Understanding Short-Term Treasury Bill Yields

Short-term treasury bills, often referred to as T-bills, are debt instruments issued by governments to raise funds for their immediate operational needs. The 3-month T-bill, or 90-day T-bill, is a particularly significant instrument because its yield serves as a key economic indicator, offering insights into the market’s perception of risk and the expected direction of interest rates in the near future. These bills are essentially short-term loans made by investors to the government, where in return, the government promises to pay back the face value of the bill at maturity. Unlike bonds, T-bills are sold at a discount to their face value, and the return the investor makes is the difference between the discounted purchase price and the face value received at the end of the 3 months. Because these bills are considered very low risk, the 3 months t bill rate is a foundational element in the broader financial market, often seen as a near risk-free return benchmark, making the 3 months t bill rate an important focal point for many investors. The rate on these 3-month treasury bills is not fixed and can fluctuate based on several influences; this article will explore the various factors affecting the 3 months t bill rate, allowing investors to better understand these market signals.

The 3 months t bill rate is a direct reflection of the supply and demand for these government-backed instruments. The United States government, for example, uses the issuance of T-bills to finance its short-term obligations, and the rates offered can influence the attractiveness of these securities to a wide array of investors. These investors range from large institutional entities like pension funds and money market funds, to individual investors looking for a safe way to store their capital for short durations. Several interconnected macroeconomic factors can drive the fluctuations seen in the 3 months t bill rate, including central bank policies, inflation expectations, and overall investor sentiment towards risk. While this article will delve deeper into these dynamics, it is important to note that these rates are constantly moving in response to changes in these underlying economic conditions. Understanding these drivers is crucial for anyone looking to comprehend the significance of the 3 months t bill rate within the broader context of the financial market.

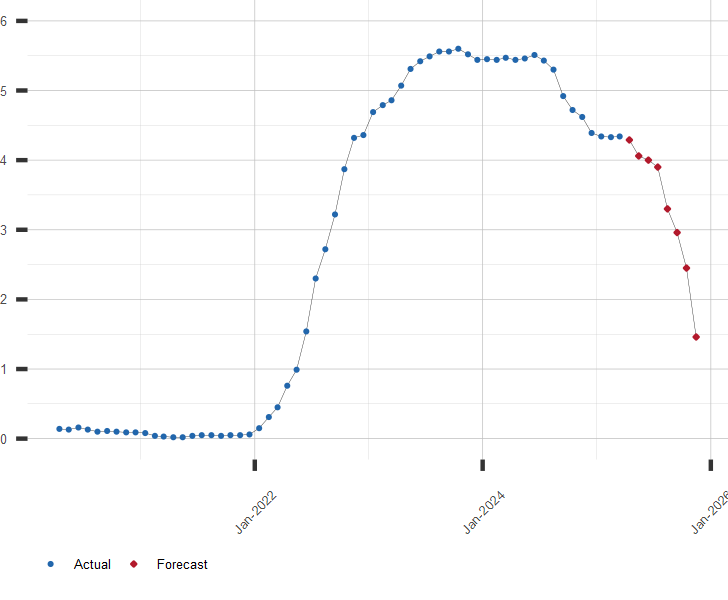

How to Track the Current 3-Month Treasury Bill Rate

For individuals seeking the most up-to-date information on the 3-month t bill rate, several reliable sources are readily available. Official government websites, such as the U.S. Department of the Treasury, provide direct access to current rates. These sites are updated regularly and offer a definitive source for this key financial metric. Monitoring these official sources ensures accuracy and timeliness. Furthermore, major financial news outlets, including well-established publications and online platforms, also report the 3-month t bill rate as part of their broader economic coverage. These outlets often provide analysis and context, which can be useful for understanding the implications of rate changes. For investors who use brokerage accounts, the current 3-month t bill rate is usually displayed within the fixed-income or treasury section of their platforms. Brokerages frequently integrate real-time data feeds, allowing users to monitor rate fluctuations. The data is often accompanied by charts, and related analysis to help investors make informed decisions.

