Navigating the World of Low-Risk Investments

In the realm of investing, short-term investments offer a unique advantage for individuals seeking to park their funds for a brief period while earning some returns. One such investment option is the 3-month US treasury bill rate, which has gained popularity among investors seeking low-risk, short-term investments. Low-risk investments, in general, provide a sense of security and stability, making them an attractive option for those with a shorter investment horizon or a lower risk tolerance. A diversified portfolio often includes a mix of low-risk investments, which can help mitigate potential losses and provide a steady stream of income. By understanding treasury bill rates, investors can make informed decisions about their short-term investment strategies, ultimately achieving their financial goals.

What is a 3-Month US Treasury Bill Rate?

A 3-month US treasury bill rate is a type of short-term government security issued by the US Department of the Treasury. It is a discount instrument, meaning that it is sold at a price lower than its face value, and the investor receives the full face value at maturity. The 3-month treasury bill rate is calculated as the difference between the face value and the discounted price, expressed as a percentage. This rate serves as a benchmark for short-term interest rates in the economy, influencing the rates offered by banks and other financial institutions on their deposit products. As a result, the 3-month US treasury bill rate has a significant impact on the economy, affecting borrowing costs, consumer spending, and business investment. For investors, understanding the 3-month treasury bill rate is crucial in making informed decisions about their short-term investment strategies.

How to Invest in 3-Month Treasury Bills

Investing in 3-month treasury bills is a straightforward process that can be completed through various platforms and institutions. Here’s a step-by-step guide to get you started:

1. Open a TreasuryDirect Account: The US Department of the Treasury’s online platform, TreasuryDirect, allows individuals to buy treasury bills directly. Create an account and fund it with a bank account or existing treasury securities.

2. Choose a Brokerage Firm: Many online brokerage firms, such as Fidelity, Charles Schwab, and Vanguard, offer 3-month treasury bills. Open a brokerage account and fund it with a bank transfer or existing securities.

3. Decide on the Investment Amount: Determine the amount you want to invest, keeping in mind the minimum investment requirement, which is typically $1,000 for TreasuryDirect and may vary for brokerage firms.

4. Place an Order: Use TreasuryDirect or your brokerage firm’s online platform to place an order for the desired amount of 3-month treasury bills. You can also invest through a bank or credit union that offers treasury bill investments.

5. Monitor and Redeem: Once your investment matures, the face value will be credited to your account. You can then redeem the funds or reinvest in another 3-month treasury bill.

By following these steps, you can easily invest in 3-month treasury bills and take advantage of their low-risk, short-term investment benefits. Remember to consider your individual financial goals and risk tolerance when investing in 3-month US treasury bill rates.

Advantages of 3-Month Treasury Bills

Investing in 3-month treasury bills offers several benefits that make them an attractive option for short-term investment strategies. Some of the key advantages of 3-month treasury bills include:

Low Risk: 3-month treasury bills are backed by the full faith and credit of the US government, making them an extremely low-risk investment. This makes them an ideal choice for investors seeking to minimize risk.

Liquidity: 3-month treasury bills are highly liquid, meaning they can be easily sold or redeemed before maturity. This flexibility is particularly useful for investors who need quick access to their funds.

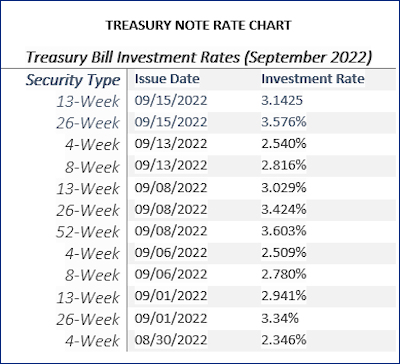

Returns: While the returns on 3-month treasury bills may not be as high as those from other investments, they offer a stable and predictable income stream. The 3-month US treasury bill rate is generally higher than traditional savings accounts, making them a more attractive option for short-term investors.

Suitability for Short-Term Goals: 3-month treasury bills are well-suited for short-term financial goals, such as saving for a down payment on a house, a wedding, or a vacation. They provide a safe and stable way to grow your savings over a short period.

By understanding the advantages of 3-month treasury bills, investors can make informed decisions about their short-term investment strategies and take advantage of the benefits offered by these low-risk investments. With their stable returns and high liquidity, 3-month treasury bills can play a valuable role in a diversified portfolio.

Risks and Considerations

While 3-month treasury bills are considered a low-risk investment, there are still potential risks and considerations that investors should be aware of. These include:

Inflation Risk: Inflation can erode the purchasing power of the returns on 3-month treasury bills, reducing their real value. This risk is particularly significant in periods of high inflation.

Interest Rate Risk: When interest rates rise, the value of existing 3-month treasury bills with lower interest rates may decrease. This can result in a loss if the investment is sold before maturity.

Credit Risk: Although 3-month treasury bills are backed by the US government, there is still a small risk that the government may default on its debt obligations. This risk is extremely low, but it is not zero.

Liquidity Risk: While 3-month treasury bills are generally liquid, there may be times when it is difficult to sell them quickly or at a favorable price. This risk is higher in times of market stress or high volatility.

It is essential for investors to carefully consider these risks and weigh them against the benefits of investing in 3-month treasury bills. By understanding the potential risks and considerations, investors can make informed decisions about their investment strategies and manage their risk exposure effectively.

Despite these risks, 3-month treasury bills remain a popular choice for investors seeking low-risk, short-term investments. By understanding the 3-month US treasury bill rate and its implications, investors can make informed decisions about their investment portfolios and achieve their financial goals.

