What is the 2-Year Treasury Yield and Why Does it Matter?

The 2-year treasury yield is a critical benchmark in the bond market, serving as a vital indicator of short-term interest rates and economic sentiment. It represents the return on investment for a 2-year US Treasury note, which is a low-risk debt security issued by the US Department of the Treasury. The 2-year treasury yield is closely watched by investors, economists, and policymakers due to its significant impact on the overall economy and financial markets.

In the context of Yahoo Finance, the 2-year treasury yield is a widely followed metric, providing valuable insights into the direction of interest rates, inflation expectations, and the overall health of the economy. A rising 2-year treasury yield often indicates a strong economy, while a declining yield may signal a slowdown or recession. As a result, investors and analysts closely monitor the 2-year treasury yield on Yahoo Finance to inform their investment decisions and navigate the complex landscape of the bond market.

The significance of the 2-year treasury yield extends beyond the bond market, as it has a ripple effect on various aspects of the economy. For instance, changes in the 2-year treasury yield can influence mortgage rates, credit card rates, and other borrowing costs, ultimately affecting consumer spending and business investment. Furthermore, the 2-year treasury yield serves as a benchmark for other short-term interest rates, such as commercial paper and certificates of deposit, making it a crucial component of the overall financial system.

How to Track and Analyze the 2-Year Treasury Yield on Yahoo Finance

To track and analyze the 2-year treasury yield on Yahoo Finance, follow these steps:

Step 1: Access Yahoo Finance and navigate to the “Bonds” or “Treasury” section, where you can find the current 2-year treasury yield data.

Step 2: Click on the “Chart” button to view the historical data of the 2-year treasury yield, which can help you identify trends and patterns.

Step 3: Use the interactive chart tools to customize your view, such as selecting a specific time frame, adding technical indicators, or comparing the 2-year treasury yield to other treasury yields or market indices.

Step 4: Analyze the chart to identify trends, such as an upward or downward trend, and look for key levels of support and resistance.

Step 5: Combine the chart analysis with fundamental analysis, such as reviewing economic indicators, monetary policy decisions, and inflation expectations, to gain a deeper understanding of the 2-year treasury yield and its implications for the economy and financial markets.

By following these steps, investors and analysts can effectively track and analyze the 2-year treasury yield on Yahoo Finance, making informed investment decisions and staying ahead of market trends.

For example, if the 2-year treasury yield is trending upward on Yahoo Finance, it may indicate a strong economy and rising interest rates, which could impact borrowing costs and consumer spending. Conversely, a declining 2-year treasury yield may signal a slowdown or recession, prompting investors to adjust their portfolios accordingly.

