What Happens When Bond Yields Increase?

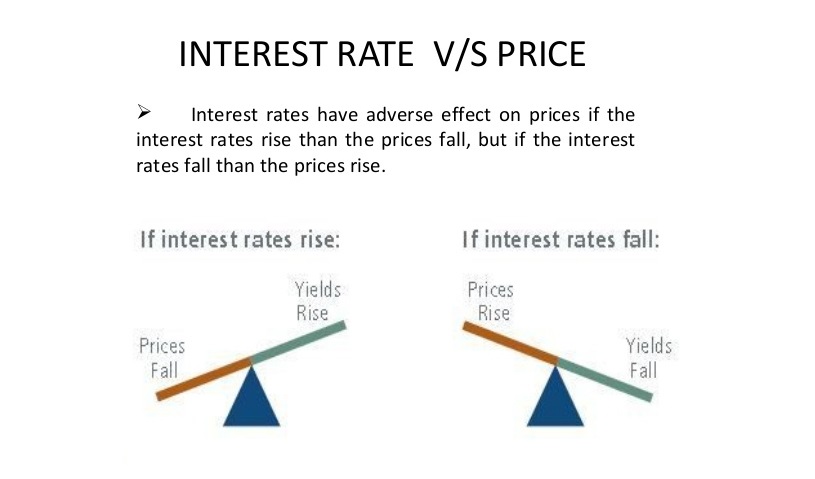

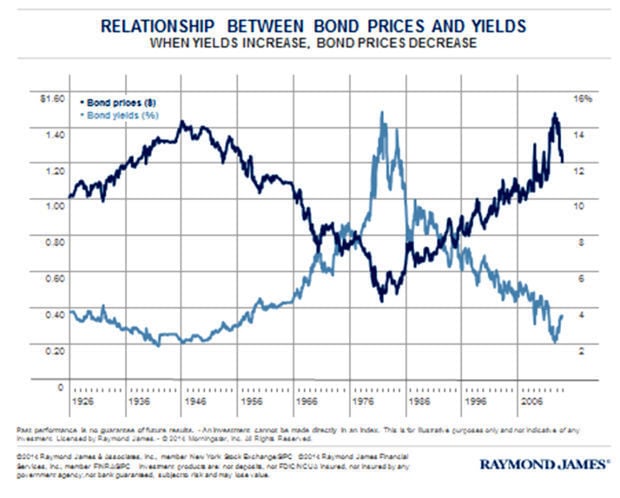

Bond yields play a crucial role in determining the value of a fixed coupon bond. When bond yields rise, it can have a significant impact on the bond’s price. In fact, if the yield on a fixed coupon bond goes up, its price will decrease, and vice versa. This inverse relationship is a fundamental concept in bond investing, and understanding it is essential for making informed investment decisions.

The relationship between bond yields and prices is straightforward: when yields rise, bond prices fall, and when yields fall, bond prices rise. This is because bond yields reflect the market’s expectations of future interest rates and inflation. When yields increase, it means that investors are demanding a higher return to compensate for the increased risk or inflation expectations, which in turn reduces the bond’s value.

For investors, it’s essential to grasp this concept to make informed investment decisions. By understanding how bond yields affect fixed coupon bonds, investors can better navigate the bond market and make more informed investment choices.

The Effect of Rising Yields on Bond Prices

The inverse relationship between bond yields and prices is a fundamental concept in bond investing. When bond yields rise, bond prices fall, and vice versa. This relationship is critical for investors to understand, as it can significantly impact their investment portfolio.

For example, consider a fixed coupon bond with a face value of $1,000 and a coupon rate of 4%. If the yield on similar bonds increases from 4% to 5%, the bond’s price will decrease to reflect the new yield. This means that the bond’s value will fall, potentially resulting in a loss for the investor if they decide to sell the bond before maturity.

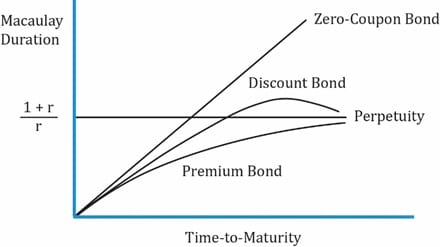

The magnitude of the price decrease depends on the duration of the bond. Bonds with longer durations are more sensitive to changes in yields, resulting in a more significant price decrease. Conversely, bonds with shorter durations are less sensitive to changes in yields, resulting in a smaller price decrease.

It’s essential for investors to understand how rising yields affect bond prices to make informed investment decisions. By grasping this concept, investors can better navigate the bond market and make more informed investment choices. For instance, if the yield on a fixed coupon bond goes up, investors may consider selling their existing bonds and reinvesting in newer bonds with higher yields, or they may choose to hold onto their existing bonds and ride out the market fluctuations.

