Understanding the Role of Treasury Bonds in the Economy

The U.S. Treasury bond market plays a vital role in the economy, with Treasury bonds serving as a cornerstone of the financial system. These government securities are issued by the U.S. Department of the Treasury to finance government operations, refinance existing debt, and influence monetary policy. As a result, U.S. Treasury bond prices have a profound impact on interest rates, inflation, and economic growth. Historical analysis of U.S. Treasury bond prices reveals that they are closely tied to the overall health of the economy, with changes in bond prices influencing borrowing costs, consumer spending, and business investment. By examining the historical trends and patterns of U.S. Treasury bond prices, investors and policymakers can gain valuable insights into the economy’s underlying dynamics and make more informed decisions.

How to Analyze Historical Treasury Bond Prices for Investment Insights

Analyzing historical U.S. Treasury bond prices can provide valuable insights for investors and policymakers alike. By examining the trends, patterns, and correlations between historical Treasury bond prices and economic indicators, investors can gain a deeper understanding of the market and make more informed investment decisions. Historical analysis of U.S. Treasury bond prices can help identify opportunities and risks, allowing investors to adjust their strategies accordingly. Furthermore, analyzing historical Treasury bond prices can also provide insights into the impact of monetary policy decisions, such as interest rate changes and quantitative easing, on the bond market. By understanding how historical events have shaped the Treasury bond market, investors can better navigate the complexities of the current market and make more informed decisions. The benefits of analyzing historical U.S. Treasury bond prices historical are numerous, and can provide a competitive edge in today’s fast-paced investment landscape.

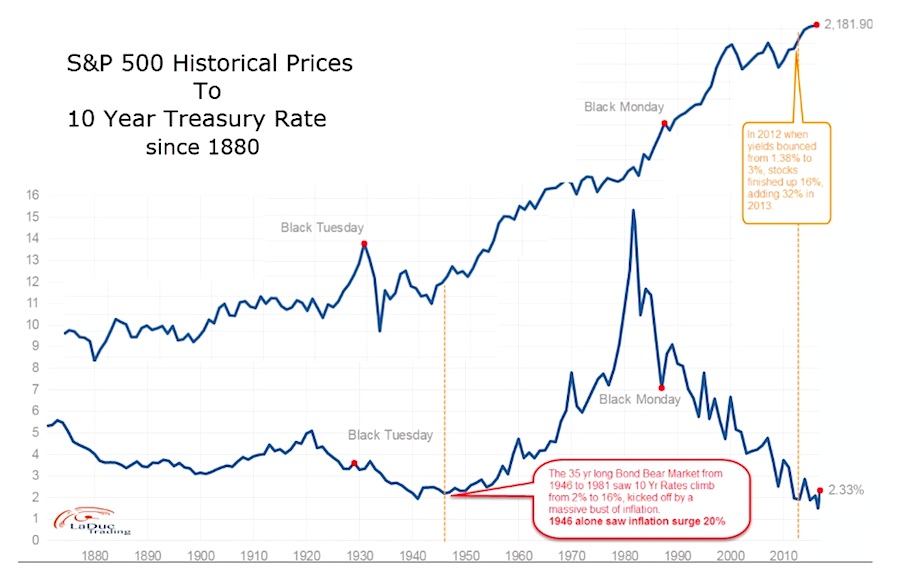

A Brief History of U.S. Treasury Bond Prices: Major Events and Trends

The history of U.S. Treasury bond prices is marked by significant events and trends that have shaped the market over time. One of the most notable events was the 1980s bond market crisis, which saw a sharp increase in interest rates and a subsequent decline in bond prices. This period was followed by a prolonged period of low interest rates and stable bond prices, which lasted until the 2008 financial crisis. The crisis led to a significant decline in Treasury bond prices and a corresponding increase in yields, as investors sought safer assets. The subsequent monetary policy decisions, including quantitative easing, have had a profound impact on U.S. Treasury bond prices historical, leading to a prolonged period of low interest rates and high bond prices. Other significant events, such as the 1998 Russian financial crisis and the 2011 European sovereign debt crisis, have also had an impact on Treasury bond prices. By examining these events and trends, investors can gain a deeper understanding of the historical context of U.S. Treasury bond prices and make more informed investment decisions.

