Understanding 13-Week Treasury Bills: Factors Influencing Yield

Treasury bills (T-bills) are short-term debt securities issued by the U.S. government. The 13-week T-bill, specifically, matures in three months. Its yield, or rate of return, is influenced by several key factors. Inflation expectations play a significant role. High inflation generally leads to higher yields as investors demand a greater return to compensate for the erosion of purchasing power. The Federal Reserve’s monetary policy is another critical driver. Interest rate hikes tend to increase 13 week treasury bill yield, while rate cuts usually lower it. The overall health of the economy also matters. During periods of economic uncertainty or recession fears, investors often flock to the safety of government securities, potentially driving up demand and lowering yields. Conversely, strong economic growth projections can sometimes push yields higher. Global market conditions, such as shifts in international capital flows or geopolitical events, can also influence the 13 week treasury bill yield, adding another layer of complexity to the picture. Understanding these interconnected factors is crucial for anyone seeking to navigate the world of short-term government debt.

The 13 week treasury bill yield reflects the market’s assessment of these various factors. Investors constantly weigh the risks and rewards associated with holding T-bills against other investment options. Changes in inflation expectations, central bank policies, and economic growth prospects can cause significant fluctuations in the 13 week treasury bill yield. These fluctuations provide valuable insights into investor sentiment and broader market trends. For example, a sudden increase in the 13 week treasury bill yield might signal growing concerns about inflation or economic instability. Conversely, a decrease could indicate increased confidence in the economy and a reduced demand for safe-haven assets. Analyzing the 13 week treasury bill yield in conjunction with other economic indicators can provide a more comprehensive understanding of the overall economic landscape. The yield offers a snapshot of market sentiment and investor expectations regarding future economic performance.

Analyzing the 13 week treasury bill yield requires understanding its relationship with other short-term interest rates. The yield isn’t isolated; it’s interconnected with broader financial market dynamics. For instance, changes in the federal funds rate, the target rate set by the Federal Reserve, directly impact short-term interest rates. This influence extends to the 13 week treasury bill yield, creating a ripple effect throughout the financial system. Furthermore, the yield on 13-week T-bills is often used as a benchmark for other short-term investments. Its relative attractiveness compared to other options, such as Certificates of Deposit (CDs) or money market accounts, can influence investor allocation decisions. Therefore, understanding the 13 week treasury bill yield requires considering its position within the broader spectrum of short-term interest rates and its impact on investor choice. It is a key element within the intricate web of financial markets.

How to Interpret the 13-Week Treasury Bill Yield

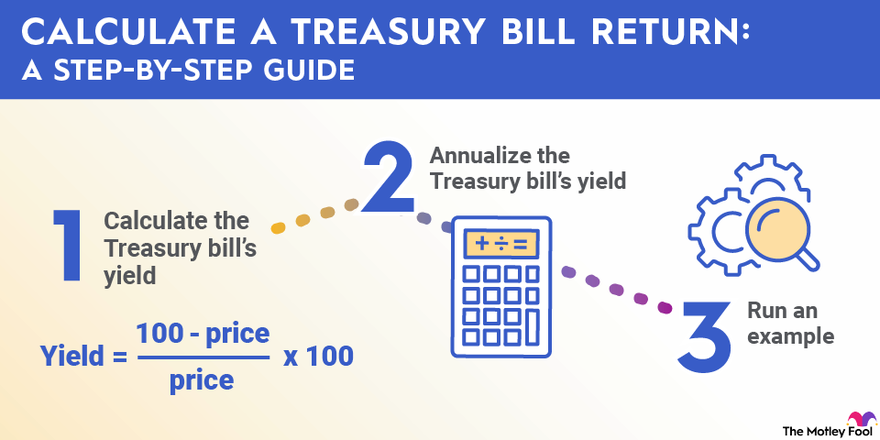

The 13-week treasury bill yield represents the annualized rate of return an investor can expect. It’s important to understand that this is an annualized figure. The actual return for the 13-week period will be significantly less. To calculate the actual return, divide the annualized yield by four (since there are roughly four 13-week periods in a year). For example, a 13-week treasury bill yield of 5% would translate to an approximate return of 1.25% over the 13-week period. Understanding this distinction is crucial for making informed investment decisions. Investors should carefully consider the 13-week treasury bill yield in relation to their investment goals and time horizons. A higher 13-week treasury bill yield indicates a greater return but also potentially reflects increased market risks.