Understanding what the 3-month t bill rate signifies for investors is crucial. The yield represents the return an investor receives for lending money to the government for a 3-month period. This rate is generally considered a risk-free benchmark, because the U.S. government is highly unlikely to default on its obligations. Investors use this rate to gauge the return they can expect from a very safe, short-term investment. Therefore, the 3 months t bill rate serves as a baseline for evaluating other fixed-income investments and assessing opportunity costs. If the 3-month t bill rate is relatively high, it might indicate that short-term investments are offering attractive yields, which might steer investors away from riskier assets. Conversely, a low rate suggests that investors might seek higher returns elsewhere. The current 3-month t bill rate reflects the market’s current expectations and demand for the short-term debt of the US government. Hence, it is a vital signpost in the landscape of interest rates, influencing various aspects of the financial market. Therefore, tracking these rates allows investors to maintain a better-informed portfolio.

The Federal Reserve’s Role in Setting Short-Term Rates

The Federal Reserve, often referred to as the central bank, plays a pivotal role in influencing the 3-month T-bill rate. While the Fed doesn’t directly set the 3 months t bill rate, its monetary policy decisions have a significant indirect impact. The primary tool the Federal Reserve uses to influence interest rates is the federal funds rate, which is the target rate at which commercial banks borrow and lend reserves to one another overnight. Changes to the federal funds rate ripple through the financial system, affecting other short-term interest rates, including the yields on 3-month Treasury bills. When the Federal Reserve lowers the federal funds rate, it makes borrowing cheaper for banks. This increased liquidity in the market often leads to a decrease in the 3 months t bill rate, as banks are less inclined to invest heavily in safe assets like T-bills, preferring to deploy capital into more lucrative loans and investments. Conversely, when the Fed raises the federal funds rate to combat inflation or cool down an overheated economy, the increase in borrowing costs for banks leads to a corresponding increase in the 3 months t bill rate as they seek to maximize returns and investors demand better yields.

Specific monetary policies, such as the use of open market operations, directly impact the supply and demand dynamics for T-bills, thereby affecting their yields. Open market operations involve the Fed buying or selling government securities in the open market. When the Fed purchases government securities, including T-bills, it injects money into the market, increasing the demand for these assets and typically driving down the 3 months t bill rate. When the Fed sells securities, it removes money from the system, reducing demand and generally leading to an increase in the 3 months t bill rate. Another important tool is the reserve requirement, which specifies the fraction of deposits that banks must hold in reserve and not lend out. Adjusting this requirement influences the available pool of credit in the economy, and consequently indirectly affects the 3 months t bill rate. Furthermore, forward guidance provided by the Fed about its future policy intentions can also influence the market’s expectations about short-term rates, including the 3 months t bill rate, as market participants anticipate future adjustments in monetary policy and act accordingly.

Supply and Demand Dynamics Impacting T-Bill Rates

The interplay of supply and demand significantly influences the 3 months t bill rate. Increased government borrowing, for instance, directly affects the supply of treasury bills in the market. When a government issues more T-bills to finance its operations, the supply increases. This increased supply, without a corresponding rise in demand, typically leads to a decrease in the price of the bills, resulting in a higher yield or 3 months t bill rate. Conversely, if the government reduces its borrowing, the supply of T-bills decreases, potentially leading to higher prices and thus lower yields. Investor risk appetite also plays a crucial role. During times of economic uncertainty, investors often seek safe-haven assets, leading to increased demand for low-risk investments like T-bills. This increased demand can drive up the price and lower the 3 months t bill rate. Conversely, when investors feel more confident and are willing to take on riskier assets, the demand for T-bills can decrease, potentially leading to higher yields. These fluctuations in supply and demand are constantly shifting the market price of these bills, and thus their rates.

