Understanding the Role of Treasury Notes in Your Investment Portfolio

Treasury notes are a cornerstone of a diversified investment portfolio, offering a low-risk investment option with the potential for steady returns. They are issued by the US Department of the Treasury to finance government operations and are backed by the full faith and credit of the US government. This makes them an attractive option for investors seeking a safe haven for their investments. Treasury notes are available in various maturities, ranging from a few weeks to 30 years, with the 10-year treasury note being a popular choice among investors. By incorporating 10-year treasury notes into a portfolio, investors can reduce overall risk and increase the potential for long-term returns. In fact, analyzing 10-year treasury note historical prices can provide valuable insights into the market, helping investors make informed decisions about their investment strategy.

How to Analyze Historical Price Trends for Informed Investment Decisions

Analyzing historical price trends for 10-year treasury notes is a crucial step in making informed investment decisions. By examining the patterns and trends of 10-year treasury note historical prices, investors can gain valuable insights into the market and identify opportunities for growth. This involves identifying key trends, such as changes in interest rates, inflation, and economic growth, which can impact the prices of 10-year treasury notes. Additionally, analyzing historical price data can help investors recognize patterns and cycles in the market, allowing them to make more informed decisions about their investment strategy. For instance, by studying the historical prices of 10-year treasury notes, investors can identify periods of high volatility and adjust their investment strategy accordingly. Furthermore, analyzing historical price trends can help investors set realistic expectations and manage risk, ultimately leading to more successful investment outcomes.

