Navigating the Complex World of Libor Swap Rates

In the financial markets, Libor swap rates play a vital role in determining interest rates on various financial instruments. A thorough understanding of these rates is essential for investors and businesses alike, as it enables them to make informed decisions about their investments and manage risk effectively. The 5 yr libor swap rate, in particular, is a widely used benchmark that provides valuable insights into the state of the economy and the direction of interest rates. By grasping the significance of Libor swap rates, market participants can better navigate the complex world of finance and achieve long-term success.

What is a 5-Year Libor Swap Rate and How Does it Work?

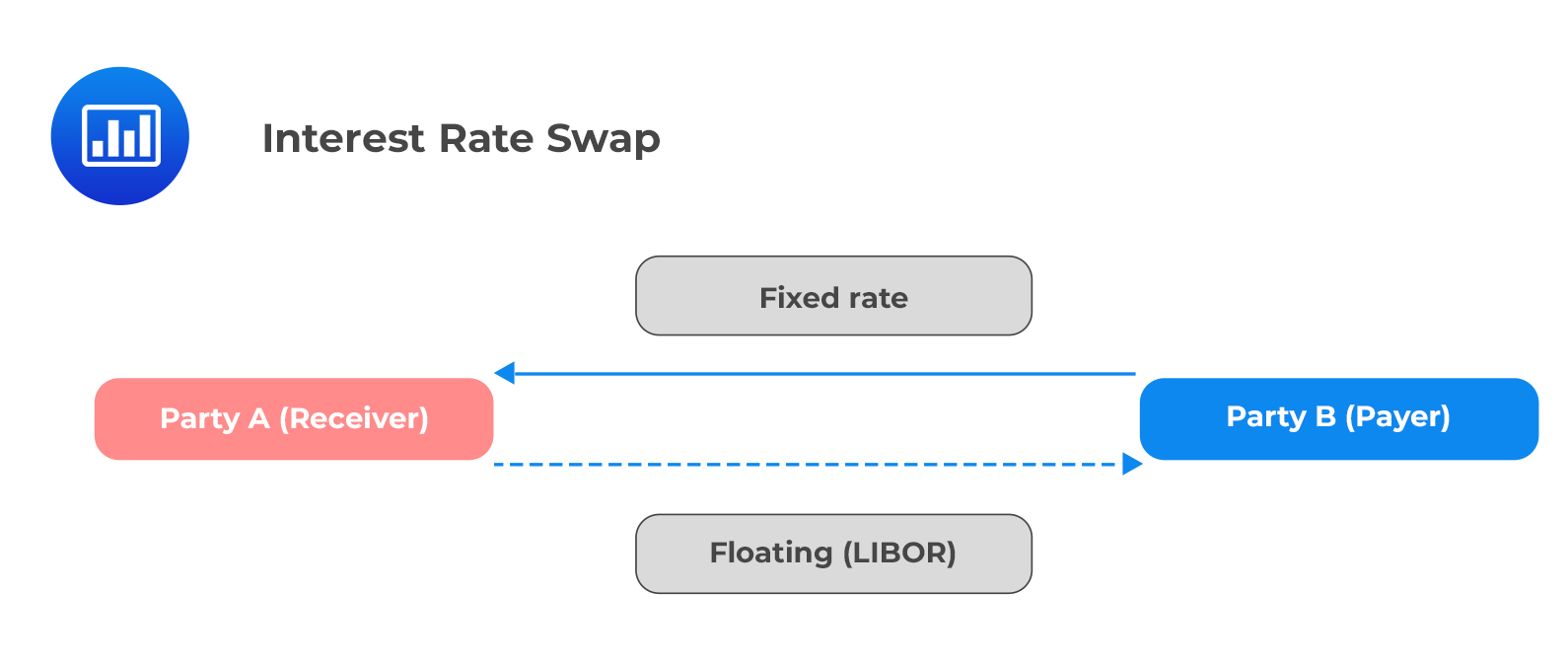

A 5-year Libor swap rate is a type of financial instrument that allows parties to exchange fixed and floating interest payments based on the London Interbank Offered Rate (Libor). This rate is calculated by averaging the interest rates at which major banks are willing to lend to each other. In a 5-year Libor swap, one party agrees to pay a fixed interest rate, while the other party pays a floating interest rate based on the 5-year Libor rate. This instrument is commonly used by corporations and financial institutions to manage interest rate risk and hedge against potential losses. The benefits of using 5-year Libor swap rates include increased flexibility, improved risk management, and enhanced returns on investments. By understanding how 5-year Libor swap rates work, investors and businesses can make more informed decisions about their investments and optimize their financial strategies.

How to Make Sense of Libor Swap Rate Quotes

When navigating the complex world of Libor swap rates, it’s essential to understand how to interpret Libor swap rate quotes. A Libor swap rate quote typically consists of two components: the bid rate and the ask rate. The bid rate represents the rate at which a party is willing to pay for a Libor swap, while the ask rate represents the rate at which a party is willing to receive for a Libor swap. The difference between the bid and ask rates is known as the bid-ask spread, which represents the profit margin of the market maker. To make informed investment decisions, it’s crucial to understand the bid-ask spread and how it affects the overall cost of a 5 yr libor swap rate. By analyzing Libor swap rate quotes and considering the bid-ask spread, investors and businesses can make more informed decisions about their investments and optimize their financial strategies. Additionally, understanding Libor swap rate quotes can help investors identify potential arbitrage opportunities and capitalize on market inefficiencies.

