What is the Spread in Forex and Why Does it Matter?

In the Forex market, understanding the spread is crucial for making informed trading decisions. The spread, which represents the difference between the bid and ask prices of a currency pair, has a significant impact on trading outcomes. So, what does spread mean in Forex? In essence, it’s the cost of trading, and it can greatly affect a trader’s profitability. A clear understanding of the spread is vital, as it influences the choice of trading strategies, risk management, and ultimately, the success of a trade.

How to Calculate the Spread in Forex Trading

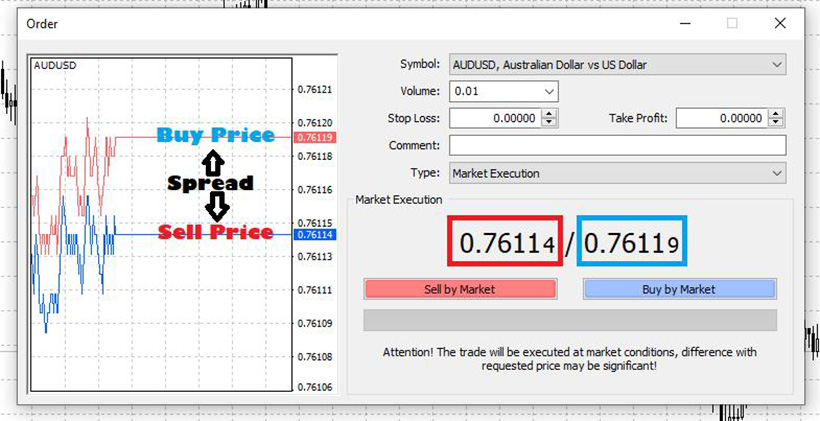

Calculating the spread in Forex trading is a straightforward process that involves understanding the bid-ask price difference. The bid price is the highest price at which a buyer is willing to buy a currency pair, while the ask price is the lowest price at which a seller is willing to sell. The spread is the difference between these two prices. To calculate the spread, traders can use the following formula: Spread = Ask Price – Bid Price. For example, if the bid price for EUR/USD is 1.1000 and the ask price is 1.1020, the spread would be 20 pips (1.1020 – 1.1000). This calculation can be applied to various currency pairs, including major, minor, and exotic pairs. Understanding how to calculate the spread is essential for Forex traders, as it helps them to make informed trading decisions and to manage their risk effectively.

The Impact of Spread on Forex Trading Strategies

The spread has a significant impact on various Forex trading strategies, and understanding its effects is crucial for traders. Scalping, a popular strategy that involves making multiple trades in a short period, is heavily influenced by the spread. A high spread can quickly erode the profits of scalpers, making it essential to choose currency pairs with low spreads. Day traders, on the other hand, need to consider the spread when setting their profit targets and stop-loss levels. A wider spread can result in higher transaction costs, which can affect the overall profitability of day traders. Swing traders, who hold positions for longer periods, may be less affected by the spread, but still need to factor it into their trading decisions. To adjust trading strategies to accommodate the spread, traders can consider using different currency pairs, adjusting their position sizes, or modifying their entry and exit points. By understanding the impact of the spread on their trading strategies, Forex traders can make more informed decisions and optimize their trading performance.

Types of Spreads in Forex: Fixed, Variable, and Dynamic

In the Forex market, the spread is a crucial aspect that traders need to understand to make informed trading decisions. When it comes to spreads, Forex brokers offer different types, each with its advantages and disadvantages. Understanding these types is essential to choose the right broker and develop an effective trading strategy. So, what does spread mean in Forex? In essence, it’s the difference between the bid and ask prices of a currency pair. Now, let’s delve into the three main types of spreads in Forex: fixed, variable, and dynamic.