Let’s illustrate with examples. Suppose the 13-week treasury bill yield is 3%. Investing $10,000 would yield approximately $300 annually. However, the return over 13 weeks would be about $75. Conversely, if the 13-week treasury bill yield rises to 6%, the annual return on the same $10,000 investment increases to approximately $600. The 13-week return jumps to about $150. These examples highlight how changes in the 13-week treasury bill yield directly impact investment returns. Investors need to consider the yield’s implications carefully when making investment decisions, especially with short-term goals. Fluctuations in the 13-week treasury bill yield often reflect broader economic trends and shifts in investor sentiment. Monitoring these changes can provide valuable insights into market dynamics.

The 13-week treasury bill yield serves as a benchmark for other short-term investments. It offers a risk-free return backed by the U.S. government. This makes it an attractive option for investors seeking capital preservation and stability. Comparing the 13-week treasury bill yield to yields from other short-term investments like Certificates of Deposit (CDs) or money market accounts helps investors determine the most suitable option based on their risk tolerance and return expectations. The 13-week treasury bill yield’s relative position within the broader market often signals investor confidence and economic outlook. A higher 13-week treasury bill yield may indicate a flight to safety, while a lower yield might signal increased risk appetite. Investors should regularly review the 13-week treasury bill yield and compare it to alternative investments to ensure their portfolio aligns with their goals.

Comparing 13-Week T-Bills to Other Short-Term Investments

Understanding the 13-week treasury bill yield requires comparing it to alternative short-term investment options. Certificates of Deposit (CDs) offer fixed interest rates for a specified period. While generally safer than many other investments, their returns might lag behind a rising 13-week treasury bill yield. The liquidity of CDs is also lower; early withdrawal often incurs penalties. Money market accounts (MMAs) provide easy access to funds and typically offer higher yields than savings accounts. However, their returns are often variable and may not match the stability associated with government-backed securities like T-bills. High-yield savings accounts provide better returns than standard savings accounts, but may still yield less than a 13-week treasury bill, particularly in periods of rising interest rates. The 13-week treasury bill yield reflects a risk-free return, backed by the full faith and credit of the U.S. government, a key differentiator from these other options. This makes T-bills an attractive choice for risk-averse investors.

Investors should consider the trade-offs between risk and return. The 13-week treasury bill yield represents a low-risk investment, making it suitable for preserving capital. However, this comes at the cost of potentially lower returns compared to higher-risk investments. For example, while a corporate bond might offer a higher yield than the current 13-week treasury bill yield, it carries a greater default risk. Similarly, investments in the stock market can provide significant returns but expose investors to substantial volatility. The choice depends on individual risk tolerance and investment goals. Understanding the current 13-week treasury bill yield is a critical step in making informed investment decisions, helping investors to benchmark against higher-risk alternatives and evaluate potential returns.

The relative advantages of 13-week T-bills are significant. Their government backing eliminates default risk, providing a level of security unmatched by most other short-term investments. The predictability of the 13-week treasury bill yield, while subject to market fluctuations, is higher than many other options. This predictability is especially valuable for investors seeking stability and capital preservation. While the return on a 13-week treasury bill might not always be the highest available, the certainty and safety it offers are compelling factors for many investors. Moreover, the ease of investing in T-bills through TreasuryDirect.gov makes them highly accessible to a broad range of investors. Considering factors like liquidity, potential for return, and inherent risk, the 13-week treasury bill yield offers a strong foundation for a diversified investment strategy.

Assessing Risk and Volatility in Short-Term Government Securities

While 13-week Treasury bills are generally considered low-risk investments, understanding potential fluctuations in the 13 week treasury bill yield is crucial. External economic factors significantly influence these yields. Changes in inflation expectations, shifts in Federal Reserve monetary policy, and unexpected economic events can all cause the yield to move. Investors should carefully consider their risk tolerance before investing. A higher yield might seem appealing, but it could indicate increased market uncertainty.

