Understanding the Role of Treasury Bonds in Your Portfolio

Treasury bonds have long been a cornerstone of investment portfolios, offering a unique combination of low risk and steady returns. By incorporating treasury bonds into a diversified investment strategy, investors can reduce their exposure to market volatility, while also generating a predictable income stream. The 10-year treasury bond, in particular, has proven to be a popular choice among investors, thanks to its relatively long duration and attractive yields. As investors navigate the complex world of treasury bond prices, it’s essential to understand the role that these bonds play in a well-diversified portfolio. By doing so, investors can make informed decisions about their investment strategy, ultimately leading to more effective risk management and improved returns.

How to Make Sense of Treasury Bond Price Fluctuations

Treasury bond prices are influenced by a complex array of factors, making it essential for investors to understand the underlying dynamics driving price fluctuations. At the forefront of these factors are interest rates, which have a direct impact on bond prices. When interest rates rise, existing bonds with lower yields become less attractive, causing their prices to fall. Conversely, when interest rates fall, bond prices tend to rise. Inflation is another key factor, as rising inflation can erode the purchasing power of bond yields, leading to lower prices. Economic indicators, such as GDP growth and unemployment rates, also play a significant role in shaping treasury bond prices. For instance, a strong economy with low unemployment may lead to higher interest rates, causing bond prices to fall. By grasping the intricacies of these factors, investors can better navigate the complexities of treasury bond price fluctuations, ultimately making more informed investment decisions.

A Historical Perspective: 10-Year Treasury Bond Price Trends

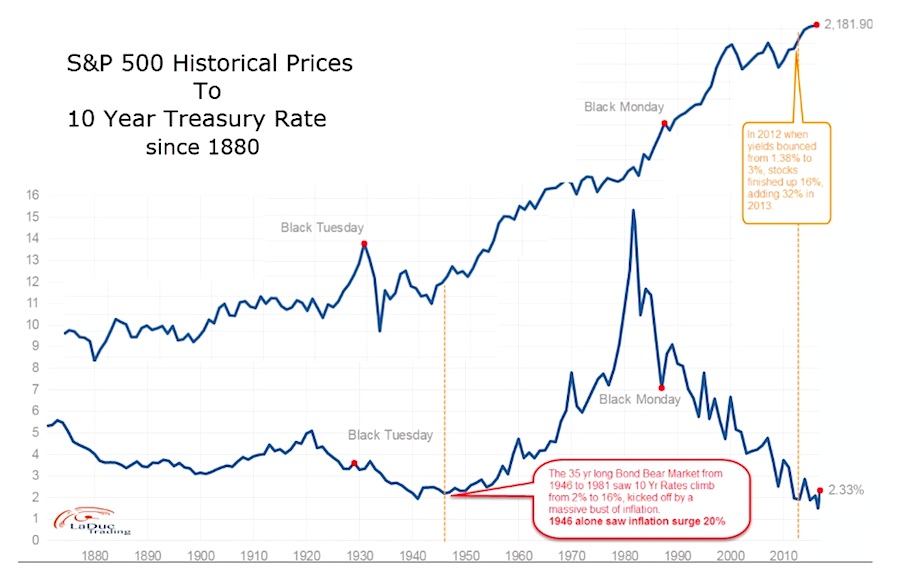

A review of the 10-year treasury bond price history reveals a complex and dynamic landscape, shaped by a multitude of factors. Over the past few decades, 10-year treasury bond prices have experienced significant fluctuations, influenced by events such as the 2008 financial crisis, changes in monetary policy, and shifts in global economic trends. For instance, during the 2008 crisis, 10-year treasury bond prices surged as investors sought safe-haven assets, driving yields to historic lows. In contrast, during periods of economic growth, such as the mid-2010s, bond prices fell as investors became more risk-tolerant and yields rose. By examining the historical trends and patterns in 10-year treasury bond prices, investors can gain valuable insights into the underlying drivers of bond price movements, ultimately informing their investment decisions. The chart below illustrates the 10-year treasury bond price history, highlighting the significant events and trends that have shaped the market.

As seen in the chart, the 10-year treasury bond price history is marked by periods of volatility and stability, reflecting the complex interplay of economic and market factors. By understanding these trends and patterns, investors can better navigate the complexities of the treasury bond market, ultimately making more informed investment decisions.

What Drives Changes in 10-Year Treasury Bond Yields

Understanding the factors that influence 10-year treasury bond yields is crucial for investors seeking to navigate the complexities of the bond market. At the heart of yield fluctuations are monetary policy decisions, which have a profound impact on bond prices. When central banks lower interest rates, bond yields tend to fall, making existing bonds with higher yields more attractive and driving up their prices. Conversely, when interest rates rise, bond yields increase, causing prices to fall. Economic growth is another key driver of 10-year treasury bond yields, as a strong economy can lead to higher inflation expectations and increased borrowing costs, driving yields up. Investor sentiment also plays a significant role, as shifts in market sentiment can influence bond prices and yields. For instance, during periods of market volatility, investors may seek the safety of treasury bonds, driving up prices and reducing yields. By grasping the intricacies of these factors, investors can better understand the dynamics driving 10-year treasury bond yields and make more informed investment decisions.

A review of the 10 year treasury bond price history reveals that monetary policy decisions have been a significant driver of yield fluctuations. For example, during the 2008 financial crisis, the Federal Reserve’s quantitative easing program led to a significant decline in 10-year treasury bond yields, as the central bank sought to stimulate economic growth. In contrast, during periods of economic growth, such as the mid-2010s, yields rose as the Fed began to normalize interest rates. By understanding the historical relationship between monetary policy decisions and 10-year treasury bond yields, investors can better anticipate future changes in the bond market.

