Understanding the Mechanics of 2-Year T-Note Futures

Treasury futures are derivative contracts that represent an agreement to buy or sell a specific U.S. Treasury bond at a predetermined price on a future date. These contracts serve as a crucial instrument for investors and institutions looking to manage risk, speculate on interest rate movements, or gain exposure to the bond market without directly owning the underlying assets. This article specifically focuses on the 2 year treasury yield futures, exploring their unique characteristics and role within the broader fixed income landscape. Unlike the cash market, where actual bonds are traded, the futures market facilitates the trading of contracts that derive their value from the expected price of these bonds. The cash market involves the immediate exchange of the bond for cash, while the futures market trades obligations to buy or sell at a future time, making it a leveraged market. The 2 year treasury yield futures are particularly sensitive to short-term interest rate changes and are widely used by market participants to express views on the future direction of these rates. Their fundamental role in fixed income markets is to provide a mechanism for price discovery and risk management. These futures are a cornerstone for financial institutions and other big players to hedge their portfolios and manage interest rate exposures, reflecting the interplay between market expectations and policy decisions.

The mechanics of 2 year treasury yield futures involve a standardized contract size, delivery date, and quality specification. These futures are traded on exchanges, providing liquidity and transparency. Participants use margins to secure their positions, which can magnify both profits and losses based on the price movement of the contract. Investors use these futures contracts to express their views on where the 2-year treasury yields are headed. These futures contracts are linked to the underlying cash treasury bond market, but are not the same. The futures price reflects the implied future cash price, incorporating the cost of carry, which takes into account the financing costs of owning the bond. Therefore, differences may arise from expectations of future yields, market liquidity and other factors. Understanding the nuances between the cash and futures markets is vital for traders and investors engaging in these instruments. The 2 year treasury yield futures market is a dynamic arena where changes in interest rates and economic events can lead to price volatility and opportunity. Their robust activity provides key insights into the financial markets.

What Drives Fluctuations in Short-Term Treasury Futures?

The price of 2 year treasury yield futures is primarily dictated by the intricate interplay of interest rates and investor sentiment. A fundamental principle in fixed income markets is the inverse relationship between bond prices and interest rates; as interest rates rise, the value of existing bonds, and consequently their associated futures contracts, tends to decrease, and vice-versa. This dynamic is crucial to understanding the fluctuations seen in the 2 year treasury yield futures market. When the Federal Reserve announces rate hikes or signals a hawkish monetary policy stance, market participants often respond by selling these futures contracts, anticipating a decline in their price. Conversely, dovish announcements or indications of potential rate cuts typically trigger buying activity, driving up the prices of 2 year treasury yield futures. This sensitivity to interest rate movements underscores the importance of closely monitoring central bank communications and monetary policy trajectories.

