What is a 5 Year Interest Rate Swap and How Does it Work?

A 5 year interest rate swap is a type of financial derivative that allows companies or individuals to manage their exposure to interest rate risks. It is a contractual agreement between two parties to exchange fixed and floating interest payments based on a notional amount. The purpose of a 5 year interest rate swap is to hedge against potential losses or gains resulting from changes in interest rates.

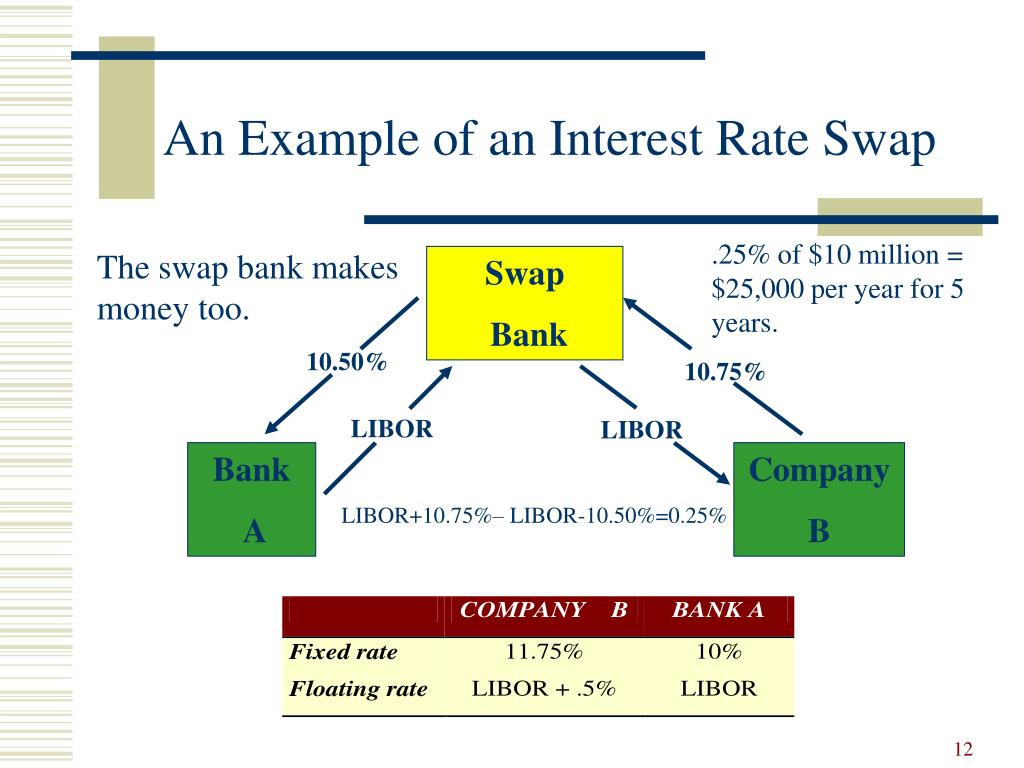

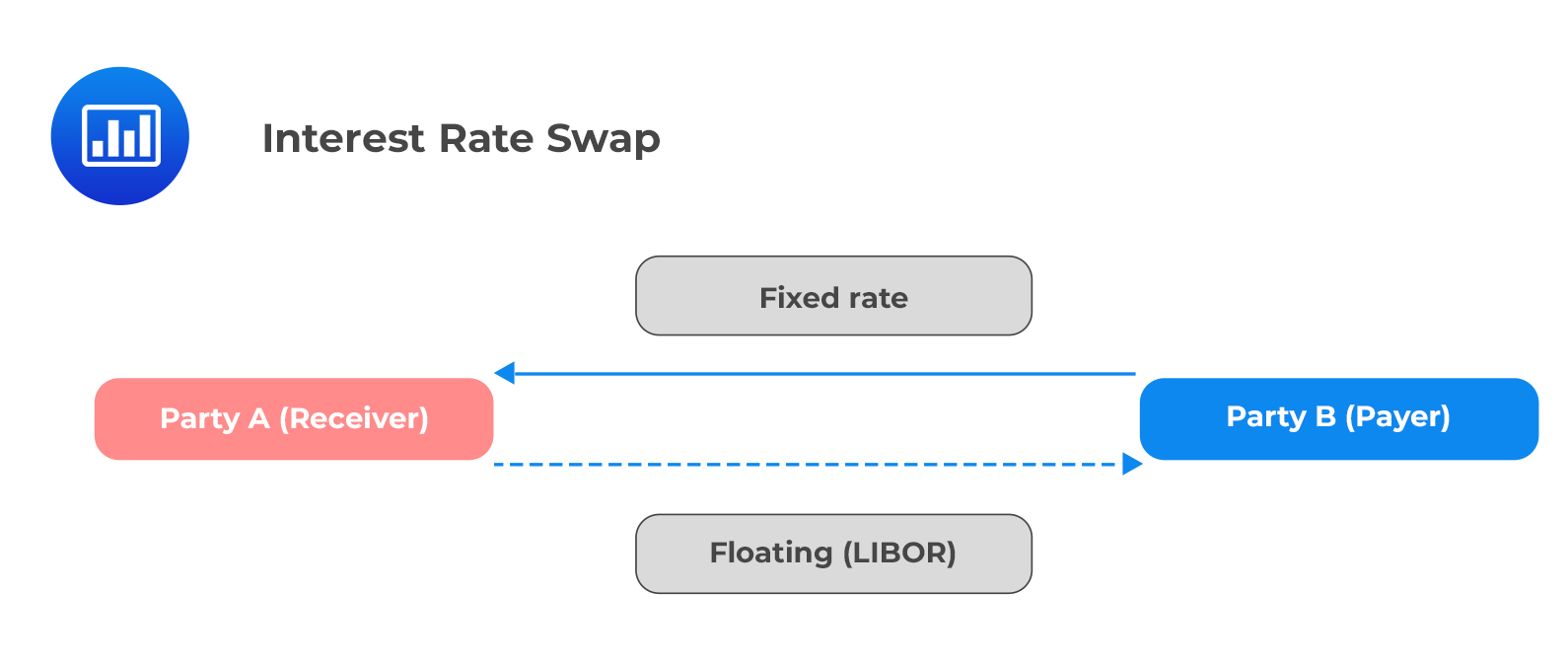

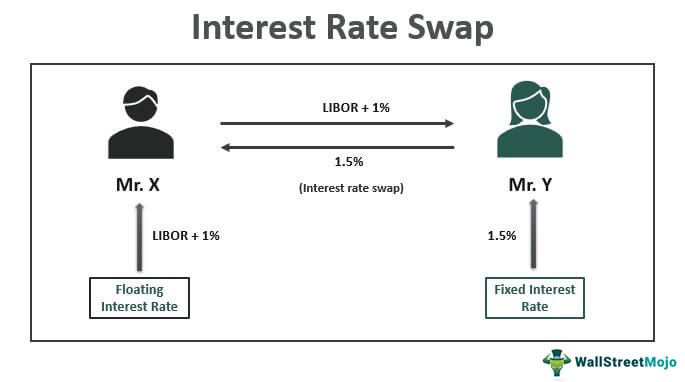

In a 5 year interest rate swap, one party agrees to pay a fixed interest rate, while the other party agrees to pay a floating interest rate, typically tied to a benchmark rate such as LIBOR. The fixed and floating legs of the swap are calculated based on the notional amount, which is the underlying value of the swap. The settlement dates are typically quarterly or semi-annually, and the swap can be customized to meet the specific needs of the parties involved.

A 5 year interest rate swap differs from other types of interest rate swaps in terms of its duration. While other swaps may have shorter or longer tenors, a 5 year interest rate swap provides a medium-term solution for managing interest rate risks. This makes it an attractive option for companies or individuals with medium-term investments or loans.