Using Treasury Bond Price History to Inform Investment Decisions

Historical treasury bond price data provides a valuable resource for investors seeking to make informed investment decisions. By analyzing the 10 year treasury bond price history, investors can identify trends, manage risk, and optimize returns. For instance, a review of the historical data may reveal patterns of yield fluctuations in response to changes in monetary policy or economic indicators. This insight can inform investment decisions, such as timing bond purchases or adjusting portfolio allocations. Additionally, historical data can help investors identify periods of high volatility or low yields, allowing them to adjust their investment strategies accordingly.

One key application of treasury bond price history is in identifying trends and patterns. By examining the historical performance of 10-year treasury bonds, investors can identify periods of sustained growth or decline, informing their investment decisions. For example, a review of the 10 year treasury bond price history may reveal a trend of increasing yields during periods of economic growth, or a pattern of declining yields during periods of monetary easing. This insight can help investors anticipate future changes in the bond market and adjust their portfolios accordingly.

Furthermore, historical treasury bond price data can be used to manage risk and optimize returns. By analyzing the historical relationship between treasury bond prices and economic indicators, investors can better understand the potential risks and rewards associated with different investment strategies. This insight can inform decisions such as asset allocation, diversification, and hedging, ultimately helping investors to optimize their returns and manage their risk exposure.

The Impact of Economic Indicators on Treasury Bond Prices

Economic indicators play a significant role in shaping 10-year treasury bond prices. GDP growth, unemployment rates, and inflation rates are just a few examples of the key indicators that influence bond prices. When GDP growth is strong, it can lead to higher inflation expectations, causing bond yields to rise and prices to fall. Conversely, during periods of slow economic growth, bond yields tend to fall, and prices rise. Understanding the relationship between these economic indicators and treasury bond prices is crucial for investors seeking to make informed investment decisions.

Unemployment rates are another important economic indicator that affects treasury bond prices. When unemployment rates are low, it can signal a strong economy, leading to higher bond yields and lower prices. On the other hand, high unemployment rates can lead to lower bond yields and higher prices. For instance, during the 2008 financial crisis, unemployment rates soared, leading to a decline in 10-year treasury bond yields and a subsequent increase in prices.

Inflation rates also have a profound impact on treasury bond prices. When inflation rates rise, it can erode the purchasing power of bondholders, leading to higher yields and lower prices. Conversely, during periods of low inflation, bond yields tend to fall, and prices rise. A review of the 10 year treasury bond price history reveals that periods of high inflation, such as the 1970s and 1980s, were accompanied by higher bond yields and lower prices.

By examining the historical relationship between economic indicators and treasury bond prices, investors can better understand the potential risks and rewards associated with different investment strategies. This insight can inform decisions such as asset allocation, diversification, and hedging, ultimately helping investors to optimize their returns and manage their risk exposure.

Comparing 10-Year Treasury Bond Prices to Other Investment Options

When considering investment options, it’s essential to evaluate the historical performance of 10-year treasury bonds in relation to other investment types. This comparison can help investors make informed decisions about their portfolio allocations and risk management strategies. A review of the 10 year treasury bond price history reveals that these bonds have historically provided a stable source of returns, with lower volatility compared to stocks and corporate bonds.

In contrast, stocks have historically offered higher returns, but with greater volatility. During periods of economic downturn, stock prices can plummet, making them a riskier investment option. Corporate bonds, on the other hand, offer higher yields than treasury bonds, but with a higher credit risk. Commodities, such as gold and oil, have historically provided a hedge against inflation, but their prices can be highly volatile.

A comparison of the historical performance of 10-year treasury bonds to other investment options reveals that they offer a unique combination of low risk and steady returns. While they may not offer the highest returns, they provide a stable source of income and can help to diversify a portfolio. By understanding the historical performance of 10-year treasury bonds in relation to other investment options, investors can make informed decisions about their investment strategies and optimize their returns.

For example, during the 2008 financial crisis, 10-year treasury bond prices surged as investors sought safe-haven assets. In contrast, stock prices plummeted, and corporate bond yields soared. A review of the 10 year treasury bond price history reveals that these bonds have historically provided a stable source of returns, even during periods of economic turmoil.

By incorporating 10-year treasury bonds into a diversified portfolio, investors can reduce their risk exposure and optimize their returns. By understanding the historical performance of these bonds in relation to other investment options, investors can make informed decisions about their investment strategies and achieve their long-term financial goals.

Conclusion: Navigating the Complex World of Treasury Bond Prices

In conclusion, understanding the complexities of 10 year treasury bond price history is crucial for making informed investment decisions. By grasping the factors that influence treasury bond prices, including interest rates, inflation, and economic indicators, investors can optimize their returns and manage risk. A review of the 10 year treasury bond price history reveals that these bonds have historically provided a stable source of returns, with lower volatility compared to other investment options.

By incorporating 10-year treasury bonds into a diversified portfolio, investors can reduce their risk exposure and achieve their long-term financial goals. Whether seeking steady returns, managing risk, or optimizing portfolio performance, understanding the 10 year treasury bond price history is essential for navigating the complex world of treasury bond prices.

Ultimately, investors who take the time to understand the intricacies of treasury bond prices and their role in a diversified portfolio will be better equipped to make informed investment decisions and achieve long-term financial success. By leveraging the insights and knowledge gained from this guide, investors can unlock the secrets of long-term investing and navigate the complex world of treasury bond prices with confidence.