What Drives the 5-Year Treasury Swap Rate?

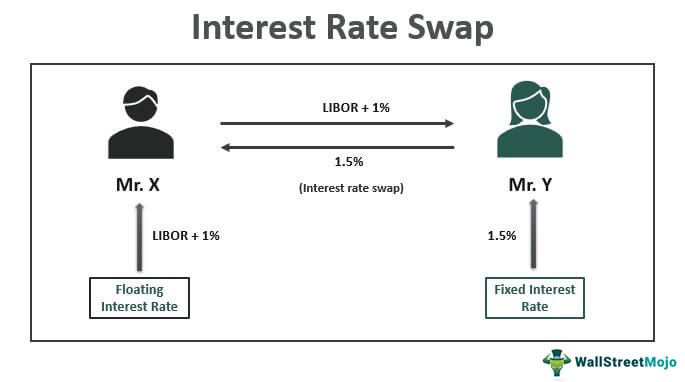

In the realm of finance, mid-term interest rates play a vital role in shaping the economy and influencing investment decisions. Among these rates, the 5-year treasury swap rate stands out as a crucial benchmark, reflecting the market’s expectations of future interest rates. This rate represents the fixed leg of a 5-year interest rate swap, where two parties agree to exchange fixed and floating interest payments based on a notional amount. The 5-year treasury swap rate is sensitive to a range of factors, including economic indicators, monetary policy, and market sentiment. Economic indicators such as GDP growth, inflation, and unemployment rates can impact the 5-year treasury swap rate, as they affect the overall health of the economy. Monetary policy decisions made by central banks, such as setting interest rates and buying or selling government securities, also influence the 5-year treasury swap rate. Furthermore, market sentiment, which reflects the overall attitude of investors towards the economy, can drive the 5-year treasury swap rate up or down. Understanding the factors that drive the 5-year treasury swap rate is essential for investors, policymakers, and businesses to make informed decisions about investments, funding, and risk management.

Understanding the Treasury Yield Curve

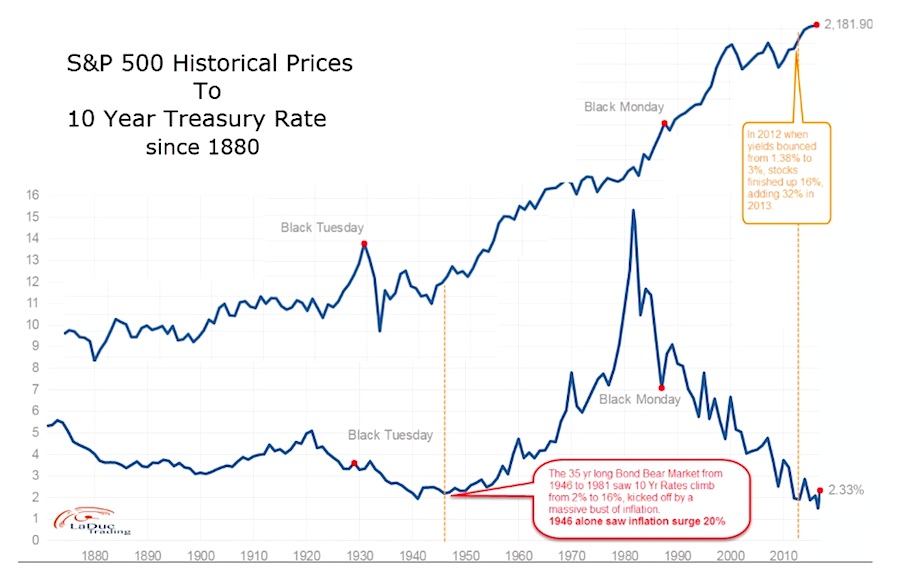

The treasury yield curve is a graphical representation of the relationship between the yield of treasury securities and their respective maturities. It is a crucial tool for investors, policymakers, and economists to gauge the market’s expectations of future interest rates. The treasury yield curve is composed of several components, including short-term, mid-term, and long-term interest rates. The 5-year treasury swap rate, in particular, is a key component of the mid-term interest rate segment. The shape of the treasury yield curve can have significant implications for the economy and interest rates. A steepening yield curve, where long-term rates rise faster than short-term rates, may indicate expectations of higher inflation or economic growth. Conversely, a flattening yield curve, where long-term rates decline relative to short-term rates, may signal concerns about economic slowdown or recession. Understanding the treasury yield curve and its relationship with the 5-year treasury swap rate is essential for making informed investment decisions and assessing the overall health of the economy.

