What are Treasury Bills and How Do They Work?

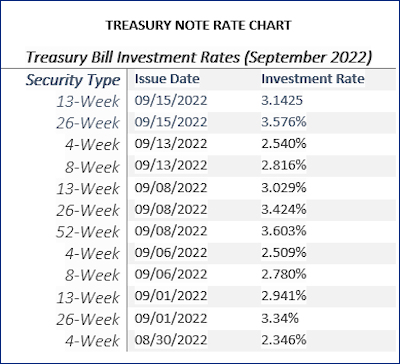

Treasury Bills, also known as T-Bills, are short-term government securities issued by the US Department of the Treasury to finance its operations. They are a type of debt instrument with a maturity period ranging from a few weeks to a year. The 13-week Treasury Bill, in particular, is a popular investment option for those seeking a low-risk, short-term investment with a fixed return.

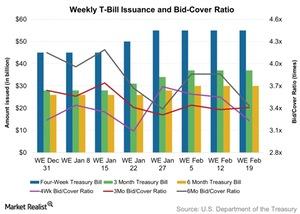

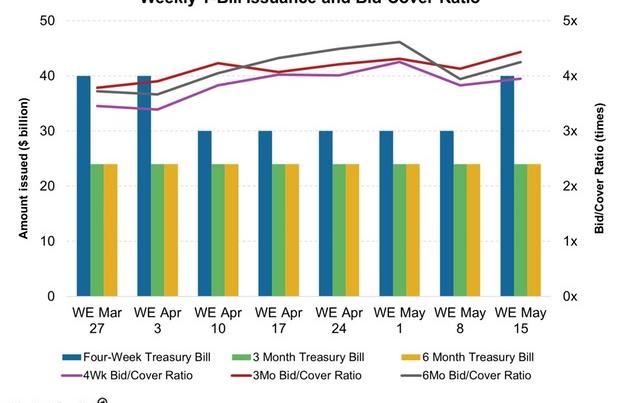

In the US financial system, Treasury Bills play a crucial role in managing the government’s cash flow and financing its activities. They are auctioned off to investors on a regular basis, with the proceeds used to fund various government programs and initiatives. The 13-week Treasury Bill rate, which is the yield or return on investment, is determined by the market forces of supply and demand during these auctions.

Compared to other investment options, Treasury Bills are known for their high liquidity, low risk, and ease of purchase. They are backed by the full faith and credit of the US government, making them an attractive option for risk-averse investors. Additionally, Treasury Bills are exempt from state and local taxes, making them a tax-efficient investment choice.

Investors can purchase 13-week Treasury Bills directly from the US Department of the Treasury’s website or through various online brokerages, including Yahoo Finance. With a minimum investment requirement of $100, Treasury Bills are an accessible investment option for individuals and institutions alike. By understanding how Treasury Bills work and their benefits, investors can make informed decisions about incorporating them into their investment portfolios, particularly when tracking the 13-week Treasury Bill rate on Yahoo Finance.

How to Invest in 13-Week Treasury Bills on Yahoo Finance

Investing in 13-week Treasury Bills on Yahoo Finance is a straightforward process that can be completed in a few steps. To get started, investors need to set up an account on Yahoo Finance, which provides access to a range of investment products, including Treasury Bills.

Once an account is set up, investors can navigate to the Treasury Bills section on Yahoo Finance, where they can find a list of available 13-week Treasury Bills. The list will include details such as the issue date, maturity date, and current yield. Investors can filter the list by criteria such as yield, maturity date, and issue date to find the right investment option for their needs.

Before executing a trade, investors should carefully review the terms and conditions of the 13-week Treasury Bill, including the face value, interest rate, and maturity date. They should also consider their investment goals, risk tolerance, and time horizon to ensure that the Treasury Bill aligns with their overall investment strategy.

To execute a trade, investors can simply click on the “Buy” button next to the desired 13-week Treasury Bill. They will then be prompted to enter the amount they wish to invest and confirm the trade. The Treasury Bill will be added to their portfolio, and they can track its performance on Yahoo Finance.

It’s essential to stay up-to-date with the 13-week Treasury Bill rate on Yahoo Finance, as it can fluctuate over time. Investors can set up custom alerts on Yahoo Finance to notify them of changes in the rate, allowing them to make informed investment decisions. By following these steps, investors can easily invest in 13-week Treasury Bills on Yahoo Finance and take advantage of their benefits, including high liquidity and low risk.