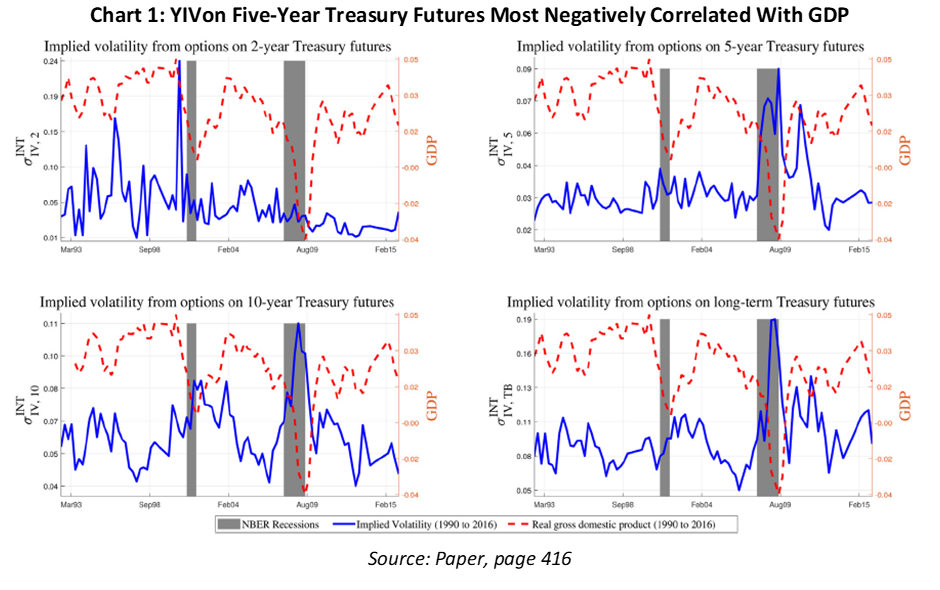

Inflation expectations also play a pivotal role in shaping the price of short-term treasury futures. If market participants anticipate an increase in inflation, they may demand higher yields on government bonds to compensate for the erosion of purchasing power, thus pushing bond prices and their corresponding 2 year treasury yield futures down. Conversely, lower inflation expectations can lead to a rally in bond prices and a rise in futures. Furthermore, broader economic conditions, including GDP growth, employment levels, and consumer confidence, significantly influence investor behavior. For instance, robust economic growth might trigger expectations of rising interest rates and inflationary pressures, leading to selling pressure on 2 year treasury yield futures, while a weaker economy might result in investors seeking the perceived safety of government bonds, driving up their prices and associated futures contracts. Hence, the futures prices are often a reflection of the complex assessment of the macroeconomic landscape by market participants and therefore, are constantly fluctuating.

How to Leverage 2-Year T-Note Futures for Portfolio Management

The versatility of 2 year treasury yield futures extends beyond mere speculation, offering significant value for strategic portfolio management. These contracts serve as powerful tools for hedging against potential adverse movements in interest rates, a crucial function for those holding fixed-income assets. For instance, an investor with a large portfolio of bonds sensitive to rate increases can mitigate risk by shorting 2 year treasury yield futures. If interest rates rise, leading to a decrease in bond values, the profit from the futures position can offset some of the losses in the cash market. Conversely, those anticipating a decline in interest rates might take long positions in these futures contracts, aiming to profit from the subsequent price increases. This allows investors to implement proactive strategies based on their market expectations. The dynamic nature of 2 year treasury yield futures also means that adjustments to a portfolio’s exposure can be done efficiently, without having to rebalance through potentially expensive bond transactions. This flexibility is a major advantage in rapidly changing economic environments, allowing for precise control over the risk profile.

Furthermore, traders also use 2 year treasury yield futures as a tool to speculate on interest rate moves. Instead of directly purchasing bonds, a trader can buy the futures contracts, which offers a leveraged way to capture short-term price changes influenced by factors like inflation reports or monetary policy decisions. This speculation isn’t just limited to directional bets; more complex strategies like spread trading – betting on the difference in yields between different maturities – also heavily rely on the short-term 2 year treasury yield futures. Understanding the nuances of how these contracts are priced and how they react to various economic indicators is key for successfully leveraging them for portfolio goals. The power lies in their ability to offer tailored responses to various market conditions, making them valuable instruments for both experienced and newer participants in the market. However, since these strategies can be complex, traders should be aware of the risks inherent in futures trading, especially leverage, which amplifies both gains and losses.

Navigating the Risks Associated With Short-Term Treasury Futures

Engaging with 2 year treasury yield futures, while offering opportunities for profit, also entails significant risks that traders and investors must understand. A primary concern stems from the inherent leverage associated with futures contracts. Leverage allows market participants to control a substantial notional value of the underlying asset with a relatively small initial margin deposit. While this can magnify potential gains, it also amplifies losses. For instance, a seemingly minor adverse price movement in the 2 year treasury yield futures market can result in substantial financial implications for a trader. Therefore, a thorough grasp of margin requirements and their effects on account balances is critical. Moreover, these contracts are not traded on a central exchange, which is why it is crucial to comprehend the contract specifications fully, this includes delivery dates, tick size, and other contract-specific details. Lack of familiarity with these aspects can lead to operational errors and unexpected financial exposures. The volatile nature of interest rates also contributes to the risk of trading 2 year treasury yield futures. Unexpected announcements by the Federal Reserve, changes in inflation expectations, or shifts in geopolitical conditions can cause sudden and significant price fluctuations. Market volatility, therefore, makes it essential to have a solid risk management plan to mitigate potential losses.

