Understanding the 4-Week Treasury Bill Rate

The 4-week treasury bill rate is a vital component of the financial market, playing a significant role in shaping short-term investment decisions. This rate, which is set by the US Department of the Treasury, represents the return on investment for a 4-week treasury bill. As a low-risk investment option, treasury bills are attractive to investors seeking to park their funds for a short period. The 4 week treasury bill rate today serves as a benchmark for other short-term investments, influencing the overall direction of the financial market. In essence, it provides a snapshot of the market’s expectations of future interest rates and economic conditions.

How to Make the Most of Short-Term Treasury Bills

Short-term treasury bills offer a unique combination of benefits that make them an attractive addition to a diversified investment portfolio. One of the primary advantages of investing in short-term treasury bills is their high liquidity, allowing investors to quickly access their funds when needed. Additionally, treasury bills are considered to be very low-risk investments, as they are backed by the full faith and credit of the US government. This low-risk profile makes them an ideal option for investors seeking to reduce their overall portfolio risk. Furthermore, short-term treasury bills often provide competitive returns, especially when compared to other low-risk investment options. By incorporating short-term treasury bills into a diversified investment portfolio, investors can effectively manage risk, increase liquidity, and optimize returns. As the 4 week treasury bill rate today continues to influence the short-term investment landscape, understanding the benefits of treasury bills is crucial for making informed investment decisions.

What Drives the 4-Week Treasury Bill Rate Today?

The 4-week treasury bill rate is influenced by a complex array of factors, including monetary policy, economic indicators, and market sentiment. Monetary policy, set by central banks, plays a significant role in shaping the 4-week treasury bill rate today. By adjusting interest rates and implementing quantitative easing, central banks can influence the overall direction of the economy and, in turn, impact the 4-week treasury bill rate. Economic indicators, such as GDP growth, inflation, and unemployment rates, also have a profound impact on the rate. As these indicators fluctuate, they can influence investor sentiment and, subsequently, the 4-week treasury bill rate. Market sentiment, which is shaped by a combination of economic indicators and geopolitical events, also plays a crucial role in determining the 4-week treasury bill rate. By understanding these factors and their interplay, investors can better navigate the complexities of the 4-week treasury bill rate today and make informed investment decisions.

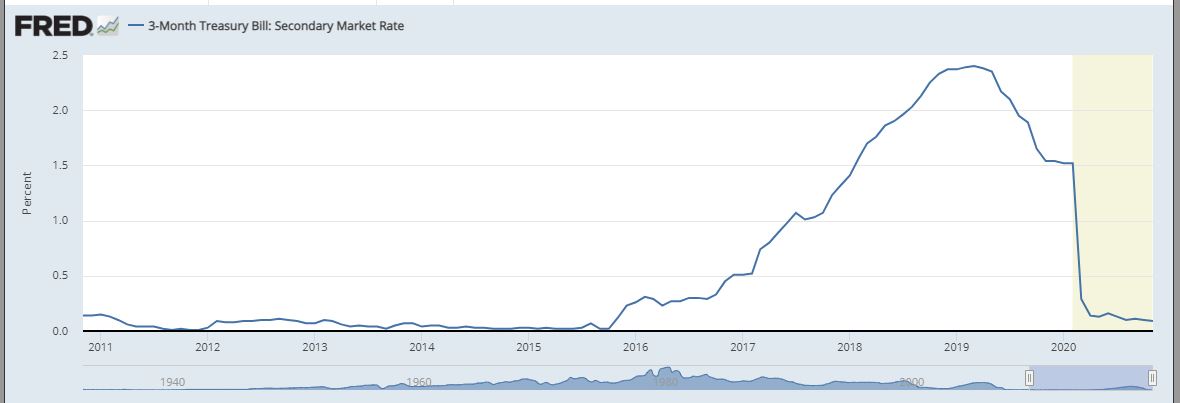

A Historical Perspective: 4-Week Treasury Bill Rate Trends

Examining the historical trends of the 4-week treasury bill rate provides valuable context for understanding the current rate and its implications for short-term investment decisions. Over the past few decades, the 4-week treasury bill rate has exhibited distinct patterns and fluctuations, often correlating with broader economic trends. During periods of economic expansion, the 4-week treasury bill rate tends to rise, reflecting increased demand for credit and higher inflation expectations. Conversely, during economic downturns, the rate tends to decline, as central banks implement accommodative monetary policies to stimulate growth. Notably, the 4-week treasury bill rate has also been influenced by significant events, such as the 2008 financial crisis, which led to a sharp decline in the rate as central banks implemented quantitative easing measures. By analyzing these historical trends, investors can gain a deeper understanding of the 4-week treasury bill rate today and its potential impact on their investment portfolios.

