Understanding the Significance of 2-Year Treasury Yields

In the bond market, 2-year treasury yields play a crucial role in shaping short-term interest rates and influencing the overall economy. As a key indicator of market sentiment, 2-year treasury yields today reflect the collective expectations of investors regarding future economic growth, inflation, and monetary policy decisions. A thorough understanding of 2-year treasury yields is essential for investors, policymakers, and economists alike, as they provide valuable insights into the direction of the economy and the potential risks and opportunities in the bond market. The 2 year treasury yield today, in particular, serves as a benchmark for short-term borrowing costs, influencing the pricing of loans, credit cards, and other financial instruments. Moreover, changes in 2-year treasury yields can have a ripple effect on the entire bond market, impacting the performance of long-term bonds, stocks, and other asset classes.

How to Stay Ahead of Market Fluctuations

To effectively track and respond to changes in 2-year treasury yields, it is essential to stay informed and up-to-date with the latest market developments. One way to do this is by setting up market alerts, which can notify investors of significant changes in 2-year treasury yields today. Additionally, following reputable economic news sources and analyzing yield curves can provide valuable insights into market trends and sentiment. By monitoring the 2 year treasury yield today and staying informed about market fluctuations, investors can make more informed investment decisions and adjust their strategies accordingly. Furthermore, analyzing yield curves can help investors identify potential opportunities and risks in the bond market, allowing them to adjust their portfolios and minimize potential losses. By staying ahead of market fluctuations, investors can gain a competitive edge and make more informed investment decisions.

The Relationship Between 2-Year Treasury Yields and Economic Indicators

The 2-year treasury yield today is closely tied to various economic indicators, providing valuable insights into the overall health of the economy. One of the most significant correlations is between 2-year treasury yields and GDP growth. As GDP growth increases, 2-year treasury yields tend to rise, reflecting the increased demand for borrowing and the subsequent increase in short-term interest rates. Conversely, during periods of slow economic growth, 2-year treasury yields tend to decline, reflecting the decreased demand for borrowing and the subsequent decrease in short-term interest rates. Additionally, 2-year treasury yields are also closely linked to inflation rates, with rising inflation often leading to higher 2-year treasury yields as investors demand higher returns to compensate for the erosion of purchasing power. Furthermore, 2-year treasury yields are also influenced by unemployment rates, with low unemployment rates often leading to higher 2-year treasury yields as the economy approaches full capacity. By understanding the relationships between 2-year treasury yields and these key economic indicators, investors can gain a better understanding of the overall economic landscape and make more informed investment decisions.

What Do Changes in 2-Year Treasury Yields Mean for Investors?

Changes in 2-year treasury yields can have significant implications for investors, impacting their investment strategies and overall portfolio performance. When 2-year treasury yields rise, bond prices tend to fall, as investors demand higher returns to compensate for the increased risk. This can lead to losses for investors holding existing bonds, particularly those with longer durations. On the other hand, rising 2-year treasury yields can also lead to increased returns for investors who invest in new bonds at the higher yields. In terms of stock market performance, changes in 2-year treasury yields can also have an impact, as rising yields can lead to increased borrowing costs for companies, potentially negatively impacting their stock prices. Furthermore, changes in 2-year treasury yields can also affect portfolio diversification, as investors may need to rebalance their portfolios to maintain an optimal asset allocation. By understanding the implications of changes in 2-year treasury yields, investors can adjust their strategies to minimize potential losses and maximize returns. For example, investors can consider investing in shorter-duration bonds or diversifying their portfolios with other asset classes to mitigate the impact of rising 2-year treasury yields. By staying informed about the 2 year treasury yield today, investors can make more informed investment decisions and navigate the complexities of the bond market.