Comparing 3-Month Treasury Bill Rates to Other Investments

When considering short-term investment options, it’s essential to compare the returns and benefits of 3-month treasury bills to other investments. This helps investors make informed decisions about their investment portfolios and achieve their financial goals.

Commercial Paper: Commercial paper is a short-term debt instrument issued by companies to raise funds. While it offers higher returns than 3-month treasury bills, it carries a higher credit risk. The 3-month US treasury bill rate is generally lower than commercial paper rates, but it provides a higher degree of safety and liquidity.

Certificates of Deposit (CDs): CDs are time deposits offered by banks with fixed interest rates and maturity dates. They tend to offer higher returns than 3-month treasury bills, but they come with penalties for early withdrawal. CDs are also subject to credit risk, whereas 3-month treasury bills are backed by the US government.

Money Market Funds: Money market funds invest in low-risk, short-term instruments like commercial paper and treasury bills. They offer liquidity and diversification, but their returns may be lower than those from 3-month treasury bills. Money market funds also come with management fees, which can eat into returns.

In general, 3-month treasury bills offer a unique combination of low risk, liquidity, and returns, making them an attractive option for short-term investors. By comparing the benefits and risks of different investments, investors can make informed decisions about their portfolios and achieve their financial goals.

Understanding the 3-month US treasury bill rate and its relationship to other investments is crucial for making informed investment decisions. By considering the trade-offs between risk, return, and liquidity, investors can create a diversified portfolio that meets their individual needs and goals.

Historical Trends and Performance

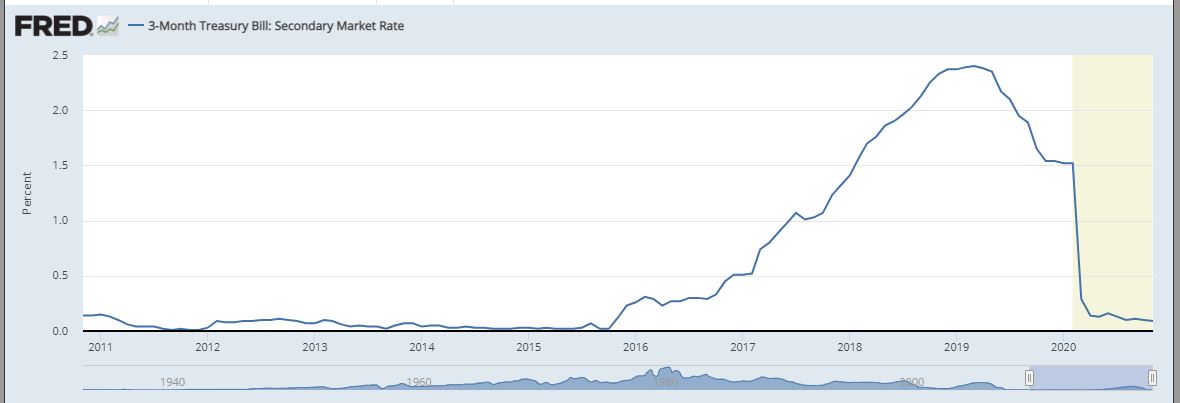

Understanding the historical trends and performance of 3-month US treasury bill rates is essential for making informed investment decisions. By analyzing the past behavior of these rates, investors can gain insights into their potential future performance and make more informed decisions about their investment portfolios.

Historically, 3-month treasury bill rates have been influenced by various economic factors, including inflation, interest rates, and monetary policy. During periods of high inflation, 3-month treasury bill rates tend to rise to keep pace with inflationary pressures. Conversely, during periods of low inflation, rates tend to fall.

In response to economic changes, the Federal Reserve has used monetary policy to influence 3-month treasury bill rates. For example, during the 2008 financial crisis, the Federal Reserve lowered interest rates to stimulate economic growth, which led to a decline in 3-month treasury bill rates. In contrast, during periods of economic expansion, the Federal Reserve has raised interest rates to combat inflation, leading to an increase in 3-month treasury bill rates.

Over the long term, 3-month treasury bill rates have exhibited a cyclical pattern, with rates rising during economic expansions and falling during recessions. This pattern is driven by the Federal Reserve’s monetary policy decisions, which aim to promote economic growth and stability.

By understanding the historical trends and performance of 3-month US treasury bill rates, investors can better navigate the complexities of the financial market and make more informed investment decisions. By recognizing the relationships between economic factors, monetary policy, and 3-month treasury bill rates, investors can position their portfolios to take advantage of opportunities and mitigate risks.

Conclusion: Making Informed Investment Decisions

In conclusion, understanding 3-month US treasury bill rates is crucial for making informed investment decisions. By grasping the concept of treasury bill rates, investors can navigate the world of low-risk investments and create a diversified portfolio that meets their individual financial goals and risk tolerance.

Throughout this article, we have explored the significance of 3-month treasury bill rates, how to invest in them, and their advantages and risks. We have also compared their returns and benefits to other short-term investment options and analyzed their historical trends and performance.

By considering the key takeaways from this article, investors can make informed decisions about their investment portfolios. Whether seeking low-risk investments for short-term financial goals or looking to diversify their portfolios, understanding 3-month US treasury bill rates is essential for achieving success in the world of finance.

Remember, a thorough understanding of 3-month treasury bill rates can help investors mitigate risks, capitalize on opportunities, and achieve their financial objectives. By staying informed and up-to-date on the latest trends and developments in the world of treasury bill rates, investors can make informed decisions that drive long-term success.