Understanding the World of Treasury Bills

Treasury Bills, commonly referred to as T-Bills, are a type of short-term government debt security issued by the US Department of the Treasury. They play a vital role in the US financial system, providing a low-risk investment option for individuals and institutions alike. With maturities ranging from a few weeks to a year, T-Bills offer a unique combination of liquidity and returns. The 4 week T-Bill rate today, in particular, is a popular choice for investors seeking a short-term, low-risk investment. As a result, understanding the world of Treasury Bills is essential for making informed investment decisions in today’s market. T-Bills are backed by the full faith and credit of the US government, making them an attractive option for risk-averse investors. Additionally, they are highly liquid, allowing investors to easily buy and sell them on the secondary market.

How to Stay Ahead of the Curve with Market Updates

Staying informed about current market conditions and interest rates is crucial for making informed investment decisions. In today’s fast-paced financial landscape, market developments can change rapidly, and investors need to be aware of these changes to adapt their strategies accordingly. The 4 week T-Bill rate today, for instance, can have a significant impact on short-term investment decisions. By staying up-to-date with the latest market news and trends, investors can identify opportunities and risks, and make adjustments to their portfolios to maximize returns. This includes monitoring interest rates, economic indicators, and market sentiment, as well as staying informed about monetary policy decisions and their potential impact on the economy. By doing so, investors can stay ahead of the curve and make informed decisions that align with their financial goals.

The Significance of Short-Term Interest Rates

Short-term interest rates, such as the 4-week T-Bill rate, play a crucial role in shaping the economy and individual investments. These rates have a direct impact on borrowing costs, influencing the affordability of loans and credit for consumers and businesses alike. A low 4 week T-Bill rate today, for instance, can make borrowing more affordable, stimulating economic growth and consumption. On the other hand, high short-term interest rates can increase borrowing costs, reducing demand and potentially leading to economic slowdown. Moreover, short-term interest rates also affect savings, as they influence the returns on deposits and other short-term investments. Investors seeking to maximize their returns need to be aware of the current short-term interest rate environment and adjust their strategies accordingly. By understanding the significance of short-term interest rates, investors can make informed decisions that align with their financial goals and risk tolerance.

What Drives the 4-Week T-Bill Rate Today

The 4-week T-Bill rate today is influenced by a combination of factors, including monetary policy, economic indicators, and market sentiment. Monetary policy decisions made by the Federal Reserve, such as setting interest rates and implementing quantitative easing, have a direct impact on the 4-week T-Bill rate. Economic indicators, such as GDP growth, inflation, and unemployment rates, also play a crucial role in shaping the 4-week T-Bill rate. For instance, a strong economy with low unemployment and rising inflation may lead to higher short-term interest rates, including the 4-week T-Bill rate. Market sentiment, including investor expectations and risk appetite, also influences the 4-week T-Bill rate. In times of economic uncertainty or market volatility, investors may seek safer assets, such as T-Bills, driving up demand and pushing rates lower. Understanding these factors is essential for investors seeking to make informed decisions about their short-term investments, including the 4-week T-Bill rate today.

Comparing Short-Term Investment Options

When it comes to short-term investments, investors have a range of options to choose from, each with its unique features and benefits. 4-week T-Bills, commercial paper, and certificates of deposit (CDs) are three popular short-term investment options that offer varying degrees of liquidity, risk, and returns. 4-week T-Bills, for instance, are backed by the full faith and credit of the US government, making them an extremely low-risk investment option. They also offer a high degree of liquidity, with maturities ranging from a few weeks to a year. Commercial paper, on the other hand, is a short-term debt instrument issued by companies to raise funds. It typically offers higher returns than T-Bills but carries a higher level of credit risk. CDs, offered by banks, provide a fixed rate of return for a specific period, usually ranging from a few months to several years. They tend to be less liquid than T-Bills but offer higher returns. Understanding the differences between these short-term investment options is crucial for investors seeking to optimize their returns in a low-interest-rate environment, such as the current 4 week T-Bill rate today. By comparing and contrasting these options, investors can make informed decisions that align with their risk tolerance, investment horizon, and financial goals.

Strategies for Investing in a Low-Rate Environment

Navigating a low-interest-rate environment, such as the current 4 week T-Bill rate today, requires a thoughtful and strategic approach to investing. One effective strategy is diversification, which involves spreading investments across different asset classes to minimize risk. This can include allocating a portion of a portfolio to short-term investments, such as 4-week T-Bills, commercial paper, and CDs, to take advantage of their relatively stable returns. Laddering is another strategy that can help investors maximize returns in a low-rate environment. This involves investing in a series of short-term instruments with staggered maturities, allowing investors to take advantage of higher rates as they become available. Additionally, investors can consider taking advantage of short-term investment opportunities, such as special Treasury Bill auctions or short-term bond offerings, to capitalize on temporary market inefficiencies. By adopting these strategies, investors can optimize their returns and navigate the challenges of a low-interest-rate environment, including the current 4 week T-Bill rate today.

The Role of Treasury Bills in a Diversified Portfolio

Incorporating Treasury Bills into a diversified investment portfolio can provide a range of benefits for investors. One of the primary advantages of T-Bills is their low-risk profile, which makes them an attractive option for investors seeking to minimize risk. Additionally, T-Bills offer a high degree of liquidity, allowing investors to quickly access their funds if needed. In a diversified portfolio, T-Bills can serve as a hedge against market volatility, providing a stable source of returns even in times of economic uncertainty. Furthermore, the low returns offered by T-Bills can help to offset the higher returns offered by riskier investments, such as stocks or corporate bonds. By including T-Bills in a diversified portfolio, investors can create a more balanced investment strategy that is better equipped to navigate the challenges of a low-interest-rate environment, such as the current 4 week T-Bill rate today. This can help to ensure that investors achieve their long-term financial goals while minimizing risk and maximizing returns.

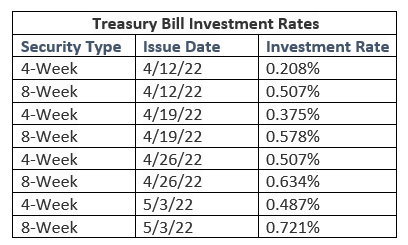

Staying Informed: Where to Find the Latest 4-Week T-Bill Rate

To make informed investment decisions, it is essential to stay up-to-date with the latest 4-week T-Bill rate and market developments. Fortunately, there are several reliable sources where investors can find this information. The US Department of the Treasury’s website is a primary source for T-Bill rates, offering real-time data on current and historical rates. Additionally, financial news sources such as Bloomberg, CNBC, and The Wall Street Journal provide timely updates on market conditions and interest rates, including the 4 week T-Bill rate today. Investors can also utilize investment platforms and online brokerages, such as Fidelity or Charles Schwab, to access current T-Bill rates and execute trades. Furthermore, setting up customized news alerts and following reputable financial experts on social media can help investors stay informed about market changes and trends. By leveraging these resources, investors can stay ahead of the curve and make informed decisions about their short-term investment portfolios.