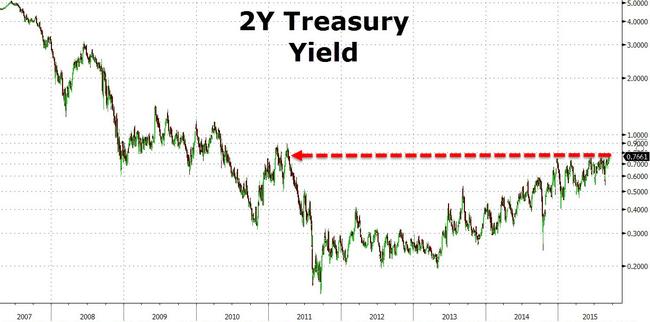

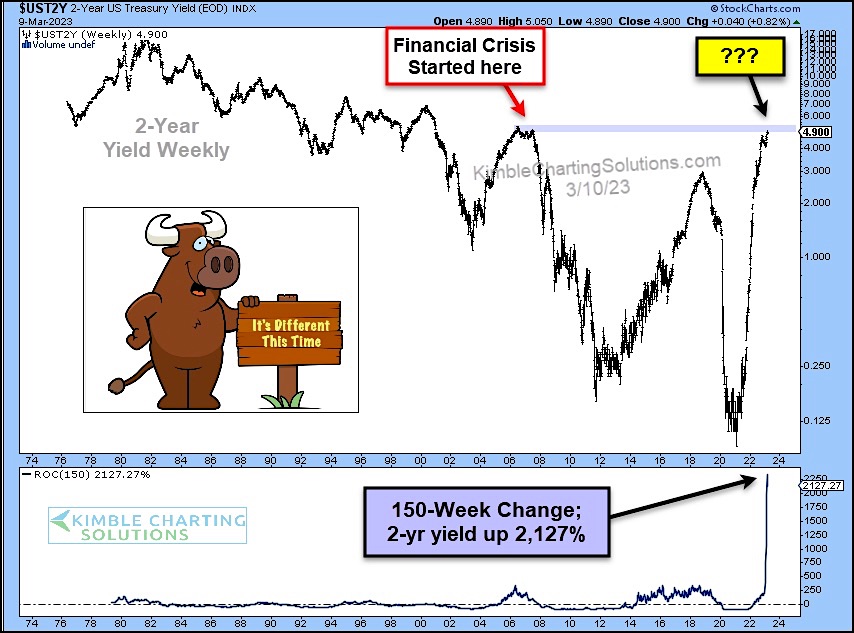

A Historical Perspective on 2-Year Treasury Yields

Examining historical trends in 2-year treasury yields provides valuable insights into their behavior during different economic cycles and the impact of monetary policy decisions. During times of economic expansion, 2-year treasury yields tend to rise, reflecting the increased demand for borrowing and the subsequent increase in short-term interest rates. Conversely, during periods of economic contraction, 2-year treasury yields tend to decline, reflecting the decreased demand for borrowing and the subsequent decrease in short-term interest rates. For example, during the 2008 financial crisis, 2-year treasury yields plummeted to near zero as the Federal Reserve implemented quantitative easing to stimulate the economy. In contrast, during the post-crisis period, 2-year treasury yields gradually increased as the economy recovered and the Federal Reserve began to normalize monetary policy. By analyzing these historical trends, investors can gain a better understanding of how 2-year treasury yields respond to different economic conditions and monetary policy decisions, allowing them to make more informed investment decisions. For instance, investors can use historical data to identify patterns and trends in 2-year treasury yields, which can help them anticipate potential changes in the 2 year treasury yield today and adjust their investment strategies accordingly.

Comparing 2-Year Treasury Yields to Other Short-Term Bond Options

When considering short-term bond investments, investors often compare 2-year treasury yields to other options, such as commercial paper and certificates of deposit (CDs). Each of these options has its own unique characteristics, benefits, and drawbacks. Commercial paper, for instance, is a short-term debt instrument issued by companies to raise capital, typically with maturities ranging from a few days to a year. While commercial paper offers higher yields than 2-year treasury yields, it also carries higher credit risk, as investors are exposed to the issuer’s default risk. CDs, on the other hand, are time deposits offered by banks with fixed interest rates and maturities, typically ranging from a few months to five years. CDs tend to offer lower yields than 2-year treasury yields but provide a higher degree of safety and liquidity. In contrast, 2-year treasury yields offer a risk-free return, backed by the full faith and credit of the US government, making them an attractive option for investors seeking a low-risk, short-term investment. By understanding the benefits and drawbacks of each option, investors can make informed decisions about their short-term bond investments, taking into account their individual risk tolerance, investment horizon, and return expectations. For example, investors seeking a low-risk, short-term investment may prefer 2-year treasury yields, while those seeking higher returns may opt for commercial paper or CDs. By staying informed about the 2 year treasury yield today, investors can make more informed decisions about their short-term bond investments and optimize their portfolios.

The Role of 2-Year Treasury Yields in Portfolio Management

In portfolio management, 2-year treasury yields play a crucial role as a risk-free asset, a hedge against inflation, and a diversification tool. As a risk-free asset, 2-year treasury yields provide a safe haven for investors seeking to reduce their exposure to market volatility. By allocating a portion of their portfolio to 2-year treasury yields, investors can mitigate potential losses and stabilize their returns. Additionally, 2-year treasury yields serve as a hedge against inflation, as their yields tend to increase with rising inflation expectations. This makes them an attractive option for investors seeking to protect their purchasing power over time. Furthermore, 2-year treasury yields can be used as a diversification tool, helping to reduce portfolio risk by spreading investments across different asset classes. By incorporating 2-year treasury yields into their portfolios, investors can create a more balanced and resilient investment strategy. For instance, investors can use 2-year treasury yields to offset the risks associated with equities or other higher-yielding investments, thereby optimizing their overall portfolio performance. By staying informed about the 2 year treasury yield today, investors can make more informed decisions about their portfolio allocations and adjust their strategies accordingly.

Staying Informed About 2-Year Treasury Yields in Real-Time

To make informed investment decisions, it is essential to stay up-to-date with the latest 2-year treasury yield data. Fortunately, there are several resources and tools available to help investors track 2-year treasury yields in real-time. Government websites, such as the US Department of the Treasury, provide daily updates on 2-year treasury yields, as well as historical data and charts. Financial news sources, including Bloomberg and Reuters, also offer real-time data and analysis on 2-year treasury yields. Additionally, market data platforms, such as Yahoo Finance and Google Finance, provide investors with access to current and historical 2-year treasury yield data, as well as tools to analyze and compare yields across different maturities. By leveraging these resources, investors can stay informed about the 2 year treasury yield today and make more informed decisions about their investment strategies. Furthermore, investors can set up market alerts and notifications to receive updates on changes in 2-year treasury yields, ensuring they stay ahead of market fluctuations. By staying informed and up-to-date, investors can optimize their portfolios and achieve their investment goals.