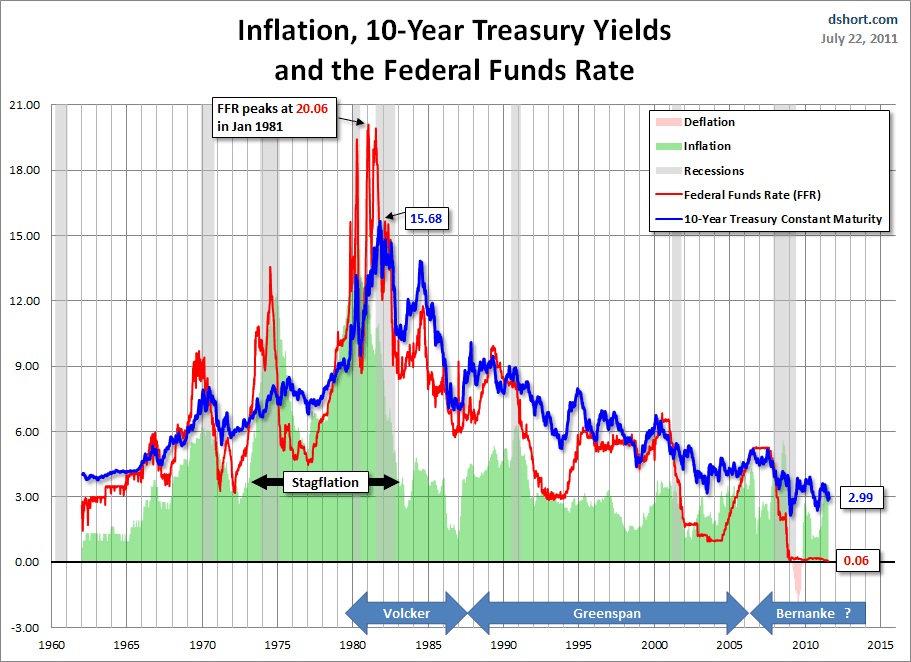

The Impact of Monetary Policy on Short-Term Treasury Yields

Monetary policy decisions, made by central banks such as the Federal Reserve in the United States, have a profound impact on short-term treasury yields, including the 2-year treasury yield. The primary tool used by central banks to implement monetary policy is the setting of interest rates, which affects the entire yield curve, including short-term treasury yields.

When central banks raise interest rates, it increases the cost of borrowing, which can lead to a decrease in economic activity and inflation. As a result, short-term treasury yields, such as the 2-year treasury yield, tend to rise, making borrowing more expensive and reducing consumer spending. On the other hand, when central banks lower interest rates, it reduces the cost of borrowing, stimulating economic growth and inflation, and causing short-term treasury yields to fall.

The impact of monetary policy on short-term treasury yields is also influenced by the pace and magnitude of interest rate changes. For instance, a rapid series of interest rate hikes can lead to a sharp increase in short-term treasury yields, while a gradual rate hike may have a more muted effect. Furthermore, the forward guidance provided by central banks can also influence market expectations and shape short-term treasury yields.

Investors and analysts closely monitor monetary policy decisions and their impact on short-term treasury yields, including the 2-year treasury yield on Yahoo Finance, to make informed investment decisions and navigate the complex landscape of the bond market. By understanding the relationship between monetary policy and short-term treasury yields, investors can better position their portfolios to respond to changes in the economic environment.

