Navigating the Landscape of Medium-Term Treasury Yields

Treasury notes are debt securities issued by the U.S. Department of the Treasury. These notes represent a promise to pay the holder a specified sum of money on a specific date, along with periodic interest payments. The government issues them to finance its operations and manage the national debt. Among the various maturities available, the instrument that matures in five years is a closely watched benchmark in the financial world. It serves as a key indicator of market sentiment and future economic expectations. Investors often use the current 5 year treasury note rate today to gauge the overall health of the economy.

The popularity of the 5-year note stems from its intermediate-term maturity. This maturity strikes a balance between short-term volatility and long-term investment horizons. It reflects investor expectations for economic growth and inflation over a moderate timeframe. It also provides a valuable reference point for pricing other debt instruments, such as corporate bonds and mortgages. As such, fluctuations in the 5 year treasury note rate today can have wide-ranging implications for financial markets and the broader economy. Analyzing the 5 year treasury note rate today provides insights into the present and future economic outlook.

Understanding the dynamics of the 5 year treasury note rate today is crucial for investors, economists, and policymakers alike. Daily movements reflect a complex interplay of factors. These factors include inflation expectations, monetary policy decisions, and global economic events. Keeping abreast of these movements and understanding their underlying drivers can help investors make informed decisions. Monitoring the current 5 year treasury note rate today allows individuals to adapt their investment strategies accordingly. This vigilance contributes to better financial outcomes.

Deciphering Factors Influencing Five-Year Treasury Note Rates

The 5 year treasury note rate today is influenced by a complex interplay of economic forces. Inflation expectations play a pivotal role. When investors anticipate higher inflation, they demand a higher yield to compensate for the erosion of purchasing power. This increased demand pushes the 5 year treasury note rate today upward. Conversely, lower inflation expectations can lead to decreased yields.

Federal Reserve monetary policy is another critical driver. The Fed’s actions, such as adjusting the federal funds rate or implementing quantitative easing, directly impact the 5 year treasury note rate today. Higher interest rates tend to increase treasury yields, while lower rates often decrease them. Economic growth forecasts also weigh heavily. A strong economy typically leads to higher yields, as investors shift funds toward riskier assets with potentially higher returns. Weaker economic prospects may drive investors toward the safety of Treasury notes, increasing demand and lowering the 5 year treasury note rate today. Global economic conditions further contribute to the overall picture. Economic instability or uncertainty in other countries can increase demand for U.S. Treasury notes as a safe haven investment, thereby affecting the 5 year treasury note rate today.

Investor sentiment acts as the final determinant. It reflects the aggregated outlook of all participants in the market. This encompasses their collective perceptions of risk, return, and the overall state of the economy. Strong investor confidence in the economy reduces the appeal of the 5 year treasury note rate today, causing a selloff that pushes yields up. Uncertainty in economic forecasts can make treasury notes a safe and popular option, therefore increasing demand and decreasing the 5 year treasury note rate today. Understanding the relationship between these factors provides investors with critical insight. It allows investors to interpret and foresee changes in the 5 year treasury note rate today.

How to Track and Interpret Daily Changes in Treasury Note Performance

Staying informed about the daily movements of the 5 year treasury note rate today requires access to reliable sources and a clear understanding of how to interpret the data. The U.S. Department of the Treasury is a primary source for official yield information. Financial news websites, such as Bloomberg, Reuters, and the Wall Street Journal, also provide updated information on government bond yields. Brokerage platforms often offer real-time data and analysis tools for tracking the 5 year treasury note rate today and other fixed-income securities.

When reviewing yield changes, it’s crucial to understand the concept of a “basis point.” A basis point equals 0.01% (one-hundredth of a percent). Therefore, a yield increase of 5 basis points represents a 0.05% rise in the 5 year treasury note rate today. Yield changes are typically expressed in basis points to provide a more precise representation of the movements. For instance, if the 5 year treasury note rate today increases from 4.50% to 4.55%, it would be reported as a 5 basis point increase. Analyzing the magnitude of the change in the 5 year treasury note rate today is vital to assessing its potential impact.

While tracking daily changes in the 5 year treasury note rate today, it’s equally important to understand the context surrounding those movements. Avoid making immediate decisions based solely on minor fluctuations. Consider the broader economic environment, recent news events, and any announcements from the Federal Reserve. For example, a small increase in the 5 year treasury note rate today might be a normal market correction after a period of decline. However, a significant and sustained increase could signal rising inflation expectations or a shift in monetary policy. It’s essential to synthesize information from multiple sources and develop a well-informed perspective before drawing conclusions about the 5 year treasury note rate today and its implications for your investment strategy.

