Unlocking the Secrets of Trading Treasury Note Agreements

The world of finance relies on various instruments for managing risk and capitalizing on market movements. Among these, the 10 year treasury futures contract stands out as a pivotal tool. This contract allows investors and institutions to hedge against interest rate fluctuations and speculate on the direction of the market. Understanding the intricacies of the 10 year treasury futures contract is essential for navigating the complexities of modern financial markets.

Treasury futures contracts, particularly the 10 year treasury futures contract, serve as a benchmark for assessing the overall health and sentiment of the economy. They are agreements to buy or sell U.S. Treasury bonds at a predetermined future date and price. These contracts are used extensively by institutional investors, such as pension funds, insurance companies, and hedge funds, to manage their interest rate exposure and to implement sophisticated trading strategies. The 10 year treasury futures contract is also utilized by smaller entities looking to make calculated bets on the market.

The importance of the 10 year treasury futures contract extends beyond mere speculation. It provides a vital mechanism for price discovery, reflecting the collective expectations of market participants regarding future interest rates. This makes the 10 year treasury futures contract a crucial indicator for policymakers, economists, and investors alike. By analyzing the trading activity and price movements of the 10 year treasury futures contract, one can gain valuable insights into the underlying dynamics of the bond market and the broader economy. In essence, the 10 year treasury futures contract is an indispensable tool for anyone seeking to understand and participate in the global financial system.

Demystifying the Mechanics: How Treasury Bonds Contracts Function

The specifics of a 10 year treasury futures contract are crucial for understanding its trading dynamics. A standard 10 year treasury futures contract represents a commitment to deliver, or take delivery of, $100,000 face value of U.S. Treasury notes at a specified future date. The ticker symbol for the most actively traded 10 year treasury futures contract is typically ZN on the Chicago Mercantile Exchange (CME). Delivery months occur quarterly, usually in March, June, September, and December. This allows traders to position themselves based on their expectations of interest rate movements over various time horizons.

Pricing conventions for the 10 year treasury futures contract are unique. Prices are quoted in points and 32nds of a point. For example, a quote of 130-16 represents a price of 130 and 16/32nds. The minimum price fluctuation, or tick size, is one-half of one 32nd of a point, which equates to $15.625 per contract. This level of precision allows for very tight bidding and asking spreads, contributing to the contract’s liquidity. Understanding how these prices relate to expected yields is essential. When the price of a 10 year treasury futures contract rises, it indicates that market participants anticipate interest rates to fall, and vice versa. This inverse relationship is the cornerstone of trading strategies involving the 10 year treasury futures contract.

The underlying asset for the 10 year treasury futures contract is not a specific Treasury note, but rather a basket of Treasury notes with a remaining maturity of at least 6.5 years, but not more than 10 years from the first day of the delivery month. A conversion factor is applied to each eligible Treasury note to account for differences in coupon rates. The seller of the futures contract can deliver any eligible note, making the contract delivery process complex but efficient. The 10 year treasury futures contract serves as a benchmark for the intermediate part of the yield curve, and its price movements often reflect broader economic expectations and Federal Reserve policy decisions. Traders use the 10 year treasury futures contract to hedge interest rate risk, speculate on market movements, and express views on the future direction of the economy.

A Comprehensive Guide to Deciphering Treasury Futures Quotes

Understanding Treasury futures quotes is crucial for anyone participating in the market. A 10 year treasury futures contract quote provides a snapshot of current market sentiment and potential trading opportunities. Each element within the quote offers valuable information that can inform trading decisions. The standard quote includes the bid price, ask price, last price, change from the previous day’s settlement, and open interest.

The bid price represents the highest price a buyer is willing to pay for a 10 year treasury futures contract. Conversely, the ask price is the lowest price a seller is willing to accept. The last price indicates the most recent price at which a trade occurred. The change reflects the difference between the last price and the previous day’s settlement price, showing the contract’s price movement. Open interest represents the total number of outstanding contracts that have not yet been settled, indicating the market’s liquidity and overall interest in the 10 year treasury futures contract.

