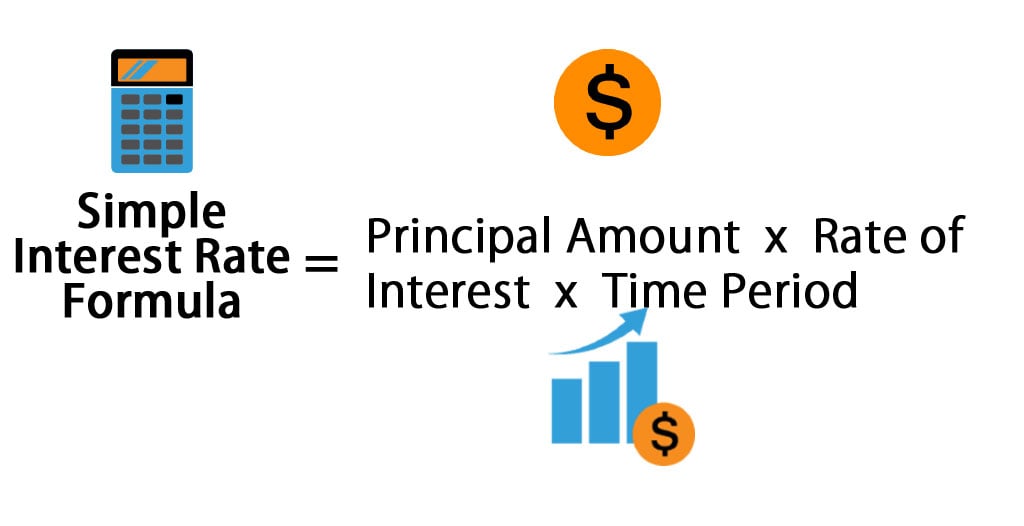

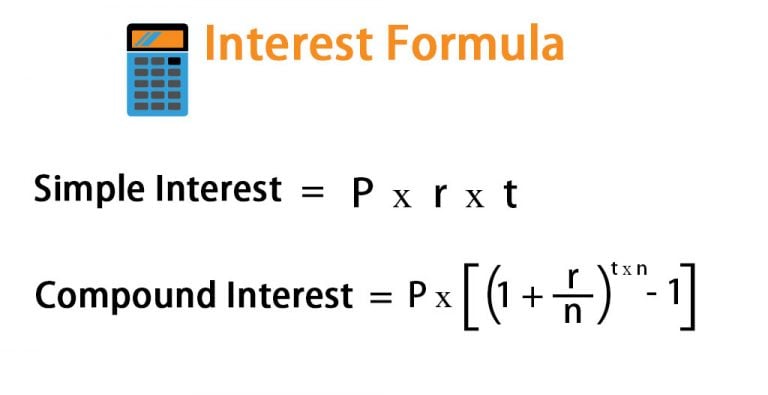

To calculate interest rate on treasury bill, investors need to understand the formula and the variables involved. The interest rate on a treasury bill is calculated using the following formula: Interest Rate = (Face Value – Discount Price) / Face Value. Where Face Value is the par value of the treasury bill, and Discount Price is the price at which the treasury bill is sold. For example, if the face value of a 26-week treasury bill is $1,000 and it is sold at a discount price of $980, the interest rate would be calculated as follows: Interest Rate = ($1,000 – $980) / $1,000 = 2%. This means that the investor will earn a 2% return on their investment over the 26-week period. By understanding how to calculate interest rate on treasury bill, investors can make informed decisions and optimize their returns on treasury bill investments. It is essential to note that the interest rate on a treasury bill is influenced by various factors, including the discount rate, face value, and maturity period. By grasping these concepts, investors can navigate the treasury bill market with confidence and achieve their investment objectives.

Understanding the Discount Rate and Its Impact on Treasury Bill Interest

The discount rate is a crucial concept in understanding how to calculate interest rate on treasury bill. The discount rate is the rate at which the treasury bill is sold at a discount to its face value. This discount rate has a direct impact on the interest rate earned on the treasury bill. The relationship between the discount rate, face value, and maturity period is essential in determining the interest rate. A higher discount rate results in a lower purchase price, which in turn leads to a higher interest rate. Conversely, a lower discount rate results in a higher purchase price, leading to a lower interest rate. For instance, if a 13-week treasury bill has a face value of $1,000 and is sold at a discount rate of 1.5%, the purchase price would be $985. The interest rate would be calculated as (Face Value – Purchase Price) / Face Value, which is (1,000 – 985) / 1,000 = 1.5%. By grasping the concept of the discount rate and its impact on treasury bill interest, investors can better understand how to calculate interest rate on treasury bill and make informed investment decisions.