One important risk factor to consider is reinvestment risk. This refers to the uncertainty of reinvesting the proceeds from a maturing 13-week Treasury bill at a comparable or higher yield. If interest rates fall after the bill matures, reinvesting at a lower rate reduces overall returns. This risk is particularly relevant in a fluctuating interest rate environment. Careful monitoring of the 13 week treasury bill yield and economic indicators helps mitigate this risk. Diversification across various asset classes can also lessen the impact of reinvestment risk on a portfolio.

Understanding the relationship between the 13 week treasury bill yield and broader economic conditions is essential for managing risk. For example, a sudden increase in the yield might signal growing concerns about inflation or economic slowdown. Conversely, a consistent decline could suggest a more stable economic outlook. Monitoring key economic indicators like inflation rates, employment figures, and consumer confidence helps investors anticipate potential shifts in the 13 week treasury bill yield. This proactive approach allows investors to make informed decisions about their investment strategies and manage potential risks effectively. Investors should always assess their individual risk tolerance before committing to any investment, including 13-week Treasury bills, and understand that even low-risk investments are subject to some degree of fluctuation.

Strategies for Investing in 13-Week Treasury Bills

Investing in 13-week Treasury bills offers a straightforward path to accessing a low-risk, short-term investment. Individuals and institutions can purchase these bills directly through TreasuryDirect.gov, the official website of the U.S. Department of the Treasury. This platform facilitates the entire process, from account creation to purchasing bills at auction or in the secondary market. The minimum investment amount is relatively low, making it accessible to a wide range of investors. Understanding the 13 week treasury bill yield is crucial before investing.

The TreasuryDirect auction process for new 13-week Treasury bills occurs regularly. Investors submit competitive bids, specifying the quantity and price they are willing to pay. The yield is determined by the market, reflecting the current demand and supply dynamics. Successful bidders purchase the bills at a discount to their face value. At maturity, after 13 weeks, investors receive the full face value of the bill. This difference between the purchase price and the face value represents the return on investment, reflecting the 13 week treasury bill yield. One can also purchase existing bills in the secondary market through TreasuryDirect or other brokerage accounts. This provides flexibility for investors who may not want to wait for the auction.

Understanding how the 13 week treasury bill yield is calculated is essential. The yield advertised is an annualized rate. To calculate the actual return for the 13-week period, you divide the annualized yield by four. For example, if the annualized yield is 5%, the return for a 13-week period would be approximately 1.25%. This simple calculation helps investors assess the actual return on their investment over the short term. It’s important to remember that while the 13 week treasury bill yield is considered low-risk, it is not entirely without risk. Fluctuations in market interest rates can impact the yield. Investors should always consider their risk tolerance and investment goals before investing in any Treasury bill, including the 13-week variety. Careful consideration of the 13 week treasury bill yield helps align investment choices with financial objectives.

Understanding the Relationship Between Treasury Yields and Monetary Policy

The Federal Reserve’s monetary policy significantly influences the 13 week treasury bill yield. The Fed uses various tools, most notably adjusting the federal funds rate, to manage inflation and stimulate economic growth. Raising the federal funds rate, the target rate banks charge each other for overnight loans, increases borrowing costs across the board. This upward pressure directly impacts the 13 week treasury bill yield, causing it to rise. Conversely, lowering the federal funds rate makes borrowing cheaper, typically leading to a decrease in the 13 week treasury bill yield.

This relationship isn’t instantaneous. Changes in the 13 week treasury bill yield often lag behind Fed actions. Market participants consider various factors beyond the current federal funds rate. Inflation expectations, economic growth forecasts, and global market conditions all play a role in determining the yield. However, the Fed’s actions provide a strong directional signal. Careful analysis of Fed announcements, including statements from the Federal Open Market Committee (FOMC), offers valuable insights into potential future adjustments to the 13 week treasury bill yield. Economic indicators, such as inflation data (CPI and PCE) and employment figures, also provide crucial information for anticipating shifts in the 13 week treasury bill yield.