How to Navigate the Consequences of Rising Yields

When bond yields rise, investors must adapt their investment strategies to navigate the consequences. A rising yield environment can be challenging, but there are several strategies that investors can employ to mitigate the impact.

One approach is diversification. By spreading investments across different asset classes, sectors, and geographies, investors can reduce their exposure to any one particular bond or market. This can help to minimize losses and maximize returns in a rising yield environment.

Active management is another strategy that investors can use to navigate rising yields. This involves regularly monitoring and adjusting the bond portfolio to take advantage of changes in market conditions. For example, if the yield on a fixed coupon bond goes up, investors may choose to sell their existing bonds and reinvest in newer bonds with higher yields.

Hedging is another technique that investors can use to manage the risks associated with rising yields. This involves taking positions in other assets that offset the potential losses from rising yields. For example, investors may choose to invest in assets that perform well in a rising rate environment, such as floating-rate notes or inflation-indexed bonds.

By employing these strategies, investors can adapt to a rising yield environment and minimize the impact on their investment portfolios. It’s essential to stay informed and flexible, as market conditions can change rapidly. By doing so, investors can navigate the consequences of rising yields and achieve their long-term investment goals.

The Role of Interest Rates in Shaping Bond Yields

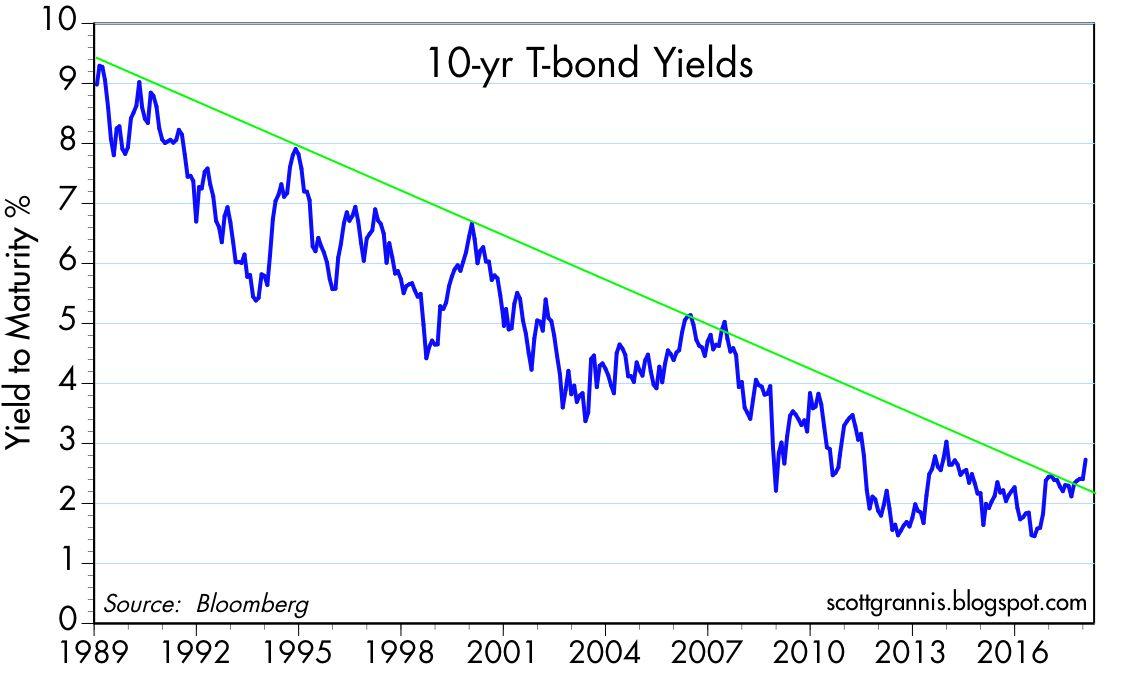

Interest rates play a crucial role in shaping bond yields, and understanding this relationship is essential for investors. Central banks, such as the Federal Reserve in the United States, set interest rates to influence the direction of the economy. When interest rates rise, it can lead to an increase in bond yields, and vice versa.

The connection between interest rates and bond yields is rooted in the concept of opportunity cost. When interest rates rise, investors can earn a higher return on their money by investing in newly issued bonds or other fixed-income securities. As a result, the demand for existing bonds with lower yields decreases, causing their prices to fall and their yields to rise.

