Understanding the Concept of Treasury Bills

Treasury Bills, also known as T-Bills, are a type of short-term government debt security issued by the US Department of the Treasury. They are designed to provide a low-risk investment option for individuals, businesses, and institutions seeking to park their funds for a short period. With maturities ranging from a few weeks to a year, Treasury Bills offer a unique opportunity for investors to earn a return on their investment while minimizing their exposure to market volatility.

In the US financial system, Treasury Bills play a crucial role in managing the government’s finances and regulating the money supply. The proceeds from T-Bill auctions are used to finance the government’s operations, refinance existing debt, and maintain a stable financial system. By investing in Treasury Bills, investors contribute to the smooth functioning of the economy while earning a competitive return on their investment.

One of the primary appeals of Treasury Bills is their low-risk profile. Backed by the full faith and credit of the US government, T-Bills are considered to be one of the safest investment options available. This makes them an attractive choice for investors seeking to reduce their risk exposure or diversify their investment portfolios. Additionally, Treasury Bills are highly liquid, meaning investors can easily sell their securities before maturity if needed.

As investors consider their short-term investment options, understanding the concept of Treasury Bills can help them make informed decisions about their financial future. Whether it’s a 13 week t bill rate or a longer-term investment, Treasury Bills offer a unique combination of low risk, liquidity, and competitive returns that can help investors achieve their financial goals.

How to Navigate the World of Treasury Bill Auctions

The US Department of the Treasury conducts regular auctions to issue Treasury Bills, providing investors with a unique opportunity to participate in the government’s financing activities. Understanding the process of Treasury Bill auctions is crucial for investors seeking to tap into the benefits of these low-risk, short-term investments.

There are two main types of Treasury Bill auctions: competitive and non-competitive. Competitive auctions allow bidders to specify the discount rate they are willing to accept, while non-competitive auctions offer a fixed discount rate set by the Treasury. Both types of auctions provide investors with a chance to purchase Treasury Bills at a discounted price, earning a return on their investment when the security matures.

Participating in Treasury Bill auctions offers several benefits to investors. For one, it provides a low-risk investment option, backed by the full faith and credit of the US government. Additionally, Treasury Bills are highly liquid, making it easy for investors to sell their securities before maturity if needed. Furthermore, the auction process ensures that investors can purchase Treasury Bills at a competitive price, maximizing their returns.

Investors can participate in Treasury Bill auctions through various channels, including the Treasury Department’s website, banks, and brokerages. To get started, investors need to create an account with the Treasury Department’s auction platform, TreasuryDirect. From there, they can browse available auctions, place bids, and manage their investments.

As investors consider their short-term investment options, understanding the process of Treasury Bill auctions can help them make informed decisions about their financial future. Whether it’s a 13 week t bill rate or a longer-term investment, Treasury Bills offer a unique combination of low risk, liquidity, and competitive returns that can help investors achieve their financial goals.

The 13-Week Treasury Bill Rate: What It Means for Investors

The 13-week Treasury Bill rate is a critical component of the US financial system, providing investors with a low-risk, short-term investment option. But what exactly is the 13-week Treasury Bill rate, and how is it calculated?

The 13-week Treasury Bill rate, also known as the 13-week T-Bill rate, is the discount rate at which the US Department of the Treasury issues 13-week Treasury Bills. This rate is calculated as a percentage of the face value of the security, and it represents the return on investment that investors can expect to earn over the 13-week term.

The 13-week Treasury Bill rate is significant in the investment landscape because it serves as a benchmark for short-term interest rates. It influences the pricing of other short-term investment options, such as commercial paper and certificates of deposit, and it provides a gauge for the overall direction of interest rates in the economy.

For investors, the 13-week Treasury Bill rate offers a unique opportunity to earn a competitive return on their investment while minimizing their exposure to market volatility. With a 13 week t bill rate, investors can earn a fixed return over a short period, making it an attractive option for those seeking to park their funds for a few months.

In addition, the 13-week Treasury Bill rate is closely watched by economists and policymakers, as it provides insights into the overall health of the economy. Changes in the 13-week Treasury Bill rate can signal shifts in monetary policy, inflation expectations, and economic growth prospects, making it a critical indicator for investors and policymakers alike.

As investors consider their short-term investment options, understanding the 13-week Treasury Bill rate is crucial for making informed decisions about their financial future. By grasping the concept of the 13 week t bill rate and its significance in the investment landscape, investors can better navigate the complex world of short-term investments and achieve their financial goals.

