What Drives the 2-Year Treasury Rate?

The 2-year treasury rate today is influenced by a complex array of factors, including monetary policy, economic indicators, and market sentiment. At the heart of these influences lies the Federal Reserve, the central banking system of the United States. The Fed plays a crucial role in setting interest rates, which in turn affects the 2-year treasury rate. The Federal Open Market Committee (FOMC), a branch of the Fed, meets regularly to assess the state of the economy and adjust interest rates accordingly.

Monetary policy decisions are based on a range of economic indicators, such as GDP growth, inflation, and unemployment rates. The Fed uses these indicators to gauge the overall health of the economy and determine the appropriate stance of monetary policy. For instance, during times of economic downturn, the Fed may lower interest rates to stimulate borrowing and spending. Conversely, when the economy is growing rapidly, the Fed may raise interest rates to prevent inflation and maintain economic stability.

Market sentiment also plays a significant role in shaping the 2-year treasury rate. Investor expectations and market psychology can influence the demand for treasury securities, which in turn affects the interest rate. For example, if investors are optimistic about the economy’s prospects, they may be more likely to invest in riskier assets, such as stocks, rather than treasury securities. This reduced demand for treasury securities can lead to higher interest rates.

In addition to these factors, the 2-year treasury rate today is also influenced by global economic trends and geopolitical events. For instance, a rise in global tensions or a slowdown in international trade can lead to increased demand for safe-haven assets, such as treasury securities, which can drive down interest rates.

How to Track the 2-Year Treasury Rate in Real-Time

Staying up-to-date with the latest 2-year treasury rate today is crucial for investors, policymakers, and anyone interested in understanding the dynamics of the economy. Fortunately, accessing current and historical 2-year treasury rate data is relatively straightforward, thanks to a range of reliable sources.

The U.S. Department of the Treasury is a primary source for 2-year treasury rate data, providing daily updates on its website. The Department of the Treasury also offers historical data on the 2-year treasury rate, allowing users to track changes over time. Similarly, the Federal Reserve, the central banking system of the United States, publishes data on the 2-year treasury rate as part of its broader economic indicators.

In addition to these official sources, financial news websites and data providers, such as Bloomberg, Reuters, and Yahoo Finance, offer real-time data on the 2-year treasury rate. These sources often provide interactive charts and graphs, allowing users to visualize trends and patterns in the data.

For those seeking more in-depth analysis, financial data providers, such as Quandl and Alpha Vantage, offer APIs and datasets that can be used to build custom applications and models. These resources are particularly useful for investors and researchers seeking to incorporate the 2-year treasury rate into their investment strategies or economic models.

By leveraging these sources, individuals can stay informed about the latest developments in the 2-year treasury rate today and make more informed investment decisions.

The Impact of the 2-Year Treasury Rate on the Economy

Changes in the 2-year treasury rate today have a ripple effect on the broader economy, influencing borrowing costs, consumer spending, and business investment. When the 2-year treasury rate rises, it becomes more expensive for consumers and businesses to borrow money, which can lead to a decrease in spending and investment. This, in turn, can slow down economic growth and potentially even lead to a recession.

On the other hand, a decrease in the 2-year treasury rate can stimulate economic growth by making borrowing cheaper and increasing consumer and business confidence. Lower borrowing costs can also lead to an increase in housing prices and a boost in the construction industry, as consumers take advantage of lower mortgage rates.

The 2-year treasury rate also has a significant impact on the stock market and other financial assets. When the rate rises, it can lead to a decrease in stock prices, as investors become more risk-averse and seek safer assets, such as treasury securities. Conversely, a decrease in the rate can lead to an increase in stock prices, as investors become more confident in the economy and seek higher returns.

In addition, the 2-year treasury rate influences the value of the US dollar. When the rate rises, it can lead to an appreciation of the dollar, as foreign investors seek higher returns in the US market. This, in turn, can lead to an increase in exports and a boost to the overall economy.

Overall, the 2-year treasury rate plays a critical role in shaping the economy, and changes in the rate can have far-reaching consequences for consumers, businesses, and investors. By understanding the impact of the 2-year treasury rate, individuals can make more informed investment decisions and better navigate the complexities of the economy.

Comparing the 2-Year Treasury Rate to Other Short-Term Rates

When analyzing the 2-year treasury rate today, it’s essential to consider its relationship with other short-term interest rates, such as the 3-month and 1-year treasury rates. Understanding the differences between these rates can provide valuable insights for investors and help them make more informed investment decisions.