Another important factor to consider is the potential for liquidity risk, especially during periods of market stress. While the 2 year treasury yield futures market is generally liquid, liquidity can dry up during times of high volatility, making it difficult to exit positions at desired prices. This can lead to greater losses than initially anticipated. Furthermore, the impact of interest rate movements on these contracts needs to be carefully considered. The inverse relationship between interest rates and bond prices means that if interest rates rise, the price of 2 year treasury yield futures typically declines, and vice versa. Traders who do not fully grasp these dynamics face the risk of making incorrect trading decisions. Finally, it is imperative to be aware of the impact of time decay on these futures contracts. As the delivery date approaches, the contract price becomes more sensitive to market movements. A clear understanding of these risks combined with a well-defined trading strategy, is essential for participating successfully in the 2 year treasury yield futures market and mitigating potential losses, where the impact of leverage is a constant factor.

A Comparison: Examining the Yield Curve and Futures Behavior

The relationship between the 2 year treasury yield futures and the broader yield curve is crucial for understanding market dynamics. The yield curve, which plots yields of government bonds across various maturities, provides a snapshot of market expectations for interest rates. The 2-year yield, representing the return on bonds maturing in two years, is a key point on this curve. It’s important to understand that the 2 year treasury yield futures contracts are directly influenced by these underlying yields. A typical yield curve shows short-term yields, like the 2-year, below longer-term yields (such as the 10-year), reflecting a normal economic environment. When short-term yields rise faster than long-term yields, the curve flattens. Conversely, if long-term yields increase more than short-term yields, the curve steepens. These changes in the yield curve can significantly impact the behavior of 2 year treasury yield futures.

Understanding the yield curve is essential for traders working with 2 year treasury yield futures because it offers a broader context for interest rate expectations. A steepening curve, for instance, typically suggests expectations of higher future growth and inflation, potentially leading to increases in the 2-year yield and a corresponding decline in 2 year treasury yield futures prices. On the other hand, a flattening or inverted curve, where short-term yields are higher than long-term yields, might indicate an anticipated slowdown in the economy and potential future interest rate cuts, driving prices of the 2 year treasury yield futures up. For example, a situation where the 2-year yield is higher than the 10-year yield may cause investors to anticipate that central banks will soon lower short-term rates. Therefore, keeping track of the shape of the yield curve and changes in its slope may offer traders a broader view of potential market moves. These changes can impact the trading of these 2 year treasury yield futures and can serve as a good tool to identify investment opportunities.

Analyzing the Influence of Economic Data Releases on Treasury Futures

Economic data releases serve as critical catalysts that frequently trigger notable price movements in 2 year treasury yield futures. Scheduled announcements, such as the Consumer Price Index (CPI), Gross Domestic Product (GDP) reports, and monthly employment figures, are closely scrutinized by market participants to gauge the overall health of the economy and anticipate future Federal Reserve policy decisions. When these figures deviate significantly from expectations, they often lead to pronounced shifts in market sentiment, consequently affecting 2 year treasury yield futures. For example, a higher-than-expected CPI reading may fuel concerns about rising inflation, prompting traders to price in potential interest rate hikes by the Federal Reserve. This would typically lead to a decline in the price of 2 year treasury yield futures, as yields and prices move inversely. Conversely, weaker-than-anticipated economic growth, as indicated by GDP or employment figures, might suggest a potential pause or cut in interest rates, causing the price of 2 year treasury yield futures to increase. The speed and magnitude of these reactions underscore the importance of closely monitoring economic data releases when engaging with the market for 2 year treasury yield futures.