Why the 13-Week Treasury Bill Rate Matters in Today’s Economy

The 13-week Treasury Bill rate plays a significant role in the broader economy, influencing interest rates, inflation, and monetary policy. As a benchmark for short-term interest rates, the 13 week t bill rate has a ripple effect on the entire financial system.

One of the primary ways the 13-week Treasury Bill rate impacts the economy is through its influence on interest rates. The rate serves as a reference point for other short-term interest rates, such as those on commercial paper and certificates of deposit. As the 13-week Treasury Bill rate changes, it can trigger a corresponding shift in these other rates, affecting the cost of borrowing for businesses and individuals alike.

The 13-week Treasury Bill rate also has implications for inflation. When the rate rises, it can signal a tightening of monetary policy, which can help combat inflationary pressures. Conversely, a decline in the rate may indicate a more accommodative monetary policy, which can stimulate economic growth but also risk fueling inflation.

In addition, the 13-week Treasury Bill rate is closely watched by central banks and policymakers, who use it as a gauge for the overall health of the economy. Changes in the rate can inform decisions about monetary policy, such as setting interest rates or implementing quantitative easing measures.

Furthermore, the 13-week Treasury Bill rate can influence the yield curve, which plots the interest rates of securities with different maturities. A steepening or flattening of the yield curve can have significant implications for the economy, as it can affect the availability and cost of credit for businesses and consumers.

In conclusion, the 13-week Treasury Bill rate is a critical component of the US financial system, with far-reaching implications for interest rates, inflation, and monetary policy. As investors and policymakers navigate the complex landscape of short-term investments, understanding the significance of the 13 week t bill rate is essential for making informed decisions about their financial future.

Comparing 13-Week Treasury Bills to Other Short-Term Investment Options

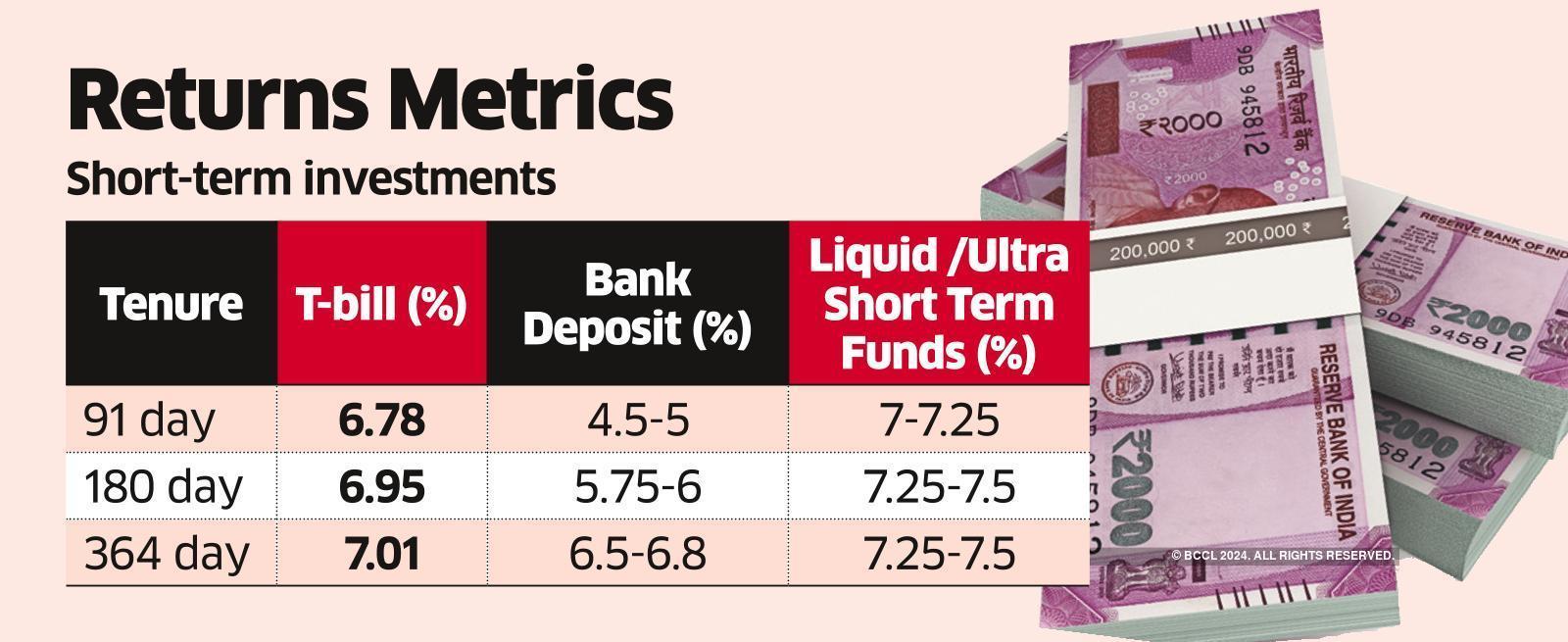

When it comes to short-term investments, investors have a range of options to choose from, each with its own unique characteristics and benefits. In this section, we’ll compare and contrast 13-week Treasury Bills with other popular short-term investment options, including commercial paper, certificates of deposit, and money market funds.