Specific market events can trigger significant shifts in both the supply and demand for 3 months t bill rate. For example, a large bond issuance could create an abundance of treasury instruments, impacting the 3 months t bill rate. Furthermore, changes in global economic conditions, like geopolitical unrest or shifts in investor sentiment towards certain markets, can cause investors to quickly move towards or away from safe havens such as the 3-month T-bills. Demand can also surge when institutional investors such as money market funds decide to shift allocations, for example away from corporate debt and towards government debt such as T-bills to protect principal. The market for T-bills is very liquid, and these changes in demand and supply dynamics can occur in a short period, leading to constant fluctuations in the 3 months t bill rate. Therefore, understanding the market’s supply and demand forces is crucial for those monitoring and investing in treasury bills.

Impact of Inflation Expectations on 3-Month T-Bill Yields

The relationship between inflation expectations and the 3-month t bill rate is a crucial factor influencing the yield investors receive on these short-term government securities. Inflation, which represents a general increase in the price level of goods and services, erodes the purchasing power of money over time. Therefore, investors typically demand a higher nominal yield on investments, including 3-month T-bills, when they anticipate higher future inflation. This demand arises from the need to preserve the real value of their investment and to achieve an inflation-adjusted return that is acceptable. For example, if investors expect inflation to rise, they will require a higher 3 months t bill rate to compensate for the reduced value of the future cash flows they will receive. The 3 months t bill rate, therefore, acts as a sort of barometer, reflecting the market’s collective anticipation of future price pressures.

The impact of inflation expectations on the 3-month t bill rate is directly tied to investor demand. When inflation expectations rise, investors become less interested in locking in low yields because the real return (the nominal return minus inflation) diminishes. This reduced demand puts upward pressure on the 3-month t bill rate, as the government needs to offer more attractive returns to attract buyers. Conversely, lower inflation expectations tend to lead to lower required rates of return on these bills. The term “inflation-adjusted return” is particularly important here because it describes the real rate of return an investor is earning after considering the effects of inflation. For instance, if an investor earns a 2% yield on a 3-month T-bill but inflation is expected to be at 3%, the inflation-adjusted return is actually -1%, meaning the investment is losing purchasing power over that period. Investors use this concept when assessing the true value of their T-bill holdings and how to anticipate movements on the 3 months t bill rate.

Changes in inflation expectations do not always result in immediate and equivalent changes in the 3-month t bill rate. Other factors such as supply and demand, monetary policy, and general market sentiment also play important roles. However, inflation expectations remain a significant driver of the yield demanded by investors. This influences the pricing mechanism of the 3 months t bill rate. The market generally tries to anticipate those changes and adjusts prices accordingly, which makes those treasury bills a good indicator on the investor’s expectations of future inflation.

The T-Bill Yield Curve and Its Interpretations

The yield curve is a graphical representation of the yields of similar-quality bonds across different maturity dates, and the 3-month T-bill rate occupies a crucial position at the very short end of this spectrum. Specifically, the 3-month t bill rate represents the return on government debt that matures in a mere three months. The position of the 3-month T-bill yield relative to longer-term treasuries is quite significant. Typically, a yield curve slopes upward, meaning that longer-term bonds offer higher yields than short-term ones. This is because investors generally demand a higher return to compensate for the increased risks and uncertainties associated with longer investment periods. However, shifts in this curve, and the relationship with the current 3-month t bill rate, can reveal a lot about market expectations of the economy.

When the yield curve flattens, or the 3 months t bill rate rises to meet the yields of longer-dated bonds, it signals that investors may anticipate a potential slowdown in the economy or future decreases in interest rates. An inverted yield curve, where the 3-month t bill rate actually exceeds the yields of longer-term treasuries, is a particularly noteworthy signal. Such an inversion has historically been a fairly reliable predictor of an impending economic recession. This happens because investors anticipate that the central bank will cut short-term rates in the future to stimulate the economy. In this scenario, the 3 month t bill rate acts as a key indicator of this potential shift. It’s worth noting that the yield curve isn’t a perfect predictor, but understanding the relationship between the 3 months t bill rate and the rest of the curve can give economists and investors valuable insights into the current market sentiment and its outlook on interest rates and economic activity.