The basic mechanics of a 5 year interest rate swap involve the exchange of fixed and floating interest payments. For example, a company may enter into a 5 year interest rate swap to hedge against rising interest rates on a floating-rate loan. By paying a fixed interest rate and receiving a floating interest rate, the company can lock in a fixed cost of borrowing and reduce its exposure to interest rate risks.

The Benefits of Using a 5 Year Interest Rate Swap

Using a 5 year interest rate swap can provide numerous benefits for companies or individuals looking to manage their exposure to interest rate risks. One of the primary advantages of a 5 year interest rate swap is risk management. By locking in a fixed interest rate, companies can reduce their exposure to rising interest rates, which can help to stabilize their cash flows and reduce uncertainty.

In addition to risk management, a 5 year interest rate swap can also provide cost savings. By swapping a floating interest rate for a fixed interest rate, companies can reduce their borrowing costs and improve their bottom line. This can be particularly beneficial for companies with floating-rate loans or investments that are sensitive to changes in interest rates.

Another benefit of a 5 year interest rate swap is flexibility. Companies can customize the terms of the swap to meet their specific needs, including the notional amount, settlement dates, and fixed and floating interest rates. This flexibility allows companies to tailor the swap to their unique circumstances and risk management goals.

For example, a company with a floating-rate loan may use a 5 year interest rate swap to hedge against rising interest rates. By paying a fixed interest rate and receiving a floating interest rate, the company can lock in a fixed cost of borrowing and reduce its exposure to interest rate risks. Similarly, an investor with a fixed-rate investment may use a 5 year interest rate swap to hedge against falling interest rates, thereby protecting their returns.

Overall, a 5 year interest rate swap can be a valuable tool for companies or individuals looking to manage their exposure to interest rate risks. By providing risk management, cost savings, and flexibility, a 5 year interest rate swap can help companies to stabilize their cash flows, reduce uncertainty, and improve their bottom line.

How to Hedge Against Interest Rate Risks with a 5 Year Swap

A 5 year interest rate swap can be an effective tool for hedging against interest rate risks. By swapping a floating interest rate for a fixed interest rate, companies or individuals can reduce their exposure to rising or falling interest rates, which can impact their investments or loans.

For example, a company with a floating-rate loan may use a 5 year interest rate swap to hedge against rising interest rates. By paying a fixed interest rate and receiving a floating interest rate, the company can lock in a fixed cost of borrowing and reduce its exposure to interest rate risks. Similarly, an investor with a fixed-rate investment may use a 5 year interest rate swap to hedge against falling interest rates, thereby protecting their returns.

To calculate the hedge ratio, companies or individuals need to determine the notional amount of the swap, which is the underlying value of the swap. The hedge ratio is then calculated by dividing the notional amount by the value of the underlying investment or loan. For instance, if the notional amount of the swap is $1 million and the value of the underlying investment is $500,000, the hedge ratio would be 2:1.

In addition to calculating the hedge ratio, companies or individuals also need to determine the fixed and floating interest rates of the swap. The fixed interest rate is typically set at the time of the swap’s inception, while the floating interest rate is tied to a benchmark rate such as LIBOR. The settlement dates of the swap are also important, as they determine when the fixed and floating interest payments are exchanged.

By using a 5 year interest rate swap to hedge against interest rate risks, companies or individuals can reduce their exposure to market volatility and stabilize their cash flows. This can be particularly beneficial for companies with floating-rate loans or investments that are sensitive to changes in interest rates.

Overall, a 5 year interest rate swap can be a valuable tool for managing interest rate risks. By understanding how to calculate the hedge ratio and determine the notional amount, companies or individuals can effectively use a 5 year interest rate swap to reduce their exposure to interest rate risks and achieve their financial goals.

Understanding the Key Components of a 5 Year Interest Rate Swap

A 5 year interest rate swap is a complex financial instrument that consists of several key components. Understanding these components is crucial for companies or individuals looking to use a 5 year interest rate swap to manage their interest rate risks.

