What is a Constant Maturity Rate and Why Does it Matter?

In the realm of fixed-income investing, constant maturity rates play a vital role in measuring the average interest rate of a portfolio of bonds with varying maturities. This rate is calculated by taking into account the yields of bonds with different maturities, providing a comprehensive picture of the bond market. The 10 year constant maturity rate, in particular, is a widely followed indicator that provides valuable insights into the long-term direction of interest rates.

Understanding constant maturity rates is crucial for making informed investment decisions. By analyzing the 10 year constant maturity rate, investors can gain a better understanding of the overall bond market, making it easier to identify opportunities and mitigate risks. This rate can also serve as a benchmark for evaluating the performance of individual bonds or bond portfolios. Furthermore, constant maturity rates can provide clues about the direction of interest rates, allowing investors to adjust their strategies accordingly.

In essence, constant maturity rates offer a snapshot of the bond market’s expectations of future interest rates. By grasping the concept of constant maturity rates, investors can develop a more nuanced understanding of the bond market, ultimately leading to more informed investment decisions. As the 10 year constant maturity rate continues to play a significant role in shaping investment strategies, it is essential for investors to stay informed about its movements and implications.

How to Calculate the 10 Year Constant Maturity Rate: A Step-by-Step Guide

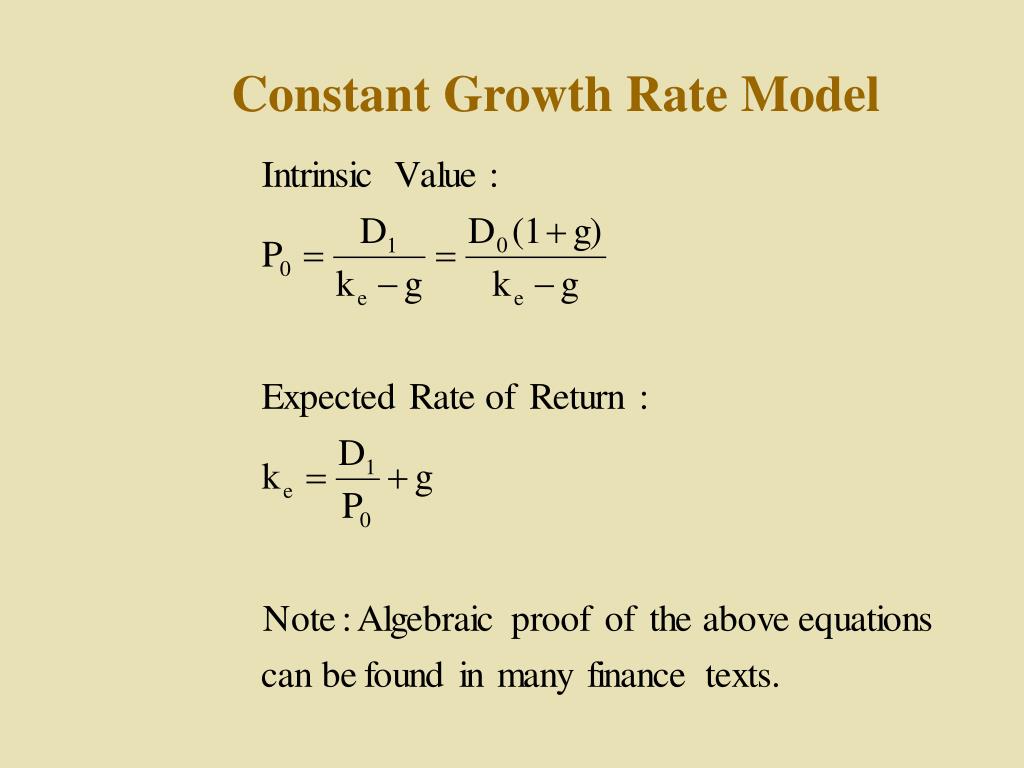

Calculating the 10 year constant maturity rate requires a thorough understanding of the underlying concepts and formulas. In this section, we will delve into the step-by-step process of calculating the 10 year constant maturity rate, providing a comprehensive guide for investors and financial professionals.

The 10 year constant maturity rate is calculated using a weighted average of the yields of bonds with different maturities. The formula for calculating the 10 year constant maturity rate is as follows:

10 Year Constant Maturity Rate = (Σ (Yield of Bond i x Weight of Bond i)) / Σ Weight of Bond i

Where:

Yield of Bond i = The yield of the individual bond

Weight of Bond i = The weight of the individual bond in the portfolio

To calculate the 10 year constant maturity rate, investors need to gather data on the yields of bonds with different maturities. This data can be obtained from financial databases or websites that provide bond yield information. Once the data is gathered, investors can plug in the values into the formula to calculate the 10 year constant maturity rate.

