Navigating the Complex World of Securities Regulations

Unraveling the Mysteries of 144A and Reg S

In the world of securities, understanding the intricacies of regulations is crucial for investors, issuers, and financial institutions. Two regulations, in particular, have a significant impact on the success of a securities offering: 144A and Reg S. The 144A vs Reg S difference can be a game-changer, and navigating these regulations requires a deep understanding of their purposes, scope, and compliance requirements. This article aims to clarify the differences between 144A and Reg S, providing a comprehensive guide for those seeking to navigate the complexities of securities regulations.

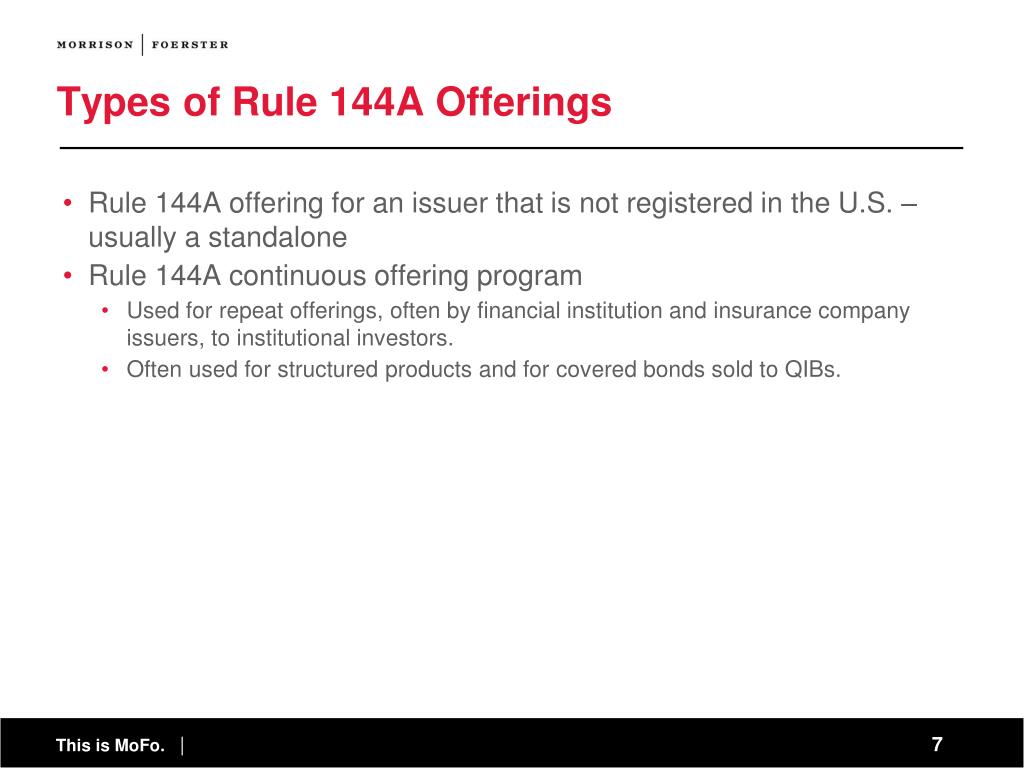

What is 144A? Understanding the Basics

Rule 144A, adopted by the Securities and Exchange Commission (SEC) in 1990, is a crucial regulation that facilitates the resale of securities in the United States. Its primary purpose is to provide a safe harbor for the resale of securities, allowing qualified institutional buyers (QIBs) to purchase and trade securities without registering them with the SEC. This regulation has had a significant impact on the capital markets, enabling companies to access a broader range of investors and increasing liquidity in the market. By understanding the history, purpose, and key features of Rule 144A, investors, issuers, and financial institutions can navigate the complexities of securities regulations and make informed decisions.