The 3-month treasury rate, also known as the 3-month T-bill rate, is a shorter-term rate that reflects the market’s expectations for short-term interest rates. The 1-year treasury rate, on the other hand, is a longer-term rate that reflects the market’s expectations for interest rates over a slightly longer horizon. The 2-year treasury rate falls in between these two rates, providing a mid-term perspective on interest rates.

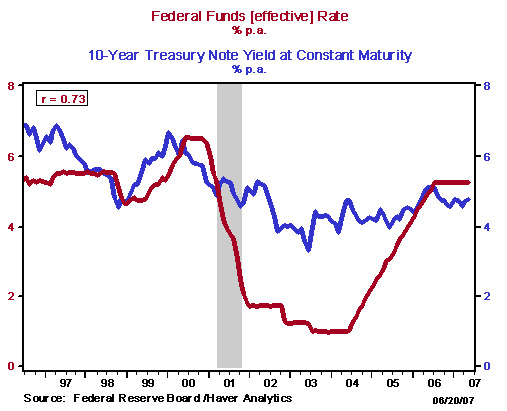

One key difference between these rates is their sensitivity to changes in monetary policy. The 3-month treasury rate is more sensitive to changes in the Federal Reserve’s target federal funds rate, while the 1-year treasury rate is more influenced by longer-term economic trends. The 2-year treasury rate, being a mid-term rate, is influenced by both short-term and long-term factors.

For investors, understanding these differences is crucial when constructing a portfolio. For example, investors seeking to minimize risk may prefer the 3-month treasury rate, which is less volatile than the 2-year treasury rate. On the other hand, investors seeking to maximize returns may prefer the 1-year treasury rate, which offers a slightly higher yield than the 2-year treasury rate.

In addition, analyzing the spread between these rates can provide valuable insights into market expectations. For instance, a widening spread between the 2-year treasury rate and the 3-month treasury rate may indicate that the market expects interest rates to rise in the short term. Conversely, a narrowing spread may indicate that the market expects interest rates to fall.

By comparing the 2-year treasury rate to other short-term rates, investors can gain a deeper understanding of the market’s expectations and make more informed investment decisions. Whether seeking to minimize risk or maximize returns, understanding the relationships between these rates is essential for navigating the complexities of the fixed-income market.

The Relationship Between the 2-Year Treasury Rate and Inflation

The 2-year treasury rate today is closely tied to inflation expectations, as investors and policymakers alike closely monitor the relationship between these two key economic indicators. Inflation, or the rate of change in prices of goods and services, plays a critical role in shaping monetary policy decisions, and the 2-year treasury rate reflects the market’s expectations for future inflation.

When inflation expectations rise, the 2-year treasury rate tends to increase, as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, when inflation expectations fall, the 2-year treasury rate tends to decrease, as investors are willing to accept lower returns in a low-inflation environment.

The Federal Reserve, the central bank of the United States, closely monitors inflation expectations when setting monetary policy. The Fed’s dual mandate of maximum employment and price stability means that it seeks to keep inflation within a target range of 2% annual growth. When inflation expectations deviate from this target, the Fed may adjust interest rates to influence borrowing costs and aggregate demand.

The 2-year treasury rate is particularly sensitive to changes in inflation expectations, as it reflects the market’s expectations for short-term interest rates. When inflation expectations rise, the 2-year treasury rate may increase more rapidly than longer-term rates, such as the 10-year treasury rate, as investors become more concerned about short-term inflation risks.

For investors, understanding the relationship between the 2-year treasury rate and inflation expectations is crucial for making informed investment decisions. By monitoring the 2-year treasury rate, investors can gain insights into the market’s expectations for future inflation and adjust their portfolios accordingly. For example, investors seeking to protect against inflation risks may prefer to invest in treasury securities with shorter maturities, such as the 2-year treasury rate, which are more sensitive to changes in inflation expectations.

In conclusion, the 2-year treasury rate and inflation expectations are closely intertwined, with changes in one influencing the other. By understanding this relationship, investors and policymakers can make more informed decisions about interest rates, borrowing costs, and investment strategies.

Using the 2-Year Treasury Rate to Inform Investment Decisions

Investors seeking to navigate the complexities of the fixed-income market can benefit from incorporating the 2-year treasury rate into their investment strategies. The 2-year treasury rate today serves as a valuable indicator of market expectations for short-term interest rates, providing insights into the direction of monetary policy and the overall health of the economy.

One key way to utilize the 2-year treasury rate is by incorporating treasury securities into a diversified investment portfolio. Treasury securities, such as 2-year treasury notes, offer a low-risk asset class that can help mitigate portfolio risk and provide a stable source of returns. By allocating a portion of their portfolio to treasury securities, investors can reduce their exposure to market volatility and lock in a fixed return.

