Navigating the Complex World of LIBOR Forward Curves

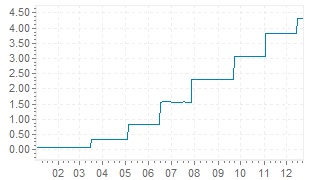

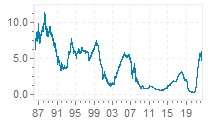

In the financial markets, LIBOR forward curves play a vital role in shaping expectations of future interest rates. These curves are graphical representations of expected future LIBOR rates, providing valuable insights into market sentiment. The 1-month USD LIBOR forward curve, in particular, is a key benchmark, reflecting market expectations of short-term interest rates in the United States. As a vital indicator of market sentiment, the 1-month USD LIBOR forward curve influences the pricing of various financial instruments, such as derivatives, bonds, and loans. However, predicting short-term interest rates is a challenging task, and the 1-month USD LIBOR forward curve is no exception. The curve’s complexity arises from the numerous factors that influence it, including supply and demand, economic indicators, and central bank policies. Accurate analysis and interpretation of the 1-month USD LIBOR forward curve are essential for investors, traders, and financial institutions seeking to make informed decisions in today’s fast-paced financial landscape.

Understanding the 1-Month USD LIBOR Forward Curve

The 1-month USD LIBOR forward curve is a crucial component of the financial markets, providing a snapshot of market expectations for short-term interest rates in the United States. Calculated from a series of LIBOR rates, the 1-month USD LIBOR forward curve represents the expected future borrowing costs for banks and financial institutions. This curve is significant because it influences the pricing of various financial instruments, such as derivatives, bonds, and loans. The 1-month USD LIBOR forward curve is widely used as a benchmark for short-term interest rates, and its movements can have far-reaching implications for investors, traders, and financial institutions.

The calculation of the 1-month USD LIBOR forward curve involves a complex process, taking into account a range of factors, including market expectations, economic indicators, and central bank policies. The resulting curve provides a graphical representation of expected future LIBOR rates, allowing market participants to gauge the direction and magnitude of future interest rate changes. By analyzing the 1-month USD LIBOR forward curve, market participants can gain valuable insights into market sentiment, identify potential trends and patterns, and make informed investment decisions.

The significance of the 1-month USD LIBOR forward curve extends beyond its role as a benchmark for short-term interest rates. It also plays a critical role in shaping the overall direction of the economy, influencing the availability and cost of credit, and impacting the profitability of financial institutions. As such, a deep understanding of the 1-month USD LIBOR forward curve is essential for anyone seeking to navigate the complex world of financial markets.

How to Analyze the 1-Month USD LIBOR Forward Curve for Informed Investment Decisions

Accurate analysis of the 1-month USD LIBOR forward curve is crucial for making informed investment decisions in today’s fast-paced financial markets. By understanding the intricacies of the curve, investors and traders can identify trends, recognize patterns, and capitalize on opportunities. To effectively analyze the 1-month USD LIBOR forward curve, it is essential to consider several key factors, including the curve’s shape, slope, and volatility.

The shape of the 1-month USD LIBOR forward curve can provide valuable insights into market sentiment and expectations. A steepening curve may indicate rising inflation expectations or a tightening of monetary policy, while a flattening curve may suggest declining economic growth or a loosening of monetary policy. By analyzing the curve’s shape, investors can adjust their investment strategies to align with market expectations.

The slope of the 1-month USD LIBOR forward curve is another critical factor to consider. A positive slope indicates that short-term interest rates are expected to rise, while a negative slope suggests that rates are expected to fall. By analyzing the slope, investors can identify potential opportunities for profit and adjust their investment strategies accordingly.

Volatile market conditions can significantly impact the 1-month USD LIBOR forward curve, making it essential to monitor and analyze the curve’s volatility. By using technical indicators, such as moving averages and standard deviations, investors can identify potential trends and patterns, and make informed investment decisions.

In addition to these factors, it is essential to consider the 1-month USD LIBOR forward curve in conjunction with other market indicators, such as economic indicators, central bank policies, and market sentiment. By taking a holistic approach to analysis, investors can gain a deeper understanding of the market and make more informed investment decisions.

By applying these practical tips and strategies, investors and traders can unlock the secrets of the 1-month USD LIBOR forward curve and make informed investment decisions in today’s complex financial markets.