To illustrate, consider a hypothetical 10 year treasury futures contract quote: Bid 125-16, Ask 125-17, Last 125-16.5, Change +0.05, Open Interest 500,000. In this example, a buyer is willing to pay 125 and 16/32nds of a point. A seller is asking 125 and 17/32nds of a point. The last trade occurred at 125 and 16.5/32nds of a point. The price has increased by 0.05 points from the previous day. There are 500,000 outstanding 10 year treasury futures contracts. This information can guide traders in determining potential entry and exit points, as well as assessing market depth and potential volatility. Analyzing the relationship between the bid and ask prices, known as the spread, can also provide insights into market liquidity. A narrow spread typically indicates high liquidity, while a wider spread may suggest lower liquidity and increased transaction costs for the 10 year treasury futures contract.

How to Strategically Trade Treasury Bills and Notes Futures

Trading the 10 year treasury futures contract requires a strategic approach, encompassing both directional and hedging strategies. Directional strategies involve speculating on the future direction of interest rates. If a trader believes interest rates will decline, they would buy a 10 year treasury futures contract, anticipating that the contract’s price will increase as yields fall. Conversely, if a trader expects interest rates to rise, they would sell a 10 year treasury futures contract, aiming to profit from the anticipated price decrease as yields increase.

Hedging strategies, on the other hand, are employed to mitigate interest rate risk. For example, a bond portfolio manager concerned about rising interest rates might sell 10 year treasury futures contract to offset potential losses in their bond holdings. If interest rates do rise, the losses on the bond portfolio would be partially compensated by the gains from the short futures position. Another hedging strategy involves using 10 year treasury futures contract to lock in borrowing costs. A corporation planning to issue bonds in the future could buy 10 year treasury futures contract to protect against a potential increase in interest rates before the bond issuance. This is a quite common use of the 10 year treasury futures contract.

Effective risk management is paramount when trading 10 year treasury futures contract. Given the leverage inherent in futures contracts, even small interest rate movements can result in substantial gains or losses. Traders should always employ stop-loss orders to limit potential losses and carefully manage their position sizes to align with their risk tolerance. A well-defined risk management plan is essential for navigating the complexities of the 10 year treasury futures contract market and achieving consistent profitability. Diversification, by trading other contracts, is also a key part of risk mitigation strategies. The success in trading 10 year treasury futures contract relies not only on understanding market dynamics but also on implementing robust risk control measures.

Identifying Key Factors Influencing Interest Rate Futures Prices

Numerous macroeconomic factors significantly influence 10 year treasury futures contract prices. The Federal Reserve’s monetary policy decisions are paramount. Interest rate hikes generally push prices down, while rate cuts tend to increase prices. This is because higher rates make existing bonds less attractive, lowering their future value, which is reflected in futures prices. Conversely, lower rates increase the demand for bonds, pushing prices higher. Understanding the Fed’s intentions and the likely path of interest rates is crucial for trading 10 year treasury futures contracts effectively.

Inflation data, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), also play a crucial role. High inflation typically leads the Federal Reserve to tighten monetary policy, raising interest rates and potentially decreasing the price of a 10 year treasury futures contract. Conversely, low inflation might prompt the central bank to maintain lower rates or even ease monetary policy, potentially supporting higher futures prices. Economic growth indicators, including Gross Domestic Product (GDP) growth and employment figures, provide insight into the overall health of the economy. Strong economic growth often leads to higher interest rates as investors anticipate future rate increases by the central bank. This, in turn, can negatively impact the price of a 10 year treasury futures contract. Conversely, weaker growth can suggest lower rates and potentially higher futures prices.

Global events can significantly impact the 10 year treasury futures contract market. Geopolitical instability, international trade tensions, or major economic shocks in other countries can cause investors to seek safety in U.S. Treasury securities. This increased demand can drive up prices. Similarly, unexpected shifts in global economic sentiment can influence the outlook for interest rates in the U.S., affecting 10 year treasury futures contracts. For instance, an unexpected slowdown in global growth might prompt the Federal Reserve to lower rates, potentially boosting futures prices. Analyzing these factors and their interplay is vital for successfully navigating the 10 year treasury futures contract market. Understanding how these factors affect market sentiment is essential for making informed trading decisions.

