Understanding the Role of Treasury Bills in Your Investment Portfolio

Treasury bills, including 3-month Treasury rates, are a cornerstone of a diversified investment portfolio. These short-term debt securities, issued by the US Department of the Treasury, offer a unique combination of low risk and liquidity, making them an attractive option for investors seeking to minimize risk and maximize returns.

In today’s fast-paced financial landscape, Treasury bills provide a sense of security and stability, backed by the full faith and credit of the US government. With maturities ranging from a few weeks to a year, Treasury bills offer a flexible investment option that can be tailored to meet individual investment goals and risk tolerance.

By incorporating Treasury bills into their investment strategy, investors can effectively manage risk and generate steady returns. This, in turn, can provide a sense of confidence and security, allowing investors to focus on their long-term financial goals. As investors navigate the complexities of the financial market, understanding the role of Treasury bills in their investment portfolio is crucial for making informed investment decisions.

How to Make the Most of Short-Term Treasury Investments

Investing in short-term Treasury bills can be a savvy move for investors seeking to balance risk and returns. With their unique combination of liquidity, low risk, and competitive returns, Treasury bills offer a compelling investment opportunity. To make the most of short-term Treasury investments, it’s essential to understand the benefits and how to incorporate them into a comprehensive investment strategy.

One of the primary advantages of short-term Treasury bills is their liquidity. With maturities ranging from a few weeks to a year, investors can easily access their funds when needed. This liquidity, combined with the low-risk nature of Treasury bills, makes them an attractive option for investors seeking to minimize risk and maximize returns.

In addition to liquidity and low risk, short-term Treasury bills offer competitive returns. While returns may be lower than those offered by riskier investments, they are generally higher than those offered by traditional savings accounts. By incorporating short-term Treasury bills into a diversified investment portfolio, investors can generate steady returns while minimizing risk.

To incorporate short-term Treasury bills into an investment strategy, investors should consider their individual financial goals and risk tolerance. By allocating a portion of their portfolio to Treasury bills, investors can create a stable foundation for their investments and reduce their overall risk exposure. Additionally, investors can use Treasury bills to ladder their investments, staggering the maturity dates to ensure a steady stream of returns.

With the current 3 month treasury rates today offering competitive returns, now is an excellent time to consider incorporating short-term Treasury bills into an investment strategy. By doing so, investors can make the most of their investments and achieve their long-term financial goals.

What Drives 3-Month Treasury Rates: An Overview of Market Forces

Understanding the factors that influence 3-month Treasury rates is crucial for making informed investment decisions. Treasury rates are affected by a complex array of market forces, including economic indicators, monetary policy, and market sentiment. By grasping the dynamics of these forces, investors can better navigate the short-term Treasury market and make the most of their investments.