A Brief History of 10-Year Treasury Note Prices: Trends and Insights

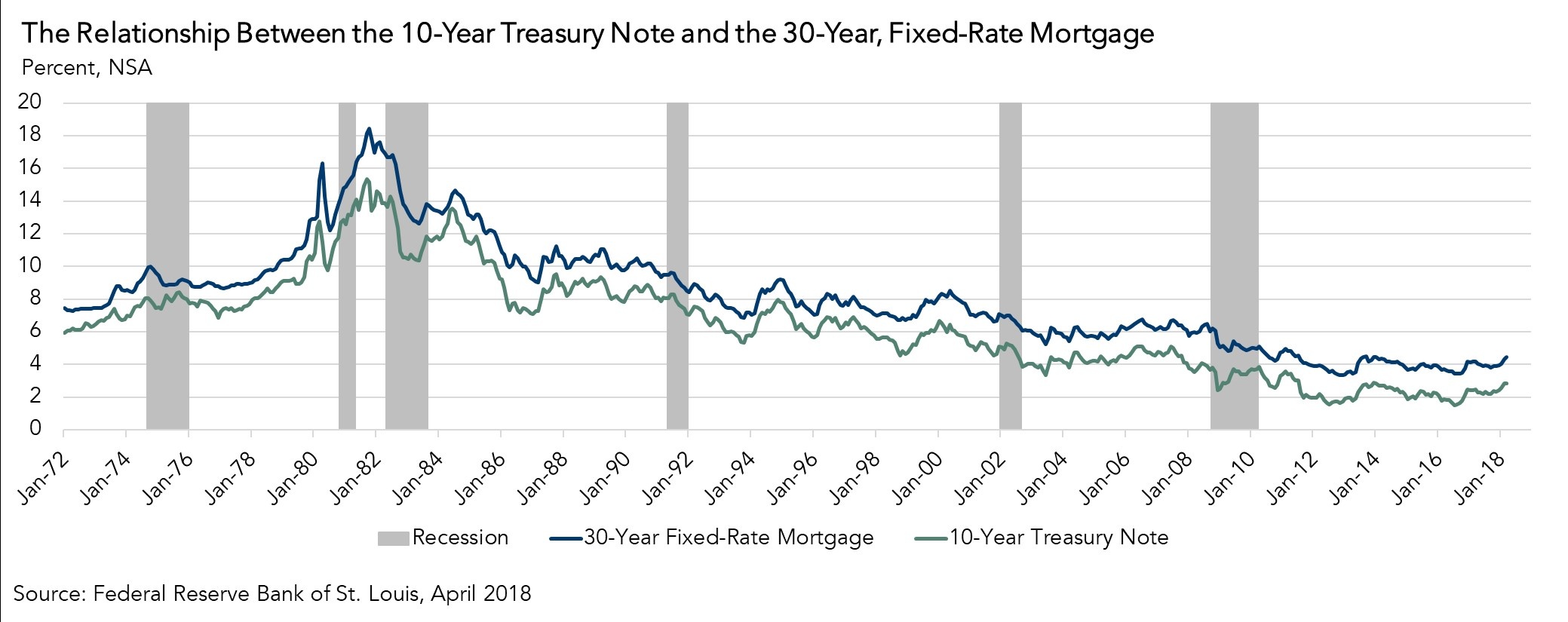

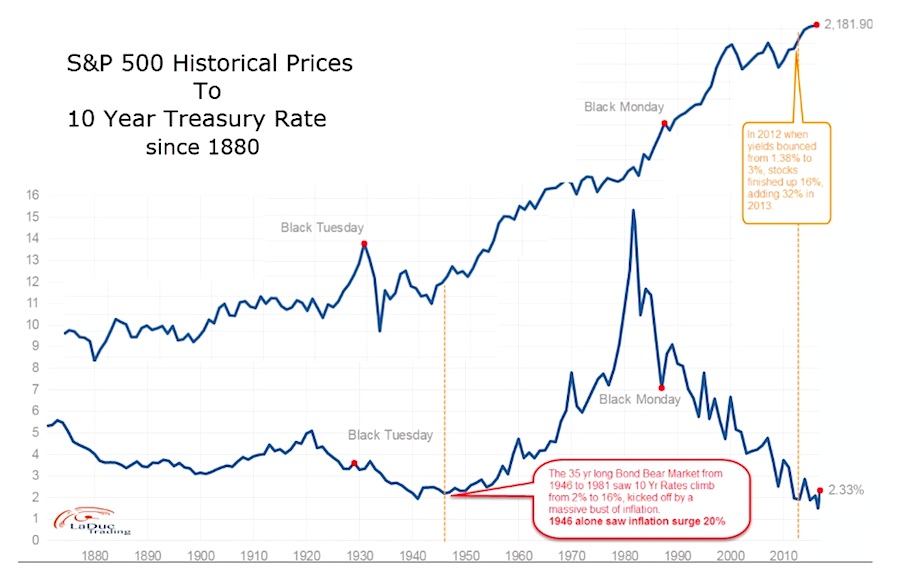

The historical prices of 10-year treasury notes have been shaped by a complex array of factors, including economic indicators, monetary policy, and market sentiment. Over the years, 10-year treasury note historical prices have experienced significant trends and shifts, reflecting the dynamic nature of the global economy. In the 1980s, for instance, 10-year treasury note prices were heavily influenced by high inflation rates, which led to a surge in interest rates. In contrast, the 1990s and early 2000s saw a decline in interest rates, driven by a period of economic growth and low inflation. The 2008 financial crisis marked a significant turning point, with 10-year treasury note prices plummeting in response to the global economic downturn. Since then, prices have been influenced by quantitative easing policies and shifting market sentiment. By examining these trends and events, investors can gain a deeper understanding of the factors that drive changes in 10-year treasury note prices, ultimately informing their investment decisions.

What Drives Changes in 10-Year Treasury Note Prices?

Understanding the factors that influence changes in 10-year treasury note prices is crucial for making informed investment decisions. Several key factors contribute to fluctuations in 10-year treasury note historical prices, including economic indicators, monetary policy, and market sentiment. Economic indicators, such as GDP growth, inflation rates, and unemployment rates, have a significant impact on 10-year treasury note prices. For instance, a strong economy with low unemployment and stable inflation tends to drive up interest rates, leading to higher 10-year treasury note prices. Monetary policy, set by central banks, also plays a critical role in shaping 10-year treasury note prices. Quantitative easing, for example, can lead to lower interest rates and decreased 10-year treasury note prices. Market sentiment, including investor confidence and risk appetite, also influences 10-year treasury note prices. When investors are risk-averse, they tend to flock to safe-haven assets like 10-year treasury notes, driving up prices. By recognizing these key factors, investors can better navigate the complex landscape of 10-year treasury note prices and make more informed investment decisions.

Using Historical Price Data to Inform Your Investment Strategy

Historical price data of 10-year treasury notes can be a valuable tool for investors looking to develop a successful investment strategy. By analyzing 10-year treasury note historical prices, investors can set realistic expectations for their investments and manage risk more effectively. One practical tip is to identify patterns and trends in historical price data, such as the impact of economic indicators, monetary policy, and market sentiment on 10-year treasury note prices. This can help investors anticipate potential changes in prices and adjust their investment strategy accordingly. Additionally, historical price data can be used to evaluate the performance of 10-year treasury notes relative to other investment options, such as stocks, bonds, and commodities. By comparing the historical prices of 10-year treasury notes to these other investment options, investors can make more informed decisions about asset allocation and diversification. Furthermore, historical price data can provide insights into the overall economy, including inflation, growth, and interest rates, which can inform investment decisions. By incorporating historical price data into their investment strategy, investors can make more informed decisions and achieve their long-term financial goals.