The interpretation of economic data is not always straightforward. Market participants must analyze the numbers in context, taking into account various factors such as revisions to previous data and the underlying trend over several periods. This analysis is crucial for anticipating how the Federal Reserve might react to the latest economic news. A central bank that emphasizes price stability might respond to inflation risks more aggressively by hiking interest rates, while one focusing on full employment might tolerate a bit more inflation. The market’s assessment of the Federal Reserve’s expected reaction often drives the movement in the 2 year treasury yield futures market after the release of key data points. Furthermore, not all economic data releases have an equal influence on the 2 year treasury yield futures. Some reports, particularly those that provide indications about future inflation and Federal Reserve policy, often have a greater impact than others. Therefore, investors and traders need to be adept at determining the significance of each economic indicator and understanding the nuanced dynamics within the 2 year treasury yield futures market, as these factors interact in real-time.

Strategies for Trading 2 Year Treasury Notes

An introductory overview of common trading strategies associated with 2 year treasury yield futures reveals a landscape of opportunities for those seeking to navigate the short-term US government debt market. These strategies, while often complex in their execution, are underpinned by fundamental concepts related to interest rate speculation and risk management. One popular approach is spread trading, which involves simultaneously taking a long position in one futures contract and a short position in another, aiming to profit from the relative price difference between the two. This is often done across different maturities or even different types of fixed-income instruments. The core principle is that even if broad market movements occur, the price difference between these assets might still present a profitable opportunity. Another approach for trading 2 year treasury yield futures involves calendar strategies, also known as time spreads, which entail buying and selling futures contracts with different expiration dates. These strategies are particularly sensitive to the shape of the yield curve and the implied forward rates. For example, traders might anticipate changes in the slope of the curve and position themselves to profit from the expected evolution of short-term rates as reflected in the prices of contracts that expire at different points in time. These introductory strategies form part of the toolkit for trading 2 year treasury yield futures, which demands a thorough understanding of market dynamics, risk tolerance and access to suitable trading platforms.

While spread and calendar trading form a significant part of the strategies employed with 2 year treasury yield futures, it is crucial to recognize that their implementation is not straightforward and often requires advanced knowledge and tools. Spread trades can be constructed using different parts of the yield curve, allowing traders to express their views about the direction or the speed of movement of specific parts of the interest rate landscape. For instance, traders can bet on the relationship between 2 year treasury yield futures and the 5 year treasury yield futures by going long one and short the other, anticipating a specific pattern in the way that short and medium term rates might behave. Calendar strategies, on the other hand, focus more on the time dimension. By trading contracts with different expiry dates, traders are essentially speculating on how the implied forward rates, or future interest rates, will develop. The complexity arises from the number of variables at play including the shape of the yield curve, which often reflects the market’s overall expectations and risk appetite. It is imperative that traders grasp the core principles before attempting these strategies and always consider the inherent volatility that comes with trading 2 year treasury yield futures.

Outlook for the Short-Term US Government Debt Market

The current landscape for the short-term US government debt market presents a complex interplay of economic factors, influencing the trajectory of 2 year treasury yield futures. Prevailing market conditions suggest a heightened sensitivity to incoming economic data, particularly concerning inflation and employment. Federal Reserve policy decisions remain pivotal, with expectations for future rate adjustments heavily shaping the sentiment around 2 year treasury yield futures. Geopolitical events and global economic trends also contribute to the overall volatility experienced in this sector. Market participants should also be aware of the yield curve, as its current shape and any changes in its steepness can serve as an important indicator of future expectations and influence how investors position themselves within the market. The current outlook underscores the dynamic nature of the short-term debt market, where continuous monitoring of these key variables is essential for navigating the fluctuations in 2 year treasury yield futures.

Looking ahead, the market for 2 year treasury yield futures is expected to remain responsive to the evolving macroeconomic environment. Potential shifts in inflation metrics could prompt adjustments in monetary policy, creating ripple effects across the yield curve and impacting the pricing of 2 year treasury yield futures. Moreover, any unforeseen global events or domestic policy changes may introduce additional uncertainty into the short-term government debt market, potentially leading to increased price swings and heightened volatility. The interplay between these factors emphasizes the need for astute risk management and a solid understanding of the underlying drivers behind these contracts. This forward-looking perspective acknowledges that the market is ever-changing and requires constant vigilance to stay informed about the potential impact on 2 year treasury yield futures. While this is not financial advice, market participants can use this information to build their own strategies.