Navigating the Complex World of Short-Term Interest Rates

Unlocking the Secrets of the Forward Curve

In the realm of finance, the forward curve is a powerful tool for understanding short-term interest rates. This graphical representation of expected future interest rates provides valuable insights for investors, policymakers, and financial institutions. Among the various tenors of the forward curve, the 3-month LIBOR forward curve stands out as a crucial benchmark, influencing a wide range of financial instruments and markets. By grasping the intricacies of the forward curve, particularly the 3-month LIBOR forward curve, market participants can make more informed investment decisions, manage risk more effectively, and stay ahead of the curve in an ever-changing financial environment. As a key indicator of short-term interest rates, the 3-month LIBOR forward curve plays a vital role in shaping the financial landscape, making it an essential component of any investment strategy.

What is the 3-Month LIBOR Forward Curve and Why Does it Matter?

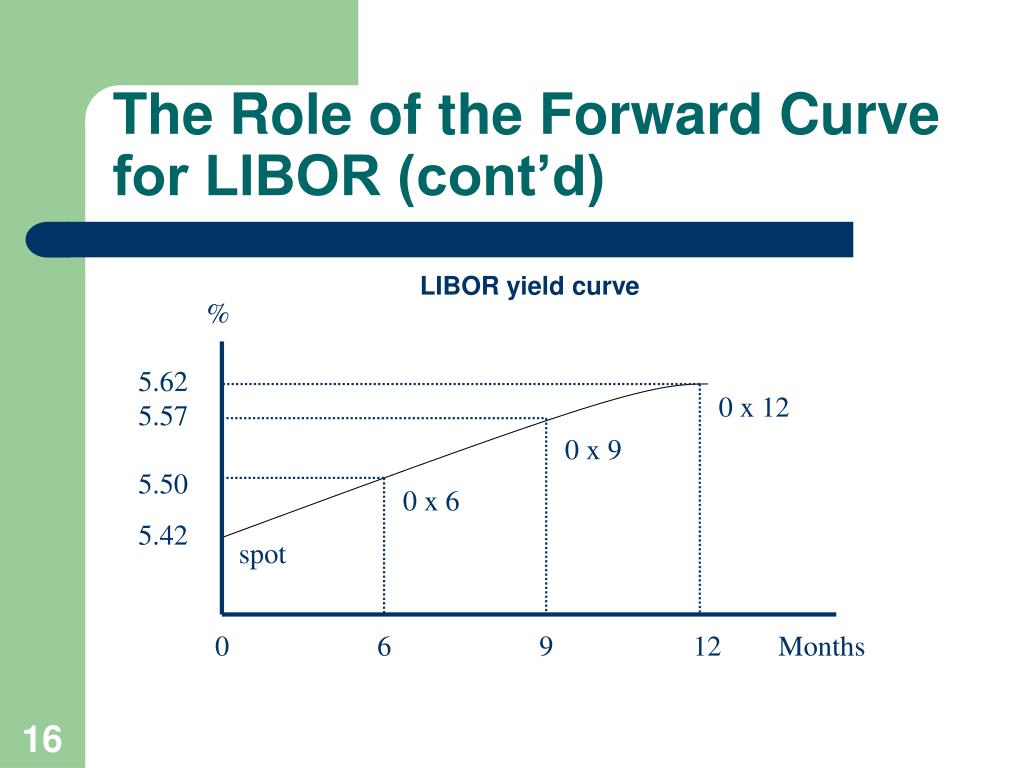

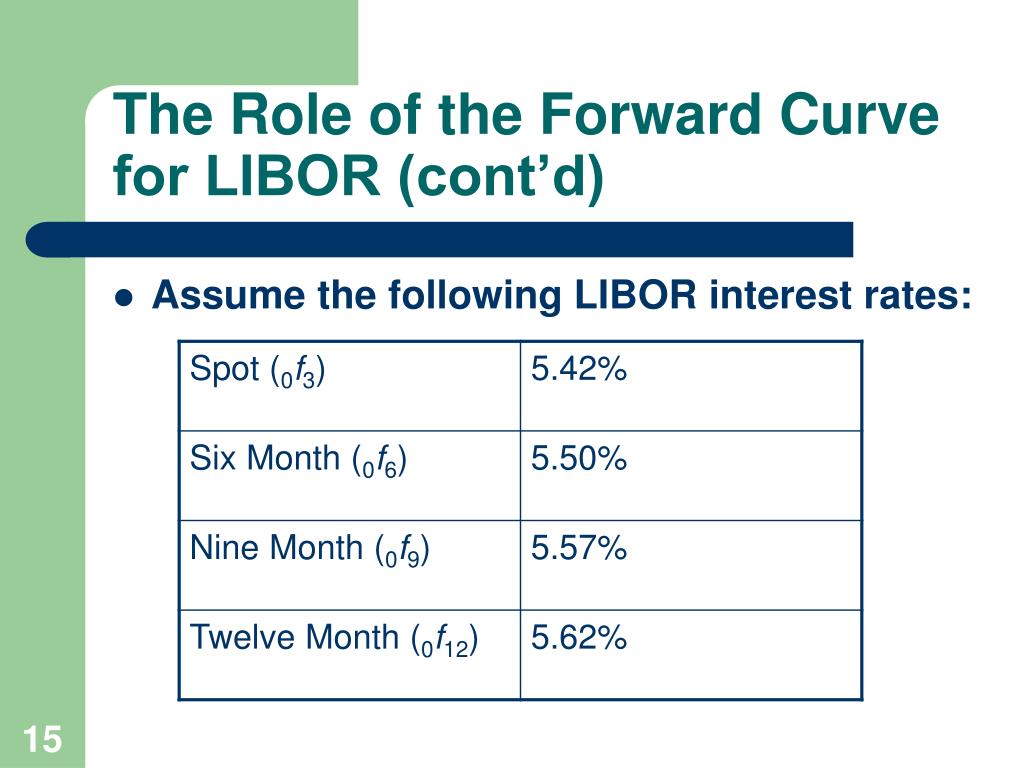

The 3-month LIBOR forward curve is a critical component of the financial landscape, providing a snapshot of expected future interest rates. It is calculated by plotting the expected 3-month LIBOR rates against a range of future dates, typically up to 12 months. This curve is essential for financial institutions, investors, and policymakers, as it influences the pricing of various financial instruments, such as derivatives, bonds, and loans. The 3-month LIBOR forward curve serves as a benchmark for short-term interest rates, reflecting market expectations of future monetary policy decisions and economic conditions. Its significance extends beyond the financial sector, as it affects the overall economy by influencing borrowing costs, consumer spending, and business investment. A deep understanding of the 3-month LIBOR forward curve is crucial for making informed investment decisions, managing risk, and navigating the complex world of short-term interest rates.

How to Interpret the 3-Month LIBOR Forward Curve for Informed Investment Decisions