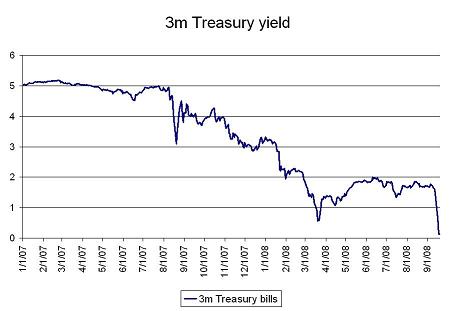

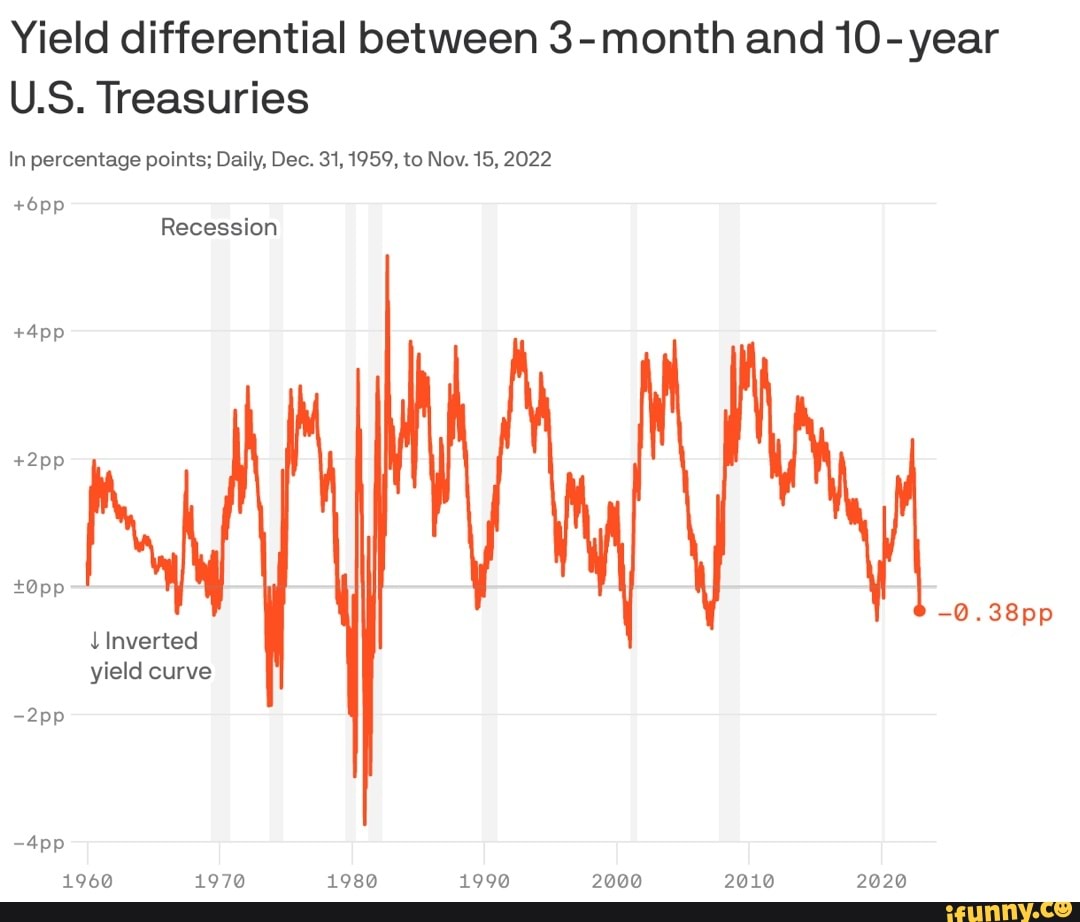

Economic indicators, such as GDP growth, inflation, and unemployment rates, play a significant role in shaping 3-month Treasury rates. When the economy is growing, Treasury rates tend to rise, as investors become more optimistic about the future and demand higher returns. Conversely, during economic downturns, Treasury rates tend to fall, as investors seek safer havens and are willing to accept lower returns.

Monetary policy, set by the Federal Reserve, also has a profound impact on 3-month Treasury rates. When the Fed lowers interest rates, Treasury rates tend to fall, making borrowing cheaper and stimulating economic growth. Conversely, when the Fed raises interest rates, Treasury rates tend to rise, making borrowing more expensive and slowing economic growth.

Market sentiment, driven by investor attitudes and expectations, also influences 3-month Treasury rates. When investors are optimistic about the economy and the stock market, they tend to demand higher returns, driving Treasury rates up. Conversely, when investors are pessimistic, they tend to seek safer havens, driving Treasury rates down.

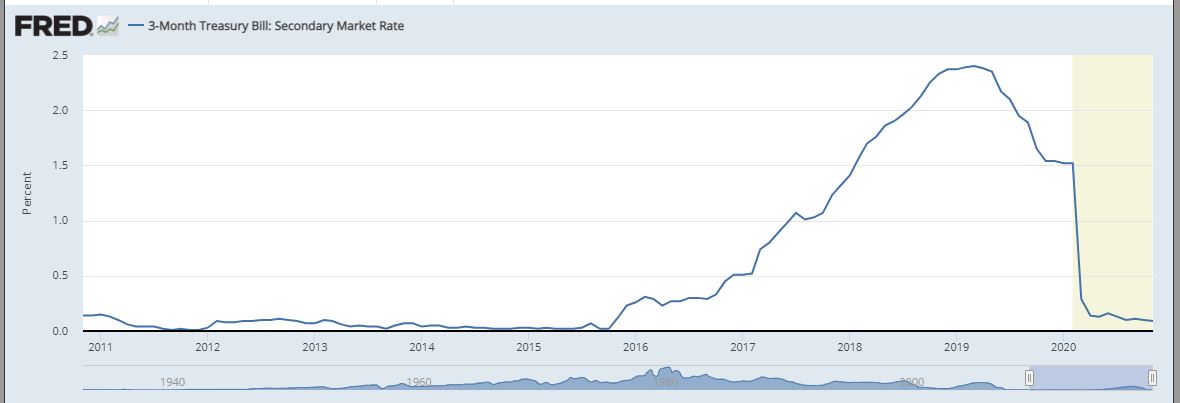

Currently, the 3 month treasury rates today are influenced by a combination of these factors. With the economy growing, albeit slowly, and the Fed maintaining a accommodative monetary policy, Treasury rates remain relatively low. However, as market sentiment shifts and economic indicators evolve, Treasury rates can change rapidly, making it essential for investors to stay informed and adapt their investment strategies accordingly.