Comparing 4-Week Treasury Bill Rates to Other Short-Term Investments

When considering short-term investment options, it’s essential to evaluate the 4-week treasury bill rate in relation to other alternatives. Commercial paper, certificates of deposit (CDs), and money market funds are popular short-term investment options that offer distinct benefits and drawbacks. Commercial paper, issued by corporations to raise short-term capital, typically offers higher yields than 4-week treasury bills but carries a higher credit risk. CDs, offered by banks with fixed interest rates and maturity dates, provide a low-risk option with returns comparable to 4-week treasury bills. Money market funds, which invest in low-risk, short-term debt securities, offer liquidity and diversification but may come with management fees. In contrast, 4-week treasury bills offer a risk-free return, backed by the full faith and credit of the government. By understanding the pros and cons of each investment type, investors can make informed decisions about how to allocate their short-term investments, taking into account their risk tolerance, liquidity needs, and return expectations. In today’s market, the 4-week treasury bill rate today serves as a benchmark for short-term investments, providing a reference point for evaluating the attractiveness of alternative options.

Strategies for Investing in 4-Week Treasury Bills

Investing in 4-week treasury bills requires a thoughtful approach to maximize returns while managing risk. One effective strategy is to ladder investments, staggering the maturity dates of multiple bills to ensure a steady stream of returns. This approach helps to mitigate the impact of interest rate fluctuations and provides liquidity. Another strategy is to take advantage of the auction process, where investors can purchase bills at a discount to their face value. This approach can provide a higher return than buying bills at face value, but it requires a thorough understanding of the auction process and market conditions. Additionally, investors can consider rolling over their investments, reinvesting the proceeds of maturing bills into new issues. This approach can help to maintain a consistent return profile and minimize the impact of interest rate changes. By incorporating these strategies into a diversified investment portfolio, investors can optimize their returns and make the most of the 4-week treasury bill rate today. Furthermore, investors should stay informed about the latest 4-week treasury bill rate today and adjust their investment strategies accordingly, taking into account changes in market conditions and monetary policy.

The Role of the 4-Week Treasury Bill Rate in Monetary Policy

The 4-week treasury bill rate plays a crucial role in monetary policy, serving as a key indicator of the overall direction of interest rates and the health of the economy. Central banks, such as the Federal Reserve in the United States, use the 4-week treasury bill rate as a tool to influence the economy and stabilize financial markets. By adjusting the rate, central banks can affect the availability of credit, the level of inflation, and the overall pace of economic growth. For example, during times of economic downturn, central banks may lower the 4-week treasury bill rate to stimulate borrowing and spending. Conversely, during periods of high inflation, central banks may raise the rate to reduce borrowing and curb inflationary pressures. The 4-week treasury bill rate today is closely watched by investors and economists, as it provides insight into the central bank’s policy stance and the likely direction of interest rates. By understanding the role of the 4-week treasury bill rate in monetary policy, investors can make more informed decisions about their short-term investments and better navigate the complexities of the financial market.

Staying Ahead of the Curve: Tracking the 4-Week Treasury Bill Rate Today

To make informed investment decisions, it’s essential to stay up-to-date with the latest 4-week treasury bill rate today. Fortunately, there are several resources available to help investors track this important metric. The U.S. Department of the Treasury’s website provides daily updates on the 4-week treasury bill rate, as well as historical data and auction results. Financial news sources, such as Bloomberg and Reuters, also offer real-time data and analysis on the 4-week treasury bill rate. Additionally, market analysis tools, such as Treasury yield curve charts and economic calendars, can help investors understand the broader market context and make more informed decisions. By regularly tracking the 4-week treasury bill rate today and staying informed about market developments, investors can optimize their short-term investment strategies and achieve their financial goals. Furthermore, investors can set up alerts and notifications to receive timely updates on changes in the 4-week treasury bill rate, enabling them to respond quickly to market shifts and capitalize on new opportunities.