The first key component of a 5 year interest rate swap is the fixed rate. This is the rate at which one party agrees to pay a fixed interest rate to the other party over the life of the swap. The fixed rate is typically set at the time of the swap’s inception and remains constant throughout the 5-year term.

The second key component is the floating rate. This is the rate that is tied to a benchmark rate, such as LIBOR, and fluctuates over time. The floating rate is typically paid by the other party to the first party over the life of the swap.

The notional amount is another critical component of a 5 year interest rate swap. This is the underlying value of the swap, and it determines the amount of interest that is exchanged between the two parties. The notional amount can be a fixed amount or a variable amount that is tied to a specific index.

The settlement dates are also an important component of a 5 year interest rate swap. These are the dates on which the fixed and floating interest payments are exchanged between the two parties. Settlement dates can be quarterly, semi-annually, or annually, depending on the terms of the swap.

These components interact and affect the value of the swap in complex ways. For example, changes in the floating rate can impact the value of the swap, as can changes in the notional amount. Understanding how these components interact is crucial for companies or individuals looking to use a 5 year interest rate swap to manage their interest rate risks.

In addition to these key components, a 5 year interest rate swap may also include other features, such as a amortizing notional amount or a step-up or step-down provision. These features can affect the value of the swap and the interest payments that are exchanged between the two parties.

Overall, understanding the key components of a 5 year interest rate swap is essential for companies or individuals looking to use this financial instrument to manage their interest rate risks. By grasping the fixed rate, floating rate, notional amount, and settlement dates, companies or individuals can make informed decisions about how to use a 5 year interest rate swap to achieve their financial goals.

The Role of Counterparties and Credit Risk in 5 Year Interest Rate Swaps

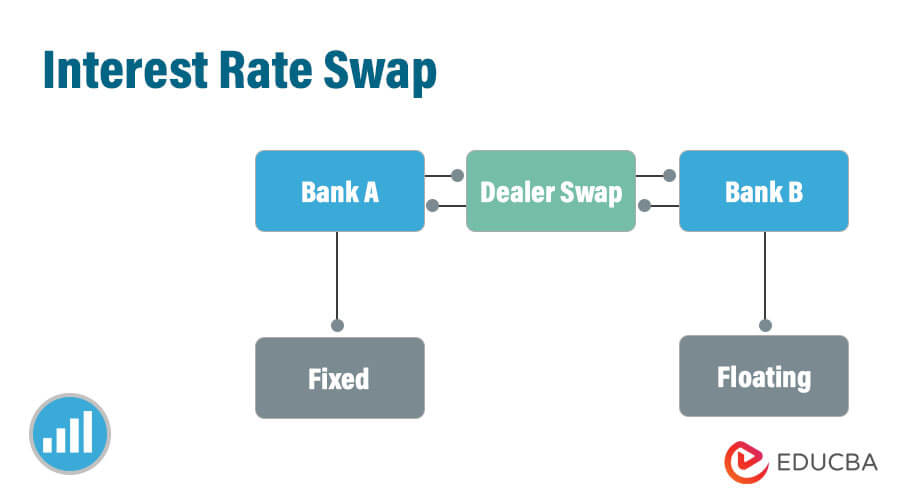

In a 5 year interest rate swap, counterparties play a crucial role in facilitating the transaction. A counterparty is an entity that agrees to exchange cash flows with another entity, based on the terms of the swap. In the context of a 5 year interest rate swap, counterparties are typically banks, financial institutions, or other corporations.

The role of counterparties in a 5 year interest rate swap is to provide liquidity and facilitate the exchange of cash flows. Counterparties act as intermediaries, enabling companies or individuals to hedge against interest rate risks or speculate on interest rate movements. By providing a platform for counterparties to trade, 5 year interest rate swaps can help to promote market efficiency and reduce transaction costs.