Current 3-Month Treasury Rates: What You Need to Know

Staying informed about current 3-month Treasury rates is crucial for investors seeking to capitalize on short-term investment opportunities. As of today, the 3 month treasury rates today are hovering around [insert current rate], reflecting the current state of the economy and monetary policy.

Recent trends in 3-month Treasury rates have been influenced by

Comparing 3-Month Treasury Rates to Other Short-Term Investment Options

When considering short-term investment opportunities, it’s essential to evaluate the benefits and drawbacks of different options. 3-month Treasury rates, commercial paper, and certificates of deposit (CDs) are popular choices for investors seeking low-risk, short-term investments. Understanding the relative advantages and disadvantages of each option can help investors make informed decisions.

Commercial paper, issued by corporations to raise short-term capital, offers higher yields than 3-month Treasury bills but carries a higher credit risk. Investors must carefully assess the creditworthiness of the issuing corporation to mitigate default risk. In contrast, 3-month Treasury rates are backed by the full faith and credit of the US government, making them virtually risk-free.

Certificates of deposit (CDs), offered by banks and credit unions, provide a fixed interest rate for a specific term, typically ranging from a few months to several years. While CDs tend to offer higher yields than 3-month Treasury bills, they often come with penalties for early withdrawal, making them less liquid. In contrast, 3-month Treasury bills can be easily sold on the secondary market before maturity, providing greater flexibility.

Currently, the 3 month treasury rates today are competitive with other short-term investment options, making them an attractive choice for investors seeking low-risk, liquid investments. However, investors should carefully evaluate their individual financial goals and risk tolerance before making a decision. By understanding the relative advantages and disadvantages of each option, investors can make informed decisions and optimize their short-term investment strategies.

Investing in 3-Month Treasury Bills: A Step-by-Step Guide

Investing in 3-month Treasury bills is a straightforward process that can be completed online or through a broker. Here’s a step-by-step guide to help investors get started:

Step 1: Determine Your Investment Amount – Decide how much you want to invest in 3-month Treasury bills, keeping in mind the minimum investment requirement of $100.

Step 2: Choose Your Purchase Method – You can purchase 3-month Treasury bills directly from the US Department of the Treasury’s website, TreasuryDirect, or through a broker. TreasuryDirect offers a convenient and cost-effective way to buy Treasury bills, while a broker may provide additional services and guidance.

Step 3: Set Up Your TreasuryDirect Account – If you choose to purchase through TreasuryDirect, create an account on the website and fund it with a bank account or debit card. You’ll need to provide identification and tax information to comply with federal regulations.

Step 4: Bid on Your 3-Month Treasury Bill – Auctions for 3-month Treasury bills are held weekly, and you can bid on the bills through TreasuryDirect or your broker. You can choose to bid at a competitive or non-competitive rate, depending on your investment strategy.

Step 5: Monitor Your Investment – Once you’ve purchased your 3-month Treasury bill, monitor its performance and adjust your investment strategy as needed. Keep in mind that 3-month Treasury rates today may fluctuate, affecting the value of your investment.

By following these steps, investors can easily incorporate 3-month Treasury bills into their investment portfolios, taking advantage of their low-risk and liquid nature. Remember to stay informed about current 3-month Treasury rates and market trends to optimize your investment strategy.