Understanding the 13-Week Treasury Bill Rate: What Drives Its Fluctuations?

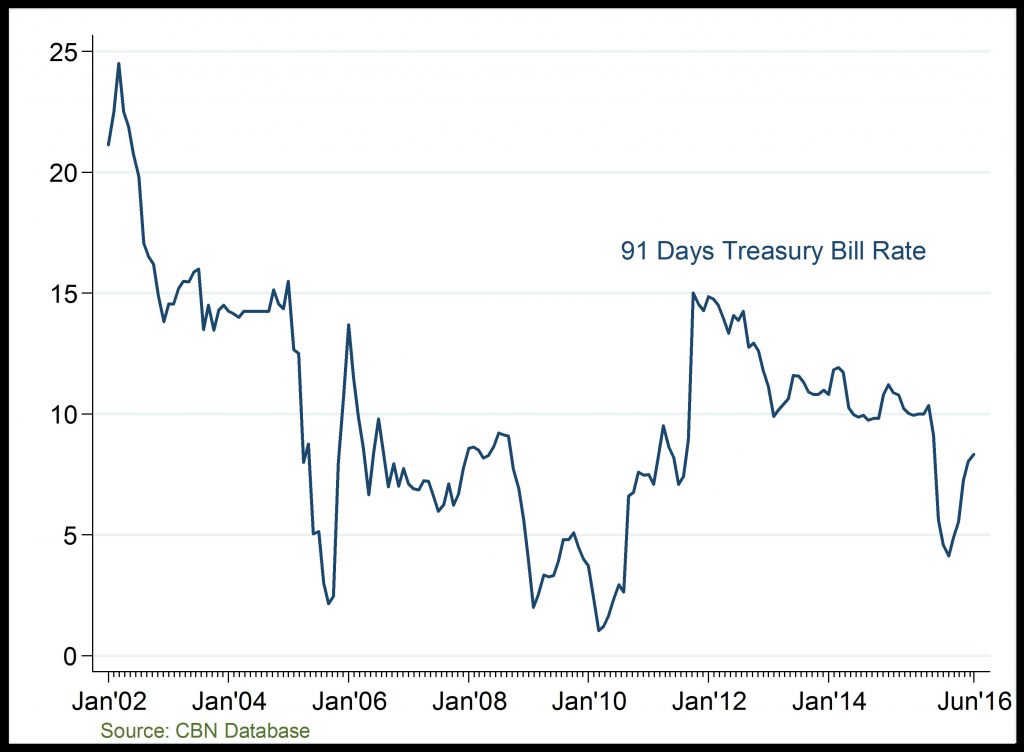

The 13-week Treasury Bill rate, as tracked on Yahoo Finance, is a crucial indicator of short-term interest rates in the US economy. It is influenced by a combination of economic indicators, monetary policy, and market sentiment. Understanding these factors is essential for investors to make informed decisions about investing in 13-week Treasury Bills.

Economic indicators, such as GDP growth, inflation, and unemployment rates, play a significant role in shaping the 13-week Treasury Bill rate. When the economy is growing, and inflation is rising, the Federal Reserve may increase interest rates to curb inflationary pressures, leading to higher Treasury Bill rates. Conversely, during times of economic slowdown, the Fed may lower interest rates to stimulate growth, resulting in lower Treasury Bill rates.

Monetary policy, as set by the Federal Reserve, also has a direct impact on the 13-week Treasury Bill rate. The Fed’s decisions on interest rates, quantitative easing, and forward guidance influence the overall direction of short-term interest rates. For instance, during the 2008 financial crisis, the Fed implemented quantitative easing, which led to a decline in Treasury Bill rates.

Market sentiment, including investor expectations and risk appetite, also affects the 13-week Treasury Bill rate. When investors are risk-averse, they may seek safer assets, such as Treasury Bills, driving up demand and pushing rates lower. Conversely, when investors are more risk-tolerant, they may seek higher-yielding assets, leading to lower demand and higher Treasury Bill rates.

By understanding these factors, investors can better navigate the fluctuations in the 13-week Treasury Bill rate on Yahoo Finance. This knowledge enables them to make informed investment decisions, taking into account the current economic environment, monetary policy, and market sentiment. By staying up-to-date with the 13-week Treasury Bill rate, investors can optimize their investment portfolios and achieve their short-term investment goals.