Treasury Bill Auctions: How They Affect Interest Rates

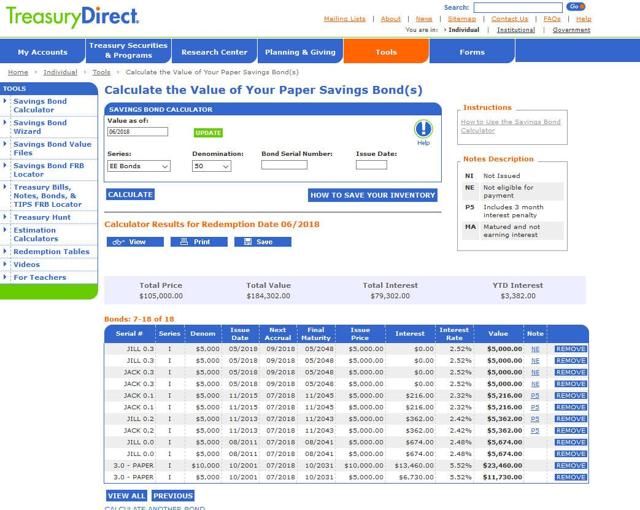

Treasury bill auctions play a crucial role in determining the interest rates on treasury bills. The auction process is a key factor in calculating interest rate on treasury bill, as it sets the discount rate at which the bills are sold. In a treasury bill auction, investors bid on the price they are willing to pay for the bill, with the highest bidder receiving the bill at the lowest discount rate. The auction process is typically conducted by the government or central bank, and the results are used to set the interest rate for the treasury bill. The bidding process is competitive, and the final interest rate is determined by the highest bid. For example, if the auction results in a discount rate of 1.2%, the interest rate on the treasury bill would be calculated as (Face Value – Purchase Price) / Face Value, where the purchase price is the face value minus the discount. By understanding how treasury bill auctions affect interest rates, investors can better navigate the market and make informed decisions when calculating interest rate on treasury bill. Additionally, investors can use the auction results to anticipate future interest rate trends and adjust their investment strategies accordingly.

Factors Affecting Treasury Bill Interest Rates: A Deeper Dive

When it comes to calculating interest rate on treasury bill, understanding the factors that influence interest rates is crucial. Treasury bill interest rates are affected by a range of economic indicators and market conditions. One of the primary factors is inflation, which can impact interest rates by influencing the demand for treasury bills. When inflation is high, investors may demand higher interest rates to compensate for the erosion of purchasing power. On the other hand, low inflation can lead to lower interest rates. Economic growth is another key factor, as a strong economy can lead to higher interest rates, while a slowing economy may result in lower rates. Monetary policy decisions, such as changes to the federal funds rate, can also impact treasury bill interest rates. Additionally, market conditions, including supply and demand, can influence interest rates. For instance, if there is high demand for treasury bills, interest rates may decrease, while low demand can lead to higher rates. By understanding these factors, investors can better anticipate changes in interest rates and make informed decisions when calculating interest rate on treasury bill. Furthermore, investors can use this knowledge to adjust their investment strategies and maximize their returns.

Real-World Examples: Calculating Interest Rates on Treasury Bills

To illustrate the process of calculating interest rate on treasury bill, let’s consider a few real-world examples. In each scenario, we’ll use the formula: (Face Value – Purchase Price) / Face Value, where the purchase price is the face value minus the discount.

Example 1: A 26-week treasury bill with a face value of $1,000 and a discount rate of 1.5%. To calculate the interest rate, we would first calculate the purchase price: $1,000 – (1.5% of $1,000) = $985. Then, we would plug in the values to the formula: ($1,000 – $985) / $1,000 = 1.5%. This means the interest rate on this treasury bill is 1.5%.

Example 2: A 52-week treasury bill with a face value of $5,000 and a discount rate of 2.2%. Using the same formula, we would calculate the purchase price: $5,000 – (2.2% of $5,000) = $4,890. Then, we would calculate the interest rate: ($5,000 – $4,890) / $5,000 = 2.2%. This means the interest rate on this treasury bill is 2.2%.

Example 3: A 4-week treasury bill with a face value of $10,000 and a discount rate of 0.8%. Again, we would calculate the purchase price: $10,000 – (0.8% of $10,000) = $9,920. Then, we would calculate the interest rate: ($10,000 – $9,920) / $10,000 = 0.8%. This means the interest rate on this treasury bill is 0.8%.

These examples demonstrate how to calculate interest rate on treasury bill in different scenarios, taking into account varying face values, maturity periods, and discount rates. By applying this formula and understanding the factors that influence interest rates, investors can make informed decisions and maximize their returns on treasury bill investments.

Maximizing Your Returns: Tips for Investing in Treasury Bills

When it comes to investing in treasury bills, maximizing returns is crucial. To achieve this, investors can employ various strategies that take into account the unique characteristics of treasury bills. One effective approach is diversification, which involves spreading investments across different maturity periods and face values. This helps to minimize risk and increase potential returns. Another strategy is laddering, which involves investing in a series of treasury bills with staggered maturity dates. This approach can provide a steady stream of income and help to manage interest rate risk.

Timing investments is also critical when investing in treasury bills. Investors should consider the current market conditions and interest rate environment before making a purchase. For instance, if interest rates are rising, it may be beneficial to invest in shorter-term treasury bills to take advantage of higher yields. Conversely, if interest rates are falling, investing in longer-term treasury bills may be more advantageous.

Additionally, investors should consider the importance of calculating interest rate on treasury bill accurately. By understanding the factors that influence interest rates, such as inflation and economic growth, investors can make informed decisions and adjust their investment strategies accordingly. Furthermore, investors should be aware of the discount rate and its impact on treasury bill interest rates, as well as the role of treasury bill auctions in determining interest rates.

By incorporating these tips and strategies into their investment approach, investors can maximize their returns on treasury bills and achieve their financial goals. Whether you’re a seasoned investor or just starting out, understanding how to calculate interest rate on treasury bill and employing effective investment strategies can help you navigate the world of treasury bills with confidence.