The Role of Market Forces in Shaping the 1-Month USD LIBOR Forward Curve

The 1-month USD LIBOR forward curve is influenced by a complex array of market forces, which shape its trajectory and impact the overall direction of short-term interest rates. Understanding these market forces is crucial for accurately forecasting short-term interest rates and making informed investment decisions.

Supply and demand play a critical role in shaping the 1-month USD LIBOR forward curve. When demand for short-term credit increases, banks and financial institutions may increase their lending rates, causing the curve to shift upward. Conversely, when supply outstrips demand, rates may decline, and the curve may flatten or invert.

Economic indicators, such as GDP growth, inflation, and employment rates, also exert a significant influence on the 1-month USD LIBOR forward curve. A strong economy with low unemployment and rising inflation may lead to higher short-term interest rates, while a slowing economy may result in lower rates.

Central bank policies, particularly those of the Federal Reserve, have a profound impact on the 1-month USD LIBOR forward curve. Monetary policy decisions, such as setting the target federal funds rate, can influence the entire yield curve, including the 1-month USD LIBOR forward curve. Forward guidance and communication from central banks can also shape market expectations and influence the curve’s trajectory.

Other market forces, including geopolitical events, regulatory changes, and market sentiment, can also impact the 1-month USD LIBOR forward curve. For example, a sudden increase in geopolitical tensions may lead to a flight to safety, causing short-term interest rates to decline and the curve to flatten.

By understanding the complex interplay of these market forces, investors and traders can better analyze the 1-month USD LIBOR forward curve and make more informed investment decisions. By recognizing the key drivers of the curve’s shape and trajectory, market participants can stay ahead of the curve and capitalize on opportunities in the short-term interest rate market.

Comparing the 1-Month USD LIBOR Forward Curve to Other Short-Term Interest Rate Benchmarks

In the complex world of short-term interest rate forecasting, the 1-month USD LIBOR forward curve is just one of several benchmarks used to gauge market sentiment and predict future interest rate movements. To gain a deeper understanding of the 1-month USD LIBOR forward curve, it is essential to compare and contrast it with other short-term interest rate benchmarks.

One of the most widely used short-term interest rate benchmarks is the Overnight Index Swap (OIS) rate. The OIS rate is a measure of the expected average federal funds rate over a given period, typically overnight or short-term. While both the 1-month USD LIBOR forward curve and the OIS rate reflect market expectations of short-term interest rates, they differ in their calculation and application. The OIS rate is often used as a risk-free rate in derivatives pricing, whereas the 1-month USD LIBOR forward curve is more closely tied to commercial lending and credit markets.

Another key benchmark is the Federal Reserve’s target federal funds rate, which is set by the Federal Open Market Committee (FOMC) to influence the overall direction of interest rates. While the target federal funds rate is a policy rate set by the central bank, the 1-month USD LIBOR forward curve reflects market expectations of short-term interest rates. The two rates are closely linked, as changes in the target federal funds rate can influence the shape and trajectory of the 1-month USD LIBOR forward curve.

Other short-term interest rate benchmarks, such as the Treasury bill rate and the commercial paper rate, also provide valuable insights into market sentiment and expectations. By comparing and contrasting these benchmarks, investors and traders can gain a more comprehensive understanding of the short-term interest rate landscape and make more informed investment decisions.

In conclusion, the 1-month USD LIBOR forward curve is just one piece of the short-term interest rate puzzle. By comparing it to other benchmarks, such as the OIS rate and the target federal funds rate, market participants can gain a deeper understanding of the complex forces shaping the short-term interest rate market.

Managing Risk with the 1-Month USD LIBOR Forward Curve

Risk management is a critical component of any investment strategy, and the 1-month USD LIBOR forward curve plays a vital role in this process. By understanding the 1-month USD LIBOR forward curve and its implications for short-term interest rates, investors and traders can develop effective risk management strategies to mitigate potential losses and capitalize on opportunities.

One of the primary ways to manage risk with the 1-month USD LIBOR forward curve is through hedging strategies. By taking positions in instruments that are sensitive to short-term interest rates, such as floating-rate notes or interest rate swaps, investors can hedge against potential losses or gains resulting from changes in the 1-month USD LIBOR forward curve. For example, a company with a floating-rate loan may hedge against rising interest rates by taking a short position in a floating-rate note.