The Benefits of Investing in 13-Week Treasury Bills: Liquidity and Low Risk

Investing in 13-week Treasury Bills offers several benefits that make them an attractive option for short-term investors. One of the primary advantages is their high liquidity, which allows investors to easily convert their investment into cash when needed. This liquidity is particularly important for investors who require quick access to their funds, such as businesses or individuals with short-term financial obligations.

Another significant benefit of 13-week Treasury Bills is their low risk profile. As a debt instrument backed by the full faith and credit of the US government, Treasury Bills are considered to be extremely low-risk investments. This means that investors can expect a high degree of certainty regarding the return of their principal investment, making them an attractive option for risk-averse investors.

In addition to their liquidity and low risk, 13-week Treasury Bills also offer the potential for steady returns. The 13-week Treasury Bill rate, as tracked on Yahoo Finance, provides a competitive yield that is generally higher than traditional savings accounts or money market funds. This makes them an attractive option for investors seeking a low-risk investment with a relatively high return.

The benefits of investing in 13-week Treasury Bills are particularly appealing for short-term investors who require a safe and liquid investment option. By investing in Treasury Bills, investors can ensure that their funds are protected while still earning a competitive return. This makes them an ideal investment option for businesses, individuals, and institutions seeking a low-risk, short-term investment solution.

Overall, the benefits of investing in 13-week Treasury Bills make them an attractive option for investors seeking a low-risk, liquid investment with a competitive return. By understanding the advantages of Treasury Bills, investors can make informed decisions about their investment portfolios and achieve their short-term investment goals.

Comparing 13-Week Treasury Bills to Other Short-Term Investment Options

When it comes to short-term investments, investors have a range of options to choose from. In addition to 13-week Treasury Bills, other popular options include commercial paper, certificates of deposit (CDs), and money market funds. Each of these options has its own unique characteristics, benefits, and risks, making it essential for investors to understand the differences between them.

Commercial paper, for instance, is a short-term debt instrument issued by companies to raise capital. While it offers a higher yield than 13-week Treasury Bills, it also carries a higher credit risk, as the issuer may default on the debt. Certificates of deposit, on the other hand, are time deposits offered by banks with a fixed interest rate and maturity date. They tend to be less liquid than 13-week Treasury Bills and may come with penalties for early withdrawal.

Money market funds, which invest in a diversified portfolio of low-risk, short-term debt securities, offer a higher yield than 13-week Treasury Bills but may come with management fees and minimum investment requirements. In contrast, 13-week Treasury Bills are backed by the full faith and credit of the US government, making them an extremely low-risk investment option.

When deciding between these short-term investment options, investors should consider their individual financial goals, risk tolerance, and liquidity needs. For investors seeking a highly liquid, low-risk investment with a competitive return, 13-week Treasury Bills may be the most attractive option. However, for those willing to take on slightly more risk in pursuit of higher yields, commercial paper or money market funds may be a better fit.

Ultimately, understanding the differences between these short-term investment options is crucial for investors to make informed decisions about their investment portfolios. By comparing the benefits and risks of each option, investors can choose the investment that best aligns with their financial objectives and risk tolerance.

For investors who want to stay up-to-date with the 13-week Treasury Bill rate on Yahoo Finance, it is essential to monitor market news and economic indicators that influence the rate. This information can help investors make informed decisions about their investment portfolios and optimize their returns.

Using 13-Week Treasury Bills as a Hedge Against Market Volatility

In times of economic uncertainty, investors often seek safe-haven assets to protect their portfolios from market volatility. One such asset is the 13-week Treasury Bill, which offers a low-risk, liquid investment option that can help mitigate losses during periods of market turmoil.

The 13-week Treasury Bill’s low risk profile makes it an attractive option for investors seeking to reduce their exposure to market fluctuations. As a debt instrument backed by the full faith and credit of the US government, Treasury Bills are considered to be extremely low-risk investments. This means that investors can expect a high degree of certainty regarding the return of their principal investment, making them an attractive option for risk-averse investors.

In addition to their low risk, 13-week Treasury Bills also offer a high degree of liquidity, allowing investors to quickly convert their investment into cash if needed. This liquidity is particularly important during times of market volatility, when investors may need to quickly adjust their portfolios in response to changing market conditions.

One strategy for using 13-week Treasury Bills as a hedge against market volatility is to incorporate them into a diversified investment portfolio. By allocating a portion of their portfolio to Treasury Bills, investors can reduce their overall risk exposure and protect their investments from market downturns. This can be particularly effective during times of economic uncertainty, when market volatility is high.