Examining the Role of Five-Year Treasury Notes in Portfolio Diversification

5 year treasury note rate today, play a crucial role in building a well-diversified investment portfolio. Understanding their risk-return profile is key to leveraging their benefits alongside other asset classes like stocks and corporate bonds. Stocks typically offer higher potential returns but come with greater volatility, while corporate bonds offer a middle ground, with varying degrees of risk depending on the issuer’s creditworthiness. The 5 year treasury note rate today can act as a stabilizing force, particularly during times of economic uncertainty or market downturns.

Treasury notes, including those with a 5-year maturity, are generally considered a safe haven asset. This is because they are backed by the full faith and credit of the U.S. government, implying a very low risk of default. During periods of market volatility, investors often flock to these safe assets, increasing demand and potentially driving prices up and yields down. Including 5 year treasury note rate today, in a portfolio can help to dampen overall volatility, providing a cushion against losses in other riskier asset classes. The extent to which they dampen portfolio volatility depends on the allocation percentage and the correlation with other assets.

The inverse relationship between bond prices and yields is essential to grasp. When demand for 5 year treasury note rate today, increases, their prices rise, and their yields fall. This can offset losses in other parts of a portfolio that may be declining due to the same economic factors driving the demand for safety. Ultimately, the decision to include 5 year treasury note rate today, in a portfolio depends on an investor’s individual risk tolerance, investment goals, and time horizon. It’s advisable to consult with a financial advisor to determine the appropriate allocation strategy based on personalized circumstances. Understanding 5 year treasury note rate today, and their characteristics is very important for every investor.

Comparing Five-Year Treasury Yields to Other Fixed-Income Investments

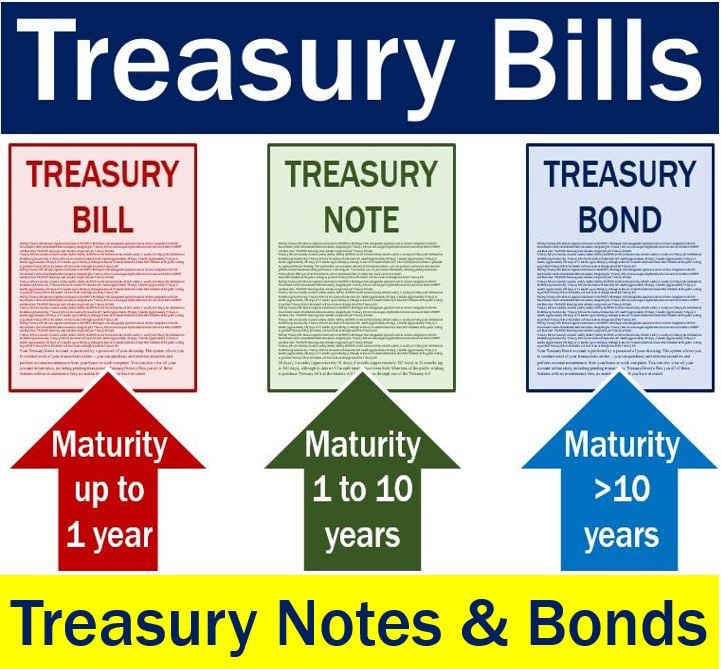

Understanding the 5 year treasury note rate today requires comparing it to other fixed-income options. Shorter-term Treasury bills offer lower yields but less interest rate risk. Investors seeking higher returns might consider longer-term Treasury bonds (10-year or 30-year). However, these are more sensitive to interest rate fluctuations. The 5 year treasury note rate today represents a middle ground. It balances yield with moderate risk.

Corporate bonds, while potentially offering higher yields than a 5 year treasury note rate today, carry significantly more credit risk. The issuer’s financial health directly impacts the bond’s value and the likelihood of receiving timely interest payments. Diversification across different bond types is often recommended. It helps manage risk effectively. The 5 year treasury note rate today, therefore, serves as a benchmark for comparison, offering a risk-free rate of return against which other investments can be assessed. Investors should carefully evaluate their risk tolerance and investment goals before making decisions. Understanding the nuances of each instrument is critical.

Investors interested in the 5 year treasury note rate today should consider the maturity differences between various bond types. A shorter maturity, like that of a Treasury bill, means less time until principal repayment. Conversely, longer-term bonds provide greater potential for capital appreciation, but expose the investor to increased interest rate risk. The 5 year treasury note rate today occupies a middle ground. It offers a balance between yield, maturity, and risk. This makes it an attractive choice for many investors. The yield on a 5 year treasury note rate today is impacted by many factors. This includes supply and demand, economic conditions, and investor sentiment. Careful consideration of these variables is essential for informed decision-making.