How to Analyze the 5-Year Treasury Swap Rate for Investment Decisions

When it comes to making informed investment decisions, understanding the 5-year treasury swap rate is crucial. This rate has a significant impact on various financial instruments, including bonds, stocks, and currencies. To effectively analyze the 5-year treasury swap rate, investors should consider its influence on bond yields, stock prices, and currency exchange rates. For instance, a rise in the 5-year treasury swap rate can lead to an increase in bond yields, making existing bonds with lower yields less attractive to investors. This, in turn, can cause bond prices to fall. Similarly, a higher 5-year treasury swap rate can impact stock prices, as it may increase borrowing costs for companies and reduce consumer spending. Furthermore, the 5-year treasury swap rate can influence currency exchange rates, as it affects the attractiveness of investments in different currencies. By understanding the 5-year treasury swap rate’s impact on these financial instruments, investors can make more informed decisions about their investments and manage risk more effectively.

The Role of Central Banks in Shaping Mid-Term Interest Rates

Central banks play a crucial role in influencing the 5-year treasury swap rate through their monetary policy decisions. One of the primary tools used by central banks is setting interest rates, which can directly impact the 5-year treasury swap rate. When central banks raise interest rates, it can lead to an increase in the 5-year treasury swap rate, making borrowing more expensive and reducing consumer spending. Conversely, lowering interest rates can decrease the 5-year treasury swap rate, stimulating economic growth. Additionally, central banks can influence the 5-year treasury swap rate by buying or selling government securities. For instance, when central banks buy government securities, it can increase demand and drive down yields, leading to a decrease in the 5-year treasury swap rate. Forward guidance, which involves communicating future monetary policy intentions, is another tool used by central banks to shape the 5-year treasury swap rate. By understanding the role of central banks in influencing the 5-year treasury swap rate, investors can better anticipate changes in mid-term interest rates and make informed investment decisions.

Market Expectations and the 5-Year Treasury Swap Rate

Market expectations play a significant role in shaping the 5-year treasury swap rate. Investors’ forecasts of future economic growth, inflation, and monetary policy decisions can influence the 5-year treasury swap rate, making it a critical factor in investment decisions. For instance, if market participants expect higher inflation in the future, they may demand higher yields on long-term bonds, leading to an increase in the 5-year treasury swap rate. Conversely, expectations of slower economic growth may lead to lower yields and a decrease in the 5-year treasury swap rate. Central banks also closely monitor market expectations, as they can influence the effectiveness of monetary policy decisions. By understanding how market expectations impact the 5-year treasury swap rate, investors can better anticipate changes in mid-term interest rates and make informed investment decisions. Furthermore, policymakers can use market expectations to gauge the effectiveness of their policies and make adjustments accordingly. The interplay between market expectations and the 5-year treasury swap rate is complex, and a deep understanding of this relationship is essential for navigating the complexities of mid-term interest rates.