The 2-year treasury rate can also serve as a benchmark for evaluating the performance of other fixed-income investments. For example, investors considering investing in corporate bonds or commercial paper can compare the yields offered by these investments to the 2-year treasury rate. This can help investors determine whether the additional credit risk associated with these investments is adequately compensated by the higher yields offered.

In addition, the 2-year treasury rate can inform investment decisions by providing insights into the direction of monetary policy. When the 2-year treasury rate is rising, it may indicate that the Federal Reserve is tightening monetary policy, which can lead to higher borrowing costs and slower economic growth. Conversely, when the 2-year treasury rate is falling, it may indicate that the Fed is easing monetary policy, which can lead to lower borrowing costs and faster economic growth.

By incorporating the 2-year treasury rate into their investment strategies, investors can make more informed decisions about asset allocation, risk management, and return expectations. Whether seeking to minimize risk or maximize returns, understanding the 2-year treasury rate today can provide valuable insights into the fixed-income market and help investors achieve their investment goals.

Historical Trends and Patterns in the 2-Year Treasury Rate

A historical analysis of the 2-year treasury rate reveals several trends and patterns that have shaped the rate over time. One notable trend is the inverse relationship between the 2-year treasury rate and the unemployment rate. During periods of high unemployment, the 2-year treasury rate tends to be lower, as the Federal Reserve seeks to stimulate economic growth through monetary easing. Conversely, during periods of low unemployment, the 2-year treasury rate tends to be higher, as the Fed seeks to prevent the economy from overheating.

Another significant pattern in the 2-year treasury rate is its response to changes in inflation expectations. During the 1970s and 1980s, the 2-year treasury rate rose sharply in response to high inflation, as investors demanded higher returns to compensate for the erosion of purchasing power. In contrast, during the 1990s and 2000s, the 2-year treasury rate fell as inflation expectations declined, reflecting the Fed’s success in achieving price stability.

The 2-year treasury rate has also been influenced by significant events, such as the 2008 global financial crisis. In response to the crisis, the Fed lowered the federal funds rate to near zero, causing the 2-year treasury rate to plummet. The subsequent quantitative easing programs implemented by the Fed also had a profound impact on the 2-year treasury rate, as the central bank’s purchases of treasury securities helped to keep rates low.

In recent years, the 2-year treasury rate has been influenced by the Fed’s gradual tightening of monetary policy. As the economy has strengthened, the Fed has raised the federal funds rate, causing the 2-year treasury rate to rise. Today, the 2-year treasury rate is closely watched by investors and policymakers alike, as it provides insights into the market’s expectations for future economic growth, inflation, and monetary policy.

By examining the historical trends and patterns in the 2-year treasury rate, investors and policymakers can gain a deeper understanding of the factors that influence the rate and make more informed decisions about investment strategies and monetary policy. Whether seeking to navigate the complexities of the fixed-income market or inform policy decisions, a thorough understanding of the 2-year treasury rate today is essential.

What the 2-Year Treasury Rate Reveals About the Market’s Expectations

The 2-year treasury rate today serves as a valuable indicator of market expectations for future economic growth, inflation, and monetary policy. By analyzing the 2-year treasury rate, investors and policymakers can gain insights into the market’s outlook for the economy and make more informed decisions.

A rising 2-year treasury rate, for example, may indicate that the market expects the Federal Reserve to tighten monetary policy in response to stronger economic growth or higher inflation expectations. Conversely, a falling 2-year treasury rate may suggest that the market expects the Fed to ease monetary policy in response to slower economic growth or lower inflation expectations.

The 2-year treasury rate also provides insights into the market’s expectations for future inflation. When inflation expectations rise, the 2-year treasury rate tends to increase, as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, when inflation expectations decline, the 2-year treasury rate tends to decrease, reflecting the reduced risk of inflation.

In addition, the 2-year treasury rate reveals the market’s expectations for future economic growth. A rising 2-year treasury rate may indicate that the market expects stronger economic growth, while a falling 2-year treasury rate may suggest that the market expects slower economic growth.

By interpreting the 2-year treasury rate as a reflection of market expectations, investors and policymakers can make more informed decisions about investment strategies and monetary policy. Whether seeking to navigate the complexities of the fixed-income market or inform policy decisions, a thorough understanding of the 2-year treasury rate today is essential.

As the 2-year treasury rate continues to evolve in response to changing market conditions, it remains a critical component of the fixed-income market, providing valuable insights into the market’s expectations for future economic growth, inflation, and monetary policy.