The Impact of Economic Indicators on 5-Year Libor Swap Rates

The 5 yr libor swap rate is influenced by a range of economic indicators, which can have a significant impact on interest rates. One of the key indicators is GDP growth, which can affect the overall demand for credit and, in turn, influence interest rates. When GDP growth is strong, it can lead to increased borrowing and spending, which can drive up interest rates. On the other hand, slow GDP growth can lead to lower interest rates. Another important indicator is inflation, which can erode the purchasing power of money and reduce the value of fixed-income investments. As a result, central banks may increase interest rates to combat inflation, which can affect the 5 yr libor swap rate. Monetary policy, set by central banks, also plays a crucial role in shaping interest rates. Changes in monetary policy, such as adjustments to interest rates or quantitative easing, can influence the 5 yr libor swap rate and have a ripple effect on the entire economy. By understanding the impact of these economic indicators on 5 yr libor swap rates, investors and businesses can make more informed decisions about their investments and optimize their financial strategies.

Using 5-Year Libor Swap Rates for Risk Management

Risk management is a crucial aspect of investing and managing financial portfolios. One effective way to manage risk is by using 5-year Libor swap rates to hedge against interest rate risk. By entering into a 5-year Libor swap, investors and businesses can lock in a fixed interest rate, protecting themselves from potential fluctuations in interest rates. This can be particularly useful for companies with floating-rate debt, as it allows them to convert their floating-rate debt into a fixed-rate debt, reducing their exposure to interest rate risk. Additionally, 5-year Libor swap rates can be used to manage exposure to market fluctuations. For example, investors can use 5-year Libor swap rates to hedge against potential losses in their investment portfolios, providing a level of certainty and stability in uncertain market conditions. By incorporating 5-year Libor swap rates into their risk management strategies, investors and businesses can better navigate the complexities of the financial markets and achieve their long-term financial goals.

Comparing 5-Year Libor Swap Rates to Other Benchmark Rates

When evaluating 5-year Libor swap rates, it’s essential to consider their relationship to other benchmark rates. One of the most commonly compared rates is the 10-year Treasury yield. While both rates reflect the market’s expectations of future interest rates, they differ in their underlying characteristics. The 10-year Treasury yield is a government-backed bond, whereas the 5-year Libor swap rate is a derivative instrument based on the London Interbank Offered Rate (Libor). This distinction can lead to differences in their behavior and responsiveness to market changes. For instance, the 10-year Treasury yield tends to be more sensitive to changes in monetary policy, whereas the 5-year Libor swap rate is more influenced by credit market conditions. Understanding these differences is crucial for investors and businesses, as it can inform their investment decisions and risk management strategies. By comparing 5-year Libor swap rates to other benchmark rates, market participants can gain a more comprehensive understanding of the interest rate landscape and make more informed decisions.

The Future of Libor Swap Rates: Trends and Predictions

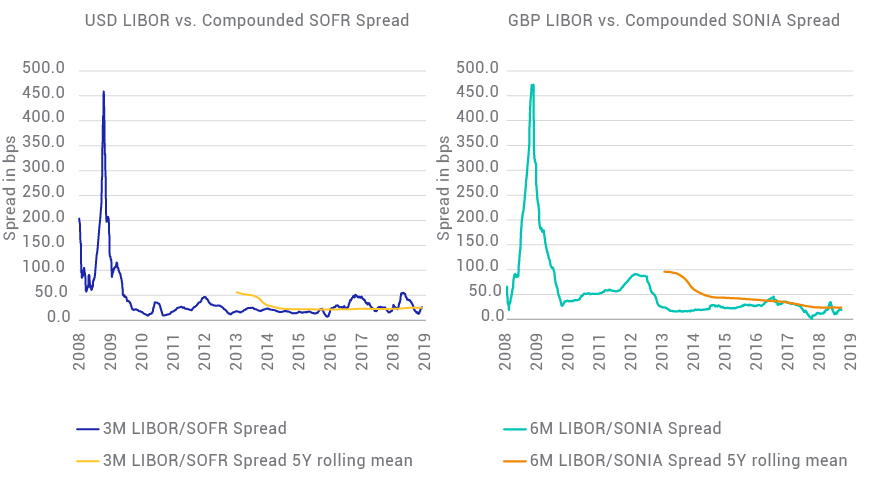

The 5-year Libor swap rate is expected to continue playing a vital role in the financial markets, with several trends and predictions shaping its future. One key development is the transition from Libor to alternative reference rates, such as the Secured Overnight Financing Rate (SOFR) in the United States. This shift is expected to have a significant impact on the 5-year Libor swap rate, potentially leading to changes in its calculation and usage. Additionally, the ongoing COVID-19 pandemic has highlighted the importance of 5-year Libor swap rates in managing interest rate risk and navigating market volatility. As the global economy continues to evolve, the 5-year Libor swap rate is likely to remain a crucial tool for investors and businesses seeking to mitigate risk and achieve long-term financial success. Furthermore, the increasing adoption of derivatives and hedging strategies is expected to drive demand for 5-year Libor swap rates, leading to further growth and development in this area. By understanding these trends and predictions, market participants can better position themselves for success in an ever-changing financial landscape.

Conclusion: Mastering the 5-Year Libor Swap Rate for Long-Term Success

In conclusion, understanding the 5-year Libor swap rate is crucial for investors and businesses seeking to navigate the complex world of long-term interest rates. By grasping the mechanics of this financial instrument, market participants can make informed investment decisions, manage risk, and achieve long-term financial success. The 5-year Libor swap rate plays a vital role in the financial markets, and its significance is expected to endure despite the ongoing transition to alternative reference rates. As the global economy continues to evolve, it is essential to stay informed about the trends and predictions shaping the future of 5-year Libor swap rates. By doing so, investors and businesses can position themselves for success in an ever-changing financial landscape. Remember, mastering the 5-year Libor swap rate is key to unlocking the secrets of long-term interest rates and achieving long-term financial success.

:max_bytes(150000):strip_icc()/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)