Comparing 10-Year Treasury Note Prices to Other Investment Options

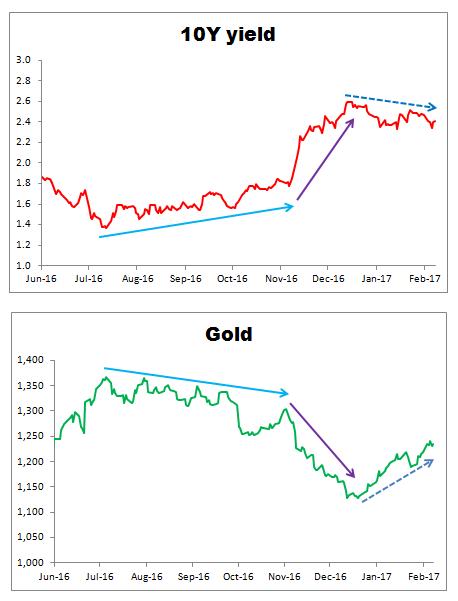

When considering an investment in 10-year treasury notes, it’s essential to evaluate their performance relative to other investment options. By comparing the historical prices of 10-year treasury notes to those of stocks, bonds, and commodities, investors can gain a better understanding of the pros and cons of each investment option. For instance, stocks tend to offer higher potential returns, but also come with higher volatility and risk. Bonds, on the other hand, offer fixed returns, but may not keep pace with inflation. Commodities, such as gold and oil, can provide a hedge against inflation and market volatility, but may be subject to supply and demand fluctuations. In contrast, 10-year treasury notes offer a low-risk investment option with relatively stable returns, making them an attractive option for investors seeking to diversify their portfolios. By analyzing the historical prices of 10-year treasury notes in relation to these other investment options, investors can make more informed decisions about asset allocation and risk management. Additionally, understanding the historical performance of 10-year treasury notes can help investors identify opportunities to capitalize on market trends and shifts. For example, during times of economic uncertainty, investors may flock to safe-haven assets like 10-year treasury notes, driving up prices. By recognizing these patterns, investors can adjust their investment strategy to take advantage of market opportunities.

What Do Historical Price Trends Reveal About the Economy?

Historical price trends of 10-year treasury notes can provide valuable insights into the overall economy, including inflation, growth, and interest rates. By analyzing 10-year treasury note historical prices, investors can gain a better understanding of the economic environment and make more informed investment decisions. For instance, a rising yield on 10-year treasury notes may indicate a growing economy, as investors become more optimistic about future growth and inflation. Conversely, a declining yield may suggest a slowing economy, as investors become more risk-averse and seek safer investments. Additionally, historical price trends can reveal patterns in inflation, such as the impact of monetary policy decisions on interest rates and prices. By examining the historical relationship between 10-year treasury note prices and economic indicators, investors can develop a more nuanced understanding of the economy and make more informed investment decisions. Furthermore, historical price trends can provide insights into the impact of global events, such as geopolitical tensions or natural disasters, on the economy and financial markets. By recognizing these patterns and relationships, investors can develop a more comprehensive understanding of the economy and make more informed investment decisions.

Conclusion: Making Informed Investment Decisions with Historical Price Data

In conclusion, understanding 10-year treasury note historical prices is crucial for making informed investment decisions. By analyzing historical price trends, investors can gain valuable insights into the economy, identify patterns, and make more informed investment decisions. The significance of 10-year treasury notes in a diversified investment portfolio cannot be overstated, offering a low-risk investment option with steady returns. By recognizing the key factors that drive changes in 10-year treasury note prices, investors can develop a more nuanced understanding of the economy and make more informed investment decisions. Furthermore, comparing 10-year treasury note prices to other investment options can help investors identify opportunities and manage risk. Ultimately, integrating historical price data into a successful investment strategy requires a deep understanding of the economy, market trends, and the role of 10-year treasury notes in a diversified portfolio. By doing so, investors can unlock the secrets of long-term investing and achieve their financial goals.

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)