Commercial paper, issued by corporations to raise short-term capital, offers a slightly higher return than 13-week Treasury Bills, but also carries a higher level of credit risk. Certificates of deposit (CDs), offered by banks, provide a fixed return over a specific term, but may come with penalties for early withdrawal. Money market funds, which invest in a diversified portfolio of short-term debt securities, offer liquidity and diversification, but may carry management fees and other expenses.

In contrast, 13-week Treasury Bills offer a unique combination of low risk, liquidity, and a competitive return, making them an attractive option for investors seeking a safe haven for their short-term investments. The 13 week t bill rate, which is influenced by market conditions and monetary policy, provides a benchmark for short-term interest rates, making it an important indicator for investors and policymakers alike.

When deciding between these short-term investment options, investors should consider their individual financial goals, risk tolerance, and time horizon. For those seeking a low-risk, liquid investment with a competitive return, 13-week Treasury Bills may be an attractive option. However, for investors willing to take on slightly more credit risk in pursuit of higher returns, commercial paper or CDs may be a better fit. Money market funds, meanwhile, offer a diversified portfolio of short-term debt securities, making them a good choice for investors seeking broad exposure to the short-term market.

Ultimately, the key to success in short-term investing lies in understanding the unique characteristics and benefits of each investment option, and selecting the one that best aligns with your individual financial goals and risk tolerance. By comparing and contrasting 13-week Treasury Bills with other short-term investment options, investors can make informed decisions about their financial future and achieve their short-term investment objectives.

Strategies for Investing in 13-Week Treasury Bills

When it comes to incorporating 13-week Treasury Bills into an investment portfolio, a well-thought-out strategy is essential for maximizing returns and minimizing risk. In this section, we’ll explore practical tips and strategies for investing in 13-week Treasury Bills, including risk management and diversification techniques.

One of the key benefits of 13-week Treasury Bills is their low risk profile, making them an attractive option for investors seeking a safe haven for their short-term investments. However, even with low-risk investments, it’s essential to diversify your portfolio to minimize exposure to any one particular asset class. By incorporating 13-week Treasury Bills into a diversified portfolio, investors can reduce their overall risk profile and increase the potential for long-term returns.

Another important consideration when investing in 13-week Treasury Bills is the impact of the 13 week t bill rate on your investment returns. As the 13 week t bill rate changes, it can affect the value of your investment, making it essential to stay informed about market trends and interest rate fluctuations. By tracking the 13 week t bill rate and adjusting your investment strategy accordingly, investors can maximize their returns and minimize their risk.

In addition to diversification and risk management, investors should also consider the benefits of laddering their 13-week Treasury Bill investments. By investing in a series of 13-week Treasury Bills with staggered maturity dates, investors can create a steady stream of income and minimize their exposure to interest rate risk. This strategy can be particularly effective in a rising interest rate environment, where the 13 week t bill rate may be increasing.

Finally, investors should consider the benefits of automating their 13-week Treasury Bill investments through a systematic investment plan. By investing a fixed amount of money at regular intervals, investors can reduce the impact of market volatility and timing risks, and increase the potential for long-term returns.

By incorporating these strategies into your investment approach, investors can unlock the full potential of 13-week Treasury Bills and achieve their short-term investment objectives. Whether you’re seeking a low-risk, liquid investment or a diversified portfolio of short-term debt securities, 13-week Treasury Bills can play a valuable role in your investment strategy.

The Benefits of Laddering Your 13-Week Treasury Bill Investments

Laddering is a popular investment strategy that involves dividing an investment portfolio into multiple segments, each with a different maturity date. When applied to 13-week Treasury Bill investments, laddering can help maximize returns and minimize risk. In this section, we’ll explore the benefits of laddering your 13-week Treasury Bill investments and provide guidance on how to implement this strategy.

The concept of laddering is simple: by investing in a series of 13-week Treasury Bills with staggered maturity dates, investors can create a steady stream of income and reduce their exposure to interest rate risk. For example, an investor might invest $10,000 in a 13-week Treasury Bill, with $2,000 maturing every 13 weeks. This approach allows investors to take advantage of the 13 week t bill rate while minimizing the impact of interest rate fluctuations.