Managing Risk in Short-Term Treasury Investments

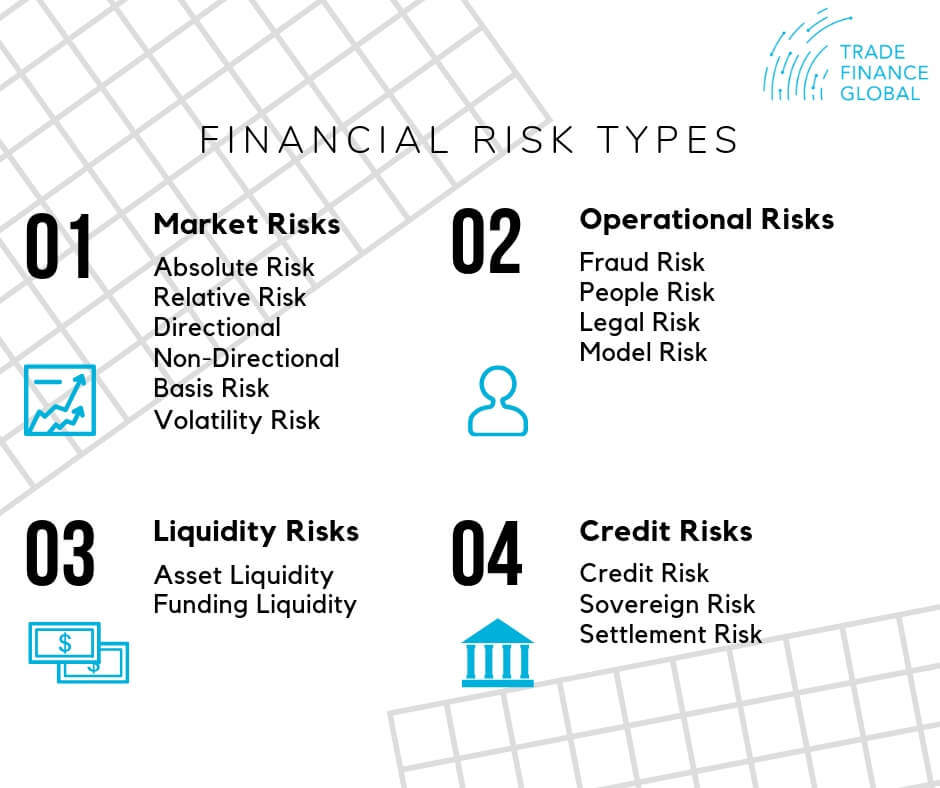

Risk management is a crucial aspect of investing in short-term Treasury bills, including 3-month Treasury rates today. While Treasury bills are considered to be low-risk investments, they are not entirely risk-free. Investors should be aware of the potential risks associated with short-term Treasury investments and implement strategies to mitigate them.

Interest Rate Risk – One of the primary risks associated with short-term Treasury investments is interest rate risk. When interest rates rise, the value of existing Treasury bills with lower interest rates decreases. To mitigate this risk, investors can adopt a laddering strategy, where they invest in Treasury bills with staggered maturity dates. This approach helps to reduce the impact of interest rate fluctuations on the overall investment portfolio.

Credit Risk – Although the risk of default is extremely low for Treasury bills, credit risk still exists. To manage credit risk, investors should ensure that they are purchasing Treasury bills directly from the US Department of the Treasury or through a reputable broker. Additionally, investors should monitor the credit rating of the US government and adjust their investment strategy accordingly.

Liquidity Risk – Short-term Treasury investments, including 3-month Treasury rates today, are generally liquid investments. However, investors should be aware that liquidity risk can arise during times of market stress or high demand for Treasury bills. To mitigate liquidity risk, investors can maintain a diversified investment portfolio and avoid over-allocating to a single asset class.

By understanding the potential risks associated with short-term Treasury investments and implementing strategies to mitigate them, investors can optimize their investment returns and achieve their financial goals. It is essential to stay informed about current 3-month Treasury rates and market trends to make informed investment decisions.

Maximizing Returns on Your 3-Month Treasury Investment

To maximize returns on 3-month Treasury investments, investors should consider implementing various strategies that take advantage of current 3-month Treasury rates today. One effective approach is laddering, which involves investing in a series of Treasury bills with staggered maturity dates. This technique helps to reduce the impact of interest rate fluctuations and provides a steady stream of income.

Diversification is another key strategy for maximizing returns on 3-month Treasury investments. By spreading investments across different asset classes and maturities, investors can reduce risk and increase potential returns. For example, investors could allocate a portion of their portfolio to 3-month Treasury bills and another portion to longer-term Treasury notes or bonds.

Timing is also crucial when investing in 3-month Treasury bills. Investors should consider the current market conditions and interest rate environment before making an investment. For instance, if interest rates are rising, it may be beneficial to invest in shorter-term Treasury bills to take advantage of higher yields. Conversely, if interest rates are falling, investors may want to consider longer-term Treasury investments to lock in higher yields.

In addition to these strategies, investors should also consider the tax implications of their 3-month Treasury investments. Treasury bills are exempt from state and local taxes, but federal taxes may still apply. Investors should consult with a tax professional to optimize their investment returns and minimize tax liabilities.

By incorporating these strategies into their investment approach, investors can maximize returns on their 3-month Treasury investments and achieve their financial goals. Remember to stay informed about current 3-month Treasury rates today and market trends to make informed investment decisions.

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)