Navigating the World of Low-Risk Investments

In the realm of investing, short-term investments play a vital role in mitigating risk and providing a stable source of returns. One such investment option is the 3 month t bill rates, which offer a low-risk haven for investors seeking to park their funds for a brief period. Understanding treasury bill rates is crucial for investors looking to capitalize on these opportunities. By grasping the intricacies of short-term investments, investors can effectively allocate their resources, minimize risk, and maximize returns. Low-risk investments, such as 3 month t bill rates, provide a sense of security and stability, making them an attractive option for investors with a conservative approach. Moreover, they can serve as a hedge against market volatility, providing a steady source of income. In a diversified portfolio, short-term investments like 3 month t bill rates can help balance out riskier investments, ensuring a more stable overall performance.

What are Treasury Bills and How Do They Work?

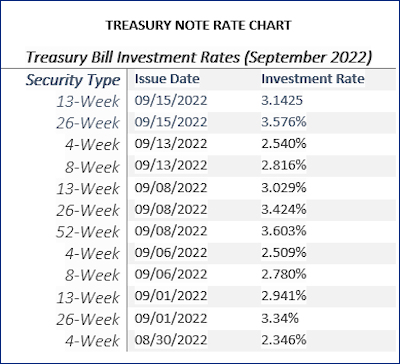

Treasury bills, also known as T-bills, are a type of short-term government debt security issued by the U.S. Department of the Treasury. They are backed by the full faith and credit of the U.S. government, making them an extremely low-risk investment option. Treasury bills are issued with maturities ranging from a few weeks to a year, with the 3 month t bill rates being a popular option among investors. There are four main types of treasury bills: 4-week, 13-week, 26-week, and 52-week bills. These securities are auctioned off to investors on a regular basis, with the proceeds used to finance government activities. Treasury bills are traded on the secondary market, allowing investors to buy and sell them before maturity. In contrast to other short-term investment options, treasury bills offer a unique combination of liquidity, low risk, and returns, making them an attractive option for investors seeking to park their funds for a brief period.

How to Invest in 3-Month Treasury Bills: A Step-by-Step Guide

Investing in 3-month treasury bills is a straightforward process that can be completed through various channels. Here’s a step-by-step guide to help you get started:

Step 1: Determine Your Investment Amount – The minimum investment amount for 3-month treasury bills is $100, with increments of $100 thereafter. Decide how much you want to invest, keeping in mind the low-risk nature of these securities.

Step 2: Choose Your Investment Channel – You can buy 3-month treasury bills directly from the U.S. Department of the Treasury’s website, TreasuryDirect, or through a bank or broker. TreasuryDirect is a convenient and cost-effective option, with no fees or commissions.

Step 3: Participate in the Auction – 3-month treasury bills are auctioned off every week, with the auction schedule available on the Treasury Department’s website. You can participate in the auction by submitting a non-competitive bid, which guarantees you the auction-determined 3 month t bill rates, or a competitive bid, which allows you to specify the rate you’re willing to accept.

Step 4: Monitor and Manage Your Investment – Once you’ve invested in 3-month treasury bills, monitor the current 3 month t bill rates and adjust your investment strategy accordingly. You can also consider laddering your investments to take advantage of changing interest rates.

By following these simple steps, you can easily invest in 3-month treasury bills and start earning low-risk returns. Remember to stay informed about current 3 month t bill rates and market trends to maximize your investment potential.

Historical Trends and Current 3-Month T Bill Rates

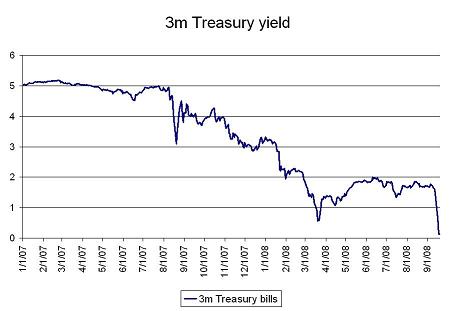

Understanding the historical trends and current 3 month t bill rates is crucial for investors seeking to make informed decisions. Over the past few decades, 3-month treasury bill rates have fluctuated in response to changes in the economy and monetary policy.

Historically, 3-month treasury bill rates have been influenced by factors such as inflation, economic growth, and Federal Reserve policy. During times of high inflation, 3 month t bill rates tend to rise as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, during periods of low inflation and economic stagnation, 3 month t bill rates may decline as investors become more risk-averse.

In recent years, 3-month treasury bill rates have been relatively low, reflecting the Federal Reserve’s accommodative monetary policy. As of [current date], the current 3 month t bill rates stand at [current rate], which is [higher/lower] than the [previous period] average of [previous rate].

The current 3 month t bill rates are influenced by a range of factors, including the Federal Reserve’s decision to maintain a accommodative monetary policy, the ongoing COVID-19 pandemic, and the resulting impact on the economy. As the economy continues to recover, 3 month t bill rates may rise in response to increased inflationary pressures and changes in monetary policy.

For investors, understanding the historical trends and current 3 month t bill rates is essential for making informed investment decisions. By analyzing the factors that influence 3 month t bill rates, investors can adjust their investment strategies to maximize returns and minimize risk.