A fixed spread is a constant difference between the bid and ask prices, regardless of market conditions. This type of spread is often preferred by scalpers and high-frequency traders who require a stable and predictable trading environment. The advantage of a fixed spread is that it provides transparency and allows traders to accurately calculate their trading costs. However, fixed spreads can be wider than variable spreads, which may result in higher trading costs.

A variable spread, on the other hand, is a dynamic difference between the bid and ask prices that changes according to market conditions. This type of spread is often preferred by traders who trade in volatile markets or during news events. The advantage of a variable spread is that it can be narrower than a fixed spread, resulting in lower trading costs. However, variable spreads can be unpredictable, making it challenging for traders to calculate their trading costs.

A dynamic spread is a type of variable spread that adjusts in real-time according to market conditions. This type of spread is often preferred by traders who require a high degree of flexibility in their trading. The advantage of a dynamic spread is that it can be highly responsive to market changes, allowing traders to capitalize on rapid price movements. However, dynamic spreads can be highly volatile, making it challenging for traders to manage their risk.

In conclusion, understanding the different types of spreads in Forex is crucial to developing an effective trading strategy. By choosing the right type of spread, traders can minimize their trading costs, manage their risk, and maximize their profits. Whether you prefer a fixed, variable, or dynamic spread, it’s essential to understand what does spread mean in Forex and how it affects your trading decisions.

How to Choose a Forex Broker with Competitive Spreads

When it comes to Forex trading, choosing the right broker is crucial to achieving success. One of the key factors to consider when selecting a Forex broker is the spread they offer. A competitive spread can significantly impact your trading costs and overall profitability. So, what does spread mean in Forex? In essence, it’s the difference between the bid and ask prices of a currency pair. Now, let’s explore the factors to consider when choosing a Forex broker with competitive spreads.

Commission Rates: One of the primary factors to consider is the commission rate charged by the broker. Some brokers charge a fixed commission per trade, while others charge a percentage of the trade value. Look for brokers that offer competitive commission rates or no commissions at all.

Leverage: Leverage is another crucial factor to consider when choosing a Forex broker. Leverage allows you to trade with a larger amount of capital than you have in your account. However, high leverage can also increase your risk. Look for brokers that offer flexible leverage options to suit your trading style.

Trading Conditions: Trading conditions, such as execution speed and slippage, can significantly impact your trading performance. Look for brokers that offer fast execution speeds and minimal slippage to ensure that your trades are executed at the best possible prices.

Spread Comparison: When comparing spreads between brokers, look for the broker that offers the lowest spread for your preferred currency pairs. However, be wary of brokers that offer extremely low spreads, as they may be compensating for it with higher commissions or other fees.

Regulation and Reputation: Finally, consider the regulation and reputation of the broker. Look for brokers that are regulated by reputable authorities, such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). A reputable broker will provide a safe and secure trading environment, which is essential for protecting your investments.

In conclusion, choosing a Forex broker with competitive spreads requires careful consideration of several factors. By understanding what does spread mean in Forex and how it affects your trading costs, you can make an informed decision when selecting a broker. Remember to consider commission rates, leverage, trading conditions, spread comparison, and regulation and reputation when choosing a Forex broker that meets your trading needs.

The Relationship Between Spread and Market Volatility

In Forex trading, market volatility plays a significant role in determining the spread. Understanding the relationship between spread and market volatility is crucial to making informed trading decisions. So, what does spread mean in Forex? In essence, it’s the difference between the bid and ask prices of a currency pair. Now, let’s explore how changes in market conditions affect the spread.

Market volatility refers to the fluctuations in currency prices due to various economic and geopolitical factors. During periods of high volatility, the spread tends to widen, making it more expensive to trade. This is because brokers and market makers increase their profit margins to compensate for the increased risk. On the other hand, during periods of low volatility, the spread tends to narrow, making it cheaper to trade.

The impact of market volatility on the spread can be significant. For example, during times of high volatility, the spread for a currency pair like EUR/USD may increase from 1 pip to 5 pips or more. This can result in higher trading costs for traders, especially those who trade with high frequency or large volumes.