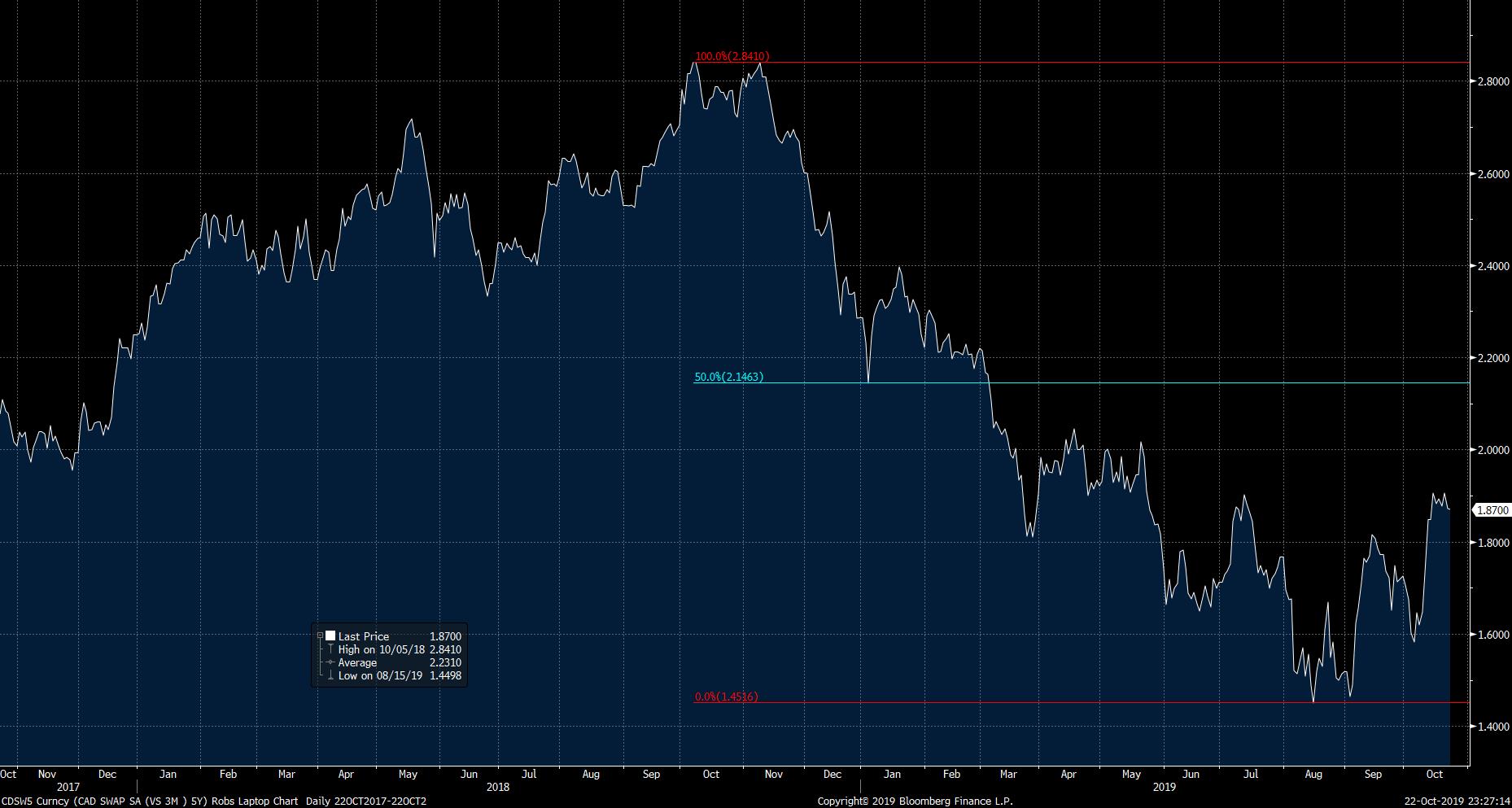

Historical Trends and Patterns in the 5-Year Treasury Swap Rate

Examining historical trends and patterns in the 5-year treasury swap rate can provide valuable insights for investors and policymakers. By analyzing the 5-year treasury swap rate’s response to various economic conditions, such as economic downturns, recessions, and periods of economic growth, investors can better understand its behavior and make informed investment decisions. For instance, during the 2008 financial crisis, the 5-year treasury swap rate plummeted as investors sought safe-haven assets, while during the subsequent economic recovery, the rate gradually increased as market confidence improved. Similarly, during periods of high inflation, the 5-year treasury swap rate tends to rise as investors demand higher yields to compensate for the erosion of purchasing power. By recognizing these patterns, investors can anticipate potential changes in the 5-year treasury swap rate and adjust their investment strategies accordingly. Furthermore, policymakers can use historical trends to inform their monetary policy decisions, ensuring that their actions are effective in achieving their economic objectives. A deep understanding of the 5-year treasury swap rate’s historical behavior is essential for navigating the complexities of mid-term interest rates and making informed investment decisions.

The Impact of Geopolitical Events on Mid-Term Interest Rates

Geopolitical events, such as trade wars, elections, and natural disasters, can have a significant impact on the 5-year treasury swap rate. These events can influence market sentiment, leading to changes in the 5-year treasury swap rate. For instance, a trade war between major economies can lead to increased uncertainty, causing investors to seek safe-haven assets and driving up the 5-year treasury swap rate. Similarly, a natural disaster can disrupt economic activity, leading to a decrease in the 5-year treasury swap rate as investors anticipate a slowdown in economic growth. Elections can also impact the 5-year treasury swap rate, as changes in government policies can influence market expectations and monetary policy decisions. The 5-year treasury swap rate’s response to geopolitical events can have significant implications for global financial markets, making it essential for investors and policymakers to closely monitor these events and their impact on mid-term interest rates. By understanding the relationship between geopolitical events and the 5-year treasury swap rate, investors can make informed investment decisions and policymakers can develop effective monetary policy strategies to mitigate the impact of these events.

Conclusion: Navigating the Complexities of the 5-Year Treasury Swap Rate

In conclusion, the 5-year treasury swap rate is a critical component of the financial market, influenced by a complex array of factors, including economic indicators, monetary policy, market sentiment, and geopolitical events. Understanding the 5-year treasury swap rate’s behavior and its implications for investment decisions and risk management is crucial for investors and policymakers. By recognizing the significance of the 5-year treasury swap rate, investors can make informed decisions about bond yields, stock prices, and currency exchange rates, while policymakers can develop effective monetary policy strategies to promote economic growth and stability. As the 5-year treasury swap rate continues to play a vital role in shaping mid-term interest rates, it is essential to stay informed about its movements and trends, ensuring that investors and policymakers are well-equipped to navigate the complexities of the financial market.