For example, if the yield on a fixed coupon bond goes up due to a rise in interest rates, investors may choose to sell their existing bonds and invest in newer bonds with higher yields. This can lead to a decrease in the value of the existing bonds, as investors are no longer willing to pay a premium for a lower yield.

Central banks’ monetary policies also influence the direction of yields. During times of economic uncertainty, central banks may lower interest rates to stimulate economic growth. This can lead to a decrease in bond yields, making existing bonds with higher yields more attractive to investors.

Conversely, during periods of economic growth, central banks may raise interest rates to combat inflation. This can lead to an increase in bond yields, making newly issued bonds with higher yields more attractive to investors.

By understanding the relationship between interest rates and bond yields, investors can better navigate the bond market and make informed investment decisions. By recognizing the impact of central banks’ monetary policies on bond yields, investors can position themselves to take advantage of changing market conditions.

Fixed Coupon Bonds: A Safe Haven in Uncertain Times?

Fixed coupon bonds have long been considered a relatively stable investment option, offering investors a predictable income stream and a lower-risk profile compared to other asset classes. During periods of market volatility, fixed coupon bonds can provide a sense of security and stability, making them an attractive option for investors seeking to reduce their exposure to market fluctuations.

One of the key benefits of fixed coupon bonds is their fixed income stream, which is not directly affected by changes in interest rates or bond yields. This means that investors can rely on a steady income stream, even if the yield on a fixed coupon bond goes up or down. Additionally, fixed coupon bonds typically offer a higher yield than other low-risk investments, such as money market funds or short-term commercial paper.

Another advantage of fixed coupon bonds is their relatively low volatility compared to other asset classes. Because the coupon rate is fixed, the bond’s value is less sensitive to changes in interest rates, making it a more stable investment option. This can be particularly appealing during times of market uncertainty, when investors may be seeking to reduce their exposure to risk.

However, it’s essential to note that fixed coupon bonds are not entirely immune to the effects of rising yields. If the yield on a fixed coupon bond goes up, the bond’s value may decrease, as investors can earn a higher return on their investment elsewhere. Nevertheless, the impact of rising yields on fixed coupon bonds is typically less pronounced than on other types of bonds, making them a relatively stable investment option.

In conclusion, fixed coupon bonds can provide a safe haven for investors during periods of market uncertainty. Their fixed income stream, relatively low volatility, and higher yields make them an attractive option for investors seeking to reduce their exposure to risk. While they are not entirely immune to the effects of rising yields, they can provide a sense of security and stability in uncertain times.

Managing Risk in a Rising Yield Environment

As bond yields rise, investors face a range of risks that can impact their investment portfolios. To mitigate these risks, it’s essential to understand the potential pitfalls and take proactive steps to manage them. In this section, we’ll explore the key risks associated with rising yields and provide tips on how to navigate these challenges.

Credit risk is a significant concern in a rising yield environment. When yields rise, the creditworthiness of bond issuers can come into question, leading to a decrease in bond value. To manage credit risk, investors can diversify their bond holdings across different issuers, sectors, and credit ratings. This can help to reduce exposure to any one particular issuer or sector.

Liquidity risk is another key concern, as rising yields can lead to a decrease in bond liquidity. This can make it difficult for investors to sell their bonds quickly and at a fair price. To manage liquidity risk, investors can maintain a diversified portfolio with a mix of liquid and illiquid bonds. They can also consider investing in bonds with shorter maturities, which tend to be more liquid than longer-term bonds.

Duration risk is also a significant concern, as rising yields can lead to a decrease in bond value. To manage duration risk, investors can adjust the duration of their bond portfolio to match their investment horizon. They can also consider investing in bonds with shorter durations, which tend to be less sensitive to changes in yields.

In addition to these risks, investors must also consider the impact of rising yields on their overall investment portfolio. If the yield on a fixed coupon bond goes up, the bond’s value may decrease, leading to a decline in the portfolio’s overall value. To manage this risk, investors can rebalance their portfolio by selling bonds that have decreased in value and investing in bonds that offer higher yields.

By understanding the risks associated with rising yields and taking proactive steps to manage them, investors can help to protect their investment portfolios and achieve their long-term investment goals. By diversifying their bond holdings, managing credit risk, liquidity risk, and duration risk, and rebalancing their portfolio, investors can navigate the challenges of a rising yield environment and achieve success in the bond market.

What Do Rising Yields Mean for Your Investment Portfolio?

Rising yields can have a significant impact on an investment portfolio, particularly if it is heavily weighted towards fixed coupon bonds. If the yield on a fixed coupon bond goes up, the bond’s value may decrease, leading to a decline in the portfolio’s overall value. This can be a concern for investors who are relying on their bond holdings to generate income or provide a stable source of returns.