Interpreting the 3-month LIBOR forward curve is a crucial step in making informed investment decisions. To unlock its secrets, it’s essential to analyze the curve’s shape, slope, and shifts. A steepening curve may indicate rising interest rates, while a flattening curve could signal a decline. Identifying trends and patterns in the 3-month LIBOR forward curve can help investors anticipate changes in short-term interest rates, adjust their portfolios, and optimize returns. For instance, a curve with a pronounced upward slope may suggest that the market expects interest rates to rise, prompting investors to adjust their bond portfolios or consider hedging strategies. Conversely, a curve with a downward slope may indicate a decline in interest rates, making it an attractive time to invest in bonds or other fixed-income instruments. By carefully analyzing the 3-month LIBOR forward curve, investors can gain valuable insights into market expectations and make more informed investment decisions.

The Role of Central Banks in Shaping the Forward Curve

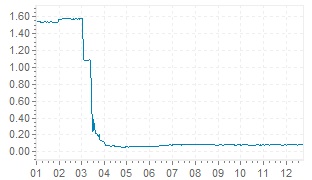

Central banks play a pivotal role in shaping the 3-month LIBOR forward curve, as their monetary policy decisions have a direct impact on short-term interest rates. By adjusting interest rates, central banks influence the borrowing costs of banks, businesses, and consumers, which in turn affects the overall economy. The 3-month LIBOR forward curve reflects market expectations of future monetary policy decisions, making it a critical tool for central banks to communicate their intentions and guide market expectations. For instance, when a central bank raises interest rates to combat inflation, the 3-month LIBOR forward curve may steepen, indicating higher borrowing costs in the future. Conversely, a rate cut may lead to a flattening of the curve, signaling lower borrowing costs. Central banks also use forward guidance to influence the 3-month LIBOR forward curve, providing clues about their future policy intentions. By understanding the complex relationship between central banks and the 3-month LIBOR forward curve, investors and financial institutions can better navigate the complex world of short-term interest rates.