Deciphering the Impact of Monetary Policy on Treasury Bond Prices

Monetary policy decisions have a profound impact on U.S. Treasury bond prices historical. The Federal Reserve‘s actions, such as setting interest rates and implementing quantitative easing, influence the demand and supply of Treasury bonds, thereby affecting their prices and yields. For instance, when the Federal Reserve lowers interest rates, it increases the demand for Treasury bonds, causing their prices to rise and yields to fall. Conversely, when interest rates are raised, the demand for Treasury bonds decreases, leading to lower prices and higher yields. Quantitative easing, which involves the purchase of Treasury bonds by the Federal Reserve, also increases demand and drives up prices. By understanding the impact of monetary policy on Treasury bond prices, investors can better navigate the complexities of the bond market and make more informed investment decisions. Furthermore, analyzing the historical relationship between monetary policy and U.S. Treasury bond prices historical can provide valuable insights into the potential effects of future policy decisions.

The Relationship Between Treasury Bond Prices and Economic Indicators

The U.S. Treasury bond prices historical are closely tied to various economic indicators, which can provide valuable insights for investors. One of the most significant correlations is between Treasury bond prices and GDP growth. During periods of strong economic growth, Treasury bond prices tend to rise, reflecting increased demand for bonds and lower yields. Conversely, during economic downturns, Treasury bond prices often decline, leading to higher yields. Inflation is another key economic indicator that affects Treasury bond prices. When inflation rises, Treasury bond prices tend to fall, as investors demand higher yields to compensate for the erosion of purchasing power. Unemployment rates also have an impact on Treasury bond prices, with lower unemployment rates often leading to higher bond prices and lower yields. By analyzing the historical relationships between U.S. Treasury bond prices historical and these economic indicators, investors can gain a better understanding of the underlying factors driving bond prices and make more informed investment decisions.

Using Historical Data to Inform Investment Decisions

By analyzing U.S. Treasury bond prices historical, investors can gain valuable insights to inform their investment decisions. One key application of historical data is identifying trends and patterns in Treasury bond prices. For instance, analyzing the historical performance of Treasury bonds during different economic conditions, such as recessions or periods of high inflation, can help investors anticipate how bonds may react to similar conditions in the future. Additionally, historical data can be used to identify correlations between Treasury bond prices and economic indicators, such as GDP growth or unemployment rates. By understanding these relationships, investors can make more informed decisions about when to buy or sell Treasury bonds. Furthermore, historical data can be used to manage risk by identifying potential pitfalls and opportunities in the bond market. For example, analyzing the impact of monetary policy decisions on U.S. Treasury bond prices historical can help investors anticipate how future policy changes may affect their bond portfolios. By leveraging historical data, investors can develop a more nuanced understanding of the bond market and make more informed investment decisions.

Comparing Historical Treasury Bond Prices Across Different Maturities

U.S. Treasury bond prices historical vary across different maturities, offering unique investment opportunities and implications. Analyzing the historical performance of Treasury bonds with different maturities, such as 2-year, 10-year, and 30-year bonds, can provide valuable insights for investors. For instance, short-term Treasury bonds, such as 2-year bonds, tend to be less sensitive to changes in interest rates and inflation, making them a more stable investment option. In contrast, long-term Treasury bonds, such as 30-year bonds, are more sensitive to changes in interest rates and inflation, but offer higher yields to compensate for the increased risk. By comparing the historical performance of Treasury bonds across different maturities, investors can identify opportunities to diversify their portfolios and manage risk. For example, during periods of rising interest rates, investors may prefer shorter-term Treasury bonds to minimize losses, while during periods of falling interest rates, longer-term Treasury bonds may offer more attractive yields. By understanding the unique characteristics of Treasury bonds with different maturities, investors can make more informed investment decisions and optimize their portfolios.

Lessons from the Past: What Historical Treasury Bond Prices Can Teach Us

By analyzing U.S. Treasury bond prices historical, investors can glean valuable insights to inform their investment strategies. One key takeaway is the importance of adopting a long-term perspective when investing in Treasury bonds. Historical data shows that Treasury bond prices can be volatile in the short term, but tend to stabilize over longer periods. This underscores the need for investors to have a time horizon of at least several years to ride out market fluctuations. Another important lesson is the value of diversification. Historical Treasury bond prices demonstrate that different maturities and types of bonds perform differently under various economic conditions. By diversifying their portfolios across different Treasury bond maturities and types, investors can reduce risk and increase potential returns. Finally, historical Treasury bond prices highlight the importance of adaptability in investment strategies. As economic conditions and monetary policy decisions change, investors must be willing to adjust their strategies to respond to new market realities. By applying these lessons from the past, investors can develop more effective investment strategies and achieve their long-term financial goals.