Some best practices to keep in mind when calculating the 10 year constant maturity rate include:

Using a diversified portfolio of bonds to minimize risk

Ensuring that the weights of the individual bonds are accurate and up-to-date

Using reliable and accurate data sources to gather bond yield information

By following these steps and best practices, investors can accurately calculate the 10 year constant maturity rate, providing valuable insights into the bond market and informing investment decisions.

The Impact of Economic Indicators on Constant Maturity Rates

The 10 year constant maturity rate is closely tied to various economic indicators, which can significantly impact its value. Understanding the relationship between these indicators and the 10 year constant maturity rate is crucial for investors seeking to make informed investment decisions.

One of the most significant economic indicators affecting the 10 year constant maturity rate is GDP growth. When GDP growth is strong, it can lead to higher interest rates, causing the 10 year constant maturity rate to rise. Conversely, slow GDP growth can result in lower interest rates, leading to a decrease in the 10 year constant maturity rate.

Inflation is another key economic indicator that influences the 10 year constant maturity rate. When inflation rises, bond yields tend to increase, causing the 10 year constant maturity rate to rise. This is because investors demand higher returns to compensate for the erosion of purchasing power caused by inflation.

Unemployment rates also play a crucial role in shaping the 10 year constant maturity rate. When unemployment rates are low, it can lead to higher interest rates, causing the 10 year constant maturity rate to rise. Conversely, high unemployment rates can result in lower interest rates, leading to a decrease in the 10 year constant maturity rate.

Other economic indicators, such as consumer spending, industrial production, and housing market trends, can also impact the 10 year constant maturity rate. By monitoring these indicators, investors can gain valuable insights into the direction of the 10 year constant maturity rate and make informed investment decisions.

For example, if economic indicators suggest a strong economy with rising GDP growth and low unemployment, investors may expect the 10 year constant maturity rate to rise. This could lead them to adjust their investment strategies, such as shifting from long-term bonds to shorter-term bonds or diversifying their portfolios to mitigate risk.

In conclusion, understanding the impact of economic indicators on the 10 year constant maturity rate is essential for investors seeking to navigate the complex world of fixed-income investing. By monitoring these indicators and their impact on the 10 year constant maturity rate, investors can make informed decisions and optimize their investment strategies.