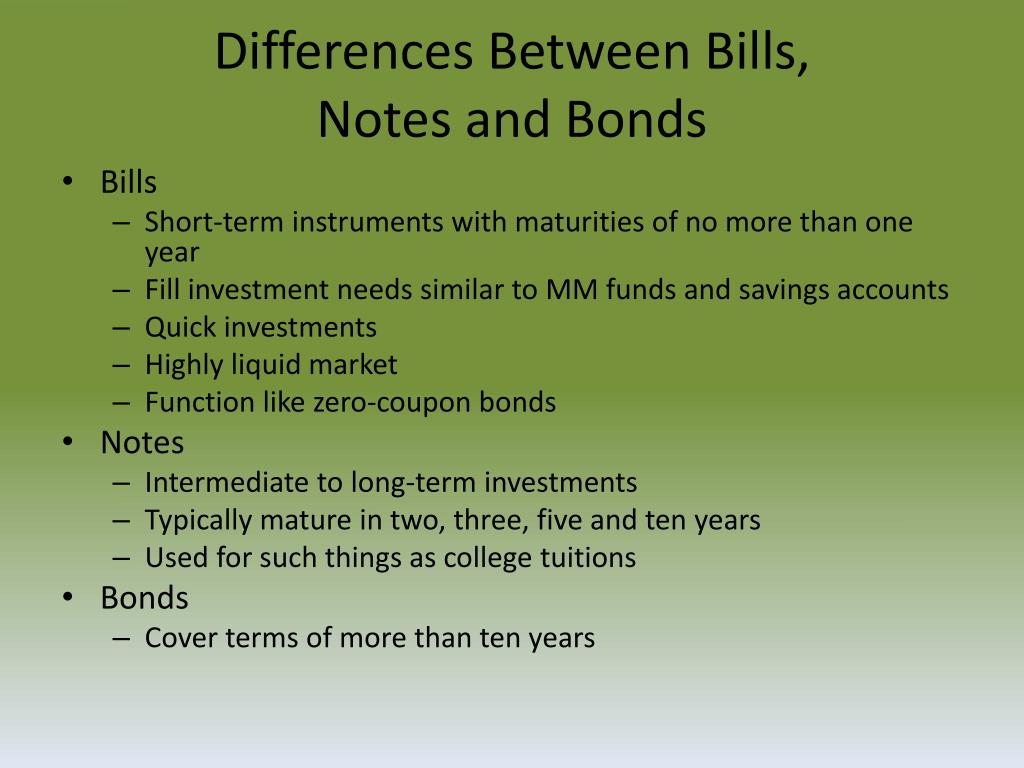

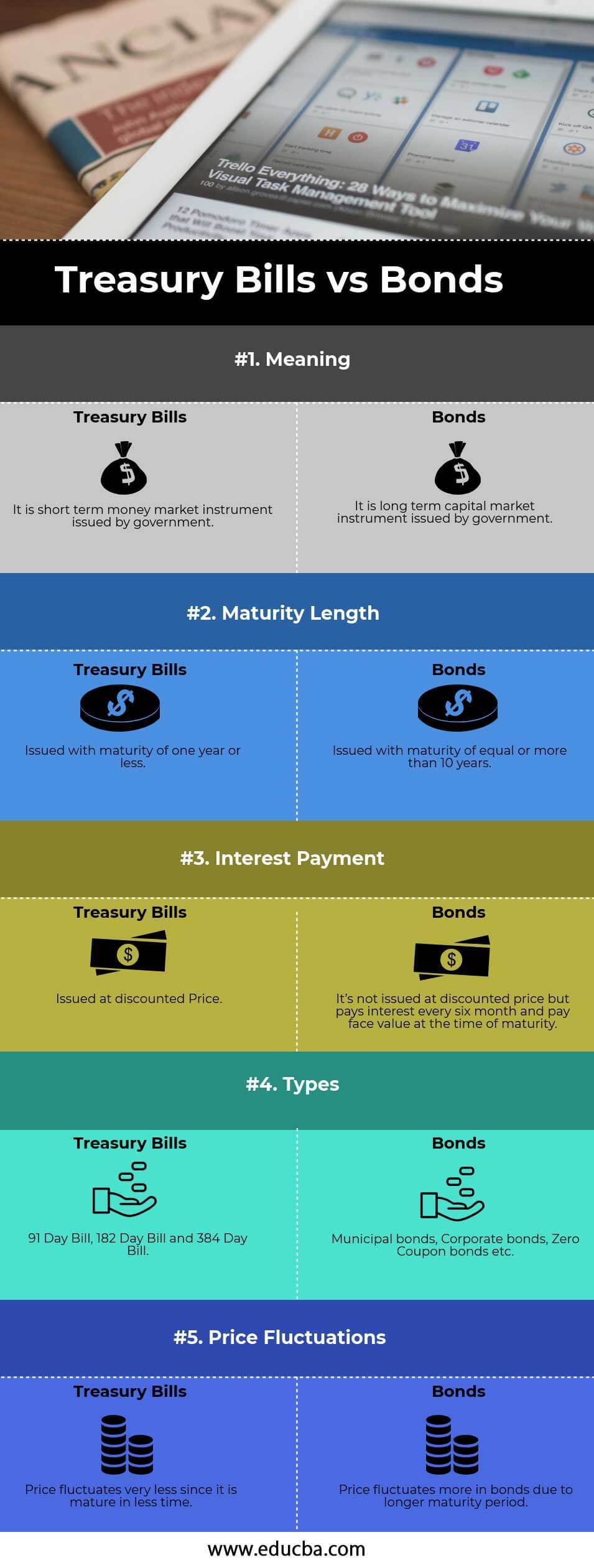

Comparing Treasury Contract Offerings: Ten-Year Notes vs. Others

The world of U.S. Treasury futures extends beyond the widely followed 10 year treasury futures contract. Understanding the nuances of different Treasury futures contracts is crucial for investors and traders. Contracts based on 2-year, 5-year, and 30-year Treasury bonds offer distinct risk profiles, liquidity characteristics, and serve different purposes within a portfolio. While all these contracts reflect expectations about future interest rates, the 10 year treasury futures contract often stands out as the benchmark.

Shorter-term Treasury futures, such as the 2-year and 5-year contracts, are generally more sensitive to near-term Federal Reserve policy and economic data releases. These contracts may appeal to traders with shorter time horizons or those seeking to fine-tune their exposure to specific parts of the yield curve. The 2-year Treasury futures contract, for example, can be used to hedge against changes in short-term interest rates, while the 5-year contract offers a middle ground between short and intermediate-term exposures. Liquidity tends to be very high in the 2-year contract, reflecting its sensitivity to monetary policy. However, the 10 year treasury futures contract typically offers a balance of liquidity and sensitivity to broader economic trends.

At the other end of the spectrum, the 30-year Treasury bond futures contract is most sensitive to long-term inflation expectations and economic growth prospects. This contract is often favored by institutional investors, such as pension funds and insurance companies, who need to hedge long-dated liabilities. Due to its longer duration, the 30-year contract experiences larger price swings than shorter-term contracts, making it potentially more volatile. While the 30-year contract provides a valuable tool for managing long-term interest rate risk, the 10 year treasury futures contract remains the most actively traded and closely watched Treasury futures contract. The 10 year treasury futures contract serves as a bellwether for the overall health of the U.S. economy and the direction of interest rates, making it an essential instrument for a wide range of market participants. The “benchmark” status is earned due to its high liquidity, sensitivity to economic news, and role in pricing other fixed income securities. Traders often use the 10 year treasury futures contract to express their views on the overall direction of the bond market, and it serves as a key reference point for pricing corporate bonds and other debt instruments. Understanding the interplay between these different Treasury futures contracts allows for more sophisticated and nuanced trading strategies.