Forex traders need to be aware of the relationship between spread and market volatility to adjust their trading strategies accordingly. During periods of high volatility, traders may need to increase their stop-loss distances or adjust their position sizes to accommodate the wider spread. Conversely, during periods of low volatility, traders may be able to trade with tighter stop-loss distances or larger position sizes.

In addition, understanding the relationship between spread and market volatility can help traders identify potential trading opportunities. For example, during periods of high volatility, traders may be able to capitalize on rapid price movements by using scalping or day trading strategies. Conversely, during periods of low volatility, traders may be able to use swing trading strategies to capitalize on slower price movements.

In conclusion, the relationship between spread and market volatility is a critical aspect of Forex trading. By understanding how changes in market conditions affect the spread, traders can adjust their trading strategies to minimize costs and maximize profits. Remember, what does spread mean in Forex? It’s the difference between the bid and ask prices of a currency pair, and it’s essential to understand its relationship with market volatility to succeed in Forex trading.

Managing Risk with Stop-Loss Orders and Spread

In Forex trading, managing risk is crucial to achieving long-term success. One effective way to manage risk is by using stop-loss orders in conjunction with the spread. But what does spread mean in Forex? It’s the difference between the bid and ask prices of a currency pair. Understanding how to use stop-loss orders and spread together can help traders minimize losses and maximize profits.

A stop-loss order is an instruction to close a trade when it reaches a certain price level, limiting potential losses. However, the spread can affect the effectiveness of stop-loss orders. For example, if the spread is wide, a stop-loss order may be triggered more easily, resulting in unnecessary losses. To avoid this, traders need to consider the spread when setting stop-loss orders.

Here’s an example of how to set a stop-loss order effectively: Let’s say you’re trading the EUR/USD currency pair with a spread of 2 pips. You set a stop-loss order 10 pips below your entry price. However, if the spread suddenly widens to 5 pips, your stop-loss order may be triggered more easily, resulting in a larger loss. To avoid this, you could set your stop-loss order 15 pips below your entry price, taking into account the potential widening of the spread.

In addition to considering the spread, traders should also adjust their stop-loss orders according to market conditions. For example, during periods of high volatility, traders may need to set their stop-loss orders farther away from their entry prices to avoid being stopped out by sudden price movements. Conversely, during periods of low volatility, traders may be able to set their stop-loss orders closer to their entry prices.

By using stop-loss orders in conjunction with the spread, traders can effectively manage risk and minimize losses. Remember, understanding what does spread mean in Forex is crucial to making informed trading decisions. By considering the spread when setting stop-loss orders, traders can improve their overall trading performance and achieve long-term success in Forex trading.

Conclusion: Mastering the Spread for Forex Trading Success

In conclusion, understanding the spread is crucial to achieving success in Forex trading. By grasping the concept of spread, traders can make informed trading decisions, adjust their strategies to accommodate the spread, and manage risk effectively. Remember, what does spread mean in Forex? It’s the difference between the bid and ask prices of a currency pair, and it plays a significant role in Forex trading.

Throughout this article, we’ve explored the significance of spread in Forex trading, including how to calculate it, its impact on trading strategies, and the different types of spreads. We’ve also discussed how to choose a Forex broker with competitive spreads, the relationship between spread and market volatility, and how to manage risk with stop-loss orders and spread.

By applying the knowledge gained from this article, traders can improve their trading performance and achieve long-term success in Forex trading. It’s essential to stay informed about the spread and its implications, as it can make all the difference between profit and loss. Whether you’re a seasoned trader or just starting out, mastering the spread is key to unlocking the secrets of Forex trading.

So, what does spread mean in Forex? It’s a critical aspect of Forex trading that requires attention and understanding. By incorporating the concepts discussed in this article into your trading strategy, you’ll be well on your way to achieving success in the world of Forex trading.