Analyzing Historical Trends in Intermediate-Term Treasury Note Values

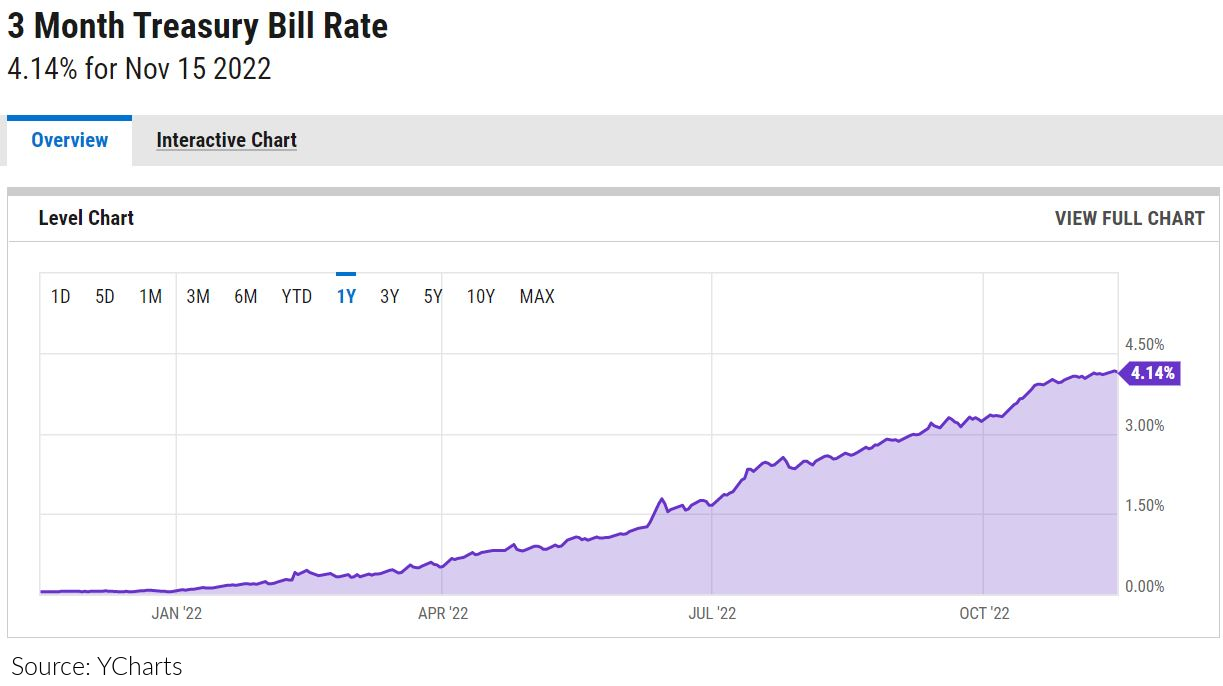

Understanding the historical performance of the 5 year treasury note rate today requires examining data from previous years. Over the past decade, the 5-year Treasury note yield has exhibited significant volatility, mirroring broader economic shifts. Periods of economic expansion often coincided with rising yields, reflecting increased investor confidence and expectations of higher inflation. Conversely, during economic downturns or periods of heightened uncertainty, such as the initial phases of the COVID-19 pandemic, the 5 year treasury note rate today fell sharply, as investors sought the safety of government debt. Analyzing this historical data provides valuable context for interpreting the current 5 year treasury note rate today and anticipating future trends. This historical perspective is crucial for understanding the current market environment. Examining periods of both high and low yields, and the corresponding economic conditions, helps investors understand the complex interplay of factors influencing the 5 year treasury note rate today.

The 5 year treasury note rate today is influenced by several key economic indicators. Changes in inflation expectations, for instance, directly impact yields. Higher inflation projections typically lead to increased yields as investors demand higher returns to compensate for the erosion of purchasing power. Similarly, Federal Reserve monetary policy plays a crucial role. Interest rate hikes by the Fed generally push yields higher, while easing policies can lower yields. Growth in the overall economy also influences the 5 year treasury note rate today. Strong economic growth often results in higher yields, reflecting increased investor confidence and higher borrowing costs. Analyzing these relationships historically allows for better forecasting of the 5 year treasury note rate today. By studying past correlations between economic data and yield movements, investors gain a more nuanced understanding of the factors currently shaping the 5 year treasury note rate today.