Asset liability management is another key application of the 1-month USD LIBOR forward curve in risk management. By analyzing the 1-month USD LIBOR forward curve, banks and financial institutions can optimize their asset and liability portfolios to minimize risk and maximize returns. For instance, a bank may adjust its lending and deposit rates in response to changes in the 1-month USD LIBOR forward curve to maintain a stable net interest margin.

In addition to hedging and asset liability management, the 1-month USD LIBOR forward curve can also be used to manage risk through scenario analysis and stress testing. By analyzing the potential impact of different interest rate scenarios on their portfolios, investors and traders can develop contingency plans to mitigate potential losses and capitalize on opportunities.

Ultimately, the 1-month USD LIBOR forward curve is a powerful tool for managing risk in the short-term interest rate market. By understanding its implications and applications, investors and traders can develop effective risk management strategies to navigate the complex world of short-term interest rate forecasting.

Real-World Applications of the 1-Month USD LIBOR Forward Curve

The 1-month USD LIBOR forward curve has a wide range of real-world applications in various financial markets and instruments. Its significance extends beyond mere theoretical interest rate forecasting, as it plays a critical role in shaping the behavior of financial instruments and influencing investment decisions.

In commercial lending, the 1-month USD LIBOR forward curve serves as a benchmark for floating-rate loans. Banks and financial institutions use the curve to determine the interest rates charged on loans, ensuring that they remain competitive and aligned with market conditions. For instance, a company seeking a floating-rate loan may be offered an interest rate tied to the 1-month USD LIBOR forward curve, plus a spread to reflect the lender’s risk.

In derivatives pricing, the 1-month USD LIBOR forward curve is used to value and hedge interest rate-sensitive instruments, such as swaps, options, and futures. By analyzing the curve, traders and investors can estimate the expected future interest rates and adjust their positions accordingly. This enables them to manage risk more effectively and capitalize on potential opportunities.

In portfolio management, the 1-month USD LIBOR forward curve is used to optimize asset allocation and risk management strategies. By analyzing the curve, portfolio managers can identify potential opportunities and threats, and adjust their portfolios to maximize returns while minimizing risk. For example, a portfolio manager may use the curve to determine the optimal mix of fixed-rate and floating-rate instruments in a bond portfolio.

In addition to these applications, the 1-month USD LIBOR forward curve is also used in other areas, such as mortgage lending, credit card pricing, and pension fund management. Its influence extends to a wide range of financial instruments and markets, making it a critical component of the global financial system.

In conclusion, the 1-month USD LIBOR forward curve is a powerful tool with far-reaching implications for financial markets and instruments. Its real-world applications are diverse and widespread, and its influence is felt across the globe.

Staying Ahead of the Curve: Best Practices for Tracking the 1-Month USD LIBOR Forward Curve

To effectively track the 1-month USD LIBOR forward curve, it is essential to have access to reliable data sources, analytical tools, and market monitoring strategies. By staying ahead of the curve, investors and traders can make informed investment decisions, manage risk, and capitalize on opportunities.

One of the primary data sources for tracking the 1-month USD LIBOR forward curve is the Intercontinental Exchange (ICE), which publishes daily LIBOR rates. Additionally, financial data providers such as Bloomberg, Reuters, and Thomson Reuters offer real-time data and analytics on the 1-month USD LIBOR forward curve.

In terms of analytical tools, investors and traders can use technical analysis software, such as charting platforms and statistical models, to identify trends, recognize patterns, and predict future movements in the 1-month USD LIBOR forward curve. Furthermore, financial modeling tools, such as Monte Carlo simulations and scenario analysis, can be used to estimate the potential impact of different interest rate scenarios on investment portfolios.

Market monitoring strategies are also crucial for tracking the 1-month USD LIBOR forward curve. Investors and traders should stay up-to-date with market news, economic indicators, and central bank policies, as these factors can influence the shape and direction of the curve. Additionally, monitoring the yield curve, credit spreads, and other market metrics can provide valuable insights into the overall health of the financial system.

Best practices for tracking the 1-month USD LIBOR forward curve also include regularly reviewing and updating analytical models, staying informed about changes in market conditions and regulatory policies, and maintaining a flexible investment strategy that can adapt to changing interest rate environments.

By following these best practices, investors and traders can stay ahead of the curve and make informed investment decisions that take into account the complexities of the 1-month USD LIBOR forward curve. Whether used for risk management, investment analysis, or portfolio optimization, the 1-month USD LIBOR forward curve is a critical component of the global financial system.