Mastering Risk Mitigation Strategies in Trading Treasury Notes Agreements

Trading 10 year treasury futures contract involves inherent risks that market participants must understand and manage effectively. One primary risk is interest rate risk. Fluctuations in interest rates directly impact the value of the 10 year treasury futures contract. A rise in interest rates typically leads to a decrease in the contract’s price, and conversely, a fall in interest rates usually increases its price. This inverse relationship requires traders to carefully monitor economic indicators and Federal Reserve policy to anticipate potential interest rate movements.

Leverage is another significant risk factor associated with trading 10 year treasury futures contract. Futures contracts offer substantial leverage, allowing traders to control a large notional value with a relatively small margin deposit. While leverage can amplify profits, it can also magnify losses. A small adverse price movement can result in significant losses that may exceed the initial margin. Prudent risk management dictates employing appropriate position sizing to limit potential losses and avoid over-leveraging. Furthermore, liquidity risk is a concern, particularly during periods of market stress. Liquidity refers to the ease with which a 10 year treasury futures contract can be bought or sold without significantly impacting its price. In illiquid markets, it may be difficult to exit a position at a desired price, potentially leading to losses. Monitoring trading volumes and market depth is crucial for assessing liquidity conditions.

To mitigate these risks, traders should implement a comprehensive risk management plan. Stop-loss orders are essential tools for limiting potential losses. A stop-loss order automatically exits a position when the price reaches a predetermined level. This helps to prevent losses from escalating beyond a tolerable threshold. Diversification is another valuable risk management technique. By spreading investments across different asset classes or futures contracts, traders can reduce their exposure to any single market. This helps to cushion the impact of adverse price movements in one particular investment. Additionally, traders should continuously monitor their positions and adjust their risk management strategies as market conditions change. Staying informed about economic events, policy announcements, and market trends is crucial for making sound trading decisions and effectively managing risk when trading 10 year treasury futures contract. A well-defined and consistently applied risk management plan is paramount for long-term success in the 10 year treasury futures contract market.

Analyzing the Long-Term Trends in Treasury Futures Markets

The historical performance of the 10 year treasury futures contract offers valuable insights into potential future trends. Examining past market behavior, particularly during periods of economic expansion and contraction, provides a foundation for understanding how these instruments react to various conditions. Demographic shifts, such as aging populations in developed countries, can influence investment patterns and demand for fixed-income assets, thereby impacting the 10 year treasury futures contract. Technological advancements, including algorithmic trading and high-frequency trading, have increased market efficiency and liquidity, but also introduced new forms of volatility. Global economic integration, characterized by interconnected financial markets and trade flows, means that events in one region can quickly ripple through the global economy, affecting the prices of 10 year treasury futures contract.

One key area of focus is the evolving role of central banks. The Federal Reserve’s monetary policy decisions, particularly regarding interest rates and quantitative easing, exert a significant influence on the 10 year treasury futures contract. Monitoring these policy shifts and understanding their implications is crucial for traders and investors. Inflation expectations also play a vital role. Rising inflation typically leads to higher interest rates and lower Treasury futures prices, while falling inflation can have the opposite effect. Therefore, tracking inflation data and understanding the factors driving inflation are essential for making informed trading decisions about the 10 year treasury futures contract. Furthermore, geopolitical risks, such as trade wars, political instability, and international conflicts, can create uncertainty and volatility in financial markets, impacting the 10 year treasury futures contract.

Looking ahead, several factors could shape the long-term outlook for interest rates and the 10 year treasury futures contract. The pace of economic growth, both in the United States and globally, will be a primary driver. A strong and sustained economic expansion is likely to put upward pressure on interest rates, while a slowdown could lead to lower rates. Changes in government fiscal policy, such as tax cuts or increased government spending, can also influence interest rates and Treasury futures prices. The development and adoption of new technologies could have a significant impact on productivity and economic growth, potentially affecting the demand for and supply of capital. Considering these diverse influences is important for assessing potential risks and opportunities associated with trading the 10 year treasury futures contract, understanding the interplay between economic forces and market dynamics is essential for navigating the complexities of this market. The 10 year treasury futures contract will continue to be a vital instrument for managing interest rate risk and expressing views on the future direction of the economy.