Understanding the Relationship Between the Forward Curve and Economic Indicators

The 3-month LIBOR forward curve is closely tied to key economic indicators, providing valuable insights into the overall health of the economy. By examining the correlation between the forward curve and indicators such as GDP growth, inflation, and unemployment rates, investors and analysts can gain a deeper understanding of the complex relationships between short-term interest rates and economic activity. For instance, a steepening 3-month LIBOR forward curve may indicate rising inflation expectations, while a flattening curve could signal a slowdown in economic growth. Similarly, changes in the unemployment rate can influence the forward curve, as a decline in unemployment may lead to higher interest rates to combat inflation. By analyzing the relationship between the 3-month LIBOR forward curve and economic indicators, investors can make more informed decisions about their investments and better navigate the complex world of short-term interest rates. Furthermore, understanding these relationships can help policymakers and central banks make more informed decisions about monetary policy, ultimately affecting the overall direction of the economy.

Managing Risk with the 3-Month LIBOR Forward Curve

Risk management is a critical component of any investment strategy, and the 3-month LIBOR forward curve can be a valuable tool in this effort. By analyzing the forward curve, investors can identify potential risks and opportunities in their portfolios, and make informed decisions about hedging and diversification. For example, a steepening 3-month LIBOR forward curve may indicate rising interest rates, which could increase the cost of borrowing for companies and individuals. In this scenario, investors may choose to hedge against potential losses by investing in instruments that benefit from rising rates, such as floating-rate notes or interest rate swaps. Conversely, a flattening curve may signal a decline in interest rates, which could lead to increased borrowing and spending. By understanding the implications of the 3-month LIBOR forward curve, investors can develop strategies to manage risk and maximize returns in their portfolios. Additionally, the forward curve can be used to identify potential arbitrage opportunities, where investors can profit from differences in interest rates between different markets or instruments. By incorporating the 3-month LIBOR forward curve into their risk management strategies, investors can gain a competitive edge in the market and achieve their investment goals.

Real-World Applications of the 3-Month LIBOR Forward Curve

The 3-month LIBOR forward curve has a wide range of practical applications in various financial markets, making it an essential tool for investors, analysts, and financial institutions. In commercial lending, for instance, the forward curve is used to determine the interest rates on floating-rate loans, allowing lenders to manage their risk exposure and borrowers to anticipate future borrowing costs. In asset management, the 3-month LIBOR forward curve is used to construct and manage investment portfolios, as it provides valuable insights into the expected returns on different asset classes. Additionally, the forward curve is a critical component in derivatives trading, where it is used to price and hedge interest rate swaps, options, and futures. Furthermore, the 3-month LIBOR forward curve is used in risk management strategies, such as hedging and diversification, to mitigate potential losses and maximize returns. By understanding the practical applications of the 3-month LIBOR forward curve, financial professionals can make more informed investment decisions, optimize their portfolios, and navigate the complex world of short-term interest rates. The forward curve’s real-world applications are diverse and far-reaching, making it an indispensable tool in modern finance.

Staying Ahead of the Curve: Trends and Future Directions in Short-Term Interest Rates

As the financial landscape continues to evolve, the 3-month LIBOR forward curve is likely to undergo significant changes in response to shifting market dynamics and regulatory environments. One key trend to watch is the increasing adoption of alternative reference rates, such as the Secured Overnight Financing Rate (SOFR), which may eventually replace LIBOR as the benchmark rate for short-term lending. This shift could have far-reaching implications for the 3-month LIBOR forward curve, potentially leading to changes in its calculation, interpretation, and applications. Additionally, the ongoing digital transformation of financial markets is likely to impact the forward curve, as advances in data analytics and artificial intelligence enable more sophisticated risk management strategies and more accurate predictions of interest rate movements. Furthermore, the growing importance of environmental, social, and governance (ESG) factors in investment decisions may lead to the development of new, ESG-focused forward curves that incorporate these considerations into the analysis of short-term interest rates. By staying ahead of these trends and future directions, investors and financial professionals can ensure that they remain well-equipped to navigate the complex world of short-term interest rates and make informed investment decisions.