However, the involvement of counterparties also introduces credit risk into the equation. Credit risk refers to the possibility that one party may default on its obligations, causing the other party to incur losses. In a 5 year interest rate swap, credit risk can arise if one counterparty fails to make interest payments or defaults on its obligations.

The impact of credit risk on a 5 year interest rate swap can be significant. If one counterparty defaults, the other party may be left with a significant loss. To mitigate this risk, companies or individuals may choose to enter into a 5 year interest rate swap with a high-credit-quality counterparty, such as a major bank or financial institution.

In addition, companies or individuals may also use credit support annexes (CSAs) to mitigate credit risk. A CSA is a legal agreement that outlines the terms and conditions of the swap, including the credit requirements and collateral obligations of each party. By using a CSA, companies or individuals can reduce their exposure to credit risk and ensure that their interests are protected.

Overall, the role of counterparties and credit risk in 5 year interest rate swaps is critical. By understanding the importance of counterparties and the risks associated with credit risk, companies or individuals can make informed decisions about how to use 5 year interest rate swaps to achieve their financial goals.

In the context of a 5 year interest rate swap, it is essential to carefully evaluate the creditworthiness of counterparties and to implement robust risk management strategies to mitigate credit risk. By doing so, companies or individuals can maximize the benefits of using a 5 year interest rate swap while minimizing the risks associated with credit risk.

Valuing a 5 Year Interest Rate Swap: A Step-by-Step Guide

Valuing a 5 year interest rate swap is a complex process that requires a thorough understanding of financial concepts and mathematical formulas. In this section, we will provide a step-by-step guide on how to value a 5 year interest rate swap, including the use of present value calculations, discount rates, and yield curves.

Step 1: Determine the Fixed and Floating Legs

The first step in valuing a 5 year interest rate swap is to determine the fixed and floating legs of the swap. The fixed leg is the series of fixed interest payments made by one party to the other, while the floating leg is the series of floating interest payments made by the other party. The fixed leg is typically based on a fixed interest rate, such as 3%, while the floating leg is based on a floating interest rate, such as LIBOR.

Step 2: Calculate the Present Value of the Fixed Leg

The next step is to calculate the present value of the fixed leg using the following formula:

Present Value of Fixed Leg = Fixed Rate x Notional Amount x (1 – (1 + Discount Rate)^(-Number of Payments))

Where:

Fixed Rate is the fixed interest rate

Notional Amount is the notional amount of the swap

Discount Rate is the discount rate used to calculate the present value

Number of Payments is the number of payments made over the life of the swap

Step 3: Calculate the Present Value of the Floating Leg

The present value of the floating leg is calculated using the following formula:

Present Value of Floating Leg = Floating Rate x Notional Amount x (1 – (1 + Discount Rate)^(-Number of Payments))

Where:

Floating Rate is the floating interest rate

Notional Amount is the notional amount of the swap

Discount Rate is the discount rate used to calculate the present value

Number of Payments is the number of payments made over the life of the swap

Step 4: Calculate the Net Present Value of the Swap

The final step is to calculate the net present value of the swap by subtracting the present value of the floating leg from the present value of the fixed leg.

Net Present Value of Swap = Present Value of Fixed Leg – Present Value of Floating Leg

By following these steps, companies or individuals can accurately value a 5 year interest rate swap and make informed decisions about their financial investments.

In addition to these steps, it is also important to consider the yield curve and the credit risk associated with the swap. The yield curve can affect the present value of the swap, while credit risk can impact the likelihood of default by one of the parties.

By incorporating these factors into the valuation process, companies or individuals can gain a more comprehensive understanding of the 5 year interest rate swap and make more informed investment decisions.

Common Mistakes to Avoid When Using a 5 Year Interest Rate Swap

When using a 5 year interest rate swap, it is essential to avoid common mistakes that can lead to financial losses or ineffective risk management. In this section, we will identify common mistakes that companies or individuals make when using a 5 year interest rate swap and provide guidance on how to avoid them.