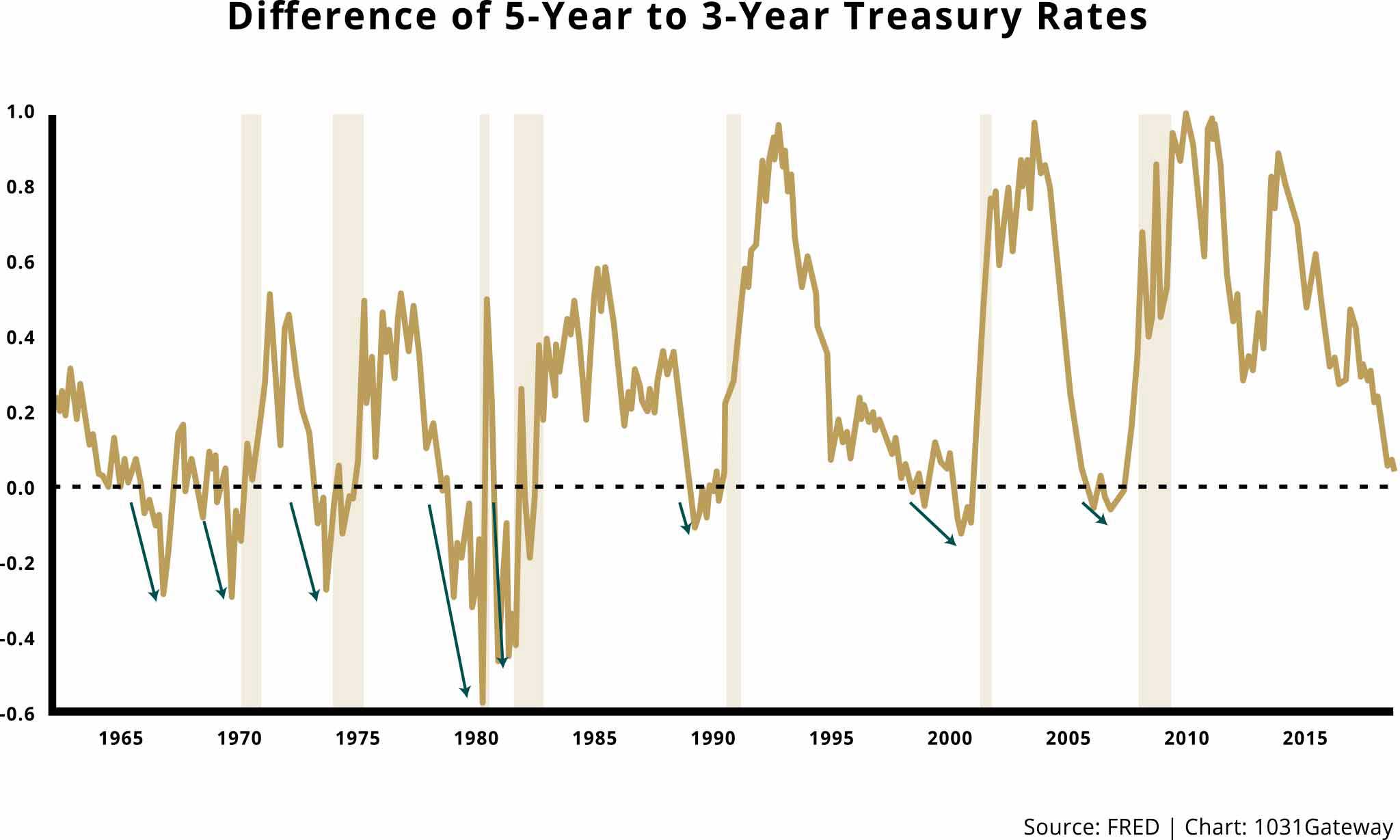

Understanding the Yield Curve and its Implications

The yield curve is a graphical representation of the relationship between the yield of a bond and its maturity. It is a crucial concept in the bond market, as it provides insights into the expectations of investors and the overall health of the economy. The 2-year treasury yield plays a significant role in shaping the yield curve, and understanding its implications is essential for investors and analysts.

The yield curve can take on different shapes, including normal, inverted, and flat. A normal yield curve slopes upward, indicating that longer-term bonds offer higher yields to compensate for the increased risk of lending over a longer period. An inverted yield curve, on the other hand, slopes downward, suggesting that investors are seeking safer assets and are willing to accept lower yields for longer-term bonds. A flat yield curve indicates that the yields of bonds with different maturities are similar, suggesting a lack of confidence in the economy.

The 2-year treasury yield is a key component of the yield curve, as it reflects the market’s expectations of short-term interest rates. When the 2-year treasury yield is high, it can indicate a strong economy and rising interest rates, which can lead to an upward-sloping yield curve. Conversely, a low 2-year treasury yield may suggest a slowing economy and falling interest rates, resulting in a downward-sloping or inverted yield curve.

Investors can use the yield curve to make informed investment decisions, such as identifying opportunities for arbitrage or predicting changes in interest rates. For example, if the yield curve is inverted, it may indicate a higher likelihood of a recession, prompting investors to adjust their portfolios accordingly. By analyzing the 2-year treasury yield on Yahoo Finance and its relationship with the yield curve, investors can gain a deeper understanding of the bond market and make more informed investment decisions.

The Role of Inflation Expectations in Shaping Treasury Yields

Inflation expectations play a crucial role in shaping treasury yields, including the 2-year treasury yield. When inflation expectations rise, investors demand higher yields to compensate for the expected erosion of purchasing power. This increase in yields can make borrowing more expensive, which can slow down economic growth. On the other hand, when inflation expectations are low, yields tend to decrease, making borrowing cheaper and stimulating economic growth.

The 2-year treasury yield is particularly sensitive to inflation expectations, as it is closely tied to the Federal Reserve’s monetary policy decisions. When the Fed raises interest rates to combat inflation, the 2-year treasury yield tends to increase, reflecting the market’s expectations of higher short-term interest rates. Conversely, when the Fed lowers interest rates to stimulate economic growth, the 2-year treasury yield tends to decrease.

Investors can use inflation expectations to make informed investment decisions. For example, if inflation expectations are rising, investors may seek to invest in shorter-term bonds, such as the 2-year treasury yield, to avoid the potential erosion of purchasing power. On the other hand, if inflation expectations are low, investors may seek to invest in longer-term bonds to take advantage of the relatively higher yields.

By analyzing the 2-year treasury yield on Yahoo Finance and its relationship with inflation expectations, investors can gain a deeper understanding of the bond market and make more informed investment decisions. For instance, investors can use the 2-year treasury yield as a benchmark to evaluate the attractiveness of other short-term investment options, such as commercial paper and certificates of deposit.