Understanding the Yield Curve: A Key to Unlocking Constant Maturity Rates

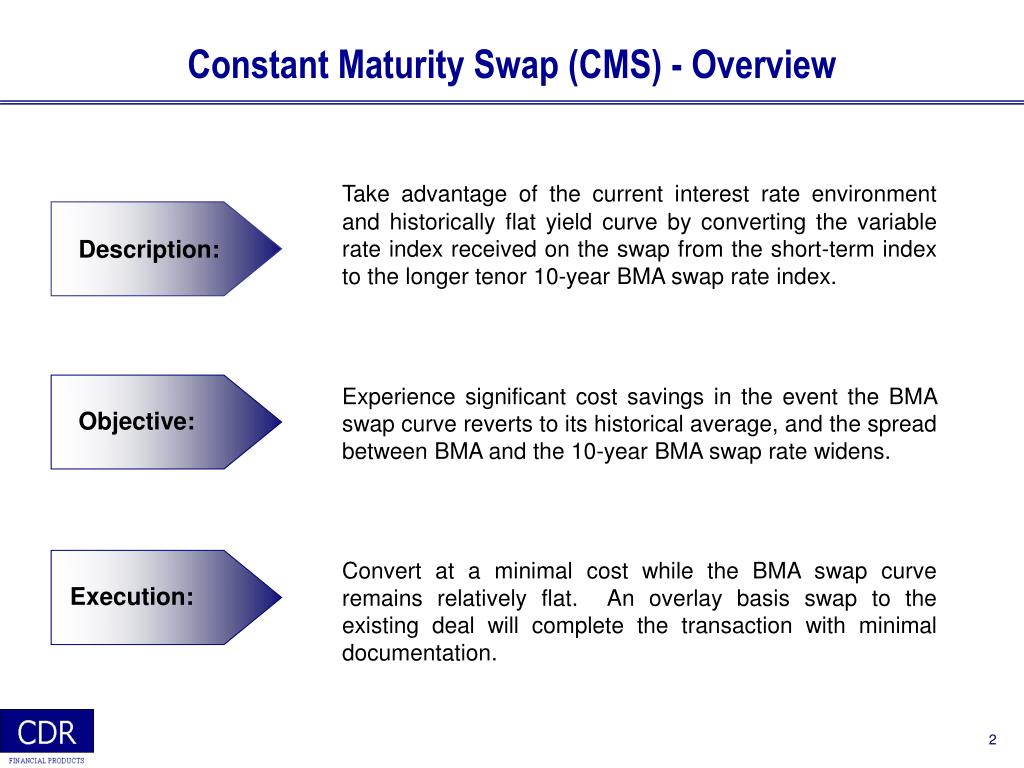

The yield curve is a graphical representation of the relationship between bond yields and maturities. It is a crucial tool for investors seeking to understand the behavior of the 10 year constant maturity rate. By analyzing the yield curve, investors can gain valuable insights into the direction of interest rates and make informed investment decisions.

The yield curve typically slopes upward, indicating that longer-term bonds offer higher yields to compensate for the increased risk of lending over a longer period. However, the shape of the yield curve can change in response to various economic factors, such as changes in inflation expectations, monetary policy, and economic growth.

A normal yield curve, where long-term yields are higher than short-term yields, suggests that the market expects interest rates to rise in the future. This can lead to an increase in the 10 year constant maturity rate. On the other hand, an inverted yield curve, where short-term yields are higher than long-term yields, may indicate that the market expects interest rates to fall, leading to a decrease in the 10 year constant maturity rate.

By analyzing the yield curve, investors can identify patterns and trends that can inform their investment decisions. For example, a flattening yield curve may indicate that the market expects interest rates to remain stable, while a steepening yield curve may suggest that interest rates are expected to rise. This information can be used to adjust investment strategies, such as shifting from long-term bonds to shorter-term bonds or diversifying portfolios to mitigate risk.

In addition, the yield curve can be used to predict changes in the 10 year constant maturity rate. By analyzing the slope and shape of the yield curve, investors can gain insights into the direction of interest rates and adjust their investment strategies accordingly. For example, if the yield curve is steepening, it may indicate that the 10 year constant maturity rate is expected to rise, leading investors to adjust their bond portfolios accordingly.

In conclusion, understanding the yield curve is essential for investors seeking to unlock the secrets of the 10 year constant maturity rate. By analyzing the yield curve, investors can gain valuable insights into the direction of interest rates and make informed investment decisions.

The Role of Central Banks in Shaping Constant Maturity Rates

Central banks play a crucial role in shaping the 10 year constant maturity rate through their monetary policy decisions. By adjusting interest rates, buying or selling government securities, and implementing quantitative easing, central banks can influence the direction of the 10 year constant maturity rate.

When central banks lower interest rates, they can lead to a decrease in the 10 year constant maturity rate, making borrowing cheaper and stimulating economic growth. On the other hand, when central banks raise interest rates, they can lead to an increase in the 10 year constant maturity rate, making borrowing more expensive and curbing inflation.

The impact of central banks on the 10 year constant maturity rate can be seen in the way they influence the yield curve. By buying or selling government securities, central banks can alter the supply and demand of bonds, which in turn affects the yield curve. For example, when central banks buy long-term bonds, they can lead to a decrease in long-term yields, flattening the yield curve and reducing the 10 year constant maturity rate.

In addition, central banks can also influence the 10 year constant maturity rate through forward guidance, which involves communicating their future policy intentions to the market. By signaling their intentions, central banks can shape market expectations and influence the direction of the 10 year constant maturity rate.

The implications of central bank actions on investment strategies are significant. Investors need to carefully consider the impact of central bank decisions on the 10 year constant maturity rate when making investment decisions. For example, if central banks are expected to raise interest rates, investors may need to adjust their bond portfolios to mitigate the impact of rising yields on their investments.

In conclusion, central banks play a critical role in shaping the 10 year constant maturity rate through their monetary policy decisions. By understanding the impact of central banks on the 10 year constant maturity rate, investors can make informed investment decisions and navigate the complex world of fixed-income investing.

Using Constant Maturity Rates to Inform Investment Decisions

Constant maturity rates, particularly the 10 year constant maturity rate, play a crucial role in informing investment decisions. By understanding the 10 year constant maturity rate, investors can make informed decisions about bond selection, portfolio optimization, and risk management.

For instance, when the 10 year constant maturity rate is high, it may be more attractive to invest in shorter-term bonds with lower yields, as the risk of rising interest rates is higher. On the other hand, when the 10 year constant maturity rate is low, it may be more attractive to invest in longer-term bonds with higher yields, as the risk of falling interest rates is higher.