To navigate the implications of rising yields, investors should consider rebalancing their portfolio to maintain an optimal asset allocation. This may involve selling bonds that have decreased in value and investing in bonds that offer higher yields. By doing so, investors can help to mitigate the impact of rising yields on their portfolio and ensure that it remains aligned with their investment objectives.

Another key consideration is the overall duration of the portfolio. If the yield on a fixed coupon bond goes up, the duration of the bond may increase, making it more sensitive to changes in yields. To manage this risk, investors can adjust the duration of their portfolio by investing in bonds with shorter or longer maturities.

In addition to these strategies, investors should also consider the credit quality of their bond holdings. If the yield on a fixed coupon bond goes up, the creditworthiness of the issuer may come into question, leading to a decrease in bond value. To manage this risk, investors can diversify their bond holdings across different issuers, sectors, and credit ratings.

Ultimately, the key to navigating the implications of rising yields is to remain proactive and adaptable. By regularly reviewing and rebalancing their portfolio, investors can help to ensure that it remains aligned with their investment objectives and that they are well-positioned to take advantage of opportunities in the bond market.

By understanding the implications of rising yields on their investment portfolio, investors can make informed decisions about how to manage their bond holdings and achieve their long-term investment goals. Whether it’s rebalancing the portfolio, adjusting the duration, or diversifying bond holdings, there are a range of strategies that investors can use to navigate the challenges of a rising yield environment.

Long-Term Implications of Rising Yields on Fixed Coupon Bonds

The long-term implications of rising yields on fixed coupon bonds are far-reaching and multifaceted. As yields continue to rise, investors can expect to see a shift in the bond market landscape. If the yield on a fixed coupon bond goes up, the bond’s value may decrease, leading to a decline in the overall value of the bond market.

One potential opportunity arising from this trend is the increased attractiveness of shorter-term bonds. As yields rise, shorter-term bonds may become more appealing to investors seeking to minimize their exposure to duration risk. This could lead to a shift in investor sentiment, with more investors opting for shorter-term bonds over longer-term ones.

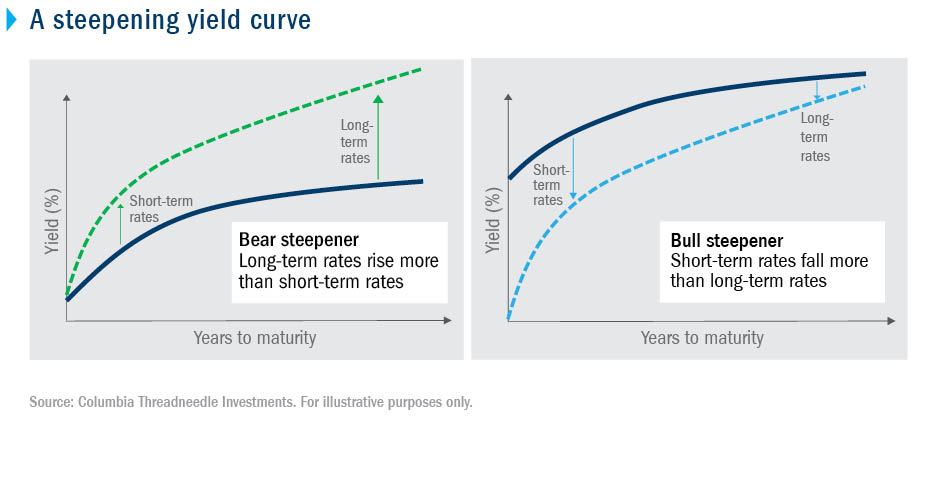

Another potential implication is the increased importance of active management in the bond market. As yields rise, investors will need to be more proactive in managing their bond portfolios to mitigate the risks associated with rising yields. This could lead to a greater emphasis on active management strategies, such as dynamic duration management and yield curve positioning.

Rising yields also have implications for the broader economy. As yields rise, borrowing costs increase, which can have a ripple effect on economic growth. This could lead to a slowdown in economic activity, as businesses and consumers become more cautious in their borrowing and spending habits.

Despite these challenges, fixed coupon bonds remain an attractive investment option for many investors. By understanding the long-term implications of rising yields, investors can position themselves to take advantage of the opportunities that arise from this trend. Whether it’s through diversification, active management, or hedging, there are a range of strategies that investors can use to navigate the challenges of a rising yield environment.

Ultimately, the key to success in a rising yield environment is to remain flexible and adaptable. By staying informed about market developments and adjusting their investment strategies accordingly, investors can help to ensure that they are well-positioned to achieve their long-term investment goals.