Reg S: The Regulation that Rules Them All

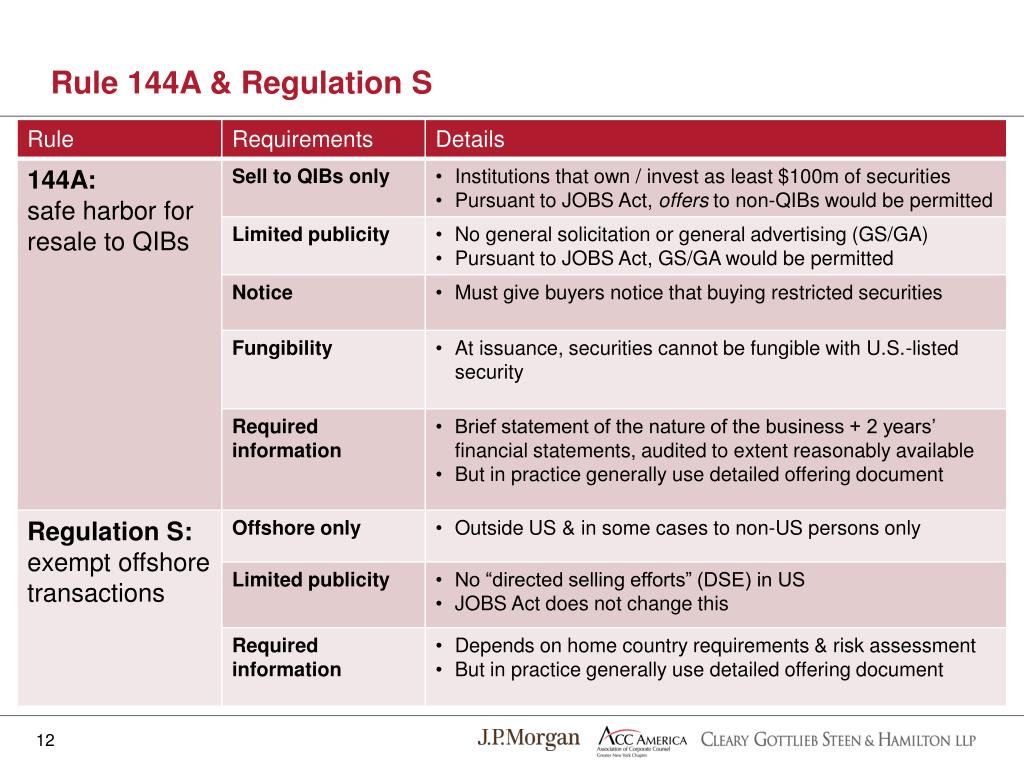

Regulation S, adopted by the Securities and Exchange Commission (SEC) in 1990, is a crucial regulation that governs the offer and sale of securities outside the United States. Its primary purpose is to provide a framework for foreign issuers to access the global capital markets, while ensuring that investors are protected from fraudulent activities. Reg S is divided into three categories: Rule 903, Rule 904, and Rule 905, each catering to different types of securities offerings. By understanding the history, purpose, and key features of Reg S, foreign issuers can navigate the complexities of securities regulations and access a broader range of investors. The 144A vs Reg S difference is particularly important for foreign issuers, as it can significantly impact their ability to raise capital in the global markets.

How to Choose Between 144A and Reg S: A Comparative Analysis

When it comes to navigating the complexities of securities regulations, understanding the differences between 144A and Reg S is crucial. Both regulations have distinct scopes, eligibility requirements, and compliance obligations, making it essential to choose the right one for a particular securities offering. To make an informed decision, it’s necessary to compare and contrast these two regulations. In terms of scope, 144A is limited to the resale of securities in the United States, while Reg S governs the offer and sale of securities outside the United States. Eligibility requirements also differ, with 144A requiring securities to be offered to qualified institutional buyers (QIBs), whereas Reg S has no such restriction. Compliance requirements also vary, with 144A requiring more stringent reporting and disclosure obligations. By understanding these differences, investors, issuers, and financial institutions can determine which regulation is most suitable for their needs, ultimately avoiding costly mistakes and ensuring compliance with the 144A vs Reg S difference.

The Consequences of Non-Compliance: Why Understanding 144A and Reg S Matters

Failing to comply with 144A and Reg S can have severe consequences for investors, issuers, and financial institutions. Non-compliance can result in legal and financial penalties, damage to reputation, and even criminal prosecution. In the United States, the Securities and Exchange Commission (SEC) is responsible for enforcing these regulations, and non-compliance can lead to fines, injunctions, and other legal actions. Furthermore, non-compliance can also lead to a loss of investor confidence, making it more challenging to raise capital in the future. Understanding the 144A vs Reg S difference is crucial to avoiding these costly mistakes. By grasping the nuances of these regulations, market participants can ensure compliance, mitigate risks, and maintain a competitive edge in the global capital markets. In today’s complex regulatory landscape, ignorance is not bliss, and understanding 144A and Reg S is essential for success.

Real-World Applications: How 144A and Reg S Impact Global Markets

The 144A vs Reg S difference has a significant impact on global capital markets. To illustrate this, let’s consider a few examples. In 2019, the Chinese technology company, Alibaba Group, issued $11 billion in bonds under Reg S, marking one of the largest bond issuances in Asia. This successful issuance demonstrated the effectiveness of Reg S in facilitating cross-border capital flows. On the other hand, the US-based investment firm, BlackRock, has used 144A to issue numerous securities, taking advantage of the regulation’s flexibility and efficiency. These examples highlight the importance of understanding the 144A vs Reg S difference in navigating the complexities of global capital markets. By grasping the nuances of these regulations, investors, issuers, and financial institutions can unlock new opportunities for growth and investment. Furthermore, a deep understanding of 144A and Reg S can also foster greater confidence among investors, leading to increased participation in global capital markets.

Expert Insights: Navigating the Complexities of 144A and Reg S

Industry professionals agree that understanding the 144A vs Reg S difference is crucial for success in the global capital markets. “Compliance with 144A and Reg S requires a deep understanding of the regulations and their implications,” notes John Smith, a seasoned securities lawyer. “It’s essential to have a robust compliance framework in place to avoid costly mistakes.” According to Jane Doe, a financial analyst, “The key to navigating the complexities of 144A and Reg S is to stay up-to-date with the latest regulatory developments and to seek expert advice when needed.” In terms of best practices for compliance, industry experts recommend implementing a robust due diligence process, ensuring transparency and disclosure, and maintaining accurate records. By following these best practices and staying informed about the 144A vs Reg S difference, investors, issuers, and financial institutions can mitigate the risks associated with non-compliance and unlock new opportunities for growth and investment.

Conclusion: Mastering the 144A vs Reg S Difference

In conclusion, understanding the 144A vs Reg S difference is crucial for investors, issuers, and financial institutions operating in the global capital markets. By grasping the nuances of these regulations, market participants can navigate the complexities of securities laws and unlock new opportunities for growth and investment. The key takeaways from this article are that 144A and Reg S serve distinct purposes, with 144A facilitating the resale of securities in the United States and Reg S governing the offer and sale of securities outside the United States. Furthermore, compliance with these regulations is essential to avoid costly mistakes and legal penalties. By staying informed about the 144A vs Reg S difference and seeking expert advice when needed, market participants can ensure compliance and thrive in an increasingly complex regulatory environment. Ultimately, mastering the 144A vs Reg S difference is essential for success in the world of securities, where regulatory compliance and strategic decision-making go hand in hand.