Geopolitical events have also significantly impacted the 5 year treasury note rate today throughout history. Periods of global uncertainty, such as the 2008 financial crisis or the ongoing Russia-Ukraine conflict, have driven investors toward the perceived safety of U.S. Treasury securities. This increased demand typically leads to lower yields. The 5 year treasury note rate today, therefore, serves as a barometer of global risk sentiment. Studying these historical instances helps investors to anticipate how future geopolitical events might influence investor behavior and consequently the 5 year treasury note rate today. Understanding this historical relationship is vital for navigating the complexities of the current investment landscape. The 5 year treasury note rate today reflects a multitude of factors, and historical context provides the framework for appropriate interpretation.

Understanding the Relationship Between Economic Indicators and Government Bond Returns

Economic indicators significantly influence the 5 year treasury note rate today. Strong GDP growth, for instance, often signals a healthy economy. This typically leads to higher interest rates as investors anticipate future inflation and seek higher returns. Conversely, weak GDP growth might prompt the Federal Reserve to lower interest rates to stimulate the economy. This, in turn, can push the 5 year treasury note rate today lower. The unemployment rate also plays a crucial role. Low unemployment often indicates strong economic activity, potentially leading to increased inflation and higher yields on the 5 year treasury note rate today. High unemployment, however, suggests a weaker economy, potentially causing lower yields. Understanding these dynamics is key to interpreting the current market environment. Investors should always consider the interplay of various economic indicators when analyzing the 5 year treasury note rate today.

The Consumer Price Index (CPI), a key measure of inflation, directly impacts the 5 year treasury note rate today. Rising inflation erodes the purchasing power of future payments from bonds. To compensate for this risk, investors demand higher yields on the 5 year treasury note rate today. This is why central banks closely monitor inflation. When inflation is unexpectedly high, it usually leads to an increase in the 5 year treasury note rate today, as investors adjust their expectations and demand higher returns to protect against inflation. Conversely, low or declining inflation can lead to lower yields on the 5 year treasury note rate today. Tracking CPI data, therefore, provides valuable insights into the potential future direction of 5 year treasury note rates.

Analyzing the relationship between economic indicators and the 5 year treasury note rate today requires a holistic approach. Investors shouldn’t focus on just one indicator. Instead, they should consider the interplay of multiple factors. For example, even with strong GDP growth, rising unemployment might suggest underlying economic weakness. This complexity necessitates a careful evaluation of various indicators before drawing conclusions about the 5 year treasury note rate today. The 5 year treasury note rate today reflects a multitude of influences. Understanding this complex interplay of economic forces allows for a more accurate interpretation of yield movements and improves investment decision-making.

The Impact of Geopolitical Events on Intermediate-Term Bond Rate Movements

Geopolitical events significantly influence the 5 year treasury note rate today and broader financial markets. Major international incidents, such as trade wars or political instability in key regions, create uncertainty. This uncertainty often drives investors towards safe-haven assets. U.S. Treasury notes, including the 5-year variety, are perceived as relatively safe. Increased demand for these notes pushes their prices higher. Consequently, yields, which move inversely to prices, tend to fall. The 5 year treasury note rate today reflects this dynamic. For example, during periods of heightened global tension, investors might reduce their exposure to riskier assets. They might shift funds into U.S. Treasuries, seeking stability and preservation of capital. This increased demand for safety lowers the 5 year treasury note rate today.

Specific geopolitical events can have varying impacts on the 5 year treasury note rate today. For instance, a sudden escalation of a conflict might trigger a sharp drop in yields as investors flock to the perceived safety of U.S. government debt. Conversely, positive developments, such as the resolution of a long-standing trade dispute, might lead to a rise in yields as investors become more willing to take on risk. The magnitude of the impact depends on several factors. These factors include the severity of the event, its perceived duration, and its potential economic consequences. Analyzing the historical relationship between specific geopolitical events and 5 year treasury note rate movements provides valuable insights. It helps investors better understand and anticipate market reactions in the future. The 5 year treasury note rate today reflects a complex interplay of these geopolitical factors.

Understanding how geopolitical events affect the 5 year treasury note rate today is crucial for investors. It allows for more informed decision-making. By monitoring global events and their potential impact on market sentiment, investors can better position their portfolios. They can adjust their allocations to potentially mitigate risks or capitalize on opportunities. This involves carefully considering the implications of various scenarios. It includes understanding the potential for yield fluctuations in response to shifting geopolitical landscapes. The 5 year treasury note rate today serves as a key indicator of this interplay between global events and investor behavior. Tracking this rate, in conjunction with geopolitical news, allows for a more comprehensive understanding of market dynamics.