Investors can use this understanding to their advantage. By closely monitoring Fed announcements and key economic data, investors can develop a more informed outlook on future 13 week treasury bill yield movements. This allows for better investment decisions, whether it’s determining the optimal time to purchase T-bills or adjusting their overall investment strategy based on anticipated changes in the 13 week treasury bill yield. Understanding this relationship is crucial for navigating the complexities of short-term investment markets and maximizing returns within a defined risk tolerance. The interplay between monetary policy and the 13 week treasury bill yield is a dynamic process, requiring continuous monitoring and analysis for effective investment management. Predicting the precise movement of the 13 week treasury bill yield remains challenging, but understanding the fundamental relationship between the Fed’s actions and the yield improves the chances of making sound investment decisions.

Long-Term Implications and Portfolio Diversification

Incorporating 13-week treasury bills into a diversified investment portfolio offers significant benefits. These short-term securities provide a stable foundation, counteracting the volatility often associated with higher-risk investments like stocks or bonds with longer maturities. Their low-risk nature makes them ideal for preserving capital and mitigating potential losses during market downturns. The predictable returns of a 13-week treasury bill yield contribute to a smoother overall portfolio performance, reducing the impact of short-term market fluctuations on long-term investment goals. Investors can strategically allocate a portion of their portfolio to 13-week treasury bills to manage risk effectively. This approach allows for greater flexibility, enabling investors to readily access their capital when needed while maintaining exposure to higher-growth opportunities.

Understanding the role of the 13-week treasury bill yield in portfolio construction is crucial for long-term success. By incorporating these low-risk instruments, investors can balance potential gains with risk tolerance. This approach is particularly beneficial for individuals with specific short-term financial goals or those seeking to reduce overall portfolio volatility. The predictable nature of the 13-week treasury bill yield helps investors plan for future expenses and ensures a steady stream of income, adding stability to their financial picture. Regularly assessing the 13-week treasury bill yield alongside other investments ensures the portfolio remains aligned with changing economic conditions and individual risk profiles. This allows for strategic adjustments, optimizing returns while maintaining the desired level of risk.

The consistent, predictable nature of the 13-week treasury bill yield makes it a valuable tool for long-term financial planning. It allows investors to build a robust strategy, incorporating different asset classes to achieve diverse goals. The predictability of returns from 13-week treasury bills allows investors to model future cash flows more accurately. This assists in making informed decisions about long-term investments, including retirement planning or major purchases. The stability provided by 13-week treasury bills forms a solid base, permitting greater flexibility with higher-risk, potentially higher-reward investments. By diversifying with 13-week treasury bills, investors can reduce their reliance on market fluctuations and protect their investments from significant losses.

The Role of 13-Week Treasury Bills in Economic Forecasting

The 13-week treasury bill yield serves as a significant economic indicator. It reflects prevailing investor sentiment and expectations regarding future inflation. A rising 13-week treasury bill yield often suggests growing confidence in the economy. Conversely, a declining yield might signal concerns about economic slowdown or potential recession. The yield acts as a barometer, gauging investor risk appetite and expectations for future interest rate adjustments by the Federal Reserve. Analyzing trends in the 13-week treasury bill yield provides valuable insights into the overall health and direction of the economy. Investors and economists closely monitor these shifts to inform their investment decisions and economic forecasts.

Changes in the 13-week treasury bill yield often precede broader market movements. This makes it a useful leading indicator. For example, a sharp increase in the 13-week treasury bill yield might foreshadow an increase in other interest rates. It could also predict a rise in inflation expectations. Conversely, a sustained decrease could signal deflationary pressures or decreased investor confidence. This predictive power stems from the fact that the 13-week treasury bill yield reflects the collective wisdom of countless market participants. Their collective assessment of economic prospects is distilled into this single, easily observable figure. Understanding the nuances of the 13-week treasury bill yield is therefore crucial for informed economic analysis.

The 13-week treasury bill yield’s relationship with monetary policy is especially noteworthy. The Federal Reserve’s actions directly impact short-term interest rates. This includes the 13-week treasury bill yield. The Fed’s decisions, communicated through announcements and actions, influence investor expectations. These expectations, in turn, are reflected in the 13-week treasury bill yield. By studying the relationship between Fed policy and the 13-week treasury bill yield, one can gain insights into the effectiveness of monetary policy and its impact on the overall economy. Analyzing the 13-week treasury bill yield, in conjunction with other economic data, provides a more comprehensive picture of the economic landscape and helps predict future trends.

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)