Inadequate Risk Assessment

One of the most common mistakes is inadequate risk assessment. Companies or individuals may fail to fully understand the risks associated with a 5 year interest rate swap, including interest rate risk, credit risk, and liquidity risk. To avoid this mistake, it is essential to conduct a thorough risk assessment and develop a comprehensive risk management strategy.

Poor Hedge Ratio Calculation

Another common mistake is poor hedge ratio calculation. The hedge ratio is critical in determining the notional amount of the swap, and a poor calculation can lead to ineffective hedging. To avoid this mistake, it is essential to use a robust hedge ratio calculation methodology and regularly review and adjust the hedge ratio as market conditions change.

Failure to Monitor Market Conditions

Companies or individuals may also fail to monitor market conditions, including changes in interest rates, credit spreads, and liquidity. This failure can lead to ineffective hedging and financial losses. To avoid this mistake, it is essential to regularly monitor market conditions and adjust the 5 year interest rate swap strategy accordingly.

Ignoring Counterparty Risk

Counterparty risk is another critical factor to consider when using a 5 year interest rate swap. Companies or individuals may ignore counterparty risk, which can lead to financial losses in the event of default by the counterparty. To avoid this mistake, it is essential to carefully evaluate the creditworthiness of the counterparty and develop a comprehensive counterparty risk management strategy.

Not Considering the Impact of Market Volatility

Market volatility can significantly impact the value of a 5 year interest rate swap. Companies or individuals may fail to consider the impact of market volatility, which can lead to financial losses. To avoid this mistake, it is essential to regularly review and adjust the 5 year interest rate swap strategy to reflect changes in market volatility.

By avoiding these common mistakes, companies or individuals can effectively use a 5 year interest rate swap to manage interest rate risk and achieve their financial objectives.

Best Practices for Implementing a 5 Year Interest Rate Swap Strategy

Implementing a 5 year interest rate swap strategy requires careful planning, execution, and ongoing monitoring. To ensure the success of a 5 year interest rate swap strategy, it is essential to follow best practices that mitigate risks and maximize benefits. In this section, we will discuss best practices for implementing a 5 year interest rate swap strategy.

Regular Portfolio Rebalancing

A 5 year interest rate swap strategy should be regularly rebalanced to ensure that it remains aligned with the company’s or individual’s financial objectives. This involves regularly reviewing the swap’s performance, adjusting the hedge ratio, and rebalancing the portfolio to maintain an optimal risk-return profile.

Stress Testing

Stress testing is a critical component of a 5 year interest rate swap strategy. It involves simulating different market scenarios to assess the swap’s performance under various conditions. Stress testing helps to identify potential risks and opportunities, enabling companies or individuals to adjust their strategy accordingly.

Ongoing Risk Monitoring

Ongoing risk monitoring is essential to ensure that the 5 year interest rate swap strategy remains effective. This involves regularly reviewing market conditions, monitoring interest rates, and assessing credit risk. By ongoing risk monitoring, companies or individuals can identify potential risks and opportunities, enabling them to adjust their strategy accordingly.

Clear Communication and Documentation

Clear communication and documentation are critical components of a 5 year interest rate swap strategy. This involves clearly documenting the swap’s terms, conditions, and risks, as well as communicating the strategy to all stakeholders. Clear communication and documentation help to ensure that all parties understand the swap’s risks and benefits, reducing the risk of misunderstandings and disputes.

Independent Valuation and Verification

Independent valuation and verification are essential to ensure that the 5 year interest rate swap is fairly valued and that the counterparty is creditworthy. This involves engaging independent experts to value the swap and verify the counterparty’s creditworthiness. Independent valuation and verification help to ensure that the swap is executed at a fair price and that the counterparty can meet its obligations.

By following these best practices, companies or individuals can implement a 5 year interest rate swap strategy that effectively manages interest rate risk, reduces costs, and enhances flexibility. A well-implemented 5 year interest rate swap strategy can provide significant benefits, enabling companies or individuals to achieve their financial objectives and succeed in a rapidly changing market environment.