Comparing the 2-Year Treasury Yield to Other Short-Term Investment Options

When considering short-term investment options, investors often compare the 2-year treasury yield to other alternatives, such as commercial paper and certificates of deposit (CDs). Each of these options has its own advantages and disadvantages, and understanding their differences is crucial for making informed investment decisions.

Commercial paper, for instance, is a short-term debt instrument issued by companies to raise capital. It typically offers higher yields than the 2-year treasury yield, but it also carries more credit risk. Investors can access commercial paper through investment-grade companies, but they must be aware of the potential default risk.

Certificates of deposit (CDs), on the other hand, are time deposits offered by banks with fixed interest rates and maturity dates. They tend to be less liquid than the 2-year treasury yield, but they provide a higher degree of safety and FDIC insurance. CDs are suitable for investors seeking a low-risk, short-term investment option.

In comparison, the 2-year treasury yield offers a high degree of safety and liquidity, as it is backed by the full faith and credit of the US government. However, its yields may be lower than those of commercial paper and CDs. By analyzing the 2-year treasury yield on Yahoo Finance and comparing it to other short-term investment options, investors can determine which option best aligns with their investment goals and risk tolerance.

For example, investors seeking a low-risk, short-term investment option may prefer the 2-year treasury yield or CDs. Those seeking higher yields may consider commercial paper, but they must be aware of the potential credit risk. By understanding the advantages and disadvantages of each option, investors can make informed decisions and optimize their investment portfolios.

The Historical Performance of the 2-Year Treasury Yield

The 2-year treasury yield has a rich history, with its performance varying significantly during different economic conditions. Analyzing its historical performance can provide valuable insights for investors and help them make informed investment decisions.

During recessions, such as the 2008 financial crisis, the 2-year treasury yield tends to decrease as investors seek safe-haven assets. This decrease in yields reflects the market’s expectation of lower short-term interest rates and a slower economy. In contrast, during economic expansions, the 2-year treasury yield tends to increase as investors become more optimistic about the economy and demand higher yields.

For example, during the 2008 financial crisis, the 2-year treasury yield plummeted to around 0.5%, reflecting the market’s expectation of lower short-term interest rates. In contrast, during the economic expansion of the 2010s, the 2-year treasury yield increased to around 2.5%, reflecting the market’s expectation of higher short-term interest rates.

By analyzing the historical performance of the 2-year treasury yield on Yahoo Finance, investors can identify patterns and trends that can inform their investment decisions. For instance, investors can use the 2-year treasury yield as a benchmark to evaluate the attractiveness of other short-term investment options, such as commercial paper and certificates of deposit.

Moreover, understanding the historical performance of the 2-year treasury yield can help investors anticipate how it may react to different economic conditions, such as changes in monetary policy or inflation expectations. By incorporating this knowledge into their investment strategies, investors can optimize their portfolios and achieve their investment goals.

Investment Strategies Using the 2-Year Treasury Yield

Investors can incorporate the 2-year treasury yield into their investment strategies to optimize their portfolios and achieve their investment goals. One popular strategy is laddering, which involves investing in a series of 2-year treasury notes with staggered maturity dates. This approach can provide a steady stream of income and reduce interest rate risk.

Another strategy is the barbell approach, which involves investing in a combination of short-term and long-term treasury notes. By allocating a portion of the portfolio to 2-year treasury notes and another portion to longer-term notes, investors can balance their returns and risk. This approach can be particularly effective in a rising interest rate environment, where short-term yields are increasing.

Hedging techniques can also be used to incorporate the 2-year treasury yield into an investment strategy. For example, investors can use 2-year treasury notes as a hedge against inflation or interest rate risk in their portfolio. By investing in 2-year treasury notes, investors can reduce their exposure to inflation or interest rate fluctuations, while still earning a return.

Investors can also use the 2-year treasury yield as a benchmark to evaluate the attractiveness of other short-term investment options. By comparing the 2-year treasury yield to other options, such as commercial paper and certificates of deposit, investors can determine which option offers the best return for their risk tolerance.

By incorporating the 2-year treasury yield into their investment strategies, investors can optimize their portfolios and achieve their investment goals. Whether using laddering, barbell strategies, or hedging techniques, investors can benefit from the stability and liquidity of the 2-year treasury yield. By tracking and analyzing the 2-year treasury yield on Yahoo Finance, investors can stay informed and make informed investment decisions.

.jpg)