Using 3-Month T-Bills as a Benchmarking Tool

The 3 months t bill rate holds a significant position in the financial world, frequently serving as a benchmark for various financial calculations and assessments. Its role as a near risk-free rate makes it a crucial starting point for evaluating the potential return of other investments. In many financial models, the 3 months t bill rate is used to represent the lowest possible return an investor should expect, given that it is backed by the full faith and credit of the government. This benchmark is essential when calculating risk premiums for assets with higher risk profiles such as corporate bonds or equities. Analysts often use the 3 months t bill rate as a base when analyzing the expected profitability of a project or investment, providing a clear baseline against which to measure the potential risk and reward. For example, the difference between the return of a corporate bond and the 3 months t bill rate can tell an investor the amount of additional return they’re getting for taking the extra risk of not holding government debt. Therefore, understanding the 3 months t bill rate is fundamental for anyone looking to grasp the fundamentals of investment valuation and risk management.

Beyond its role as a risk-free benchmark, the 3 months t bill rate is also a key metric when assessing the performance of fixed-income instruments. Investors and portfolio managers look to the 3 months t bill rate as a comparison point when evaluating the yields of other bonds, especially those of short to medium term maturities. This benchmark helps investors assess if the potential yield of another fixed-income instrument justifies its corresponding risk, highlighting whether the market is appropriately valuing that instrument relative to the most basic and safest investment. Furthermore, the 3 months t bill rate serves as an important anchor when setting discount rates in various valuation models. It’s vital to know that the 3 months t bill rate is not a perfect benchmark and has certain limitations. It does not account for real long-term rates, it is also not useful when measuring different long-term investments, because the economic conditions that are affecting a short-term bill might not be representative for long-term investment goals. Therefore, while the 3 months t bill rate is an essential tool, it must be used judiciously along with other financial benchmarks when constructing a portfolio. It is important for investors to have a good grasp of the 3 months t bill rate and its proper applications in finance.

The 3 months t bill rate provides a stable benchmark that can be used to compare different opportunities, however, it doesn’t provide the full picture for those looking for higher returns. Investors may use the 3 months t bill rate as a starting point in various risk models, however, they should consider other benchmarks and investment metrics as they build a diversified portfolio that can potentially produce higher returns while at the same time managing its risk.

Strategies to Evaluate Current Treasury Bill Returns

Investors can employ several strategies to make informed decisions based on the current 3 months t bill rate. One primary use is comparing the yield against other short-term investment options, such as certificates of deposit (CDs) or money market accounts. When evaluating these alternatives, it’s crucial to consider the risk-reward profile of each. The 3-month T-bill is often seen as a virtually risk-free investment due to its backing by the government, while other short-term instruments might carry slightly higher risks but potentially offer better returns. If the 3-month treasury bill rate is higher than the offered rate by a bank account it may be the best alternative for risk-averse investors. Comparing the 3 months t bill rate with these other instruments will give a clear picture of the short-term return landscape. Investors must also understand that this rate is highly dependable, thus giving them a clear understanding of the minimum return they will get over a 3-month period, and can be used as a safe benchmark in evaluating their other portfolio options.

Another key strategy involves using the 3-month t bill rate as a tool for managing the overall investment portfolio. It’s not uncommon for investors to allocate a portion of their portfolio to very low-risk assets like T-bills, particularly in times of economic uncertainty. If the current 3-month t bill rate is seen as attractive, an investor might decide to increase their allocation to these bills as a temporary move away from riskier investments. Similarly, if the yield on 3 months treasury bill rate is low compared to the historical averages, an investor may choose to reduce their allocation, seeking higher returns elsewhere, if their risk profile allows it. Additionally, the 3-month t bill rate can be an important variable when calculating risk-adjusted returns, this rate can help investors analyze the risk vs reward trade-off of riskier assets in their portfolios. The 3 months t bill rate offers a clear perspective of low-risk short term opportunities, which is very useful for investors trying to achieve diversification in their portfolio. It is crucial for investors to make informed decisions based on their investment goals, risk profile, and financial situations. It is important to consult with a financial professional to receive tailored advice.