In addition, the 10 year constant maturity rate can be used to optimize bond portfolios. By analyzing the yield curve and the 10 year constant maturity rate, investors can identify opportunities to invest in bonds with higher yields and lower durations, thereby maximizing returns while minimizing risk.

The 10 year constant maturity rate can also be used to inform risk management decisions. By understanding the impact of changes in the 10 year constant maturity rate on bond prices, investors can adjust their portfolios to mitigate potential losses. For example, if the 10 year constant maturity rate is expected to rise, investors may need to adjust their bond portfolios to reduce exposure to long-term bonds.

Furthermore, the 10 year constant maturity rate can be used to evaluate the performance of bond funds and ETFs. By comparing the returns of these funds to the 10 year constant maturity rate, investors can determine whether they are generating alpha or simply tracking the market.

In conclusion, the 10 year constant maturity rate is a powerful tool that can be used to inform investment decisions. By understanding the 10 year constant maturity rate, investors can make informed decisions about bond selection, portfolio optimization, and risk management, ultimately leading to better investment outcomes.

Historical Trends and Patterns in the 10 Year Constant Maturity Rate

Analyzing historical data on the 10 year constant maturity rate can provide valuable insights into trends and patterns that can inform investment decisions. By examining the historical behavior of the 10 year constant maturity rate, investors can identify opportunities to capitalize on trends and avoid potential pitfalls.

One notable trend in the 10 year constant maturity rate is its inverse relationship with economic growth. During periods of strong economic growth, the 10 year constant maturity rate tends to rise, as investors become more optimistic about the economy and demand higher returns. Conversely, during periods of economic downturn, the 10 year constant maturity rate tends to fall, as investors become more risk-averse and demand lower returns.

Another pattern in the 10 year constant maturity rate is its sensitivity to monetary policy decisions. When central banks lower interest rates, the 10 year constant maturity rate tends to fall, as investors anticipate lower borrowing costs and increased economic activity. Conversely, when central banks raise interest rates, the 10 year constant maturity rate tends to rise, as investors anticipate higher borrowing costs and reduced economic activity.

In addition, the 10 year constant maturity rate has historically exhibited a strong correlation with inflation expectations. When inflation expectations are high, the 10 year constant maturity rate tends to rise, as investors demand higher returns to compensate for the expected erosion of purchasing power. Conversely, when inflation expectations are low, the 10 year constant maturity rate tends to fall, as investors are willing to accept lower returns in exchange for reduced inflation risk.

By understanding these historical trends and patterns, investors can make more informed decisions about their investment portfolios. For example, if the 10 year constant maturity rate is trending upward, investors may want to consider shifting their portfolios towards shorter-term bonds or other low-duration assets to minimize exposure to rising interest rates. Conversely, if the 10 year constant maturity rate is trending downward, investors may want to consider shifting their portfolios towards longer-term bonds or other high-duration assets to capitalize on lower interest rates.

In conclusion, analyzing historical data on the 10 year constant maturity rate can provide valuable insights into trends and patterns that can inform investment decisions. By understanding these trends and patterns, investors can make more informed decisions about their investment portfolios and achieve long-term success.

Conclusion: Mastering the 10 Year Constant Maturity Rate for Long-Term Success

In conclusion, understanding the 10 year constant maturity rate is crucial for achieving long-term investment success. By grasping the concepts and principles outlined in this guide, investors can make informed decisions about their investment portfolios and navigate the complexities of the bond market.

The 10 year constant maturity rate is a powerful tool that can help investors anticipate changes in interest rates, inflation, and economic growth. By analyzing historical trends and patterns in the 10 year constant maturity rate, investors can identify opportunities to capitalize on trends and avoid potential pitfalls.

Moreover, the 10 year constant maturity rate can be used to inform investment decisions, including bond selection, portfolio optimization, and risk management. By incorporating the 10 year constant maturity rate into their investment strategies, investors can optimize their returns and minimize their risks.

Ultimately, mastering the 10 year constant maturity rate requires a deep understanding of the bond market, economic indicators, and monetary policy decisions. By staying informed and up-to-date on the latest developments in the 10 year constant maturity rate, investors can stay ahead of the curve and achieve long-term success.

Remember, the 10 year constant maturity rate is a key indicator of the bond market’s expectations of future interest rates and economic growth. By understanding and utilizing this powerful tool, investors can unlock the secrets of long-term investing and achieve their financial goals.