One of the key benefits of laddering is that it helps to reduce the impact of interest rate risk. When interest rates rise, the value of existing Treasury Bills with lower interest rates decreases. By laddering their investments, investors can reduce their exposure to this risk and take advantage of higher interest rates as they become available. Additionally, laddering can help to increase returns by allowing investors to reinvest their principal and interest at higher rates.

Laddering can also help to improve liquidity and reduce the impact of market volatility. By having a series of Treasury Bills with staggered maturity dates, investors can access their funds as needed, while minimizing the impact of market fluctuations. This approach can be particularly useful for investors who require a steady stream of income or who are seeking to reduce their exposure to market risk.

To implement a laddering strategy, investors should start by determining their investment goals and risk tolerance. They should then identify a series of 13-week Treasury Bills with staggered maturity dates and invest a fixed amount of money in each. As each Treasury Bill matures, investors can reinvest the principal and interest at the prevailing 13 week t bill rate, taking advantage of higher interest rates as they become available.

By incorporating laddering into their investment strategy, investors can unlock the full potential of 13-week Treasury Bills and achieve their short-term investment objectives. Whether you’re seeking a low-risk, liquid investment or a diversified portfolio of short-term debt securities, laddering can help you maximize your returns and minimize your risk.

Staying Ahead of the Curve: Tracking 13-Week Treasury Bill Rates and Trends

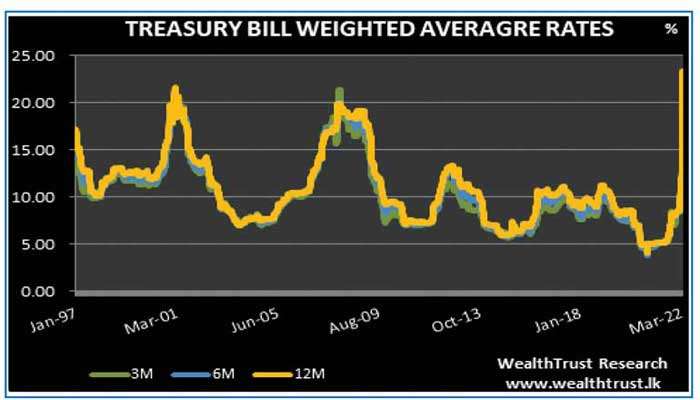

Staying informed about 13-week Treasury Bill rates and trends is crucial for investors seeking to maximize their returns and minimize their risk. In this section, we’ll provide guidance on how to track market data and news, and offer tips on how to stay ahead of the curve in the world of 13-week Treasury Bills.

One of the most effective ways to track 13-week Treasury Bill rates and trends is to follow reputable financial news sources and websites. The US Department of the Treasury’s website, for example, provides up-to-date information on Treasury Bill auctions, including the 13 week t bill rate. Investors can also track market data and news through financial news websites, such as Bloomberg and CNBC.

In addition to tracking market data and news, investors should also stay informed about broader economic trends and indicators. This includes tracking interest rates, inflation, and monetary policy, as these factors can all impact the 13 week t bill rate and the overall investment landscape. By staying informed about these trends and indicators, investors can make more informed investment decisions and stay ahead of the curve.

Another important consideration for investors is the frequency of Treasury Bill auctions. The US Department of the Treasury typically holds weekly auctions for 13-week Treasury Bills, with the results announced on Mondays. By tracking these auctions and staying informed about the 13 week t bill rate, investors can identify opportunities to invest in 13-week Treasury Bills at favorable rates.

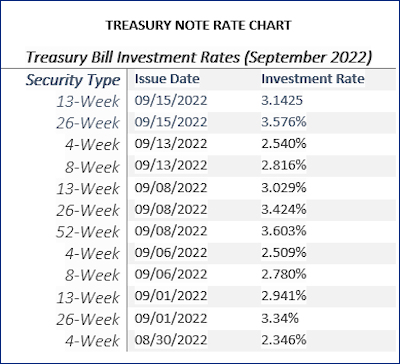

Investors can also use online tools and resources to track 13-week Treasury Bill rates and trends. For example, the Treasury Department’s website provides a Treasury Bill rate chart, which allows investors to track the 13 week t bill rate over time. Additionally, investors can use online calculators and tools to calculate the return on investment for 13-week Treasury Bills and compare them to other short-term investment options.

By staying informed about 13-week Treasury Bill rates and trends, investors can make more informed investment decisions and stay ahead of the curve in the world of short-term investments. Whether you’re a seasoned investor or just starting out, tracking market data and news is essential for maximizing returns and minimizing risk.