Benefits and Risks of Investing in 3-Month Treasury Bills

Investing in 3-month treasury bills offers a range of benefits, making them an attractive option for investors seeking low-risk returns. One of the primary advantages of 3-month treasury bills is their low risk profile, which is backed by the creditworthiness of the US government. This makes them an ideal choice for investors who prioritize capital preservation.

In addition to their low risk, 3-month treasury bills offer liquidity, allowing investors to easily access their funds when needed. They also provide a steady stream of returns, with interest paid at maturity. The current 3 month t bill rates, although subject to fluctuations, offer a relatively stable source of income.

However, investing in 3-month treasury bills is not without risks. One of the primary drawbacks is inflation risk, which can erode the purchasing power of returns over time. Additionally, investors may face opportunity cost, as they may miss out on higher returns available from other investments. Furthermore, 3-month treasury bills are sensitive to changes in interest rates, which can impact their value.

Despite these risks, 3-month treasury bills remain a popular choice for investors seeking low-risk returns. By understanding the benefits and risks associated with these investments, investors can make informed decisions and optimize their portfolios. With the current 3 month t bill rates offering a relatively stable source of income, investors may find that 3-month treasury bills provide a valuable addition to their investment portfolios.

Comparing 3-Month T Bill Rates to Other Short-Term Investment Options

When considering short-term investment options, it’s essential to compare 3-month treasury bill rates to other alternatives. This includes commercial paper, certificates of deposit (CDs), and money market funds. Each of these options has its unique characteristics, benefits, and drawbacks, which are discussed below.

Commercial paper, issued by corporations, offers a higher return than 3-month treasury bills, but carries a higher credit risk. CDs, offered by banks, provide a fixed return for a specific term, but may come with penalties for early withdrawal. Money market funds, which invest in low-risk, short-term instruments, offer liquidity and diversification, but may have lower returns than 3-month treasury bills.

In comparison, 3-month treasury bill rates are generally lower than those of commercial paper, but offer a higher degree of safety and liquidity. CDs and money market funds, on the other hand, may provide a more stable return, but may come with restrictions on access to funds. By understanding the differences between these short-term investment options, investors can make informed decisions about their investment portfolios.

Currently, 3 month t bill rates are [insert current rate], which is [higher/lower] than the rates offered by commercial paper and CDs. However, money market funds may offer competitive returns, depending on the specific fund and market conditions. By comparing the rates and characteristics of these short-term investment options, investors can optimize their portfolios and achieve their investment goals.

Strategies for Maximizing Returns on 3-Month Treasury Bills

To maximize returns on 3-month treasury bills, investors can employ several strategies that take advantage of the unique characteristics of these low-risk investments. One effective approach is laddering, which involves investing in a series of 3-month treasury bills with staggered maturity dates. This strategy allows investors to take advantage of changing 3 month t bill rates, while minimizing the impact of interest rate fluctuations on their overall portfolio.

Diversification is another key strategy for maximizing returns on 3-month treasury bills. By spreading investments across multiple treasury bills with different maturity dates, investors can reduce their exposure to any single issue and minimize the risk of losses. Additionally, diversification can help investors take advantage of changing market conditions and optimize their returns.

Taking advantage of rate fluctuations is another strategy for maximizing returns on 3-month treasury bills. By monitoring changes in 3 month t bill rates and investing in treasury bills when rates are high, investors can optimize their returns and minimize the impact of interest rate fluctuations. This strategy requires a deep understanding of the factors that influence 3 month t bill rates, as well as the ability to adapt to changing market conditions.

Other strategies for maximizing returns on 3-month treasury bills include investing in treasury bills with longer maturities, such as 6-month or 1-year treasury bills, and taking advantage of treasury bill auctions. By understanding the unique characteristics of 3-month treasury bills and employing these strategies, investors can optimize their returns and achieve their investment goals.

By incorporating these strategies into their investment portfolios, investors can maximize their returns on 3-month treasury bills and achieve a steady stream of income. With 3 month t bill rates offering a relatively stable source of returns, investors can benefit from the low-risk nature of these investments and achieve their long-term financial goals.

Conclusion: Why 3-Month Treasury Bills Deserve a Place in Your Portfolio

In conclusion, understanding 3 month t bill rates is crucial for investors seeking low-risk investments with steady returns. By incorporating 3-month treasury bills into a diversified portfolio, investors can benefit from their low risk, liquidity, and returns. With historical trends and current 3 month t bill rates providing a stable source of income, investors can optimize their portfolios and achieve their long-term financial goals.

The benefits of investing in 3-month treasury bills, including their low risk and liquidity, make them an attractive option for investors seeking to minimize their exposure to market volatility. By employing strategies such as laddering, diversification, and taking advantage of rate fluctuations, investors can maximize their returns on 3-month treasury bills and achieve a steady stream of income.

In a diversified investment portfolio, 3-month treasury bills can play a crucial role in providing a stable source of returns, while minimizing the impact of interest rate fluctuations and market volatility. By understanding the importance of 3 month t bill rates and incorporating them into their investment strategies, investors can achieve their long-term financial goals and secure their financial futures.

Ultimately, 3-month treasury bills offer a unique combination of low risk, liquidity, and returns, making them an attractive option for investors seeking to optimize their portfolios and achieve steady returns. By understanding the benefits and importance of 3 month t bill rates, investors can make informed decisions about their investment portfolios and achieve their long-term financial goals.