Another strategy is to use 13-week Treasury Bills as a tactical asset allocation tool. During periods of market stress, investors can shift a portion of their portfolio into Treasury Bills, reducing their exposure to riskier assets and protecting their investments from potential losses. Once market conditions stabilize, investors can then shift their allocation back into riskier assets, such as stocks or corporate bonds.

By incorporating 13-week Treasury Bills into their investment portfolios, investors can create a more resilient and diversified investment strategy that is better equipped to weather market volatility. And with the ability to track the 13-week Treasury Bill rate on Yahoo Finance, investors can stay informed about market conditions and make informed decisions about their investment portfolios.

The Role of 13-Week Treasury Bills in a Diversified Investment Portfolio

Diversification is a fundamental principle of investment management, and for good reason. By spreading investments across different asset classes, investors can reduce their exposure to risk and increase the potential for long-term returns. One often overlooked but valuable addition to a diversified portfolio is the 13-week Treasury Bill.

13-week Treasury Bills offer a unique combination of low risk, high liquidity, and steady returns, making them an attractive option for investors seeking to diversify their portfolios. By incorporating Treasury Bills into a portfolio, investors can reduce their overall risk exposure and increase the potential for stable returns.

One way to incorporate 13-week Treasury Bills into a diversified portfolio is to use them as a cash allocation. By allocating a portion of their portfolio to Treasury Bills, investors can maintain a cash reserve that can be quickly deployed into other investments when opportunities arise. This can be particularly effective during times of market volatility, when investors may need to quickly adjust their portfolios in response to changing market conditions.

Another strategy is to use 13-week Treasury Bills as a fixed income allocation. By incorporating Treasury Bills into a fixed income portfolio, investors can reduce their exposure to credit risk and increase the potential for stable returns. This can be particularly effective for investors seeking to generate income from their investments, as Treasury Bills offer a regular coupon payment.

In addition to their role in a diversified portfolio, 13-week Treasury Bills can also be used as a tactical asset allocation tool. During periods of market stress, investors can shift a portion of their portfolio into Treasury Bills, reducing their exposure to riskier assets and protecting their investments from potential losses. Once market conditions stabilize, investors can then shift their allocation back into riskier assets, such as stocks or corporate bonds.

By incorporating 13-week Treasury Bills into a diversified investment portfolio, investors can create a more resilient and adaptable investment strategy that is better equipped to weather market volatility. And with the ability to track the 13-week Treasury Bill rate on Yahoo Finance, investors can stay informed about market conditions and make informed decisions about their investment portfolios.

Staying Up-to-Date with 13-Week Treasury Bill Rates on Yahoo Finance

To make informed investment decisions, it’s essential to stay up-to-date with the latest 13-week Treasury Bill rates on Yahoo Finance. With the right tools and resources, investors can track market trends, analyze economic indicators, and adjust their investment strategies accordingly.

One of the most effective ways to stay informed is to set up custom alerts on Yahoo Finance. By setting up alerts for the 13-week Treasury Bill rate, investors can receive real-time notifications when the rate changes, allowing them to quickly respond to market shifts. Additionally, investors can track market news and analysis on Yahoo Finance, providing valuable insights into the factors driving the 13-week Treasury Bill rate.

Another key resource for investors is the Yahoo Finance charting tool, which allows users to visualize the 13-week Treasury Bill rate over time. By analyzing the chart, investors can identify trends and patterns in the rate, making it easier to make informed investment decisions. Furthermore, the charting tool provides access to a range of technical indicators, such as moving averages and relative strength index, which can help investors identify potential buying or selling opportunities.

In addition to these tools, investors can also stay informed about the 13-week Treasury Bill rate by tracking economic indicators, such as GDP growth, inflation, and unemployment rates. By analyzing these indicators, investors can gain a deeper understanding of the factors driving the 13-week Treasury Bill rate and make more informed investment decisions.

Finally, investors can stay up-to-date with the latest market news and analysis by following reputable financial news sources and market experts on Yahoo Finance. By staying informed about the latest market trends and developments, investors can adjust their investment strategies to maximize returns and minimize risk.

By leveraging these resources and tools, investors can stay ahead of the curve and make informed investment decisions based on the latest 13-week Treasury Bill rate on Yahoo Finance. Whether you’re a seasoned investor or just starting out, staying up-to-date with the latest market trends and developments is essential for achieving long-term investment success.

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)